🌎 Bright spots and sunsets in the OBBB #253

One Big Beautiful Bill ushers in new (and old) energy agenda

Plus, spotlight on Andy Karsner, senior strategist at X (the moonshot factory)

We stand with the millions of Black Americans and allies fighting for racial justice and equality.

Racism and climate change are explicitly linked. Historically marginalized communities face the most adverse effects of climate change, but oftentimes are faced with threats more immediately existential. It’s hard to worry about offsetting your carbon when you’re more worried about not setting off the police. Technology capable of limiting the impacts of a warming planet needs to be made consciously available and accessible, and today the curve of technology unfortunately tilts toward those with the money and power to signal they can afford to care more about the future.

We’re privileged to come from backgrounds that enable us to choose to work on climate change. Those who are experiencing the brunt of global warming do not.

We’ve been reading and learning from what Dr. Ayana Elizabeth Johnson, marine biologist and CEO of the Ocean Collectiv, said in The Washington Post:

“[The] many manifestations of structural racism, mass incarceration and state violence mean environmental issues are only a few lines on a long tally of threats. How can we expect black Americans to focus on climate when we are so at risk on our streets, in our communities, and even within our own homes? How can people of color effectively lead their communities on climate solutions when faced with pervasive and life-shortening racism?

[...] Climate work is hard and heartbreaking as it is. [...] When you throw racism and bigotry in the mix, it becomes something near impossible.

[...] Look, I would love to ignore racism and focus all my attention on climate. But I can’t. Because I am human. And I’m black. And ignoring racism won’t make it go away.

So, to white people who care about maintaining a habitable planet, I need you to become actively anti-racist. I need you to understand that our racial inequality crisis is intertwined with our climate crisis. If we don’t work on both, we will succeed at neither. I need you to step up. Please. Because I am exhausted.”

We cannot build a sustainable planet until we confront the reality of structural racism. It’s what has led the children of Flint to drink polluted water, coronavirus to disproportionately impact Black communities, and generations of urban families to bear the brunt of respiratory illnesses caused by the noxious mix of pollution and poverty.

For our part, we’ll prioritize more issues of race and climate justice, with a focus on educating ourselves on where saving the planet and saving black lives intertwine. We remain committed to building a community focused on bringing more diverse voices to the table, and while we’re learning, would love your thoughts on how we can do better.

💨 Climeworks, a Switzerland-based direct air capture startup, raised $76m from undisclosed investors. The startup builds machines which capture carbon dioxide from the air and stores it in solid state underground or delivers it to industrial clients such as Coca-Cola. Bloomberg had more here.

⛽ LanzaTech, a Chicago-based carbon recycling company, raised $50m in funding from Suncor Energy, All Nippon Airways, Mitsui & Co., and the US Department of Energy (grant). The funding will help launch LanzaJet, a new company producing sustainable aviation fuel. More here.

🚲 Tembici, Brazil-based micromobility startup, raised $47m in Series B funding from Valor Capital, Redpoint eventures, and the IFC. The startup currently owns 80% of Latin America’s micromobility market and will use the funding to double down on rolling out shared electric bikes. TechCrunch has more here.

🛴 Beam, a Singapore-based micromobility startup providing shared e-scooters, raised $26m in Series A funding from Sequoia India and Hana Ventures. TechCrunch has more here.

⚡ Atom Power, a Charlotte, NC-based maker of a digital circuit breaker, raised $17.8m in Series B funding from Valor Equity Partners, Rockwell Automation, and ABB Technology Ventures. The breakthrough technology allows users to seamlessly switch energy sources (e.g. grid to solar power) and will be applied to the EV charging infrastructure market. VentureBeat has more here.

🛴 Superpedestrian, a Boston-based micromobility startup, raised $15m from Edison Partners, Spark Capital, and General Catalyst. As part of the arrangement, Superpedstrian also acquired Zagster, a fleet management firm, from Edison Partners. The Verge has more here.

