🌎 Bright spots and sunsets in the OBBB #253

One Big Beautiful Bill ushers in new (and old) energy agenda

Infrastructure deal nears as triple digit temperatures deliver on climate fears

Happy Monday!

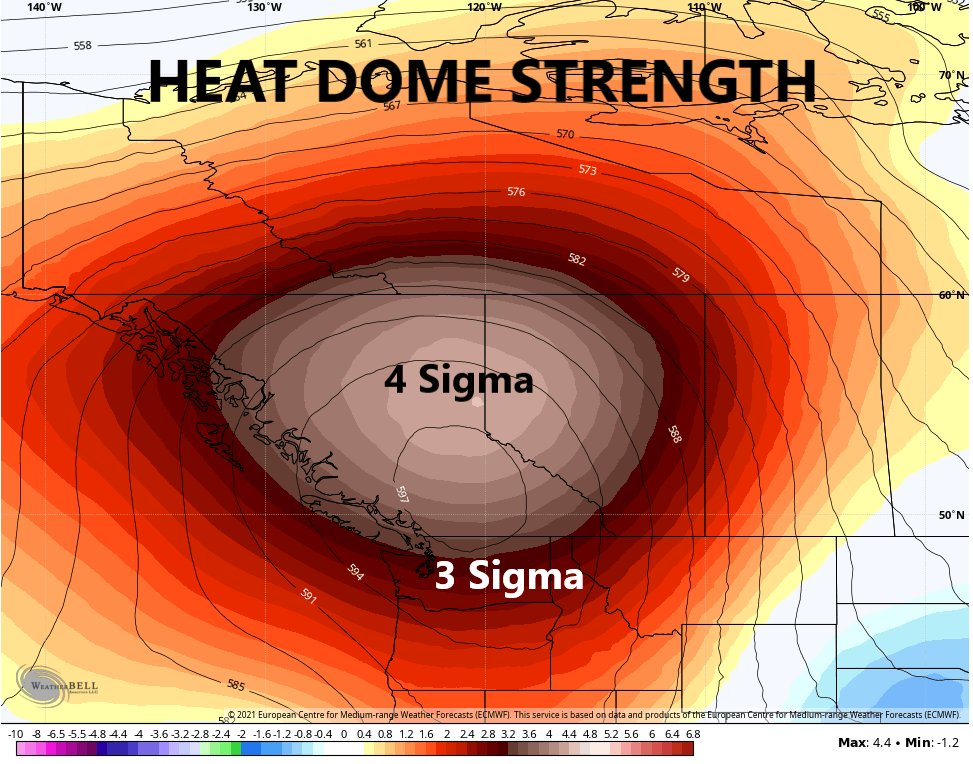

As those of you in the Pacific Northwest open this email, the National Weather Service has issued an excessive heat warning for virtually all of WA and OR - the region’s hottest heat wave ever clocking in with triple-digit temperatures for the first time. The heat dome will endanger many of those without air conditioning - sending a clear message on climate change and our requisite collective resilience.

In this week’s big climate news, BMW and Land Rover are pumping up their hydrogen fuel cell vehicles, FANG+ is revealed to make up 20% of Blackrock’s largest ESG ETF and a smattering of recycling, solar, and shipping fundings lead the week.

We’re taking a break from publishing the week after July 4th, and will shift to biweekly features for the summer.

Thanks for reading, and stay cool out there!

Not a subscriber yet?

We saw movement in the US Capitol this week as bipartisan groups settled their differences (No Climate, No Deal) to make movement on infrastructure and agriculture climate action. While infrastructure negotiations led to some concessions, agriculture talks grew carbon stocks.

🤝 An Infrastructure Deal. The deal between Biden and a bipartisan group of senators places $1.2T in investments to rebuild the nation’s infrastructure, which includes $579b in new spending to repair the nation’s roads, rails, and bridges.

The deal kept some key climate-related components from the initial proposal but decreased capital allocations specifically in:

🚗 EVs (-96%)

Proposal: $174b for installing a network of 500,000 EV charging stations by 2030

Deal: $7.5b for EV infrastructure

🚌 Public transport (-34%)

Proposal: $85b for public transit, electrifying 20% of the school bus fleet, and buying electric USPS vehicles

Deal: $56.5b for public transit ($49b) and electric buses / transit ($7.5b)

💧 Water systems (-9%)

Proposal: $66b for updating water system safety and stormwater management

Deal: $60b for water infrastructure ($55b) and Western water storage ($5b)

⚡️ Power infrastructure (-27%)

Proposal: $100b for improving power grid infrastructure

Deal: $73b for power infrastructure (including grid authority)

☂️ Disaster resilience (-6%)

Proposal: $50b to improve infrastructure resilience from climate change-related events

Deal: $47b for resilience

The other climate-relevant measure in the updated infrastructure deal includes $21b for environmental remediation. However, one of the major unmet hopes was to use the infrastructure bill as a method to enact a national “clean electricity standard” that requires power companies ratchet up the amount of electricity they generate from renewables.

Since the infrastructure legislation must still be written and passed by both the House and Senate, there is still time for both climate-positive and -negative changes.

