🌎 Overheard at LCAW #252

Climate, capital, and carrots in London's new playbook

Biden issues an executive order requiring climate-related financial risk disclosure and mitigation

Happy Monday!

Last week, apart from affably avuncular Biden getting behind the wheel of a F-150 electric pick up (“this sucker’s quick!), his administration passed an executive order dictating a government-wide response to assessing climate risk financially. Lots of things need to be true before it goes live, but it’s pretty bold press on the idea that climate should be taken seriously as a systemic, financial risk.

We’ve also got lots of exciting fundings - from WeaveGrid’s charging software to Cervest’s climate risk platform - with lots of varied investors (read: Drake investing in Daring Foods’ vegan chicken substitute… there’s a fowl fake love joke in there somewhere).

In the news, IEA published a bombshell roadmap to net zero by 2050 with no new oil developments post 2021, Google partners with Fervo on geothermal, and the electric Ford F-150 finally drops. Plus, Shopify tells all about their tricks to kickstarting the carbon removal market, and Forerunner Ventures’ post-covid survey surfaces surprising consumer willingness to buy green.

Thanks for reading!

Not a subscriber yet?

You can’t manage what you don’t measure. And up until now, climate financial risk has been actively mismeasured.

The Biden Administration fired the starting gun on Thursday with an executive order (EO) that’s sent the entire government - from the National Economic Council, to the Treasury, to the window, to the wall - sprinting toward measuring and mitigating financial risks related to climate change.

Beyond Wall Street, this EO on Climate-Related Financial Risk affects you. “From signing a loan for a new home or small business to managing life savings or a retirement fund… [the executive order] will help the American people better understand how climate change can impact their financial security.” Or as NEC director Brian Deese put it, “Our modern financial system was built on the assumption that the climate was stable. And today it's clear that we no longer live in such a world."

Key takeaways

Who does what? The (long) checklist of roles & responsibilities:

🔲 Government. The National Economic Council Director (Brian Deese) and National Climate Advisor (Gina McCarthy) will devise a strategy in 120 days for identifying and disclosing climate risks to government programs, assets, and liabilities.

🔲 Financial Stability. The Treasury Secretary (Janet Yellen) and members of the Financial Stability Oversight Council - which include the Fed and SEC - will issue a report in 180 days on improving climate-related disclosures and incorporating climate risk into regulatory and supervisory practices.

🔲 Retirement Savings. The Labor Secretary will rescind Trump’s prior attempts at barring ESG factors from being considered in pension investment decisions, and report on how ESG can be better implemented to protect life savings and pensions.

🔲 Federal Budget. The Office of Management of Budget will publish an annual assessment and reduce exposure to climate-related fiscal risk in the federal budget.

🔲 Federal Lending. The Office of Management of Budget will improve management and reporting on climate risk in federal lending programs, and require federal suppliers to disclose GHG emissions and climate risks.

✈️ Beta Technologies, a South Burlington, VT-based electric aviation company, raised $368m in Series A funding from Fidelity, Amazon's Climate Pledge Fund, and Redbird Capital.

🥩 GOOD Meat, a San Francisco, CA-based division of Eat Just making meat from animal cells, raised $170m in funding from UBS O’Connor, Graphene Ventures, and K3 Ventures.

🐔 Daring, a Los Angeles, CA-based maker of plant-based chicken-meat, raised $40m in Series B funding from D1 Capital Partners, Drake, Maveron and Palm Tree Crew.

🌲 Cervest, a London, UK-based AI-powered climate intelligence company raised $30m in Series A funding from Draper Esprit, Astanor Ventures, Lowercarbon Capital, Future Positive Capital, UNTITLED and TIME Ventures.

⚡ Zap Energy, a Seattle, WA-based nuclear fusion energy startup, raised $27.5m in Series B funding from Addition, Energy Impact Partners, GA Capital, Fourth Realm, Chevron Technology Ventures and Lowercarbon Capital.

🔋 Twaice, a Munich, Germany-based maker of battery analytics software, raised $26m in Series B funding from Energize Ventures.

⚡ WeaveGrid, a San Francisco, CA-based developer of software designed to connect electric vehicles to the grid, raised $15m in Series A funding from Coatue, Breakthrough Energy Ventures, The Westly Group and Grok Ventures.

⚡ Moxion Power, a Richmond, CA-based maker of mobile energy storage systems, raised $10m in Series A funding from Energy Impact Partners, Tamarack Global, and Liquid 2 Ventures.

🏢 Buildings IOT, a Concord, CA-based maker of building systems management software, raised $10m in funding from Keyframe Capital.

