🌎 Overheard at LCAW #252

Climate, capital, and carrots in London's new playbook

Climate Tech market reporting with Azeem Azhar and SPAC attacks

In honor of this Monday, it’s worth reflecting on the indigenous genocide that the New World’s ‘discovery’ set off and its ensuing climate effects.

In this issue, we sit down with Azeem Azhar of Exponential View for his authorly take on The State of Climate Tech 2020 - climate tech’s first market report boils down to an exciting time with some parallels but little playbook. We also dig into the hype and hope of climate SPACs, a boom that’s attracted big names, big dollars, and big assumptions about the growth of the total climate tech market.

Thanks for reading!

Not a subscriber yet?

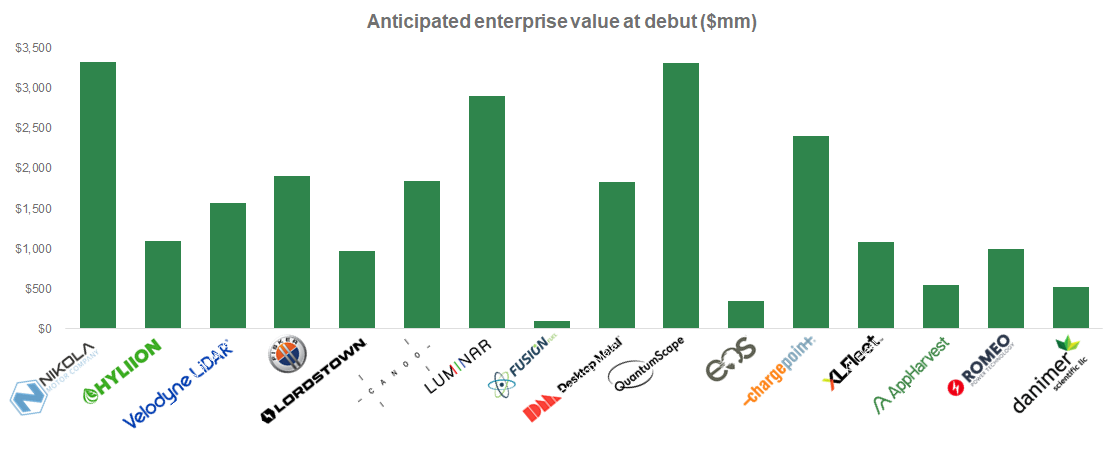

Starting from Nikola’s famed SPAC announcement back in March, a “Cleantech SPAC attack” is booming, with a range of EV companies, battery-makers, bioplastic manufacturers, and vertical farms vying to become public within the next few months. This SPAC attack is notable, not only because Shaq is getting in on the game (SHAQ SPAC?!), but because this alternative mechanism for companies to go public has been embraced virtually overnight. In 2020, SPACs have raised $41bn, more than the last 10 years combined. While it’s yet to be seen whether SPAC returns will meet their hype, they are undeniably part of the equation enabling climate tech to enter the mainstream with 16 companies announced thus far.

How does a SPAC work?

A SPAC sponsor (typically well-connected individuals or investors) raises capital to create a public shell company which has a 2 year timeframe to acquire a private company to take public in a reverse merger. The capital is held in a trust and, often in combination with a PIPE (private investment in public equity), used as the cash source for the transaction. SPACs have very compelling economics for the sponsor, who invest ~3-4% of the IPO proceeds and typically receive 20% of the common equity. In a $250m SPAC, the sponsor would invest $7m in warrants and receive $60m of common stock, achieving an ~8x return. SPACs are also attractive to the target, which can go public much faster by circumventing the traditional roadshow and disclosure process, partner with a credible sponsor, and benefit from an influx of cash to the balance sheet.

Key Takeaways

⚡ Redaptive, a San Francisco, CA-based energy “efficiency-as-a-service” startup, raised $157m in funding from CarVal Investors, CBRE, Engie New Ventures, Evergy Ventures, and Linse Capital. More here.

🐜 Ynsect, a Amiens, France-based insect protein farm startup, raised $65m in new equity and $139m in debt funding Upfront Ventures and FootPrint Coalition. TechCrunch has more here.

💨 Newlight Technologies, a Huntington Beach, CA-based maker of high-performance biomaterials from greenhouse gases, raised $45m in Series F funding from Valedor Partners, Newlight Investors, and GrayArch Partners. More here.