In the same week, the infrastructure bill overshadowed exciting developments for farmers and carbon markets...

🌾 The Growing Climate Solutions Act. In a rare example of bipartisan action on climate, 92 senators voted to help shore up private agriculture and forestry carbon markets.

The Growing Climate Solutions Act helps producers to generate and sell carbon credits by setting up a third party certification process through the USDA. The bill also creates new producer-friendly resources that will help farmers and foresters scale up sustainable practices and tap into new economic opportunities through voluntary carbon markets.

More than 75 agriculture, food, forestry and environmental groups, including Microsoft and McDonalds, have signed on in support of the bill. The widespread push for voluntary carbon markets coincides with major corporations seeking to increase supply of carbon credits to reach their net-zero pledges.

♻️ Recycle Track Systems, a New York, NY-based waste and recycling management company, raised $35m in Series C funding from Citi Impact Fund, Edison Partners, Cue Ball, and Greenspring Associates.

💨 Sendle, an Australia- and Seattle, WA-based shipping carrier focused on carbon neutrality and small business, raised $35m in Series C funding from AP Ventures, Federation, Full Circle, and NRMA.

☀️ Solfácil, a Brazil-based solar fintech, raised $30m in Series B funding from QED Investors, Valor Capital Group, and angel investors.

⚡ Electric Hydrogen, a San Francisco, CA-based renewable energy startup focused on hydrogen, raised $24m in Series A funding from Breakthrough Energy Ventures, Prelude Ventures, and Capricorn’s Technology Impact Fund.

💨 Aeroseal, a Dayton, OH-based developer of building seals to reduce carbon emissions, raised $22m in Series A funding from Breakthrough Energy Ventures, Energy Impact Partners, and Building Ventures.

🌱 Equinom, an Israel-based developer of “smarter seeds” for plant-based foods, raised $20m in Series C funding from Phoenix Insurance Co., Fortissimo Capital, BASF VC, Trendlines Group, and Maverick.

🏠 Sealed, a New York, NY-based startup providing HVAC, weatherproofing, and smart home technology, raised $16m in Series B funding from Fifth Wall, FootPrint Coalition Ventures, Cyrus Capital, and CityRock Ventures.

⚡ IoTech, a Piscataway, NJ-based EV charging company, raised $13m in Series B funding led by BP Ventures.

💨 Ryte, a Germany-based startup that measures website carbon footprints, raised $10m in funding from Bayern Kapital, Octopus Investments, and others.

🚲 Ubco, a New Zealand-based electric utility bike startup, raised $10m in funding from Seven Peak Ventures, Nuance Capital, and TPK Holdings.

🔋 Electra Vehicles, a Boston, MA-based battery optimization software startup, raised $3.6m in Seed funding from BlackBerry Limited, LIFTT S.p.A., Club degli Investitori, Massachusetts Clean Energy Center, Hyperplane Venture Capital, Prithvi Ventures, Launchpad Venture Group, and TiE Boston Angels.

🪁 Kitepower, a Netherlands-based developer of airborne wind energy systems, raised $3.6m in Seed funding from ENERGIIQ, Windhandel Beheer, and Stichting ifund.

👔 Oxwash, a UK-based on-demand sustainable laundry service, raised $3m in Seed funding from Future Positive Capital, Clean Ventures, and Conduit-Ascension EIS Impact Fund.

💨 Holy Grail, a Mountain View, CA-based startup prototyping a small and modular direct air carbon capture device, raised $2.7m in Seed funding from LowerCarbon Capital, Goat Capital, Stripe founder Patrick Collison, Charlie Songhurst, Starlight Ventures, 35 Ventures, Deep Science Ventures, Y Combinator, and others.

🏪 Rheaply, a Chicago, IL-based provider of a resource management and exchange platform enabling the circular economy, raised $2.2m in funding from Microsoft’s Climate Innovation Fund and MIT Solve.

🔋 Circunomics, a Germany-based circular battery platform, raised $2.2m in Seed funding from Kalodion, Circularity Boost, and TES.

Circulate Capital announced a $14m first close of its new VC fund aimed at investing in innovations in materials and deep tech solutions to combat plastic waste and advance the circular economy.

The Rockefeller and IKEA foundations unveiled a $1b initiative to deliver clean energy to huge numbers of people worldwide who lack electricity access. The partnership aims to raise an additional $10b from other international development agencies by the end of the year, then invite commercial investors to develop individual projects in Asia and Africa.

Just this past week, 5 incumbent auto giants - Mazda, Volvo, Audi, Ford, and GM - all made moves to jump on the EV bandwagon. Ford, Mazda, and Audi promised new EV models, with Audi promising to halt internal combustion vehicles production by the mid-2020s. Meanwhile, Volvo and GM are boosting battery production investments through partnerships with existing battery manufacturers.

As for hydrogen-powered vehicles, BMW and Land Rover are developing and testing out new hydrogen fuel cell electric vehicles, hoping to fill in customer segments who can’t charge at home and/or want to preserve fast refueling times. BMW hopes their fuel cell electric vehicles will hit the road starting 2022 and Land Rover looks to convert most of their vehicles before the company’s EV-only production target by 2025.

