🌎 Overheard at LCAW #252

Climate, capital, and carrots in London's new playbook

Tesla takes a turn and White House rolls out new EV charging rules

Happy Tuesday!

Ahead of President’s Day, the Biden administration released new details about what it will take to qualify for federal funding for EV chargers. Despite the somewhat passive-aggressive relationship between President Biden and Elon Musk, Tesla’s charging network may play a role in expanding public EV charging infrastructure in the US.

Elsewhere in the news, Ford’s joint venture in Michigan with battery-maker CATL draws political scrutiny. Overvalued properties at risk of flooding could create a climate housing bubble. And utilities disagree with DOE about the best way to make transmission more efficient.

In deals this week, Chinese automaker Geely’s EV arm, Zeekr, is valued at $13B after a $750M Series A round. Loam Bio captures $73M for soil carbon sequestration and NanoGraf gets $65M for silicone-based batteries.

If you haven't already, please take a few minutes to tell us more about yourself in our 2023 reader survey! We want to better understand our audience and your feedback is essential to making sure we're sharing the insights you need the most.

Thanks for reading!

Not a subscriber yet?

📩 Submit deals, announcements, events & opportunities, or general curiosities for the newsletter here.

💼 Find or share roles on our job board here.

EV charging in the US is getting a supercharged upgrade.

The White House announced new standards on Wednesday to ensure that the $7.5B for EV charging funded by the Bipartisan Infrastructure Law is convenient, reliable, and made-in-America. The Biden Administration wants to ensure chargers are accessible—regardless of brand—to reach its goal of having 500,000 on highways by 2030. To grow the market and address complaints, federal funding will come with new EV charger standards requiring:

🔌 Consistent plug types, power levels, and a minimum number that support fast charging

🎛 97% up-time reliability

📍 Mapping and publicly-accessible data on charger locations, price, availability, and accessibility

📱 A single method of identification for all chargers, so EV drivers won’t have to use multiple apps and accounts

🔮 Forward-looking compatibility like international standard Plug and Charge

On top of EV charging’s new rules of the road, the White House also highlighted new charging infra commitments—including a notable u-turn on Tesla’s once-exclusive charging policy.

In order to tap into the $7.5B EV charging goodie bag, Tesla has agreed to open at least 7,500 chargers to all EV owners by the end of 2024.

