🌍 EU CBAM’s €8bn price tag #282

We did the EU carbon math

Happy Monday!

It was great to see so many of you at New York Climate Week! We sent out our full on recap of the week on Friday, but ICYMI, we’ve got some highlights and reflections below, and what it means for what’s to come.

In other news, the DOE pulls back unobligated funds, Orsted gets the judicial go-ahead to resume offshore wind, and the UK’s LDES cap-and-floor scheme is starting.

In deals, $845m for waste disposal services, $67m for alternative proteins development across two deals, and $34m for EV charging.

Thanks for reading!

Not a subscriber yet?

📩 Submit deals and announcements for the newsletter at [email protected].

💼 Find or share roles on our job board here.

Climate Week is technically over, and it was great to see so many of you out there at everything from early coffee chats to late-night rooftop mixers to off-the-record roundtables. If your group chats are still buzzing and your feet are still sore, you’re in good company.

We’re still absorbing what felt like a very different NYCW. And if you missed our full Friday wrap up, here’s the TLDR: It didn’t feel so much like “climate week” this year. It felt like Energy & AI Week — and that might not be a bad thing.

While UNGA made global headlines — with the US president skipping the climate summit and calling climate change a “con job” — the climate tech world couldn’t have felt further from that stage. It felt pedal to the metal for this community, with a recognition that the world is already teetering on 1.5 degrees while power demand is meaningfully rising for the first time in decades.

We’d been wondering how NYCW would play under Trump 2.0 — would it be a holding pattern or a reset? Maybe both. Yes, it’s a challenging market. And yes, the policy picture is murky. But it’s still an opportunity: we heard about deals moving forward, projects getting built, and money still flowing — not just from VCs but infra and project finance, too.

This year wasn’t about climate as a broad theme — it was about power: Who’s producing it, who’s buying it, and who’s trying to build it faster.

Utilities, hardtech founders, and infra investors found themselves at the center of the conversation. “Climate” as a word took a quiet step offstage, replaced by security, resilience, affordability, and reliability.

Corporates, investors, founders, and protesters were all still there, of course. But the tone was scrappy and solution-focused. Out with the lofty decarbonization pledges and photo ops, in with the grounded urgency, realistic solutions diving. Less “green everything,” more grid everything — and definitely no more talk of green premiums.

As we said on Friday: “The paradox is that the same headwinds threatening the sector are also its strongest tailwinds.” Higher load growth, climate risks, cost pressures, and policy uncertainty aren’t just friction, they’re forcing functions. What felt like existential risk last year now looks more like an accepted market opportunity for clean firm power, storage, grid innovation, and demand flexibility.

The week felt like a signal of what's next, brought to you by the people doing the work: The real investable opportunity is at this intersection, the consumption surge of this New Energy Era and the risk mitigation imperative of the New Climate Reality.

For the full rundown (quotes, pics, on-the-ground flavor), read our full Overheard at NYCW recap. But here’s the short version of what we saw:

⚡ Energy & AI took the mic. Startups were selling interconnection APIs, load-balancing platforms, and grid analytics. Data centers are now the wedge issue everyone’s planning around.

📈 Demand is up. So is uncertainty. Everyone agrees the load is coming. No one agrees on how much, and how fast. The urgency around affordability and resilience was high — and economics, not emissions, are driving buying decisions.

🔋 Infra capital is circling. Infrastructure and PE firms might not have been in the spotlight as much as the startup demos or policymakers speechmaking. But they were a quiet force throughout the week – actively sourcing, sitting down with founders, and looking for what’s buildable.

🔄 “Climate” is being rebranded. From national security to circularity to reliability, the climate narrative is being reframed. It’s not smaller, overall, just more focused on adjacencies. Maybe it’s the political climate, maybe it’s rising climate risks plus load growth, but solutions were positioned more broadly than we’ve seen before.

📊 Data is the product. From MRV and methane to permitting APIs, startups are trying to make infrastructure legible. But the bar is high: investors want “investor-grade” data that can be underwritten, not just visualized.

We’ll have more NYCW-adjacent coverage soon — including what you missed at our own event, SightLive, plus deeper dives from our founder and investor convos. (And if you can’t get enough NYCW takes, read Heatmap’s roundup, Bloomberg Green’s coverage, Reuters’ UNGA vs. NYCW comparison, and ESG Dive’s announcement highlights.)

But for now? Deep breaths, glass of water, inbox zero – and head’s down to get building.