A group of leading climate scientists including David King (former UK chief scientist) and Faith Birol (head of the IEA) formed the Climate Crisis Advisory Group to advise and warn global policymakers about the climate. While carbon mitigation is a key component of decarbonization strategies, the group will also focus on removing carbon and repairing natural systems to buy humans more time.

The world’s largest ESG-labeled ETF, the $17.5b iShares ESG Aware MSCI that’s managed by BlackRock, is loaded with tech stocks. Apple, Microsoft, Amazon, Facebook and Alphabet together account for ~20% of the fund’s investments. Ironically three of these companies are among the biggest companies fighting the SEC over its adoption of—wait for it—new ESG-related disclosures.

On the same (coincidental?) day as Amazon Prime Day, a British news outlet discovered how Amazon throws away millions of items of unsold stock every year. ITV uncovered footage of products being carried off and dumped at a warehouse which destroys an average 130,000 items per week.

Recognizing that maritime shipping accounts for 3% of global emissions, the International Maritime Organization (IMO) adopted key mandatory measures to reduce ships’ carbon intensity and established a rating system for a ship’s operational carbon intensity.

UPS delivered three new targets to meet the company’s net-zero emissions by 2050. While the package delivery company aims to cut package emissions by 50% and power their vehicle fleet and facilities with renewables, UPS’ hardest target will rely on taking a leap in decarbonizing air fleet emissions.

The Biden administration banned polysilicon materials from suspected forced labor in Xinjiang, which supplies 45% of the global solar panel production supply chain. While it intends to change labor practices, the ban along with a solar manufacturing tax credit will attempt to grow domestic production for the US.

A Massachusetts judge determined that Exxon must face a lawsuit accusing them of misleading investors and consumers about the impact of climate change on its business and products.

The global voluntary carbon market could be worth $50b by 2030. So far this year, the volume of the most liquid carbon credit exchange, Xpansiv CBL, saw more than 30 million tons of CO2 traded emission, nearing the all time record of 31 million tons.

Coal mine operators, like CM Mining, hope their spent coal mines and toxic wastelands can resurrect themselves into solar farms.

NYT Magazine published a series of stunning long-form pieces on climate, including the carbontech revolution, Engine No. 1’s Exxon win, and massive cargo ships going green.

Tactics for building in sustainability with the (female!) CEO powerhouses of C16 Biosciences, Shiru, Modern Synthesis, and Compound Foods.

Thoughtful and well-deserved profile of LACI, the Los Angeles Clean Tech Incubator - which incubated ChargerHelp! (See our profile with CEO Kameale Terry)

The debate over ocean floor mining deepens. Hook line and sinker on the “against” side of the table of deep sea mining.

Look out for floods of capital flowing into even bigger climate tech funds soon. TPG is raising a $5b climate-related fund. Chris Sacca’s Lowercarbon Capital is raising $830m across a flagship fund and an opportunities fund.

Overview and examples of the many AI applications in climate. Tldr; it’s a massive market opportunity.

McKinsey dropped a report on the top 2021 trends in tech. Do you agree with their positioning of the future of clean technologies?

TED’s list of 12 climate documentaries and series. How many have you watched?

Old Faithful is at risk from new warming.

Get your baby green, no matter the cost.

According to the CEO of Calvert Research Management, we’re “way behind” in water and sanitation systems. Some might even say that we’re running dry.

🗓️ Puro.earth NASDAQ acquisition: The acquisition of the Puro.earth marketplace by NASDAQ could be transformative for the carbon removal industry. Join on June 30th for an interview with Puro’s Founder, moderated by Sophie and hosted by AirMiners.

🗓️ Techstars Sustainability Roundtable: Join on July 15th for a discussion with Amazon, Spotify, and Climate Finance Solutions on ways decarbonization startups can secure funding from leading practitioners in the sector.

💡 The Clean Fight: New Energy Nexus and NYSERDA are partnering for the second edition of The Clean Fight, a non-profit accelerator focused on building decarbonization. Apply by July 18th.

Associate @Rhapsody Venture Partners

Program Assistant @Aspen Institute Energy & Environment Program

Program Director @CELI

Product Manager @Therma

Head of Market Relationships @Nephila Climate

Sales Account Executive @Therma

Senior Systems Engineer @Antora

Design Lead @Joro

Data Scientist & Science Communicator @Kairos Aerospace

EV Charging Sr Engineer @Amazon

Carbon Project Development Lead @Cargill

R&D Process Engineer @Mission Zero

Electric Grid Product Management Lead @X

Island Cloud Sr Software Engineer @Crusoe

Methodology Analyst/Environmental Scientist @Nori

Quality Control Lead/Analyst @Kula Bio

Feel free to send us new ideas, recent fundings, or general curiosities. Have a great week ahead!

One Big Beautiful Bill ushers in new (and old) energy agenda

Climate, capital, and carrots in London's new playbook

US plays popcorn politics with biofuels and beyond