🌎 IEA pulls the plug on peak oil #271

New report shows energy addition > transition

Happy Monday, and official end of Q3 🎉

This week, we’ve got a quick roundup of the quarter’s highlights for you. Deal volume may have dipped, but investors doubled down on steel, concrete, and electrons. Check out the biggest deals, exits, and new funds of the quarter below.

In deals, $123m for ethanol and biofuels, $100m for lithium mining, and $50m for data center operations.

In other news, the government shutdown’s impact on climate programs, from staffing to funding cancellations, plus big updates in lithium.

Thanks for reading!

Not a subscriber yet?

📩 Submit deals and announcements for the newsletter at [email protected].

💼 Find or share roles on our job board here.

The third quarter of 2025 saw a steady drumbeat of deals, even as broader markets contended with regulatory shifts and geopolitical turbulence. Investors seized on opportunities at the edges of macro trends to favor more scaled hardware, proven tech, and verticals aligned with energy security and AI/power demand. They doubled down on fewer, larger rounds in sectors with these clear demand signals and commercial pathways.

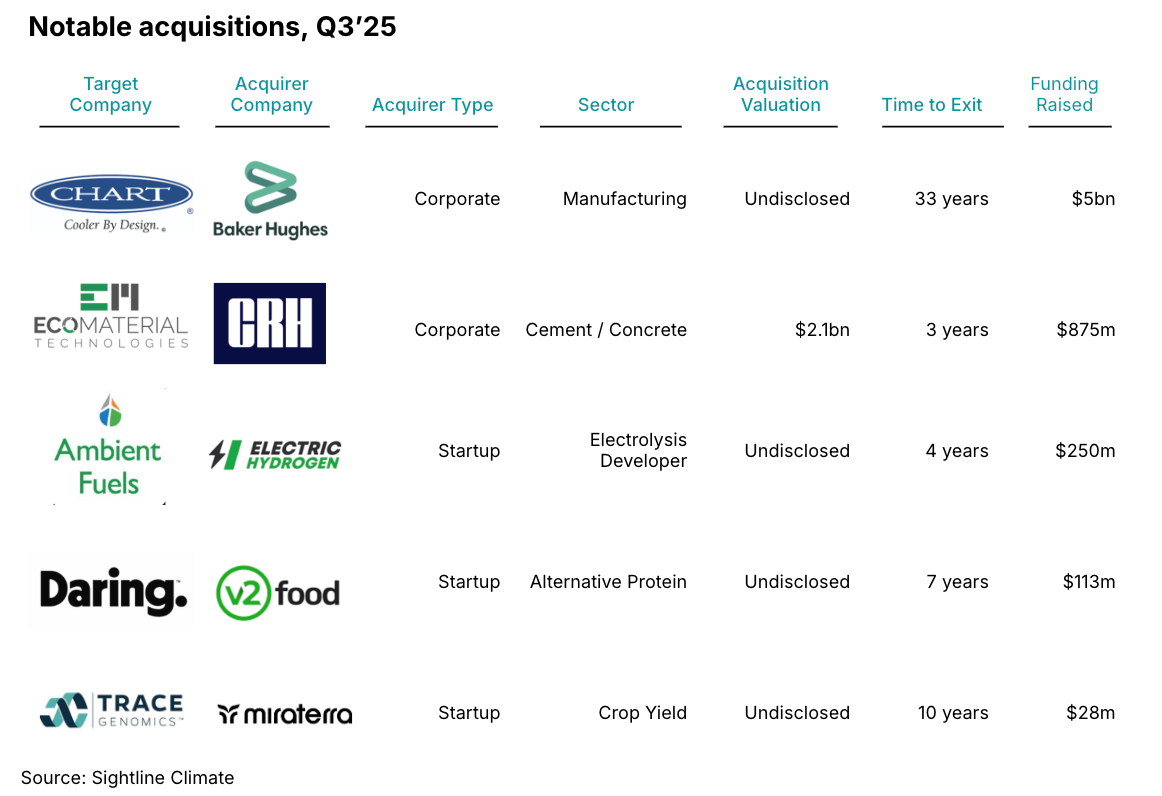

On the exit front, Q3 delivered more consolidation than celebration. Industrial incumbents snapped up enabling tech in cement and hydrogen, using M&A to secure upstream advantages and expand into climate-aligned verticals. Meanwhile, agtech and clean fuels saw smaller, quieter tuck-ins. With startup valuations down and capital more selective, acquirers are staying strategic.