🚄 Zeleros, a Spain-based hyperloop company, raised €7m from Altran, Road Ventures, Plug and Play, and Angels Capital. The “fifth mode of transport” will become the best alternative to efficiently and sustainably connect long-distance routes, with connections like Paris-Berlin reduced to less than an hour. More here.

⚡ SwitchDin, an Australia-based distributed energy resources software company, raised $3.5m from QCELLS, a German-Korean solar-system manufacturer. SwitchDin’s energy management software helps facilitate the participation of solar, storage, and other equipment in virtual power plants. More here.

🌳 Propagate Ventures, an agroforestry project development and investments platform, raised $1.5m in seed funding from Neglected Climate Opportunities, an arm of Grantham Environmental Trust. The platform is modeled after companies like AngelList and Wunder Capital to make it easier for investors to back agroforestry projects. AgFunder has more here.

This past week, we Zoomed with Andy Karsner, Senior Strategist and Space Cowboy at X, the moonshot factory of Alphabet. Karsner has been a leader in energy financing for 30 years and is also founder and Executive Chairman of Elemental Labs and a Precourt Energy Scholar at Stanford University. He was most recently Managing Partner at Emerson Collective and leader of Elemental, its environmental practice. From 2005 to 2008, he also served as Assistant Secretary of Energy for Efficiency and Renewable Energy of the United States. Karsner has invested in successful technology startups, including Nest and Tesla). Our chat below has been edited lightly for length and clarity, so read the full interview here.

When is private capital versus public capital better suited to fund certain climate tech opportunities?

The question sounds simpler than it is. Neither funding source is uniform. Within private capital, project finance differs significantly from venture capital. It’s the same with public money. Public loan guarantees differ from ARPA-E (government funding for early-stage moonshot projects).

It is more useful to focus on the merits of a project instead of its funding source. If an effort is worthwhile and the public has a stake in its success, public policy instruments can be marshalled to support it. However, public money is usually limited and slow-moving (excluding during crisis situations like the pandemic), so public capital often lacks the scale and agility to solve problems alone.

The question becomes how to get private markets moving in the right direction. Private capital, philanthropic capital, and market-based solutions do remarkably well when properly incentivized and deployed for longer, more patient cycles. Private markets in the U.S. can be highly effective, but they are usually constrained by having a singular goal of maximizing profitability. These markets do not inherently promote national strategic priorities or humanitarian values. We need leaders with foresight to encourage investment in areas where there is a pressing need for a public good. Unfortunately, politics today often consists of polarized coalitions that impede making decisions that advance our interests. Too much political dysfunction yields too little policy efficacy or consistency to achieve predictable market signals.

What does “climate tech” mean to you?

I like and dislike the term “climate tech.” On the positive side, the “tech” label encourages dialogue by providing a platform for people to exchange ideas. “Tech” is also a priority for investors, so the term alone can help spur capital formation. That’s why investors are more likely to subscribe to a newsletter about “climate tech” than “climate solutions,” even if they address the same topics. I like the climate tech space because it galvanizes enthusiastic smart minds to develop new ideas that improve our world.

On the flip side, “climate tech” is a misnomer. It suggests a distinct category when, in reality, it has expanded to encompass innovations that are not focused on climate issues. These technologies might still address climate change indirectly by boosting energy efficiency, for example, in a way that is good for the environment. And, while some solutions deemed to fall within the climate tech space are not climate-focused, some others are not technical.

In this context, we should ask not only whether a solution is “climate tech” but also if it is “climate optimal” ̶ how much will it help the climate, and how fast will it work? This is not to say we should look for a single remedy. To the contrary, climate change will require aggregating and scaling many incremental solutions.

How will the pandemic affect our actions on climate change?

Some people say that we should not focus on climate change now because doing so will distract from our efforts to contain the pandemic. Of course, we cannot separate one from the other - they are interconnected. Both the pandemic and climate change are Mother Nature’s invoice that we need to pay for disrupting the environment. Both the pandemic and climate change emerged from nature’s responses to human activity. Moreover, both problems require urgent action.

