🌎 Lithium-ion is the benchmark in new LDES leaderboards #281

With long duration energy procurement surging, new rankings reveal who's pulling ahead

Happy Monday!

Carbon capture is having a policy moment, with the OBBB boosting 45Q credits and the EU eyeing negative emissions in its ETS. We’re breaking down the new implications and economics for CCUS below as part of a new series about policy impacts.

In deals, $500m for autonomous vehicles, $40m for utility-scale solar, and $27m for clean hydrogen.

In other news, Trump’s new executive order on solar and wind, controversy at the NRC, and the UK’s grid reforms.

Thanks for reading!

Not a subscriber yet?

📩 Submit deals and announcements for the newsletter at [email protected].

💼 Find or share roles on our job board here.

The passage of the One Big Beautiful Bill (OBBB) marked a tectonic shift in the energy transition landscape, reworking the calculus for everything from clean firm power to supply chains. At Sightline, we’ve been digging into the implications for key technologies, and this week, we’re giving you a sneak peek at our client-only analysis of one of OBBB’s clear winners: carbon capture, utilization, and storage (CCUS).

The updated package supercharges 45Q tax credits, delivering full financial parity between storing CO2 underground and putting it to work in products or enhanced oil recovery (EOR). Across the Atlantic, the EU is moving in parallel: tighter climate targets and updates to its Emissions Trading System (EU ETS) could soon reward negative emissions technologies like direct air capture (DAC).

CCUS has long held promise to capture CO2 emissions from industrial sources like power plants and factories. With these policy tailwinds, amid surging data center power demand, CCUS emerges as an increasingly attractive option to deliver clean(er) firm power. But in practice, deployment has lagged, as small-scale projects haven’t offered sufficient returns.

The OBBB gives a major boost to CCUS, updating the tax credit values for it (45Q) to create full parity between storage and utilization. Point-source capture for storage holds steady at $85/ton, while utilization and enhanced oil recovery (EOR) jump from $60 to $85/ton — a 42% increase. For DAC, credits for storage remain at $180/ton, but DAC used for utilization or EOR rises from $130 to $180/ton, up 38%.

The bill also preserves tax credit transferability, allowing developers to monetize credits through tax equity or third-party sales, and introduces Master Limited Partnership (MLP) eligibility so certain CCS projects can tap public markets for financing. From 2026, however, projects with significant ties to “Foreign Entities of Concern” (China, Iran, North Korea, Russia) will lose access to 45Q credits.

Meanwhile, across the Atlantic, the EU is updating its Emissions Trading System (EU ETS) under the “Fit for 55” package. New rules set for 2024 clarify how CO2-based products are treated, and by 2026, the Commission will decide whether to integrate negative emissions technologies like DAC and BECCS into the system, opening the door for permanent removals to generate tradable credits.