Fundraising held steady, but the mood was cautious. Most new vehicles were targeted, regionally scoped, and heavy on infrastructure — a far cry from the generalist mega-funds of 2021. From commercial building retrofits to regenerative ag, LPs are favoring tangible assets, defined return profiles, and strategies that match today’s cost of capital.

Let’s break down the quarter.

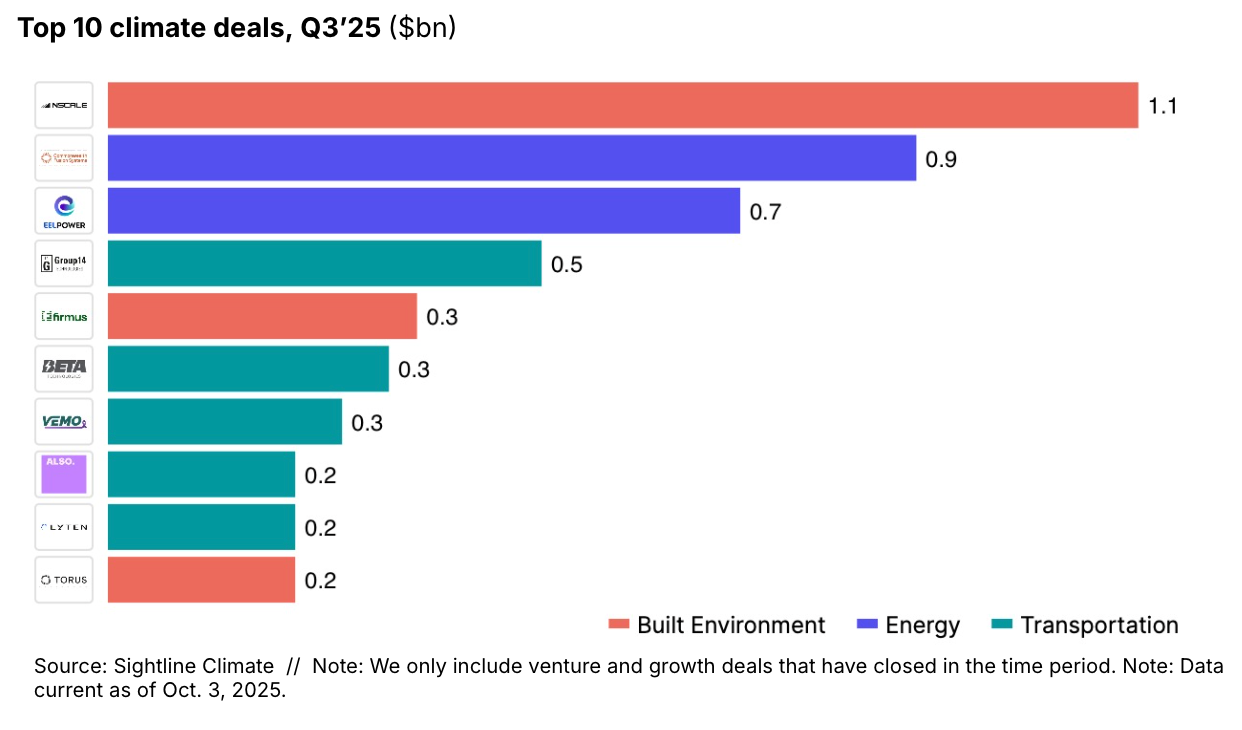

💰 Mega-deals in the built environment and energy topped the charts – with three >$500m raises and seven companies securing $200m+, even though overall deal volume remained low. Hardware-heavy climate tech is back in favor, but mostly where clean power meets digital infrastructure.

🏠 Built environment tech took the top and bottom slots. Nscale ($1.1bn for low-carbon data centers) and Torus ($200m for smart homes) bookended the leaderboard. Firmus also raised $330m for AI-optimized immersion-cooled data centers.

