🌎 Bright spots and sunsets in the OBBB #253

One Big Beautiful Bill ushers in new (and old) energy agenda

Plus, $100m+ climate mega-rounds raised by Octopus Energy, Perfect Day, Ola Electric, and Semios

Happy Monday!

In this week’s issue, climate tech deals bring us around the world - including mega-rounds from British darling, Octopus Energy, and Indian e-mobility star, Ola Electric. Almost $600m of new climate venture capital hits the market - including $330m for Energize Ventures who joined us for Friday's perspective on renewable construction finance.

We share news on the dramatic climate policy week in Washington, the world’s largest sovereign fund’s new CO2 mandate, and a peek into the much-anticipated Lucid Motors and Rivian unveil. Plus, Elemental Excelerator’s new Cohort X and an Earthshot of a role at climate tech's latest new fund.

Thanks for reading!

Not a subscriber yet?

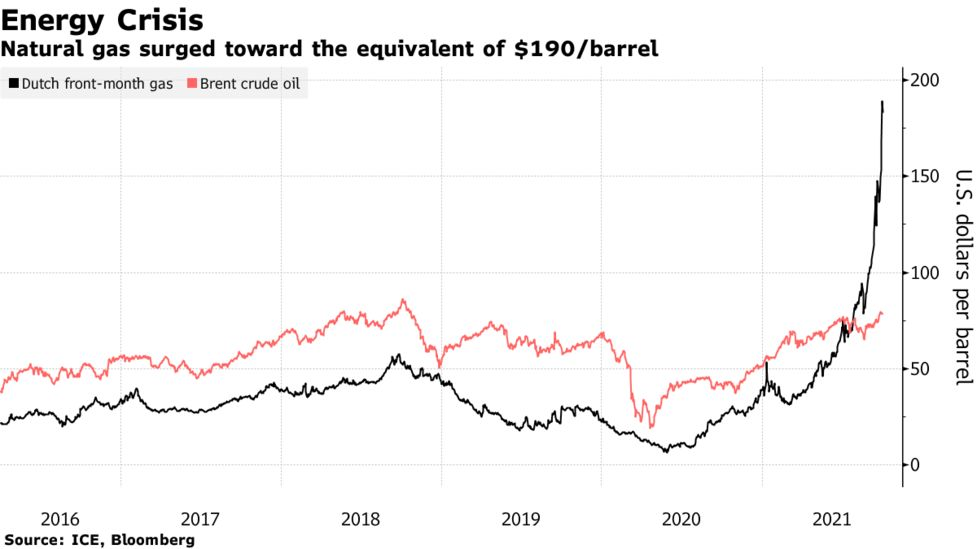

Global markets are getting shocked with an energy crunch as the world starts to come back to life. Natural gas prices have surged worldwide, pushing to the equivalent of $190 a barrel (something never before seen in the oil market) in places like Europe and China.

🕵️♀️ Why? Global demand has risen as economies recover after Covid-19 lockdowns, while supplies have been impacted by several factors – including volatile weather, restraint by US producers, lags in maintenance from Covid restrictions, and limited capacity in pipelines from Russia to Western Europe. In China, tightly regulated pricing mechanisms which keep energy costs low and provincial emissions quotas are forcing power producers to shut down. The pinch is likely to continue as countries brace for a cold winter and after China ordered state-backed companies to secure energy supplies no matter the cost.

🤬 Who’s reacting? Critics of renewable energy have taken this moment as an opportunity to blame “the energy transition” for shortages. Climate ambitious countries like the UK, which allowed the closing of gas storage facilities, also happen to be the hardest hit.

🤔 How should we react? High reliance on renewable energy (largely wind with some solar) and declining coal use has caused imported natural gas for electricity generation to fill the gaps when the wind doesn’t blow or the sun doesn’t shine. While investing in natural gas storage facilities is a short-term band-aid to fix the problem, this is also an opportunity and signal to inject money into other forms of storage: hydrogen, batteries, and others.

🤙 Embrace change. Reliance on foreign energy imports, as this event has demonstrated, is a risky business. The energy transition can drive domestic and independent power production, especially coupled with local and contextual clean energy plans that maximize renewable energy generation and storage. An energy shortage reliant on fossil fuels shows that it’s time to lean even more into renewables.

👋 Promote reliability and stability. The energy transition will continue to be a bumpy road, so we need options to smooth the volatility and intermittency of renewable sources. Countries should pair ambitious climate targets with better market mechanisms to optimize supply and demand curves for intermittent generation. We should encourage more investment and faster adoption of breakthroughs in storage - whether through batteries (e.g., Form Energy and Ambri, hydrogen (e.g., Electric Hydrogen and H2GO Power), or other creative forms (e.g., Energy Vault and Malta).