The pandemic offers a glimpse of the potentially catastrophic results of ignoring climate change and should motivate us to move quickly. At the same time, the expedited global response to the pandemic offers insight into how we can slow or stop global warming. We have become united in a race for a vaccine because we generally agree that it is critical for a recovery. The climate crisis is the same in that we know what we have to do to solve the problem. The climate “vaccine” may be deep decarbonization, a reduction of the amount of CO2 in the atmosphere.

Unlike a vaccine treatment, we will not cure climate change with a single injection. Rather, we must change our behaviors (together with using better technology) as though we are managing diabetes. Placing a premium on carbon reduction efforts can unlock the race to a climate “vaccine.” Many of the technologies that can help us achieve this goal are within reach. It needs to be a race so we can bend the curve as soon as possible. Every day that we wait, the curve gets steeper, so we need to employ the same vigor to address climate change that we apply to developing a vaccine. Public funding and good regulation can mobilize private capital and help spur efforts to find and implement climate solutions.

Continue reading the full interview below.

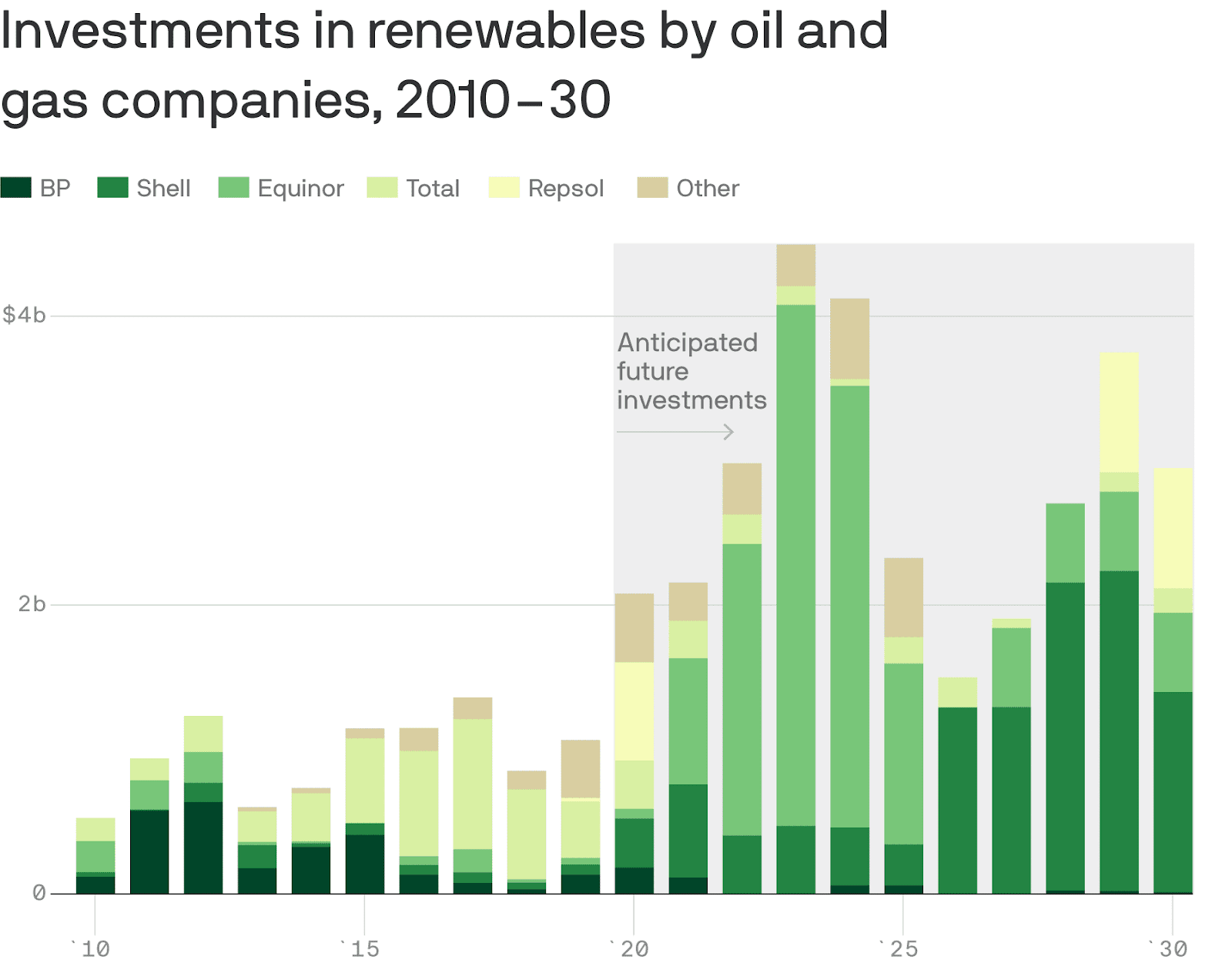

Rystad Energy: For all of the talk from oil and gas majors around their clean energy transitions, there’s been little investment to show for it (and practically none from US majors.) The next few years’ investment will be dominated by Equinor, a Norwegian state-owned energy company. In a similar vein, last week Total announced a significant stake ($88M for 51%) in a new UK offshore wind farm.

NYTimes: Russia declared a state of emergency when one of the biggest oil spills in modern Russian history turned a river crimson.

White House: Trump issues an executive order to accelerate / waive environmental reviews for infrastructure projects under emergency circumstances which “make it necessary to take actions with significant environmental impacts without observing the regulations”.

Reuters: US senators introduced the Growing Climate Solutions Act which encourages farmers to employ carbon dioxide-absorbing practices which generate revenue through carbon credits.

MIT Technology Review: Despite enthusiasm for soil carbon sequestration, there’s little evidence that carbon farming works as well as promised. As farmers have known for millennia, soil is a powerful yet fickle creature which scientists have yet to quantify and wrangle.