⚛️ Fusion, batteries, and grid storage saw major momentum. Commonwealth Fusion raised $863m, Group14 closed a $463m Series D, and Eelpower picked up $675m to scale UK battery storage projects.

🌍 Mobility kept moving, with VEMO ($250m) and Also ($200m) clean transport across Mexico and the US. Carbon removal was quiet, with only Climeworks making the list — $162m for its solid sorbent DAC tech.

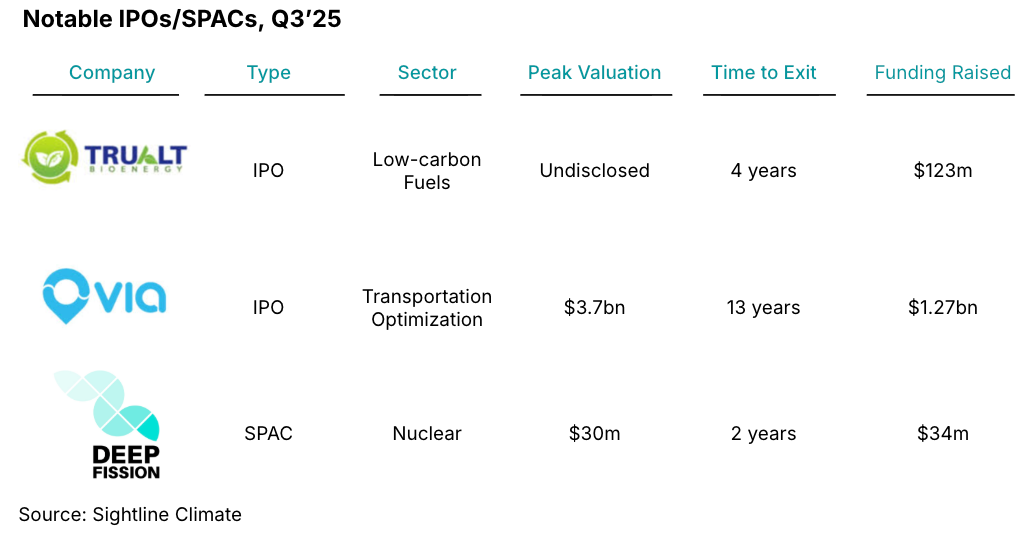

📈 IPOs came back — selectively. Via went public at a $3.6bn valuation, and TruAlt Bioenergy raised $123m on India’s ethanol mandate. Deep Fission also took a (confusing) SPAC detour.

