🌎 Taxing times for CCUS #254

OBBB blows tailwinds through CCUS, but takeoff stalls

Cooling down with Therma and heating up with the election tomorrow

Happy Monday! Here’s hoping we only fall back an hour this week (vs. four years).

In this week’s issue, we chill out with Therma, a new venture focused on saving energy and reducing food waste by making the cold chain smarter.

Other big news is MIT The Engine’s new $250m fund, Stripe’s new Climate donation tool, and South Korea and Arizona pledging climate neutrality.

As the election tomorrow looms, climate ads are flooding the airwaves. Take them as a reminder to vote as though your belief in science depends on it.

Thanks for reading!

Not a subscriber yet?

Different organizations across the climate community came together online during a series of virtual conferences last week to share, learn, and connect.

Shout out to all of the organizing forces behind TEDxElemental, The Engine’s Tough Tech Summit, Co_Invest Cleantech, and GreenBiz’s VERGE.

After 9 months in quarantine, and a seeming world apart from when humans actually did these sorts of things in person, it was encouraging to embrace togetherness before tomorrow’s election where science remains on the ballot.

It wasn’t stats or stump speeches which stuck with us from last week’s content tsunami, but rather a slam poem by Amanda Gorman. We’re dropping the link to “Earthrise” here, so that over the next few topsy turvy days we’ve got a message to remind us what all the fuss is actually about: “So, Earth, pale blue dot, we will fail you not.”

🌱 Benson Hill, a St. Louis, MO-based agricultural breeding startup for sustainable foods, raised $150m in Series D funding from Wheatsheaf Group and GV. More here.

🥩 V2Food, a Sydney, Australia-based producer of plant-based meat, raised $55m in Series B funding from Sequoia Capital China, China Renaissance, and Esenagro. More here.

🍎 Apeel Sciences,a Santa Barbara, CA-based developer of food preserving technology, raised $30m in funding from International Finance Corp, Temasek, and Astanor Ventures to expand into Asia, Africa, and Latin America. TechCrunch has more here.

⚡ Voltus, a San Francisco, CA-based electricity reduction platform, raised $25m in Series B funding from NGP Energy Technology Partners III, Prelude Ventures and Ajax Strategies. More here.

🌱 Arable, a San Francisco, CA-based provider of data-based agriculture solutions, raised $20m in Series B funding from Prelude Ventures, M20, Nassau Street Ventures, and Tridon. More here.

💧 Ketos, a Milpitas, CA-based provider of water quality analytics , raised $18m in Series B funding from Motley Fool Ventures, Citi, and Illuminated Funds Group. TechCrunch has more here.

💧 Micronic Technologies, a Richmond, VA-based developer of industrial wastewater concentration technologies, raised $3m in Seed Funding from the Center for Innovative Technology, The Pearl Fund, and CAV Angels. More here.

⚡ Seatrec, a Monrovia, CA-based renewable energy company, raised $2m in Seed funding from Sunstone Management, Frontier Angels, and other angel investors. More here.

The Engine raised $230m for its second “tough tech” fund backed by MIT and Harvard. TechCrunch has more here.

This week we sat down with Manik Suri and Aaron Cohen, founders of cold chain startup, Therma. Manik and Aaron are both impact-motivated, seasoned entrepreneurs who share a compelling and candid story about their pivot into the climate tech space after a lightbulb moment around energy and food waste. [We’re edited the newsletter version lightly for length; visit our website for the full feature].

You have been working together for some time on a prior company, CoInspect. What’s the story there?

MS: They say that life makes sense in the rearview mirror. We had set out to work on a problem that we thought was significant -- improving health and safety compliance -- only to discover that the solution we built applied to another problem that was perhaps even more significant. Our original approach was to build technology to reduce the frictions and cost of compliance through a company called CoInspect. We were trying to shift the dynamics in the antiquated compliance sector to use mobile apps and data analytics to allow businesses to better ensure management of health and safety standards, especially across the food industry.

AC: We were able to scale CoInspect to thousands of locations, but realized a compliance workflow tool that required users to do necessary (but unpopular) tasks couldn’t easily scale to becoming a very large business.