🛰 Hubble Network, a Seattle, WA-based satellite-powered bluetooth connectivity network developer, raised $70m in Series B funding from Y Combinator.

🥩 The Protein Brewery, a Breda, Netherlands-based plant-based protein developer, raised $35m in Series B funding from Brabant Development, Invest-NL, Madeli, Novo Holdings, and Unovis.

🥩 Revyve, a Rotkreuz, Switzerland-based ingredients from single-cell proteins developer, raised $28m in Series B funding from ABN AMRO, Invest-NL, BOM, Grey Silo Ventures, Lallemand Bio-Ingredients, and other investors.

⚡ Chakr Innovation, a Gurgaon, India-based manufacturer of retrofitted diesel generator emissions control devices, raised $22m in Series C funding from Iron Pillar, Indian Angel Network, Inflexor Ventures, ONGC, and SBI Ventures.

🏭 ANYbotics, a Zürich, Switzerland-based manufacturer of autonomous legged robots for inspections, raised $20m in Growth funding from Climate Investment, Aramco Ventures, Bessemer Venture Partners, NGP Capital, Qualcomm Ventures, and other investors.

🏠 ATEC, a Castlemaine, Australia-based smart stove developer, raised $16m in Growth funding from Lightrock, TRIREC, and Schneider Electric.

🚗 Telo Trucks, a San Carlos, CA-based electric compact truck developer, raised $20m in Series A funding from E12 Ventures, Marc Benioff, and TO VC.

🌱 Sunhat, a Köln, Germany-based sustainability data platform, raised $11m in Series A funding from CommerzVentures, Capnamic Ventures, EnBW New Ventures, WEPA Ventures, and xdeck Ventures.

🛵 Simple Energy, a Bengaluru, India-based smart electric scooters developer, raised $9m in Series A funding from Haran Family Office.

🔋 Unbound Potential, a Thalwil, Switzerland-based long-duration energy storage developer, raised $7m in Pre-seed funding from Founderful, Kvanted, and Zurich Cantonal Bank.

🐄 ArkeaBio, a Boston, MA-based livestock methane-reduction vaccine developer, raised $7m in Series A funding from AgriZeroNZ and Breakthrough Energy Ventures.

🚗 Futurail, a Munich, Germany-based autonomous rail systems developer, raised $6m in Seed funding from Asterion Ventures, Leap435, EIT Urban Mobility, Heroic Ventures, and Zero Infinity Partners.

🧪 Scindo, a London, England-based AI-driven enzyme engineering provider, raised $5m in Seed funding from Clay Capital, Kadmos Capital, AgFunder, Farvatn Venture, SOSV, and other investors.

🧪 Holy Technologies, a Hamburg, Germany-based automated carbon fiber manufacturer, raised $5m in Seed funding from EIT Manufacturing, Innovationsstarter Fonds Hamburg, Rockstart, Sands Capital, and Vanagon Ventures.

🏗 Amwoodo, a Kolkata, India-based bamboo-based consumer products manufacturer, raised $4m in Series A funding from Rainmatter Capital, Adventz Group, Caspian Debt, and Thinkuvate.

🔋 Xbattery, a Hyderabad, India-based battery management systems developer, raised $2m in Seed funding from Bipin Patel Family Office and Jhaveri Credits.

♻️ Clean Harbors, a Norwell, MA-based environmental and industrial services provider, raised $845m in Post-IPO Debt funding.

⚡ ePower, a Dublin, Ireland-based electric vehicle charging solutions platform, raised $17m in Debt funding from Dunport Capital Management and $17m in PE Expansion funding from Impax Asset Management.

🔋 Unbound Potential, a Thalwil, Switzerland-based long-duration energy storage manufacturer, raised $9m in Grant funding from BlueLion (KlimUp), InnoSuisse, Migros, and SPRIND.

🚗 Futurail, a Munich, Germany-based autonomous rail systems developer, raised $1m in Grant funding.

⚡ Akselos, a Lausanne, Switzerland-based structural simulation software, raised an undisclosed amount in PE Expansion funding from GRO Capital.

☔ Nuvio Planet, a Berlin, Germany-based environmental intelligence platform, spun out of BASF for an undisclosed amount.

⚡ Edify Energy, a Manly, Australia-based renewable energy developer, was acquired by La Caisse (Caisse de dépôt et placement du Québec) for $726m.

💸 Datia, a Stockholm, Sweden-based sustainability data and reporting service provider, was acquired by Connect Earth for an undisclosed amount.