⚡ Octopus Energy Group, a UK-based renewable energy company, raised $600m in funding from Generation Investment Management.

🧀 Perfect Day, a Berkeley, CA-based animal-free dairy producer, raised $350m in Series D funding from Temasek, CPPIB, and Bob Iger.

🛴 Ola Electric, an India-based e-scooter maker, raised over $200m in funding from Falcon Edge Capital and SoftBank.

🌱 Semios, a Canada-based crop risk analytics startup, raised $100m in funding from Morningside Group.

🔥 DroneSeed, a Seattle, WA-based startup using drones to reforest after wildfires, raised $36m in Series A funding from Social Capital, Seven Seven Six, TIME Ventures, DBL Partners, and Tobi Lütke.

🥩 New Age Meats, a Berkeley, CA-based cultured meat company, raised $25m in Series A funding from Hanwha Solutions, SOSV, TechU Ventures, ff VC and Siddhi Capital.

🚗 BluSmart, an India-based EV ride-hailing company, raised $25m in Series A funding from bp ventures, Mayfield India Fund, 9Unicorns, and Survam Partners.

🚲 Dance, a Germany-based e-bike subscription business, raised $19.4m in funding from Eurazeo, HV Capital, BlueYard, and others.

🌆 ClimateView, a Sweden-based platform helping cities manage their transition to net zero, raised $11.6m in Series A funding from CommerzVentures, NordicNinja, Norrsken, 2050.VC, and Gaingles.

🌱 Burro, a Philadelphia, PA-based agricultural robotics startup, raised $10.9m in Series A funding from S2G Ventures, Toyota Ventures, F-Prime Capital and the Cibus Enterprise Fund.

⚡ Urbio, a Switzerland-based energy planning software startup, raised $2m in pre-Seed funding from Wingman Ventures, Contrarian Ventures, Urban Us, and David Helgason.

⚡ Cheesecake Energy, a UK-based energy storage startup, raised $1.4m in Seed funding from The Imperial College Innovation Fund, Perivoli Innovations, and angel investors.

⚡ Enerpoly, a Sweden-based zinc-ion battery startup, raised $475K in Pre-Seed funding from Sting Holding and other angel investors.

⚡ Ampd Energy, a Hong Kong-based startup developing battery systems for electrifying construction sites, raised an undisclosed amount in Series A funding from 2150 and Tarongra Group.

Polestar, a Swedish maker of electric and hybrid cars, agreed to go public at a $20b valuation via a SPAC with Gores Guggenheim.

Fluence Energy, an Arlington, VA-based energy storage company, filed for an IPO.

HSBC and Temasek launched a partnership to catalyze sustainable infrastructure projects in Asia, seeking to scale up to $1b of loans within 5 years to support commercial development of the region’s sustainable infrastructure sector.

Energize Ventures raised $330m fund to invest in digital technologies accelerating the energy transition [see Construction Tech feature].

MacKinnon, Bennett & Co. (“MKB”), a Canada-based energy transition fund, raised $175m focused on electrification, decarbonization and digitization of transportation and energy.

Investible, an Australian VC firm, raised $72.3m for its Climate Tech Fund investing in Seed companies reducing climate change.

It’s been a dramatic and anxiety-ridden week for climate policy in Washington. US House representatives were scheduled to vote for the most pivotal US climate and infrastructure policies this week, but House Speaker, Nancy Pelosi, delayed the vote to ensure she had enough to pass the bill (deep breaths folks). Even while the vote count for Democrats is shaky, the party considers adding carbon tax to the budget bill as a creative way to fund the $3.5T price tag.

Laurene Powell Jobs, president of Emerson Collective, is injecting $3.5bn into a new climate action group called the Waverly Street Foundation. All the money will be spent over the next 10 years on initiatives around housing, transportation, food security and health for underserved communities most impacted by climate change.

The Fed introduced a formal climate risk stress-testing model for big banks. Fed economists submitted this model through a research journal, laying out a methodology assessing the climate risks exposed within a bank’s portfolio and calculating the expected capital shortfall due to the extreme-weather events.

Norway’s $1.4T Government Pension Fund, the world’s largest sovereign wealth fund, is setting a CO2 mandate requiring companies to have a carbon reduction goal or risk losing their capital. Part of that said portfolio are the 12 of the world's largest oil companies, which have announced plans to cut their carbon and methane emissions by 50 million metric tons annually by 2025, but specifically left out Scope 3 emissions.