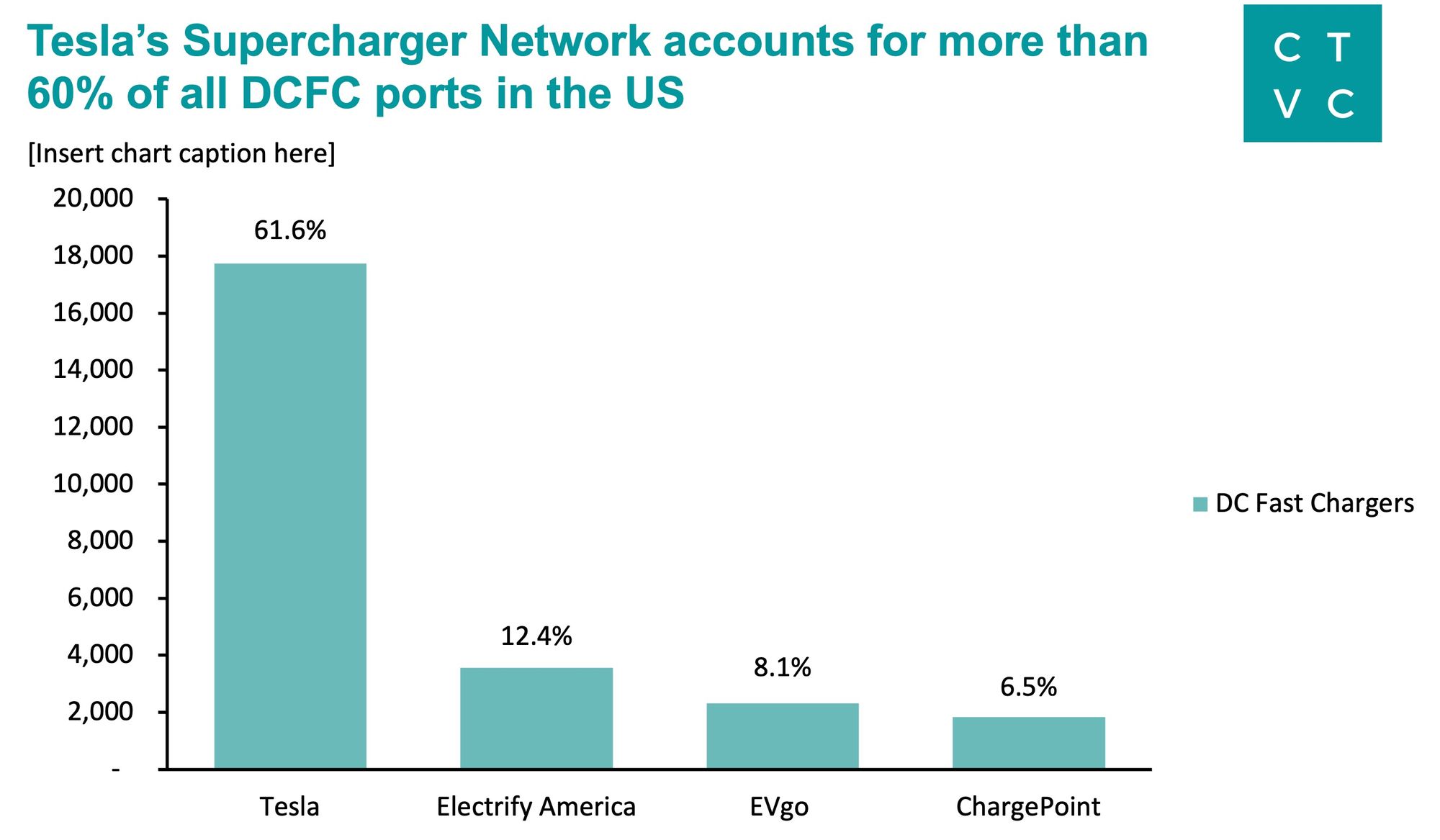

The company has hinted at unlocking its chargers for years. Tesla owns one of the largest charging networks in the US, including >60% of all DC fast chargers (DCFCs) installed nationwide, which have historically been reserved for Tesla customers. Now, at least 3,500 of those Tesla Superchargers along key highway corridors will be publicly available.

Rapid growth: While Tesla is facing a recall of its self-driving software and accusations of union-busting, one area where the automaker doesn’t really need federal back-up is getting EV chargers in the ground.

Nearly three out of every four new fast chargers installed in the US last year were part of the Tesla Supercharger network—with Tesla planning to more than double the number of DCFCs in its US network, according to the update from the White House.

The NEVI program, which will distribute $5B of the BIL money, is set up to fund new EV charging installations based on competitive grants at the state level. With control of its own charging hardware manufacturing and more experience with permitting and construction than most of the large EV charging players, Tesla is well-positioned to underbid other charging companies for these projects.

However as the EV charging pie grows, O&G companies are also looking to get a slice of the sector. On Thursday, BP announced a $1.3B deal to buy rest-stop operator TravelCenters of America, which is working with Electrify America to install 1,000 chargers at 200 sites along US highways.

🚗 Zeekr, a Beijing, China-based EV manufacturer, raised $750m in Series A funding from Contemporary Amperex Technology, Guangzhou Yuexiu Industrial Investment Fund, Tongshang Fund, and Xin’an Intelligent Manufacturing Fund.

🚆 Via, a New York, NY-based provider of public mobility solutions, raised $110m in Growth funding from 83North, Common Fund, EXOR N.V., ION Crossover Partners, Janus Henderson Investors, Pitango VC, Planven Entrepreneur Ventures, and RiverPark Ventures.