This is a sample of the deals available on Sightline Climate. Can’t get enough deals?

The US Department of Energy announced last week it will return more than $13 bn in unobligated funds that had been set aside for clean energy and climate programs. The move follows new legislation (e.g. the One Big Beautiful Bill) that rescinds unspent balances from programs tied to the Inflation Reduction Act, and shifts the administration’s rhetoric away from climate subsidy programs toward energy dominance. The pull‑back threatens to slow or stall deployment for emerging clean energy projects, although many investors have accepted that the funds would not be given out given the administration’s positions.

A US federal judge ruled that Ørsted can resume construction on its 704MW Revolution Wind project off Rhode Island, halting the Trump administration’s stop-work order issued in August. The court found the order likely violated due process and posed “irreparable harm” to Ørsted, which warned delays could cost $25m per week and threaten project viability. The ruling is a rare reprieve for US offshore wind, signaling judicial pushback against recent federal efforts.

The UK’s first LDES cap‑and‑floor shortlist is out, with 77 projects (~28.7 GW discharge capacity) clearing the eligibility stage for the regulatory phase 1. Lithium‑ion battery storage dominates (> 20 GW), with pumped hydro (≈ 4.6 GW across ~5 projects), and a smaller share of flow/zinc/vanadium and hybrid/Liquid Air/C/AE (compressed air / LAES) systems also passing eligibility. This is a boost for more mature lithium-ion projects projects as well as emerging ones like liquid air, which currently has minimal deployment, so this could be a push.

Fusion lands a megadeal, as Eni signed a $1bn+ PPA with Commonwealth Fusion Systems. Energy company Eni is set to get power from CFS’ planned 400MW ARC fusion plant in Virginia, adding to Google’s earlier 200 MW offtake. The deal highlights surging demand for clean, firm power driven by data center growth, even as commercial fusion remains unproven and years from operation.

The SOO Green transmission project secured its last Iowa franchise agreement, advancing a $2.1bn plan to deliver low-cost wind, solar, and storage from MISO into PJM via a 350-mile underground HVDC line. As demand surges from data centers and grid reliability concerns mount, this bi-directional line offers new inter-regional flexibility and price relief in markets like Chicago. If successful, it could be a model for future clean energy corridors that accelerate renewables deployment and reduce curtailment risk.

LAC to the future: Reciprocal’s new report on the opportunity for the region rich in solutions, not just resources.

Cool new interactive tool, the Climate Tech Atlas, featuring technical “Innovation Imperatives” and “Moonshots” to accelerate decarbonization, from Speed & Scale and more.

Valuation math meets grid-hardening grit in B Cap’s new Resilience Tech roadmap.

Turns out birds of different feathers can flock together: meet the grue jay, likely evolved due to climate change.

Is the “twilight of shale” upon us, per oil execs?

💡 2025 Buildings Tech Lab: Apply by October 24, 2025 to participate in a transformative program designed for early- and growth-stage tech startups with solutions for workforce optimization and workflow modernization in NYC's construction and development regulation sector.

📅 Powerhouse's New Dawn: On October 23rd in Oakland CA, an opportunity to engage with leading climate and energy innovators, investors, and entrepreneurs shaping the future of the industry.

📅 Are You Smarter Than a 4th Grader: Energy Investor Showdown: On Tuesday, September 30 at 4:00 PM in New York for an interactive showdown where energy pros face off against a fourth grader using AI to vet a $100M renewable energy project. Held in connection with REFF 2025 and NYC Climate Week. Registration subject to approval.

Senior Account Executive @Sightline Climate

Senior DevOps Engineer @Sightline Climate

Senior Product Designer @Sightline Climate

Senior Software Engineer @Sightline Climate

Investment Associate @Galvanize Credit and Capital Solutions

Founding Sales Development Representative @CNaught

Strategy Associate @Fervo Energy

Growth Marketer @WorkHero

Founding Software Engineer @Barnwell Bio

Business Development Lead @Barnwell Bio

Head of Operations @Tokamak Energy

📩 Feel free to send us deals, announcements, or anything else at [email protected]. Have a great week ahead!

We did the EU carbon math

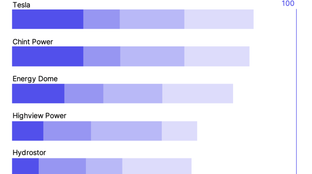

With long duration energy procurement surging, new rankings reveal who's pulling ahead

A tale of two public debuts