🚚 Einride, a Sweden-based electric and autonomous freight transport startup, raised $10m in funding from Norrsken VC, EQT Ventures, Nordic Ninja VC, and Ericsson Ventures. More here.

💨 Airly, a Krakow, Poland-based startup combining sensing technologies and software to measure air quality, raised $2m in Seed funding from Giant Ventures, Sir Richard Branson, and several others. TechCrunch has more here.

🚚 Hyzon Motors, a Honeoye Falls, NY-based fuel cell truck startup, raised an undisclosed amount from Total SE, Ascent Hydrogen Fund, Hydrogen Capital Partners and Audacy Ventures. More here.

🚲 Ridepanda, a San Francisco, CA-based online seller of e-bikes, e-scooters, and e-mopeds, raised an undisclosed amount of Seed funding from General Catalyst and Will Smith's Dreamers Fund. TechCrunch has more here.

💸 Better World Acquisition, a SPAC formed by N*GEN Partners targeting ESG companies filed for a $125m IPO. More here.

💸 Rice Acquisition, a SPAC backed by Rice Investment Group targeting the Energy Transition space filed for a $200m IPO. More here.

Romeo Systems, an electric battery company will merge with a SPAC, RMG Acquisition Corp, at a $1.3b valuation. More here.

Danimer Scientific, a company that makes biodegradable and compostable biopolymers, will merge with a SPAC, Live Oak Acquisition Corp, at a valuation of $890m. More here.

Future Energy Ventures, a venture capital platform created by E.ON investing in the energy landscape, launched with $295m. More here.

Azeem Azhar, Founder of Exponential View & Venture Partner at Kindred Capital VC

This week, we chatted with Azeem Azhar, an entrepreneur, investor, and creator bridging the gap between technology and the humanities to share a broad lens on our near future. Exponential View is a highly-regarded futurist newsletter, and Kindred Capital VC is a venture capital firm focused on pre-seed and seed founders.

During Climate Week, Azeem, Celine Herweijer, and a team at PwC published The State of Climate Tech 2020. In addition to breaking ground as the first market report on “climate tech,” the research included a number of interesting findings:

We asked Azeem to share more about his background and the report. [The newsletter version has been edited lightly for length, so check out our website for the full feature].

Why did you predict climate tech as the “dominant narrative” of the next decade?

Fifteen years ago I invested in New Energy Finance - now Bloomberg New Energy Finance - and started to develop an understanding of the climate tech space. Since, I’ve seen more founders and investors talking about climate change related issues and I’ve started to connect the dots between climate change urgency and the news that I write about in Exponential View.

One of the amazing things about venture capital is that it's an incredibly fast follower, in the sense that it can “vector” very rapidly into a new domain. Much like how at one point no VCs were investing in social networking platforms, and then suddenly everyone's investing in them – VC has started to “vector” toward climate tech and has accelerated quickly.

How does the story of climate tech investment’s growth parallel the AI investment boom?

For a long time, AI companies couldn’t get funded. It took a couple breakthroughs, like computer vision and speech recognition, to trigger massive interest. Within a year of that development, large companies and venture capital started to invest, which then grew to billions. The growth in AI investment took about six or seven years. We are now seeing this parallel in the climate tech space. Great entrepreneurs with venture capital backing are a leading indicator about the boom coming in this space.

Your report found that ~63% of climate tech funding is in the mobility / transport space. How much of the surge in climate tech investing reflects EV hype?

Let's peel that apart. 60% of EV investments are in Chinese venture capital investments. American and European investments are largely made by publicly listed companies, so Volkswagen’s investments in batteries for example won’t show up in this data.

Moreover, China's investment in climate tech is virtually all in the mobility space – whether it's electric vehicles or micro-mobility. So far, there hasn't been much investment in alternative climate technologies that we're seeing across Europe and the US, like carbon capture and storage.

We’re seeing companies and funds tout climate pledges without an approach to carbon measurement. How will we quantifiably assess their performance?

I think that's a great observation. There’s an opportunity for startups to come in and provide that missing data piece of quantifying carbon levels.

For example, if I use Salesforce, I know exactly what my sales position is on a given day, who I owe money to, and what my inventory looks like. We don't have that yet for carbon. We need solutions that can provide data that’s more accurate and closer to real-time than a biannual audit so that investors and companies can view their performance against all of the SDGs and their carbon footprint.

