🌍 Solugen (bio)forges ahead with LPO

A Q&A with the DOE LPO director Jigar Shah and Solugen CEO Gaurab Chakrabarti

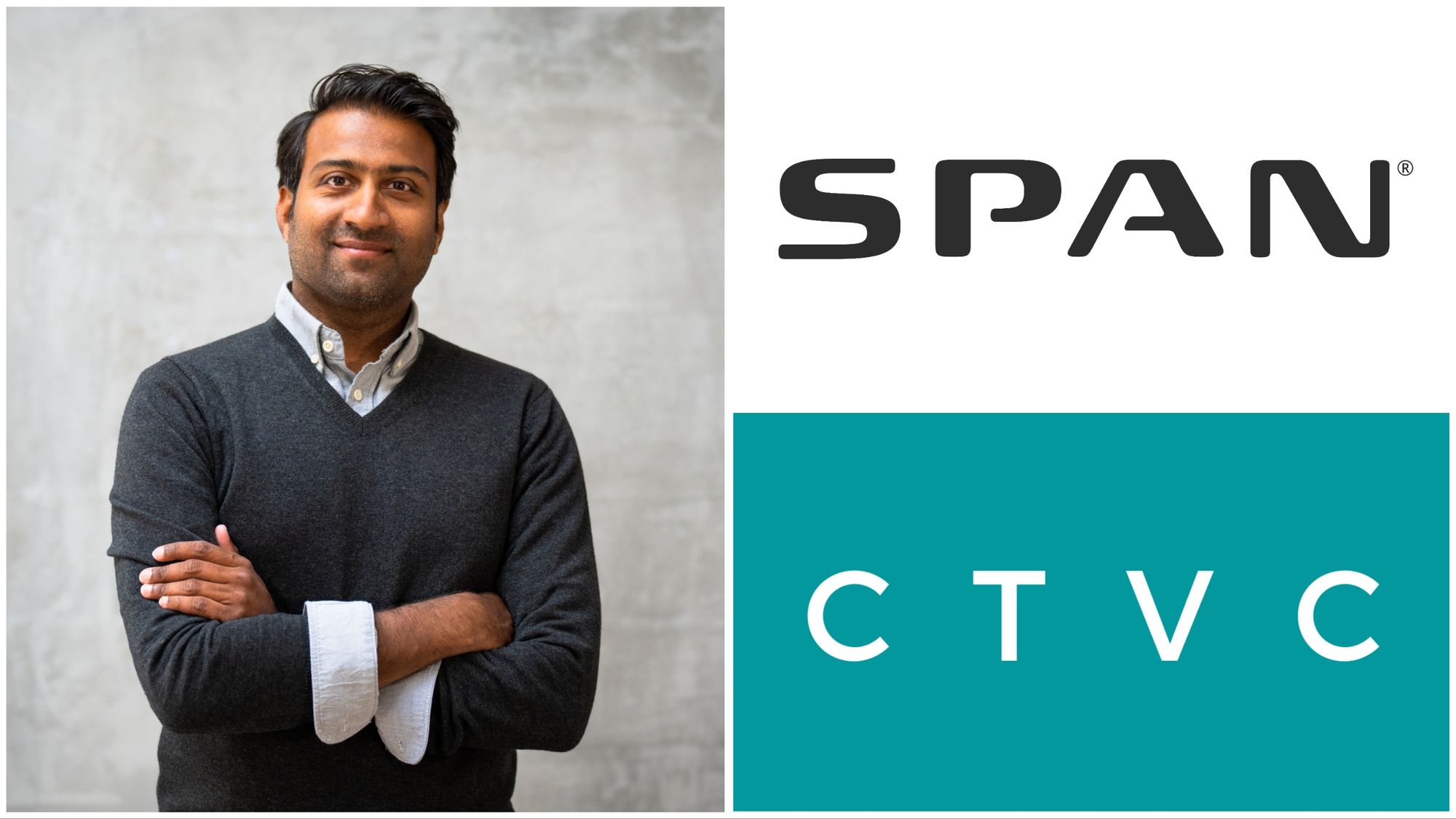

This week, smart electrical panel startup Span raised an additional $96M, following a $90M Series B round last year. We Zoomed in with founder and CEO Arch Rao, who’s amped up about the widespread need for more intelligent control of residential energy consumption. Span’s electric dream takes a ground-up approach—reimagining the old-school panel that enables electrification as a gateway for energy management. With fresh funding and partners like Sunrun and Kenmore, the company’s next phase will couple more household hardware with software for grid operators to balance a panoply of electric home upgrades like DERs, EV chargers, and battery storage.