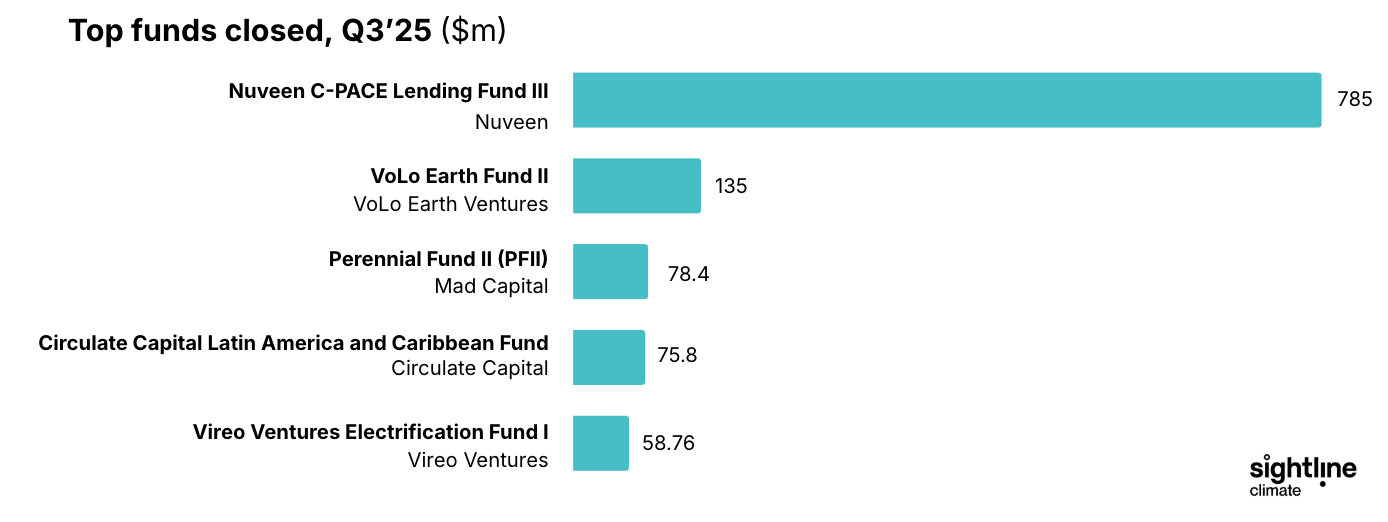

💸 Funds stayed focused and local. Nuveen Green Capital led with a $785m close for C-PACE commercial real estate. Other new funds focused on early-stage, ag, materials, and electrification.

Taken together, Q3’s biggest deals show climate capital continuing to flow toward infrastructure-heavy solutions — especially those with clear regulatory support, commercial offtake potential, or relevance to the energy-AI nexus. A lot of the quarter’s heat comes from hyperscaler infrastructure and fusion, where large, late-stage, or strategic rounds dominate the top decile.

Q3 was marked by a wave of strategic M&A, led by industrial buyers consolidating critical technologies and bigger startups scooping up smaller ones. Baker Hughes’ acquisition of Chart Industries folded its tech for gas, hydrogen, and liquid handling into its energy systems portfolio. CRH’s $2.1bn purchase of Eco Material Technologies secured upstream cement inputs as the construction sector bets on decarbonization. Electric Hydrogen’s quiet acquisition of Ambient Fuels, though undisclosed, looks like an IP and pipeline grab to speed up execution. Even in agtech, where outcomes are smaller, exits continued quietly with Trace Genomics and Daring changing hands.

Yes, real IPOs happened this quarter. But the quality varied. Via made a debut, listing at a $3.6bn valuation and becoming one of the largest publicly traded transportation optimization companies in the US. TruAlt Bioenergy raised $123m on the strength of India’s ethanol mandate — continuing a regional trend of public market momentum. On the other end of the spectrum, Deep Fission’s $30m SPAC felt more like a nuclear publicity play than a commercial milestone. If anything, Q3’s listings showed that scale, revenue, and regulatory clarity are still prerequisites for serious IPOs — and that investor appetite remains cautious outside a handful of proven verticals.

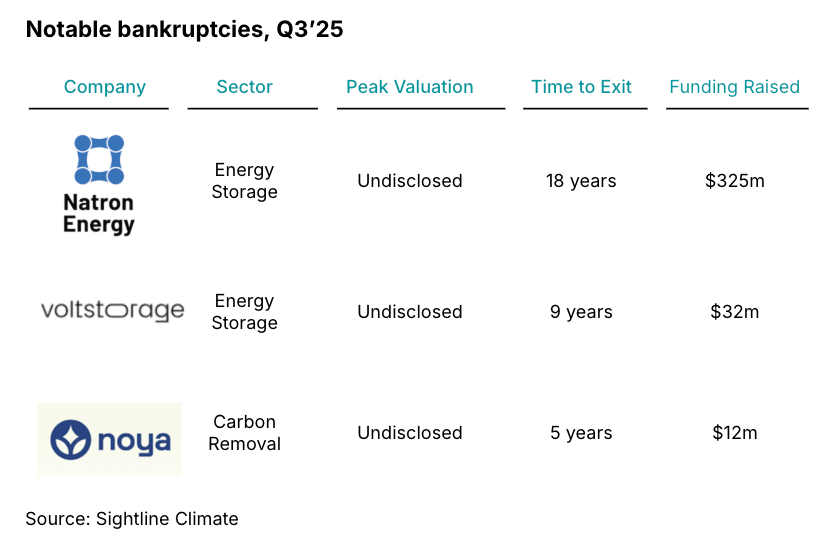

Sadly, Q3 also saw more bankruptcies, especially in high capex sectors. Natron Energy, with over $300m in funding , filed for bankruptcy after 18 years and $325m raised, proving how hard it is for alternative chemistries to break lithium-ion’s grip. VoltStorage quietly shut down after nine years and $32m, another victim of scale barriers in storage. And in carbon removal, Noya folded after just five years and $12m raised, a cautionary tale of how unforgiving direct air capture can be without deep pockets, stable offtake, and policy support.