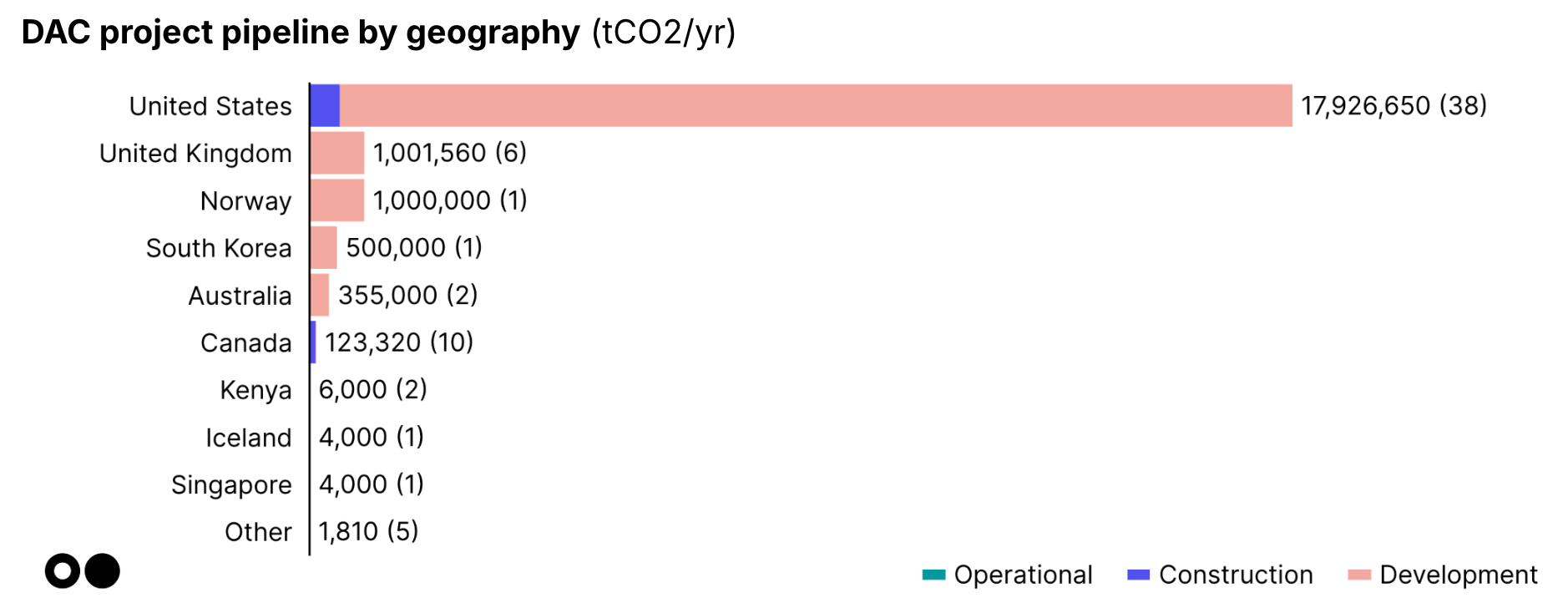

But in practice, deployment has still lagged. For DAC, we’ve found only fourteen lab or pilot-scale projects that are operational worldwide, collectively capturing less than 20ktCO2 annually.

The real bottlenecks for CCUS aren’t in the capture technologies themselves. The challenges lie downstream: economics, infrastructure, and permitting hurdles that keep the dozens of announced projects stuck on paper.

For projects operating intermittently or without CO2 transport networks, the economics haven’t stacked up — yet. Now, this wave of support from OBBB could still tip the scales for certain developers. The updated 45Q tax credits create financial parity between geologic storage and utilization, potentially accelerating pathways that are more profitable but less climate-aligned. Enhanced oil recovery (EOR), for instance, could dominate near-term deployment: vertically integrated oil and gas players like Occidental could find the economics more compelling. Its flagship Stratos project, initially framed around EOR, can now monetize an additional $25m annually under the revised credit structure, or $300m over the 12-year 45Q window. For developers with oil-linked infrastructure, the path of least resistance (and highest returns) could shift to capture-and-sell rather than capture-and-store.

But that comes with trade-offs. EOR often re-releases most of the CO2 it captures. At Exxon’s Shute Creek plant in Wyoming, about 120 MtCO2 has been captured since the 1980s, but ~95% was sold for EOR and ~70% likely re-emitted — meaning roughly 80 MtCO2 has potentially found its way back into the atmosphere. Globally, 75–80% of all captured CO2 to date has been used for EOR, not permanent storage.

🚗 Momenta, a SuZhou, China-based autonomous driving technology developer, raised $500m in Series C funding from Bosch, SAIC Motor, Toyota, Mercedes-Benz, Temasek Holdings, and other investors.

💧 Membrion, a Seattle, WA-based ceramic desalination membranes maker, raised $11m in Series C funding.

☀️ Reset Company, a Seongnam-si, South Korea-based solar panel cleaning and recycling systems developer, raised $4m in Series B funding from POSCO, Ascendo Ventures, BeHigh Investment, and GS Ventures.

⚡ Tulum Energy, a Luxembourg, Luxembourg-based clean hydrogen producer, raised $27m in Seed funding from CDP Venture Capital, TDK Ventures, Doral Energy-Tech Ventures, MITO Technology (Mito Tech Ventures), and TechEnergy Ventures.

🏗 Parspec, a San Francisco, CA-based AI-powered construction platform, raised $20m in Series A funding from Threshold, Building Ventures, Heartlan Ventures, Hometeam Ventures, and Innovation Endeavors.

⚡ Helical Fusion, a Tokyo, Japan-based helical fusion reactors, raised $16m in Series A funding from Aoki Super, Crest Capital Partners, Daiwa House Ventures, HAKOBUNE, KDDI Green Partners Fund, and other investors.

💨 Chloris Geospatial, a Newton, MA-based natural capital carbon MRV, raised $9m in Series A funding from Future Energy Ventures, AXA Investment Managers, At One Ventures, Cisco Foundation, Counteract, and other investors.

⚡ Cariqa, a Berlin, Germany-based EV charging payment and pricing platform, raised $5m in Seed funding from Anthemis Group, Contrarian Ventures, Earth, Golden Egg Check Capital, and Techstars.

🏠 LumenStream, a Belfast, Northern Ireland-based lED lighting solutions and energy efficiency services, raised $2m in Seed funding from Clarendon Fund Managers and Techstart Ventures.

🚆 BusUp, a Barcelona, Spain-based sustainable transportation platform, raised $2m in Series A funding from Bonsai Partners.