When did CoInspect spur Therma?

MS: There’s a saying, “In order to change the world, you must first accept it.” With Therma, our continuous asset management platform in the cold chain brings to life a more efficient way of checking critical control points along the food supply chain -- using sensors to automate these controls -- that accepts the limitations of manual processes. As we built Therma, our customers started rapidly buying it, not primarily because of food safety, but because they saw measurable ROI across food waste prevented and energy costs saved. Therma solves for food safety while also advancing the climate tech imperative.

What is the core technology?

AC: The Internet of Things (IoT) revolution has not yet delivered on its promises of automation and data-driven optimization in the multi-billion dollar refrigeration cold chain. Therma is an early leader that leverages a new emerging technology standard in this space.

MS: We use a Low Power, Wide Area networking protocol called LoRa, which allows our sensors to reliably transmit data in environments with dense insulation or siding, including the walls of commercial fridges and freezers. LoRa is perfect for continuously sending a three digit temperature figure. Building on this new protocol, we were able to develop a price-disruptive sensor that can be self-installed in minutes -- an ideal solution for monitoring assets across the cold chain.

What is the size and scope of the cold chain industry?

MS: The cold chain, as we think of it, consists of several hundred million commercial refrigeration units including fridges, freezers, display cases, holding containers, and warehouses. If you include residential refrigeration units, the total number we’re talking about would be even larger. The goal of these products is to keep ambient air below a certain temperature, which broadly include four categories: 70ºF to 32ºF is considered “above freezing,” 32ºF to 0ºF is “frozen,” 0ºF to -40ºF is “deep frozen,” and -40ºF to -80ºF is “cryo.” Meat products, for example, tend to be kept frozen, ice cream is kept at deep frozen, and certain vaccines may require cryo (including some leading COVID-19 vaccine contenders).

AC: It’s important to know that the cold chain encompasses three critical dimensions: food, pharma, and data. We shouldn't overlook how significant cloud computing data centers are in the cold chain nor just how much energy is needed to cool the cloud.

What’s the environmental impact of the cold chain?

AC: Project Drawdown had a big influence on us. We’ve learned just how massive an impact the cold chain has on climate change. Recent estimates suggest that the cold chain is responsible for 3-3.5% of greenhouse gas emissions. This shouldn’t be surprising, given that 40% of all food requires refrigeration, and approximately 15% of the electricity consumed worldwide is used for refrigeration.

Cold chain-driven emissions come from three sources: food waste, energy (electricity), and refrigerants themselves. Therma directly addresses Project Drawdown’s reduced food waste and refrigerant management categories, which are, respectfully, the #1 and #4 most impactful climate solutions in a 2˚C temperature rise scenario.

In terms of the financial impact, BCG did a landmark study on food waste in which they found $120 billion worth of food supplies are wasted each year -- just due to poor storage and handling!

How does Therma reduce emissions and costs?

MS: Therma enables real-time monitoring and drives optimization through behavior change, policy change, and rapid-response through two primary drivers. The first driver is reducing product loss. Owners and operators use Therma to ensure that their products are being stored appropriately, and won’t walk in on Monday to a turned off freezer full of ruined product. We sell to commercial buyers by helping them avoid tens of thousands of dollars in product loss each year. Our monitoring system identifies leaks and predicts maintenance needs before they become a significant problem.

The second driver is energy savings. On the industrial side, energy efficiency is a prominent concern for cold storage warehouses and logistics operators. In enormous warehouses, we can tell businesses when and where they are over- or under-cooling to meet their requirements as well as save energy. We are also identifying hotspots in situations that might ramp up energy consumption. When new shipments come in, for example, the pallets are typically warmer than the ones that have been in the fridge/freezer for a while. Therma can guide the company on where to place pallets to maximize energy efficiency and keep cooling uniform. Therma helps answer questions like, “Do I need to make my warehouses cooler or do I need to change my delivery schedule?”

In the future, Therma will evolve from simply monitoring the environment to eventually being able to control it. The key is to automatically raise or lower the temperature and thereby draw less electricity while also reducing inventory loss or “shrink.” And by making facilities more energy efficient, we also limit refrigerant usage and leakage over time.