Bloomberg. Hydrogen fuel companies such as ITM Power are having a stellar year, gaining as much as 290%. By using electricity to turn water into hydrogen, these companies help decarbonize heavy-emitting industries such as steel production. As hydrogen projects scale to industrial levels, we will (hopefully) see the cost trend plummet in line with that of the solar and wind industry.

KQED: As COVID depressed energy consumption, the revenue from the California cap and trade market dropped to $25M from an expected $600M+. That lost revenue was needed for a just clean energy transition - at precisely when it would’ve most benefited newly jobless communities. Why does the CA cap and trade market have so many alliances with fossil fuel generators?

McKinsey: New technologies in four key areas could help the world feed itself sustainably. These areas include reducing agricultural emissions, using artificial intelligence to limit food waste, making fisheries sustainable with advanced analytics, and developing sustainable proteins. More here.

Reuters. GM is developing an electric van for business customers such as Amazon and UPS in a bid to capture a lucrative market segment Tesla has yet to address.

NYTimes: Read up on articles, essays, and books which elucidate the links between racism and environmental degradation.

Grist: Five environmental justice leaders address the compounded threats of racial injustice, climate change, and COVID-19

Hot & Bothered: Podcast with J. Mijin Cha, a professor at Occidental College, discussing a just transition to a low-carbon economy - with hot takes on the CA cap and trade program’s environmental justice missteps and what a post-pandemic jobs program needs to look like.

TechCrunch: Venture funds have an abysmal diversity fingerprint. Could institutional investors move the needle quickly by mandating that fund managers must invest a certain percentage of capital to underrepresented founders?

WRISE Climate Conversations: WRISE (Women of Renewable Industries and Sustainable Energy) has launched a series of workshops to elevate the diversity of voices on the critical issue of climate change. VoteRunLead will host the first session on Monday, June 8 at 11am PT.

Insights from Early-Stage Climatetech Investors: Greentown Labs is hosting a panel of investors on Friday, June 12 at 9AM ET. They will discuss how to build company resilience, manage investor relationships, and approach fundraising in an uncertain economy.

Feel free to send us new ideas, recent fundings, or general curiosities - particularly those from folks with diverse voices and perspectives.

One Big Beautiful Bill ushers in new (and old) energy agenda

Climate, capital, and carrots in London's new playbook

US plays popcorn politics with biofuels and beyond