💨 Carbyon, an Eindhoven, Netherlands-based direct air carbon removal technology developer, raised an undisclosed amount in Series A funding from ISAI VC.

⚡ Lightshift Energy, an Arlington, VI-based utility-scale energy storage developer, raised $40m in Debt funding from Aiga Capital Partners.

☀️ FTC Solar, an Austin, TX-based solar tracker systems provider, raised $14m in Debt funding from AV Securities and Cleanhill Partners.

🌊 Seaturns, a Bordeaux, France-based wave energy converter manufacturer, raised $3m in Crowdfunding funding from Team for the Planet.

⚡ Move Mobility, a Fribourg, Switzerland-based e-mobility infrastructure provider, was acquired by Energie360° for an undisclosed amount.

Mars, a McLean, VA-based multinational CPG company, launched a $250m Mars Sustainability Investment Fund (MSIF) to support innovation across three core sectors, agriculture, packaging, and ingredients and raw materials.

Can’t get enough deals? See full listings and deal analytics on Sightline Climate.

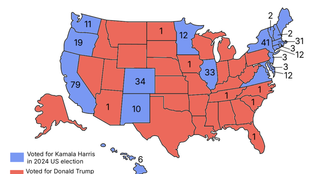

President Trump has signed an executive order ending subsidies for foreign‑controlled wind and solar. The move directs the phase out of wind and solar tax credits — currently under safe harbor rules through 2026 with a four‑year window to complete projects — within 45 days. Since the order phases out credits starting 2026 but allows projects breaking ground by mid‑2026 to qualify through around 2030, this order risks new projects.

The shakeups at the US Nuclear Regulatory Commission have caused new tensions. DOGE reportedly directed the NRC to “rubber stamp” reactor approvals already cleared by the Departments of Energy (DOE) or Defense (DOD), sparking controversy over the erosion of NRC’s regulatory independence and the sidelining of its traditional safety oversight role. Scientists warn that politics‑driven, schedule‑focused oversight could weaken safety and erode public trust.

The UK has outlined reforms to build a fairer, more secure, affordable, and efficient electricity market as it adjusts to a decarbonized grid. Rather than adopting zonal pricing, it will retain a national wholesale rate while improving generation locations through the Strategic Spatial Energy Plan, to be published in 2026. The plan will likely encourage new generation in better locations through favorable interconnection, changes to seabed leasing, and reforms to who is charged for network use.

Germany is preparing a Hydrogen Acceleration Act to fast‑track green hydrogen permitting by designating these projects as being of “overriding public interest.” New rules would allow faster approvals for production, import, transport, and storage infrastructure, with clear deadlines, processes, and exemptions. The draft law, effective through 2045, intends to remove planning bottlenecks and revive stalled hydrogen roll-out, although questions about funding and demand remain.

The European Commission has introduced a comprehensive methodology to define low‑carbon hydrogen and fuels. The new act sets a requirement that such fuels achieve at least 70 % greenhouse‑gas savings versus unabated fossil fuels, and considers various production pathways including natural gas with CCUS and low‑carbon electricity. The act offers investment certainty to scale clean hydrogen across hard‑to‑decarbonize sectors like aviation, shipping, and steel.

Puerto Rico virtual power plant dashboard. This is cool, even if Tesla isn’t anymore

China blows past the rest of the world in wind and solar.

Big, not-so-beautiful federal policy changes could slow the US energy transition.

Toad-ally trippy: Sonoran Desert toads are being poached for their psychedelic excrements.

Climate tech has a diversity drought.

“Make America Beautiful Again” — Trump’s newest executive order champions parks and wildlife but skips climate strategy.

Hannah Ritchie has a new book coming out.

📅 VERGE at Trellis Impact 25: Join us October 28-30, 2025 in San Jose for three events at the intersection of climate and technology. Connect with 5,000+ professionals and 500+ speakers advancing decarbonization strategies and climate tech. Register by June 13th to save $500+ and use our partner code TI25SL for 10% off! #TrellisImpact #VERGE

💡 Growth Catalyst Early Stage Funding Competition: UK registered micro and small businesses can apply August 6th for a share of up to £10 million to develop affordable, adoptable and investable innovations in the five critical technologies.

Technician @Barocal

Corporate Development Senior Analyst @Fervo Energy

Civil Project Engineer @New Leaf Energy

Management and Program Analyst @US DOE

R&D Researcher @H2Pro

📩 Feel free to send us deals, announcements, or anything else at [email protected]. Have a great week ahead!

With long duration energy procurement surging, new rankings reveal who's pulling ahead

A tale of two public debuts

US courts roll back Trump-era actions on offshore wind and DOE grant cancellations