Tell us about your background and what got you energized about electrical panels.

The last two decades of my career I've been focused on clean energy technologies. I worked on developing wind turbines, energy markets, and trading algorithms. Then I co-founded a company (Verdigris) focused on energy efficiency. Most recently, I was the head of product at Tesla for the energy business.

Along the way, I've had the good fortune—or misfortune—of working on grid-scale power generation all the way to behind-the-meter storage and demand response. Having deployed a lot of these systems, there's been hands-on observation of the fact that the electrical infrastructure plays a critical role in enabling us to decarbonize. That seems like an obvious statement, but a good number of companies have been working on software-type solutions that frankly don't change the current model of how energy is delivered and consumed. Every home, every building has an electrical panel, which is what your existing appliances are connected to and your new suite of appliances—like solar, batteries, EV charging—have to connect to by design. But that has remained an analog device for as long as any of us can remember.

So that created this notion that there should be more opportunity, from a purely technical architecture standpoint, to make this panel smarter and a hub or gateway for being able to do energy management.

How do Span panels fit into the push toward decarbonization?

We've seen the decarbonization of transportation happening through EVs, but the consumer-led adoption of electric cars far surpasses the electrification of trucks and buses, etc. That's happened because when you deliver products that are functionally comparable or superior to the incumbent alternative, and have economic merit, consumers are going to make that shift. That's precisely what I expect to see with homes as well. Consumers will lead the decarbonization narrative by electrifying their everyday lives by switching their HVAC systems to heat pumps and electric water heaters and induction cooktops, plus adopting new appliances, like solar, batteries, and EV charging. The device that enables them to do so rapidly is the smart panel. That is the genesis of Span—wanting to reinvent the infrastructure at the edge of the grid, which enables faster adoption of consumer-led electrification.

The electrical panel is an enabler for home electrification and upgrades. Can you spell out how panels fit into the whole system?

If you want to replace your appliances with electric alternatives or you want to add an EV charger, you're faced with another difficult challenge. You have to spend a lot of money, and this is true for two out of three homes in the US—40 million homes have to update from a 100-amp panel and service to a 200-amp panel or service. But that upgrade comes at a very punitive cost and dependency on the utility. In places like San Francisco, that can be $30,000 and having to wait 12 months for PG&E to update your service. That is not a scalable way for us to solve that for electrification at large.

With our panel, we can control those loads during those few hours in a year where they’re coincident—which means when your EV is charging at the same time your electric dryer is running at the same time your electric water heater is running—in a way that’s not disruptive to your lifestyle. We can avoid a very expensive infrastructure upgrade while allowing you to fully electrify. That is functionally different and economically compelling. And that economic rationale has just become much stronger for a larger portion of the population with the Inflation Reduction Act rebates. A lot more households can now afford and access solutions that Span is developing, either directly or indirectly through partners.

There are a couple other companies that are working on products like smart circuit breakers. What’s the difference there?

You can either think about piecemeal solutions to existing infrastructure—like CT-based energy measurement, smart breaker-based load management, external grid disconnects, or automatic transfer switch for backup—or you can think about it from the ground up, which is harder to do, but a much better solution. Our panel is already a revenue-grade smart meter, a grid disconnect, a gateway computer with all the forms of communication you need, and already meters and controls every circuit. So out of the box, you can put any existing one-inch breaker into the panel, and you can get the same degree of visibility and controls that you do on just one load if you had a smart breaker. Smart breakers are expensive and take up more space because you're trying to add all this capability into a single breaker. We’re able to measure multiple circuits using a single microprocessor. So it becomes more cost-effective and more adaptable.

With the IRA making some of these solutions more accessible to more households, what kind of impacts have you seen so far? And what do you expect to see moving forward?