💨 Loam Bio, an Orange, Australia-based microbial soil carbon sequestration startup, raised $73m in Series B funding from Lowercarbon Capital, Wollemi Capital, Horizons Ventures, Acre Venture Partners, Main Sequence Ventures, Clean Energy Finance Corporation, Grok Ventures, and CEFC.

🔋 NanoGraf Corporation, a Chicago, IL-based developer of silicone-based anode material for batteries, raised $65m in Series B funding from Arosa Capital Management, CC Industries, Emerald Technology Ventures, Evergreen Climate Innovations, GIC, GOOSE Capital, Hyde Park Angels, Material Impact Fund, Nabtesco Technology Ventures, TechNexus Venture Collaborative, and Volta Energy Technologies.

🥩 Elo Life Systems, a Durham, NC-based producer of monk fruit natural sweeteners, raised $25m in Series A funding from Accelr8, DCVC Bio, and Novo Holdings.

⚡ ChargerHelp!, a Los Angeles, CA-based EV charging maintenance platform, raised $18m in Series A funding from Blue Bear Capital, Aligned Climate Capital, Exelon Corporation, Energy Impact Partners, and non sibi ventures.

🌾 Growers Edge, a Johnston, IA-based agriculture fintech startup, raised $15m in Series B funding from Bunge Ventures, Cox Enterprises, Finistere Ventures, iSELECT FUND, S2G Ventures, and Skyline Global Partners.

🌱 Earth Finance, a Seattle, WA-based climate consulting and finance services company, raised $14m in Seed funding.

🏭 QiO Technologies, a Farnborough, UK-based AI industrial optimization software platform, raised $10m in Series B funding from WAVE Equity Partners.

♻️ Cylib, an Aachen, Germany-based battery recycling company, raised $9m in Seed funding from World Fund, 10x Founders, Vsquared Ventures, and Speedinvest.

🌾 SwarmFarm Robotics, a Gindie, Australia-based provider of autonomous farming robotics services, raised $8m in Series A funding from Access Capital, Artesian VC, Conexus Venture Capital, GrainInnovate, Grains Research and Development Corp, Tenacious Ventures, and Tribe Global Ventures.

☀️ Qotto, a France-based provider of solar systems in Africa, raised $8m in Series A funding from IBL Group, Off-Grid Energy Access Fund, Cordaid Investment Management, Sowefund, and Lion’s Head Global Partners.

🌱 CarbonCloud, a Göteborg, Sweden-based climate footprinting platform for food supply chains, raised $8m in Series A funding from Cusp Capital, Peak Capital, Maki.vc, and TS Ventures.

🏭 CaPow, a Israel-based provider of energy systems for robotic fleets, raised $8m in Seed funding from Doral Energy-Tech Ventures, IL Ventures, Mobilion Ventures, Mobilitech Capital, and Payton Planar Magnetics.

💨 BioSqueeze, a Butte, MT-based developer of biomineralization technology to seal methane leaks, raised $7m in Series A funding from NEXT Frontier Capital, Riverstone Holdings, Valo Ventures, and Zero Infinity Partners.

⚡ BluWave-AI, an Ottawa, Canada-based grid energy optimization platform, raised $7m in Series A funding from FedDev, Ontario Power Generation, and other investors.

🌾 Robigo, a Cambridge, MA-based provider of a biopesticide crop protection platform, raised $7m in Seed funding from Congruent Ventures, Good Growth Capital, First Star Ventures, and Evergreen Climate Innovations.

📦 BIBAK, a Versailles , France-based provider of software for reusable containers, raised $6m in Series A funding from Founders Future, MAIF Impact, Notus Technologies, Seed-One Ventures, and Swen Capital Partners.