Fresh capital entered the sector — but new funds are more focused, more local, and more infrastructure-aligned. Nuveen Green Capital led the pack with a $785m close for C-PACE financing, targeting energy efficiency, water conservation, and climate resilience projects in commercial real estate. The rest of the quarter’s top funds flowed into highly specific themes: Circulate Capital’s $76m LAC fund for circular economy solutions in Latin America, VoLo’s $135m fund with an early-stage remit, and more ag- and mobility-focused funds from Mad Capital and Vireo Ventures. While headline numbers were smaller than past quarters, LPs are still backing funds with tangible deployment targets.

Sightline clients can read more here. Interested in becoming a client?

🏠 Phaidra, a Seattle, WA-based AI control systems for data centers provider, raised $50m in Series B funding from Collaborative Fund, Helena, Index Ventures, NVIDIA, and Sony Innovation Fund.

⚡ OpenSolar, a Sydney, Australia-based solar installer platform, raised $20m in Growth funding from 2150, Google, and Titanium Ventures.

🌾 SwarmFarm Robotics, a Central Highlands, Australia-based autonomous farming robotics developer, raised $20m in Series B funding from Edaphon, Artesian VC, Clean Energy Finance Corporation, Emmertech, QIC, and other investors.

🌾 EF Polymer, an Okinawa, Japan-based biowaste upcycler, raised $18m in Series B funding from AgVenture Lab, IMPACT Capital, SVG Ventures, Soken Chemical & Engineering, TOPPAN Holdings and other investors.

🔋 Electroflow, a San Bruno, CA-based battery materials conversion provider, raised $10m in Seed funding from Union Square Ventures, Fifty Years, Harpoon Ventures, and Voyager Ventures.

🌬 GBM Works, a The Hague, Netherlands-based silent offshore wind monopiles installer, raised $7m in Seed funding from Invest-NL, European Innovation Council, and Rotterdamse Havendraken.

☔ Cetasol, a Malmö, Sweden-based maritime energy optimization platform, raised $3m in Seed funding from BackingMinds, Shift4Good, and Sarsia Seed Management.

🧱 Terran Robotics, a Bloomington, IN-based AI and robotics-powered weeding solutions provider, raised $2m in Series A funding from Uni.fund, Genesis Ventures, Helidoni Group, and Hellenic Business Angels Network.

💨 CUR8, a London, England-based carbon removals portfolio builder, raised an undisclosed amount in Seed funding from Airbus Ventures, CapitalT, and GV (Google Ventures).

⚒️ Lithium Americas, a Vancouver, Canada-based lithium mining service provider, raised $100m in Post-IPO Debt funding from the US Department of Energy’s Loan Programs Office.

⚒️ Cornish Lithium, a Penryn, England-based lithium exploration and projects developer, raised $47m in PF Equity funding from National Wealth Fund (UKIB) and TechMet.

⚡ LanzaJet, a Chicago, IL-based sustainable aviation fuel developer, raised $13m in Grant funding from the UK Department for Transport.

⚡ TruAlt Bioenergy, a Bangalore Rural, India-based ethanol and biofuels developer, raised $123m in IPO funding.

⚡ Sunder Energy, a Sandy, UT-based residential solar sales provider, was acquired by SunPower for an undisclosed amount.

🔋 Wolfspeed, a Durham, NC-based silicon carbide semiconductor manufacturer, filed for Bankruptcy / Out of Business.

🌬 Nabrawind Technologies, a Pamplona, Spain-based wind turbine component developer, was acquired by Fortescue for an undisclosed amount.

🏗 Canada Waterworks, a Toronto, Canada-based water infrastructure materials distributor, was acquired by Core & Main for an undisclosed amount.

⚡ Ally Energy Solutions, a Lenexa, KS-based RNG developer, raised an undisclosed amount in PE Buyout funding from Nuveen.

💰 Norges Bank, an Oslo, Norway-based sovereign wealth investor, raised $1.5 bn for Brookfield’s Global Transition Fund II, a dedicated energy transition fund focused on renewable infrastructure.