The measurable impact of deployments is yet to happen, but the tax credits are already available. We're seeing the pull-through of that through solar storage installers, but also now appliance installers. The IRA provides for up to $4,000 in cash rebates for a panel and up to $2,500 for the labor associated with installing the electrical panel in a home. For a low-income household, you can capture 100% of that rebate. A moderate-income household can capture 50% of that cash rebate, and every household that has taxable income can claim 30% ITC on electrification products like our panel.

We now have a lot more technology providers, like heat pump manufacturers or electric water heater manufacturers or even EV providers, that are looking to partner with us, because this infrastructure limitation in a home that previously gated the adoption of a heat pump or electric water heater can now be almost fully paid for in a lot of instances with these IRA incentives. Right now we're doing a lot of the partnerships and technical integration work, so that when the rebates become available through state energy offices, we can scale our operations fairly rapidly with our partners.

What kind of business models are best suited for residential electrification?

Home electrification is not a short-term investment. It’s really investing in a meaningful improvement to your built environment or your lifestyle, similar to how you think about weatherization or replacing your windows or replacing your roof. We couldn't just drop ship our product to your home, like you would buy an Alexa device. By design, it requires a licensed contractor or an electrician to install the product.

On one end, we educate the consumers about the benefits and the available incentives that make it economically compelling for them to buy a product. On the other end, we sell through established partners that are solar storage providers or electrical contractors installing EV chargers or plumbing contractors installing heat pump devices or, increasingly, home builders and, over time, utilities that can get more benefit than just the individual consumer’s electrification gain. A utility could potentially enroll customers automatically into demand response programs or platforms, because our panel, once installed, is your home for the next ~30 years and can control every device—no matter what car you have, no matter what HVAC system you have, no matter what pool pump you have.

Are you considering a Sunrun-type model where you could lease these panels and have that type of stable, recurring revenue?

We don’t necessarily have to do that on our own. Companies like Sunrun currently bundle this as part of your loan or PPA—similar to how they bundle storage with your solar loan or lease agreement. This is just an enabling piece of technology for a better customer experience. Really what we're looking at offering customers is the appliance. When you buy a solar system, you're not necessarily thinking about the inverter, but you know the inverter gets co-installed with the panels and the solar modules on the roof. That's how you would start to think about products like our smart panel. It's what you get when you're upgrading your home to an electric alternative.

How are you hoping to expand the business with this new round of funding? Are there products beyond the EV chargers and electrical panels that you've explored so far?

What we are ready to talk about publicly is investing in more physical products that can have relevance in more installation contexts. So not just single family homes with a main panel, but single family homes with a main panel and sub-panel or a multi-family home or apartment with a smaller panel. We think there are opportunities for us to enable electrification for all these customers, and we're investing in developing versions of our product that make that possible.

We’re also investing in two forms of software. One is software integration that allows consumers to connect our panel with local devices, like an EV charger or a heat pump or a thermostat or a water heater, allowing for more refined control or set-point control of these devices, outside of just turning an entire circuit on or off. Secondly, we're investing in software capabilities at the fleet level or the platform level, where we can aggregate thousands of Span homes and make it available to DER aggregators or virtual power plant solutions. Essentially through a single interface, we can control multiple devices in your home—generation devices like solar, storage devices like batteries or EVs, or loads, like your heat pumps, water heaters, etc.

And we're hiring! We're continuing to grow and we'd love to add exceptional people to the team.

So the vision moving forward is for this to be an entire Span ecosystem—the panel, the control, the user interface and some of the appliances themselves?

Some of the appliances, yes. We don't envision making induction cooktops and displacing the Mieles of the world. But I think appliances like EV charging and storage and power electronics for solar, or other DC devices are still relatively nascent as an industry and there is opportunity for us to bring better, more integrated solutions to market there.

Candidly, I'm hoping that the hardware we're developing today becomes commoditized over time—that homes aren’t getting analog panels or dumb panels installed. Every home should demand visibility and control into every circuit at the panel. At that point what you're really scaling up is what else you can do once you have that degree of visibility and control at the edge of grid.