🍙 Ocean Rainforest, a Faroe Islands-based provider of fully-traceable seaweed products, raised $6m in Series A funding from Katapult VC, Builders Vision, Ocean Born Foundation, World Wildlife Fund, Norðoya Íløgufelag, Twynam Investments , and Grantham Environmental Trust.

🥩 Planetarians, a San Francisco, CA-based maker of whole-cut, plant-based protein, raised $6m in Seed funding from Mindrock Capital, SOSV, Techstars, Traction Club Partners, and ZX Ventures.

🚌 FreshBus, a Hyderabad, India-based provider of an electric bus service in India, raised $3m in Seed funding from ixigo.

⚡ MPower Ventures, a Zürich, Switzerland-based emerging markets solar financing and distribution, raised $2m in Seed funding.

♻️ Greyparrot, a London, United Kingdom-based robotic waste management platform, raised $2m in follow-on Series A funding from Regeneration.vc and Closed Loop Partners.

🌱 Kloopify, a Pittsburgh, PA-based sustainable procurement analytics platform, raised $2m in Seed funding from Black Tech Nation Ventures, Hypothesis, Innovation Works, The Unity Now Fund, and Urban Redevelopment Authority of Pittsburgh.

🔋 Quino Energy, a San Leandro, CA-based redox flow battery company, raised $1m in Seed funding from Doral Energy-Tech Ventures, TechEnergy Ventures, and Energy Revolution Ventures.

☀️ Xfloat, an Israel-based maker of floating solar PV systems, raised an undisclosed amount of funding from Miya.

Vast, an Australia-based developer of concentrated solar-thermal projects, announced a SPAC merger with Nabors Energy Transition Corp at an implied equity value between $305m-$586m.

Verde Clean Fuels, a Houston-based syngas-to-gasoline supplier, completed its SPAC merger with Cenaq Energy and Bluescape Clean Fuels Intermediate Holdings.

Environmental 360 Solutions, an Ontario-based waste and environmental management company, was acquired by Blackrock Alternatives.

Germany launched a €1bn fund, DeepTech & Climate Fonds, to invest in deeptech and climate tech growth-stage companies.

AfricaGoGreenFund, closed $47m in equity and debt funding, to fund climate resilience in Africa.

Ocean 14 Capital raised €130m for a ocean sustainability fund from the private equity arm of Ikea, European Investment fund, Builders Vision, and other individual investors.

Ford is investing $3.5B into a Michigan plant that will produce EV batteries using technology licensed from China’s CATL, the world’s largest battery-maker. Though the project is wholly owned by Ford and spurred by IRA tax credits for domestic battery manufacturing, it has stirred political controversy that the automaker is still working closely with CATL and relying on the Chinese battery giant’s IP. The facility, which will produce both NMC and LFP batteries, is set to open in 2026.

The EPA will allocate $20B of IRA funding to nonprofits that partner with local financial institutions on projects to cut emissions and energy costs and another $7B to help disadvantaged communities build solar arrays.

A second Norfolk Southern train derailed in Michigan last week, following the disaster in East Palestine, Ohio earlier this month that’s caused major health concerns about toxins including vinyl chloride gas. The carcinogen is used in plastics production, which not only generates more than 3% of global greenhouse emissions, but also poses life-long health risks that are disproportionately borne by the low-income communities where the industry’s manufacturing and infrastructure are located.

The DOE proposed new energy-efficiency standards for distribution transformers in December, but utilities are now complaining that the proposed rule would cause delays and higher costs.

Global fossil fuel subsidies hit an all-time high last year, according to the IEA. Spikes in energy prices after Russia’s invasion of Ukraine led governments to spend more than $1T on subsidies for oil, gas, and power to ease the burden on consumers.

World Bank President David Malpass will step down early amid criticism over his climate denialism.

A climate housing bubble threatens to erode real estate prices in much of the US in the coming years, posing particular challenges for low-income households. According to a new study published in Nature, residential properties exposed to flood risk are overvalued by $121B to $237B, and tend to be concentrated in counties along the coast where there are no flood risk disclosure laws and communities are less concerned about climate change.