The Carlyle Group and CalPERS are trying to standardize ESG reporting with their ESG Data Convergence Project - a huge win for investors looking to compare across the ESG investing field.

Big Auto continues its big push into electrification, with Ford announcing a $11.4b investment in US EV assembly plants and 11,000 new workers and General Motors introducing its new electric midsize commercial vehicle, the EV 410, designed for smaller but more frequent trips.

Meanwhile, the upstarts Lucid Motors and Rivian, invited car reviewers for their respective show and tells. Even though the Lucid Air received good reviews, everyone was raving about Rivian’s R1T, taking everyone offroading and even cooking at 10,000ft above sea level.

California will require all autonomous vehicles to be zero-emission starting in 2030. While these cars make up less than 1% of all cars on the road in California, their vehicle miles traveled soar above most vehicles, making the avoided emissions significant.

US wildlife officials declared 23 species extinct including 11 birds, 8 freshwater mussels, 2 fish, a bat and a plant. In an effort to save the birds, Biden has restored protection under the 1918 Migratory Bird Treaty Act, which penalizes groups for unintentionally causing bird deaths.

Elemental Excelerator announced its latest Cohort X of 19 hot climate cos including Nth Cycle, Climate Robotics, and WeaveGrid - with a fun voting game to boot.

Could methane removal be the new carbon removal?

Like long-forms? Fortune released their second installment of Path to Zero, with deep dives covering climate crypto and the rise of cleantech 2.0.

Weighing the near-term benefits of solar geoengineering over carbon removal from the former co-founder of Carbon Engineering.

The classiest burn from Bill Gates. "Space? We have a lot to do here on Earth."

The final frontier for solar? Space perhaps.

NASA launches another set of eyes on the planet with Landsat 9.

In even more space news, climate change is actually making the earth dimmer.

Google Maps is beefing up with wildfire tracking and tree canopy cover tools to help users adapt to our new climate reality.

Pondering what a climate conscious Facebook looks like. TLDR; less climate misinformation [we dive deeper here]

Think there aren’t enough EV options? The DOE counts 54 plug-in electric models ranging from small SUVs to minivans.

Don’t count on your offsets. The market may need to grow 50x to meet 2050 net-zero emissions goals, according to a BofA.

Storm chasing like never before - watch unprecedented footage caught by Saildrone in the eye of category 4 hurricane Sam.

Stack up on your hydroponic hops courtesy of Aerofarms x Goose Island.

🗓️ SOA 5th Wave Cohort Demo Day: The Ocean Solutions Accelerator has propelled 45 groundbreaking ocean startups to the global stage! Don’t miss your chance to meet the 9 newest early stage ventures on Oct 7th.

🗓️ How to Fuel Climate Innovation with Impact Investing: Join VertueLab on Oct 10th at an informational webinar where you'll learn how crucial impact investing is to growing and scaling early-stage climate startups, and how to participate in VertueLab's Climate Impact Fund.

🗓️ Carbon to Value Initiative Showcase: Meet 10 startups like Air Company, Mars Materials, and Cemvita Factory that are shaping the future of the carbontech industry on Oct 21st.

🗓️ EnVest 2021: Request an invite to join environmental investors and 36 presenting companies at EnVest's annual investing summit on Nov 18th in San Francisco.

💡 Chain Reaction Innovations Program: Argonne National Laboratory’s CRI is a 2-year fellowship program that provides $220k in non-dilutive funding plus a salary with benefits for clean energy and science based innovators who are fighting climate change with revolutionary technologies. Apply by October 31st.

💡 Entrepreneur in Residence at Union Labs: Are you an experienced founder or senior executive looking to start the next impactful DeepTech startup? Union Labs is actively looking for Entrepreneurs In Residence in climate. Apply on a rolling basis.

Business Associate @Phoenix Tailings

Senior Associate @OnePointFive

Product Manager, Energy & Sustainability @C3.ai

Director of Business Development @Nitricity

Product Manager, Charging Systems @Volta Charging

Senior Accountant @Sealed

Senior Analyst @Earthshot Ventures

Associate, Private Credit Funds @Closed Loop Partners

VP of Business Development @Modern Electron

US & LatAm Head of Commercial and Operations @Biome Makers

Senior Electrical Engineer @Gradient Comfort

Feel free to 📩 send us new ideas, recent fundings, events & opportunities or general curiosities. Have a great week ahead!

One Big Beautiful Bill ushers in new (and old) energy agenda

Climate, capital, and carrots in London's new playbook

US plays popcorn politics with biofuels and beyond