AC: Our system consists of a gateway and sensors that measure temperature and humidity. But in the future we could be able to detect refrigerant leaks through “sniffers” – and prevent significant amounts of high-global warming potential gases from being leaked into the atmosphere.

To learn more about Therma, check out their website and be sure to tune in to Point 01, Aaron’s podcast with the 0.01% of innovators who will shape our fight against climate change. Therma is hiring! Check out AngelList for open engineering, sales, and operations roles.

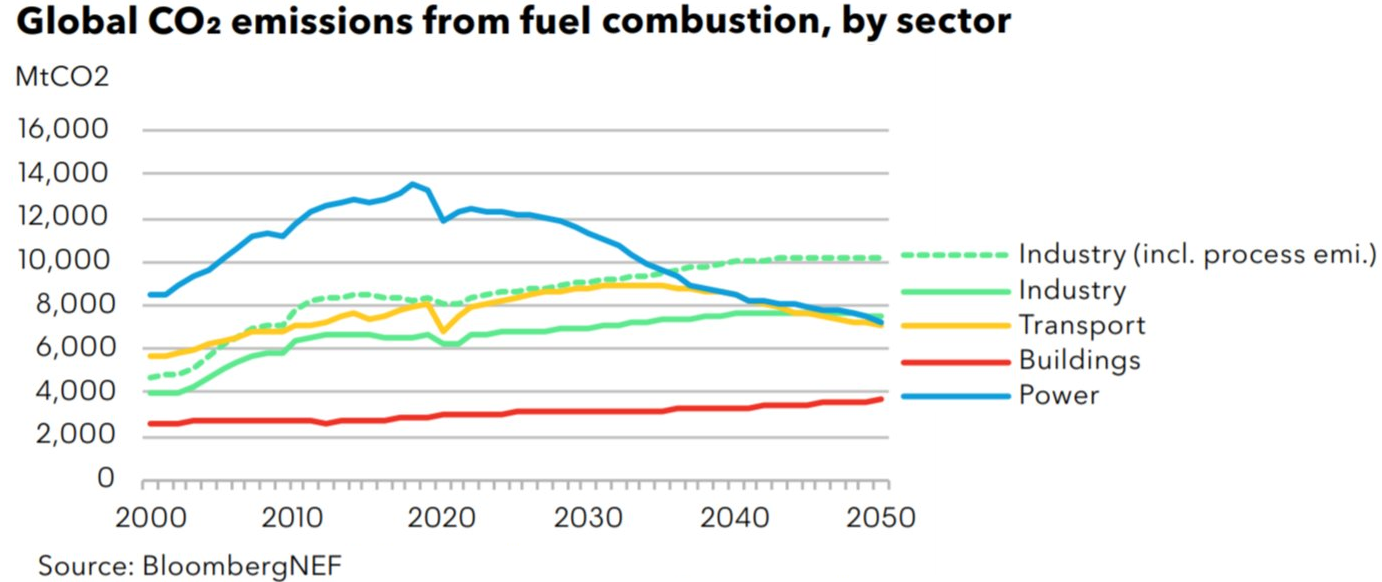

Bloomberg New Energy Finance released their 2020 New Energy Outlook with a gloomy headline: the world is on track to reach 3.3 degrees of warming in 2100, even with the pandemic’s negative aggregate emissions. To limit warming to two degrees, emissions would need to decline 6% each year until 2050.

South Korea pledged to reach carbon neutrality by 2050. SK will invest $7B in “green new deal” projects and build charging stations for electric and hydrogen vehicles. The three largest economies in East Asia have now committed to net-zero emissions by near or mid-century. It’s now a wait-and-see game to know if the West will follow suit (with tomorrow’s election holding much in the balance.)

Arizona becomes the newest state to pledge to be carbon-free by 2045. Unlike other states with similar emissions targets, Arizona will have to wean off of fossil fuels much faster and much more aggressively, despite ~60% of their current energy generation from natural gas and coal. This will be an uphill battle for utilities in the area but a welcome new market for clean energy investments.