🏠 Pearl Certification, a Charlottesville, VA-based certifier of energy-efficient homes, raised $9.5m in Series A funding from Clean Energy Ventures, Keller Enterprises, the Felton Group, and Clean Energy Ventures Group.

📦 Boox, a Petaluma, CA-based startup creating reusable shipping boxes, raised $9.3m in Series A funding from . Valor Siren Ventures, Village Global, and Kid VC.

🥛 VlyFoods, a Berlin, Germany-based maker of plant-based dairy alternatives, raised $7.4m in Series A funding from Five Seasons Ventures, Good Seed Ventures, and Global Founders Capital.

🛏️ Kaiyo, a New York, NY-based marketplace for used furniture, raised $5m in Series A funding from Moderne Ventures, Max Ventures, and Lerer Hippeau.

🏢 Dabbel, a Dusseldorf, Germany-based provider of HVAC control automation solutions to cut CO2, raised $4.4m in Series A funding from Target Global, Commerzbank and SeedX.

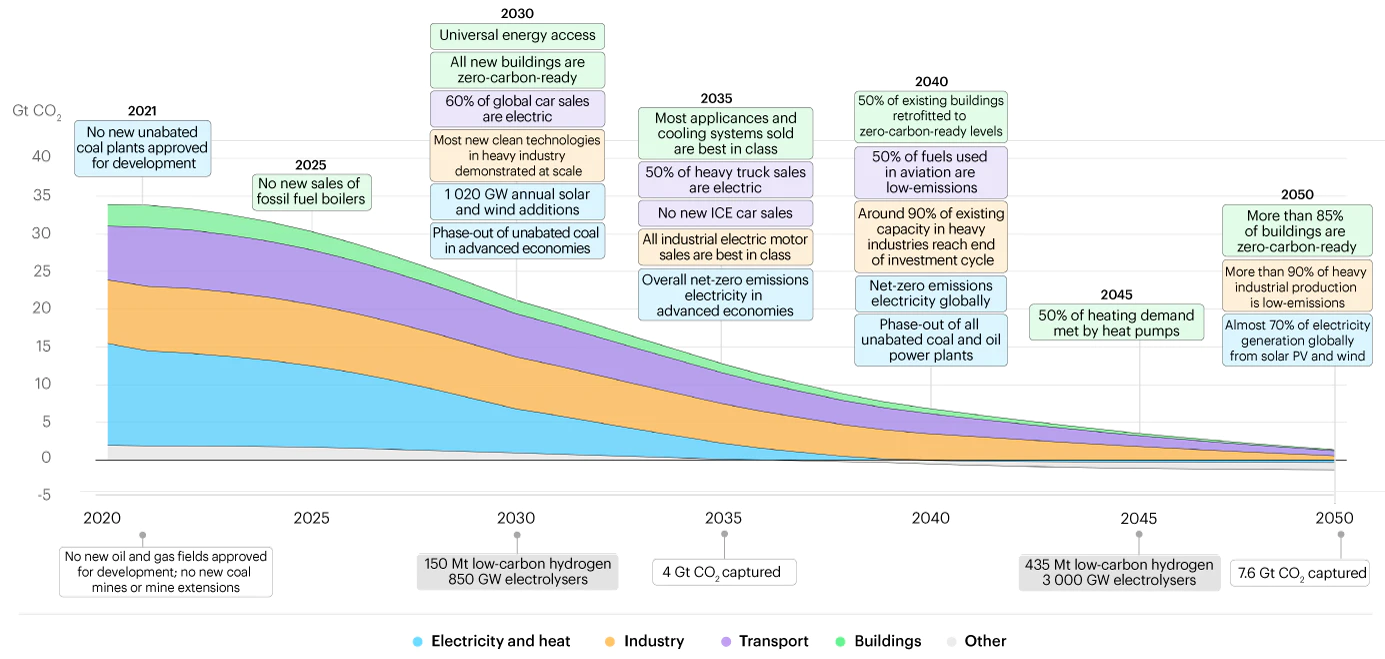

The IEA dropped its bombshell Net Zero by 2050 report filled with hard-hitting charts and takeaways. One of the most shocking statements coming from an organization initially founded to secure oil supply: “Beyond projects already committed as of 2021, there are no new oil and gas fields approved for development in our pathway, and no new coal mines.” The pathway to Net Zero is narrow with an ambitiously aggressive storyline in order to transform deeply emissions- entrenched sectors.

⚡🔋 With fossil retiring and clean energy technologies maturing, the power sector is projected to be close to net zero by an ambitious target of 2040.