What we're focusing on is the major loads. Electric vehicle charging is going to be a new important load to control and why don't we design systems that can be controlled out of the box? HVAC is the next big load and water heating that's electric is the other big load. Everything else becomes noise in the system if you can control these major loads, and it becomes even more flexible if you already have a battery system that's attached to the panel. Because now you can push and pull power.

What have you learned from your existing pilot projects and partnerships about scaling this from individual homes to aggregated DER assets? And what needs to happen in the future to enable more of that?

We've only been selling and installing products for the last couple of years, but along the way, what we’ve been able to do is validate the value proposition or the benefits to grid operators. Once the Span panel is installed, they can see and control many things through it. That's what the pilots have enabled us to do. But at the same time, we now have more resources to invest in building out a more robust, scaled-up version of our platform with the right kind of API integrations required, etc.

The other key thing we've been able to do is validate the business models. If you're a utility in a certain part of the country, how do you offer this to your customer? Do you offer it as a fully rate-based device? Do you offer it to only customers that are buying EVs? Do you offer it to customers anytime they require a service upgrade or panel upgrade? What's evolved is a few different versions. There are some utilities that can directly replace the panel. There are some utilities that will give you a one-time upfront rebate for a smart panel, as opposed to a dumb panel. And there are some utilities that want to create DER enrollment programs that you can opt into once you have a panel like Span.

How does Span work with utilities and grid operators right now? What does that relationship look like?

It's intentionally small today, because we're looking at programs where utilities are typically owning and installing the product on behalf of the customers. But we are moving in the direction of being able to give customers direct software and send you a notification saying, ‘Hey, your local utility will compensate you X amount for enrolling in the program. If you're interested just click here on the app.’ So think about how Nest Renew works. It just pops up when you turn on your Nest thermostat and says, ‘Would you like to participate in a Renew program that'll help you be greener or save you some money?’ And you can click ‘Yes’. That's actually where we're going.

As a grid operator, or even a utility, you'd like to know what and where your loads are. And we don't have to do any clever software disaggregation to know that. By design, our panel measures every single circuit and all these major loads—your EV charger, your air conditioning system, your pool pump, your sauna—are all on dedicated circuits as it is. So it becomes a very, very easy way for us to say, ‘Hey, customers in the zip code that have EV chargers, I'd like for you to not charge or charge at a lower speed between 5pm and 6pm.’ We already know how to do that.

How are you communicating with customers about the way demand response works and what kind of reaction are you getting? Are people receptive to this or is there some concern about home appliances being turned on and off?

Broadly, there are three types of customers. There are customers that are purely driven by the tech capabilities and functionality and are not necessarily motivated by providing grid services through adopting our products. We’re scaling up to customers now that are primarily motivated by shifting to an electric lifestyle and perhaps not as sensitive about the economics. They're buying the products because they can electrify further, because they can get a better EV charger, and because they can participate in DER programs. It's not an outlier expectation. They are happy to participate in these programs and maybe marginally be inconvenienced by a pool pump or a water heater being shut off for a short period of time.

Increasingly, we're entering the realm of customers that are doing it because it just makes pure economic sense. They're thinking, ‘Why would I replace my water heater with a gas-burning water heater when I can get an electric water heater with a Span panel at a price point that's cheaper and lessens the emissions in my home and has a better set of controls, better functionality, and saves me money on energy and I can take advantage of the rebates?’

How do you hope Span will fit into the future of home electrification? And what sort of scale for demand response do you expect to see in 2030 or beyond?

By the end of the decade, we're hoping to be in 10 million homes, having enabled either full or partial electrification. It seems like an ambitious and daunting number, but if you distill it down to just the 77 million single family homes in the US, 122 million households in the US, 10 million is a fraction of that. And in that time horizon, we expect to be in more than just the US.

Even if you aggregate just a subset of those 10 million homes, you've suddenly got gigawatts of controllable demand across these feeds. You will at least have a single homogenous platform, as long as you have a Span device in your home, to be able to orchestrate these. And that's true for 20 or 30 years once the panel is installed.

If you’re energized by the challenges and opportunities of residential electrification, check out the open roles at Span!

A Q&A with the DOE LPO director Jigar Shah and Solugen CEO Gaurab Chakrabarti

The White House’s new announcement clears the air about the voluntary carbon market

The Goldilocks effect in geothermal HVAC systems