💰 Woven Capital, a Tokyo, Japan-based growth fund backed by Toyota, raised $800m for its second fund focused on mobility, energy, AI, and climate innovation.

This is a sample of the deals available on Sightline Climate. Can't get enough?

The US government shutdown is disrupting key weather and climate programs, including halting new flood insurance policies and furloughing nearly 90% of EPA staff. While critical services like weather forecasting will continue, many environmental research projects, policy updates, and regulatory actions are paused, and fears of layoffs are growing among federal workers.

The DOE also said last week it was canceling $7.6bn in clean energy project awards across 16 states, comprising 321 financial awards supporting 223 projects in all Democratic states. The DOE claims the projects were rushed and lacked financial justification, but critics say it's political retaliation that undermines federal climate investment. The move jeopardizes major hydrogen, battery, and grid upgrade initiatives.

In even more DOE news, the Trump administration announced a $625m initiative to support the coal industry, including opening 13.1m acres of federal land for mining and rolling back environmental regulations. The plan is aimed at extending the life of aging coal plants and securing energy reliability, despite coal’s ongoing decline in the US power sector.

The US government is also taking a 5% equity stake in Lithium Americas and its lithium mining project in Nevada, a joint venture with General Motors. The project is expected to produce 40,000 metric tons of battery-grade lithium carbonate annually, supporting the production of up to 800,000 electric vehicles. The DOE also agreed to a $435m loan with deferred payments to help advance the mine.

Neptune Energy has identified a massive lithium resource in Germany’s Altmark region, about 43m tons of lithium carbonate equivalent. The firm is pursuing a method called direct lithium extraction from underground brine, and has already piloted processes while applying for exploration and production licenses in the region.

MIT Technology Review's new 10 Climate Tech Companies to Watch list highlights the bold startups and businesses tackling one of the world's biggest challenges, climate change. From carbon free energy to battery recycling, this year's trailblazers are helping shape a cleaner, more sustainable future. Find out who made the list.

Forget BYOB – it’s “bring your own capacity” in the age of AI.

With 60 nations on board, the oceans just got their biggest life raft yet.

Inside the DOE’s dictionary: ‘climate change’ is banned, but ‘fossil fuels’ reads just fine.

Best bird photo awards: Cormorants & eagles & shoebills, oh my!

From chip shortages to power surges, PJM plots its next moves.

Amazonian trees are hitting their growth spurts to adapt to climate change.

An homage to Jane Goodall’s extraordinary life.

Sweden’s budget rethink puts a dent in BECCS’s big ambitions.

📅 Ideate, Design, Build – with Sustainability in Mind: Join Renee Davis, co-founder of Climate Conscious Leaders, on Monday, October 6 at 6:00PM for a virtual workshop on the Product–Market–Earth Fit methodology, as a part of San Diego Climate Week.

📅 VERGE at Trellis Impact 25: Join us October 28-30, in San Jose for three events at the intersection of climate and technology. Connect with 5,000+ professionals and 500+ speakers advancing decarbonization strategies and climate tech. Register by October 3rd to save $300 and use our partner code TI25SL for 10% off.

📅 Small Group Networking for Product People: Join a fun and engaging monthly virtual meetup on Wednesday, October 8 at 3:00PM to expand your network with eco-conscious product professionals and share ideas on bringing a sustainable mindset to your career.

📅 Climate Innovation Festival: Join students, start-ups, researchers, NGOs, corporates and innovators from 45+ countries in Vienna on October 24 for a festival featuring world’s largest competition for early-stage green business ideas.

Principal Engineer @Ezra Climate

CTO/VP Engineering @Ezra Climate

Analyst Program @Giant Ventures

Director, Customer Success & Community Engagement @Pano AI

Sr. Account Executive, Public Sector @Pano AI

Rust Developer Intern @Darwin Data

CTVC is powered by Sightline, the tactical market intelligence platform for energy and investment decision-makers.

New report shows energy addition > transition

Get the data, insights, and case studies behind the next wave of climate tech

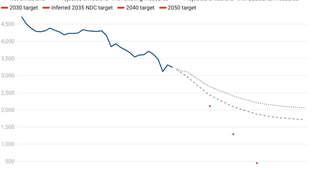

Inside the EU’s 2040 climate plan