🚗 🏠 A cleaner grid and higher efficiencies will accelerate emissions reductions in transport and buildings.

⛏ 🏭 However, there’s no current solution for the hard-to-abate industrial sector, hinging on hydrogen, biofuels, DAC and CCUS for the last mile.

Dig around the report and the data for yourself!

At its virtual I/O event this past week, Google announced two big climate forays into decarbonizing its data centers. The first is a climate intelligence computing platform to shift load during periods of clean energy, and the second a deal with Fervo Energy to power its Nevada data centers with clean geothermal.

If you want something that “hauls ass and tows like a beast”, you better get in line for the new electric F-150. 45,000 placed pre-orders for the new electric F-150 in less than 48 hours since the reveal.

Electrifying ride-hailing platforms is getting a sudden recharge. California is the first state to approve a mandate requiring most trips on ride-hailing platforms to be electric by 2030.

The Popemobile shall be an “exhaust-free and emissions-free experience for those gathered for blessings by His Holiness.” First in line to convert the Pope to EV holiness? Fisker.

Will hydrogen or batteries win out in the race to decarbonize heavy-duty trucks? In the EU, hydrogen looks like to take the lead with Shell agreeing to install hydrogen-refueling stations for Daimler’s heavy-duty trucks.

The 5 EV SPACs that made a splash in 2020 - Nikola, Fisker, Lordstown Motors, Canoo and Arrival - have lost $40b in value since their peak.

Oatly cashed in on the oat-milk fad at a frothy $10b valuation.

Street sweepers in NYC are going electric. Though we still wouldn’t recommend standing behind one.

Only Shayle Kann can get nearly 300 Twitter likes on a pie chart (!) of decarbonization startup high flyers.

More leading by doing from Shopify. Incredibly cool open sourced playbook presentation of their unconventional strategy to kick-starting the carbon removal market.

Forerunner Ventures’ post-COVID consumer survey shows an inversely correlated high chatter about lifestyle changes (e.g. meat alternatives) vs. actual strong consumer willingness to make big investments (e.g. buying cleaner HVAC systems).

Fifth Wall released a survey report of real estate investors’ anticipated climate tech trends. Spoiler alert: efficient lighting and heating & cooling win as the highest investment priorities.

CREO Syndicate published a new 67-page report on scaling Regenerative Agriculture, featuring 48 funds raising $3.9B to invest in the space.

A neat list of climate jobs, newsletters, podcasts, books, and other resources from Elemental Excelerator in their new Interactive Hub.

TerViva partners with Danone to continue putting down roots with their pongamia protein and oil producing trees that also restore soil and sequester carbon. (CTVC TerViva profile)

As temperatures go up, grapes go north. Michigan is predicted to become the wine hub of the US (conveniently, by researchers at Michigan State University).

The Wells Fargo Innovation Incubator announced the five startups in its eight cohort focused on affordable and sustainable housing.

WSJ with the official call: green finance is now mainstream.

99 of the top 100 most climate vulnerable cities are in Asia.

Researchers have developed a prototype for rechargeable cement-based batteries. The new battery on the block is... the block itself.

🗓️ ARPA-E Energy Innovation Summit: Join for the 11th annual, four day program on transformational energy technologies from May 24-27th.

🗓️ Emerging New Models in Sustainable Real Assets: Join for a webinar hosted by Responsible Investor on June 9thfeaturing panelists from Cambridge Associates, Cyan Capital, and Spring Lane Capital.

🗓️ Urban-X Summit: Join Urban-X for their first ever summit from June 1-3rd featuring eight founders from Cohort 9 exploring how new technologies can build greener cities.

💡 Katapult Climate: Apply to the 3-month Katapult Climate Accelerator Program by June 6th.

💡 On Deck Climate Tech Fellowship: Apply to the second cohort of the 10-week fellowship by June 20th.

Green Bank Strategy Intern @Banyan Infrastructure

Research Intern @Carbon Collective

Summer Associate @Burnt Island Ventures

Head of Demand Generation @Sylvera

Growth Lead @Terra.do

Director of IP @Opus 12

Content Manager @Carbon Collective

Business Development Leader @Aralez Bio

Managing Director @Activate Berkeley

Environmental Innovation Fellow @Yale Center for Business and Environment

Feel free to send us new ideas, recent fundings, or general curiosities. Have a great week ahead!

Climate, capital, and carrots in London's new playbook

US plays popcorn politics with biofuels and beyond

Groundbreaking results from the geothermal developer’s main project