Payments giant Stripe has launched “Stripe Climate” – a new integration that allows vendors to automatically contribute a portion of their sales to Stripe’s existing $1m carbon reduction investment portfolio. As we covered back in May, Stripe’s current portfolio includes CarbonCure, Climeworks, Project Vesta, and Charm Industrial.

Frontline climate communities like Orange County, FL, Denver, CO, and Berkeley, CA, are putting climate on the ballot with tax and funding measures to invest in climate mitigation. Denver proposed a selective sales tax to fund climate jobs and justice programs.

Despite the recent hype over Tesla’s Battery Day, Chinese EV battery manufacturers are poised to dominate the global market – and the US is lagging behind. 'In just one sign of how far ahead China has progressed in electric vehicle development, out of 142 lithium-ion battery megafactories under construction globally, 107 are set for China, versus 9 in the U.S.

Recent carbon pricing study by E3 reveals that an effective carbon price policy must be applied market-wide or else risk higher costs and emissions from incentivizing fossil generation to shift to neighboring states without carbon pricing.

American universities have adopted a new wave of climate initiatives in recognition of the urgency of the climate crisis. Stanford and Columbia established new “climate schools,” while others have expanded existing programs.

While the combination of long wait times and unproven technology give many VC investors the jitters, the green VC space is teeming as profiled in a nice new Economist article.

In the 11th hour, the Biden campaign is using some of its airtime to push climate-themed ads.

Circular carbon network has released its new market report detailing the data behind the innovators, investors, corporates, and catalysts in the carbon space.

Play around with Energy Innovation’s energy policy simulator to explore the impact of various decarbonization pathways.

Morgan Stanley predicted the timing of Apple’s ramp up of iPhone 12 manufacturing using data showing a surge in low air quality data in four Chinese manufacturing cities.

Keurig Dr Pepper Inc., announced that it would transition its Snapple and CORE brands to 100% recycled plastic, eliminating an expected 46.3m pounds of virgin plastic annually.

Fattening up invasive urchins and harvesting them for restaurants is helping to save the ocean.

Meet the first black woman to run a community solar company. Plus a bonus Vogue photoshoot.

Stanford hosted a recent Global Energy Dialogue with Eric Toone of Breakthrough Energy Ventures and Avik Dey of Canadian Pension Plan’s energy & resources investments to discuss sustainable energy invention and deployment. Notable quote from Toone, “The most important thing that climate investors can do is make money.”

🗓️11/6 2020 MIT Sustainability Summit: This year’s virtual summit will explore how innovations are changing the way the world produces, transports, stores, consumes and disposes of food. Hear from companies including Impossible Foods, Replate, Oatley, and Apeel.

🗓️11/6 Annual Energy & Environment Symposium at Harvard Business School: Join the Energy & Environment Club at HBS to hear about issues informed by COVID, the current economic downturn, and the climate crisis.

🗓️11/18 Terra.do Virtual Climate Job Fair: Join dozens of organizations and hundreds of mission-driven professionals at the world’s first online climate jobs fair. If you are hiring, meet talented individuals in a speed-dating format. If you’re looking to work in climate, expand your search universe and meet hiring managers in top climate organizations. Register here.

We spoke to Lea Borland from Four Layers (formerly 4 Cool Jobs) this week about job opportunities in energy storage. Her newsletter explores a new industry each week and features, well, four cool jobs.

Masters thesis on scenario modeling @IKEA

Sr Associate, Capital Markets @Wunder Capital

Sr Investments and M&A Associate @EDP Renewables

VP Finance @OhmConnect

Junior Agronomist @Soil Capital

Product Designer @Mantle314

Marketing Strategist @C16 Biosciences

Various Roles @Voltus

Operations & People Manager @C16 Biosciences

Digital and Data Consultant @Catapault Energy Systems

ML and Full-stack Engineers @Pachama

CTO @MarketPearl

Product Manager @Schmidt Futures

Feel free to send us new ideas, recent fundings, or general curiosities. Have a great week ahead!

OBBB blows tailwinds through CCUS, but takeoff stalls

One Big Beautiful Bill ushers in new (and old) energy agenda

Climate, capital, and carrots in London's new playbook