Doubling down on sustainable aviation fuel: Boeing just signed a fresh 5.6M-gallon purchase agreement with SAF-maker Neste. The SAF will power Boeing's ecoDemonstrator flight test program and its commercial sites in Washington state and South Carolina, using carbon credits from the purchase to offset commercial deliveries, Dreamlifter and executive flights.

Wake up on the right side of the bed with Nat Bullard and 146 slides on the State of Climate and Decarbonization.

Smoke plumes and fire-pixels. How Google uses satellite imagery for real-time wildfire tracking.

23 companies were chosen as BNEF pioneers finalists, including HySiLabs in clean hydrogen deployment, Altris in sustainable metals, and Fork and Good in Net-Zero food production, to name a few. Winners will be chosen in April.

UK Prime Minister Rishi Sunak and Bill Gates launched Cleantech for UK, a coalition of investors and venture-builders with combined funds of over £4B.

One Vanderbilt exemplified a sustainably designed building… in 2016. Now the Manhattan skyscraper is caught “not green enough” as New York City adopts more ambitious climate policies.

CTVC data spotted downtown. Union Square Ventures calls out the FOAK/Pilot funding gap in the climate tech capital stack.

The DOE and industry experts have dropped a new 🔋 special. The Li-Bridge report lays out a strategy for developing a North American lithium battery supply chain, emphasizing the need for better investment incentives and US government intervention to “level the playing field” against China.

A new temperature-related mortality study accounts for air conditioning. Click here for super interesting graphics on mortality-rate, based on who can and can’t afford temp control.

Sneaky solar panels that look like centuries-old Italian rooftops were installed around Ancient Pompeii.

ESG is the new M&A. A survey of 400 US and U.K dealmakers think the “E” in “ESG” will play a role in acquisition plans.

A model from another Moscow: When the cold war cooled off, the US turned 20,000 nuclear warheads into nuclear energy. The program was shuttered in 2012.

Remember when Twitter tracked Elon’s private jet? A teenager tracked the top jet-setters in the US and where they are going. Queue the White Lotus theme song.

“Super-Realistic Meat Alternatives” from Sarah Ransohoff.

If you want to be the teacher’s pet, electrify your school with Rewiring America’s DIY-in-your district kit.

🗓️ London Climate Connection: Register to join LCC on Feb 22nd to hear from founders, investors, and experts within the climate community. The events include three lightning talks and speed-networking.

🗓️ MCJ Climate Art Workshop: Join virtually on Feb 28th and learn from Nicole Kelner, MCJ Collective’s artist-in-residence, on how to draw and paint about climate.

🗓️ BERC Energy Summit: Attend the sixteenth annual BERC Energy Summit on Mar 8th-9th and partake in nuanced discussions on domestic and international energy challenges.

🗓️ GSB Climate Summit: Join GSB’s fifth annual climate, business, and innovation summit on Mar 8th to hear from accomplished sustainability experts and learn about the intersections of climate and business.

💡 Climate Vault RFP: Apply by Mar 29th to Climate Vault’s first Request For Proposal, awarding funds towards innovative decarbonization technologies.

Director of Finance & Administration @Carbon180

Analyst @At One Ventures

Director of Marketing & Communications @Evergreen Climate Innovations

Analyst/Associate, Private Credit Funds @Closed Loop Partners

Director of Technology & Operations @Pacific Crest Labs

Investment Associate @Avesta Fund

Head of Market Intelligence @Rumin8

Vice President, Impact Measurement @Galvanize Climate Solutions

Chief of Staff @thredUP

Feel free to 📩 send us new ideas, recent fundings, events & opportunities, or general curiosities. Have a great week ahead!

Climate, capital, and carrots in London's new playbook

US plays popcorn politics with biofuels and beyond

Groundbreaking results from the geothermal developer’s main project