If we look out three or four years, funds should have a much better real-time view of what's going on. Maybe this will come from Equilibrium World, which is one of the companies I recently invested in, or maybe it will come from a Stripe or Shopify plugin.

Private market managers can ensure that they’re on track for their carbon targets by simply asking management the right questions. I talked to Rebecca Henderson, who is Harvard Business School professor and the author of Reimagining Capitalism in a World On Fire, and asked her why fund managers or ETFs perform better when they have an ESG mandate. Rebecca thinks that ESG mandates cause managers to ask many more questions about how businesses are being run. That additional diligence, from competent managers, results in outperformance.

UK Prime Minister Boris Johnson announced an effort to power every home with clean energy by 2030, with the help of offshore wind. The proposal centers around investing $200m+ to upgrade ports and factories to build turbines.

ExxonMobil planned to increase CO2 emissions to the equivalent of Greece, a 17% jump over the next five years while their European oil major peers transition to net-zero. Shareholders penalized Exxon by slashing its market capitalization in half over the past 6 months.

Wind and solar power provider, NextEra Energy, surpassed ExxonMobil in market value. This seesaw in markets reflects steady investor appetite for clean energy, but moreover a sudden death spiral for fossil fuels producers spurred by the pandemic.

In a letter to the Governor of California, the California Independent System Operator (CAISO) emphatically pointed to the lack of planning for climate change as a root cause of the rolling blackouts back in August.

Following on Morgan Stanley’s footsteps last week, JPMorgan committed to the Paris Climate Accord and global net-zero emissions by 2050. The devil remains in the details as the bank isn’t planning to cut ties with big emitters and has no plan to measure portfolio carbon intensity.

In the race for hydrogen trucks, Hyundai is the first to market delivering its XCIENT fuel cell trucks to customers in Switzerland last week. Other competitors gearing up for the race include JVs between Daimler and Volvo / Honda and Isuzu, Toyota, and Nikola.

Climate change (and fracking) got a seat at the VP debate table.

Elemental Excelerator announced the 19 innovators in its latest cohort. Tune in to catch these companies live at TedXElemental on October 28.

Amazon unveils its custom electric delivery vehicle designed and built by Rivian.

Google released designs for its new 80-acre “climate positive” campus in downtown San Jose.

Canada plans to ban single-use plastic nationwide by the end of 2021.

A McKinsey study found that companies now expect month-long supply chain disruptions every 3.7 years, due in large part to extreme weather events amidst the changing climate.

Your hot new Adidas and Lululemon gear might be made of fungus.

We started reading David Remnick’s The Fragile Earth this weekend – an anthology of New Yorker climate change stories from the past 30 years.

💡 Westly Group Prize: Upload a brief video about your community challenge moonshot for a chance to win $145k!

💡 Raise Green: The climate tech marketplace for local impact investing is distributing a $1,000 cash bonus for referred and listed clean energy projects!

🗓️ 10/13 Joe Biden’s Plan for a Clean Energy Revolution: Join Young Professionals in Energy to hear about Biden's plans for a clean energy revolution, solutions for climate change, and other critical issues in the 2020 Election.

🗓️ 10/14 Cleantech Investing 101: Greentown Labs will be discussing topics relevant to making cleantech investments and introduce the foundations of angel investing in cleantech.

🗓️10/13-10/16 Explore 2020: Join CTVC as we tune into Planet Labs’ conference on satellite imagery and implications. Many speakers (e.g., Al Gore and Jane Goodall) and breakout sessions are climate-focused.

Graphic design @CTVC

Renewable & Storage Analyst @Form Energy

Analyst / Associate @Congruent Ventures

Growth Equity Associate @Generation Investment Management

Breakthrough Technologies Associate @RMI

Industrial Venture Associate @Third Derivative

Partnership Manager @Powerhouse

Head of Finance and Administration @Pale Blue Dot

Clean energy position @Biden Administration (!)

Various @Weave Grid

Senior Data Scientist @ClimateAI

C-level position @Stealth Seaweed Company

CEO @Cornea

Feel free to send us new ideas, recent fundings, or general curiosities. Have a great week ahead!

Climate, capital, and carrots in London's new playbook

US plays popcorn politics with biofuels and beyond

Groundbreaking results from the geothermal developer’s main project