🌎 Taxing times for CCUS #254

OBBB blows tailwinds through CCUS, but takeoff stalls

What you need to know about the latest IRS guidance on tax credits for clean energy projects

Happy Tuesday!

Last week, the US Treasury and IRS released additional guidance on the Inflation Reduction Act’s updates to clean energy incentives. The proposed rules still leave a few unanswered questions, but market experts expect this information gives enough certainty to buyers and sellers for transactions to begin in Q3. (If it feels like we’re becoming a tax credit newsletter, don’t sweat it! We’re mostly done here, but these rules are worth at least a skim for anyone in climate tech.)

In other news, California gets a supersized truck-charging depot, COP28 controversy continues, and a Norwegian aluminum-maker produces the world’s first batch using green hydrogen.

In deals this week, a weather intelligence platform lands $87M. Geothermal pulls in $37M and cultivated meat attracts $30M.

Thanks for reading!

Not a subscriber yet?

📩 Submit deals, announcements, events & opportunities, or general curiosities for the newsletter at [email protected].

💼 Find or share roles on our job board here.

The IRS and Treasury released much-anticipated guidance on transferability and direct pay on Wednesday. These new measures created by the Inflation Reduction Act (IRA) are aimed at boosting traditional clean energy incentives—like the ITC and PTC for solar and wind—and dramatically speeding up climate tech deployment. (ICYMI, read our in-depth breakdown of tax equity investing and IRA accelerants here!)

Last week’s proposed rules were generally in line with industry expectations and signal that the IRS is on board with creating an efficient process for kickstarting these tax incentives.

Transferability: Any taxpayer that is not an “applicable entity” (i.e., a tax-exempt organization) is able to buy tax credits eligible for transferability. However, the IRS guidance clarifies rules around passive and active income, essentially limiting potential individual participants to those looking to offset tax liability from passive income (like a large real estate portfolio).

Direct pay: Tax-exempt entities like states, municipalities, and tribal governments are eligible for elective pay, meaning they can receive a direct payment from the federal government for the value of the tax incentive. The new guidance also clarifies that smaller public entities, like school districts and rural electric co-ops, qualify for direct pay as well.

Transferability: Each individual project or facility will be assigned a tax credit registration number—essentially a project ID—to document the credit transfer. Importantly, the IRS guidance clarifies that the sale of tax credits can take place at any point throughout the year before taxes are filed, which should help avoid timing delays on deals themselves.

Direct Pay: The guidance on when eligible projects will receive cash from the government is a little less favorable. Direct payments won’t be paid out until after the year’s taxes are filed and processed, meaning a project that kicks off in early 2023 may not receive money for the incentives until mid-2024.

Transferability: Project developers looking to transfer their tax credits are able to divide them up in order to sell them to multiple buyers. The guidance clarifies that the bonus credits (or “adders”) can’t be split off and sold separately. Tax credits can only be divided into proportional amounts of the full credit.

Transferability: One major unknown has been who bears the risk in a situation where a project fails to meet all the requirements but the buyer has already purchased and claimed the tax benefits, leading to a recapture or disallowance of the credits. The latest guidance says that if a recapture event occurs, the responsibility for repayment falls on the buyer—except in the case that ownership of a project changes (i.e., one partner sells their stake) after tax credits have been bought, which does not affect the buyer of the tax credits as long as the project continues operating.

Despite remaining questions about adders and registration, this updated guidance clarifies important unknowns and kicks off a 60-day period for public comments. Major changes to the proposed rules are unlikely given last year’s extensive public engagement, but the Treasury will host a series of webinars to share more information beginning June 29.

Bottom line: With a clearer picture of what this expanded tax credit market will look like, investors, developers, and startup marketplaces have the green light to start putting new IRA incentives to work… even as House Republicans attempt to throw up another speedblock.

🛰️ Tomorrow.io, a Boston, MA-based weather intelligence platform, raised $87M in Series E funding from Activate Capital Partners, Canaan Partners, Clearvision Ventures, JetBlue Ventures, Pitango VC, RTX Ventures, Seraphim Space, and Square Peg Capital.

⚡ Eavor, a Calgary, Canada-based geothermal energy company, raised $37M in Series B funding from OMV AG, BP Ventures, Eversource Energy, and Vickers Venture Partners.

🚚 FERNRIDE, a Munich, Germany-based electric autonomous trucks and operating systems company, raised $31M in Series A funding from 10x Founders, Fly Ventures, HHLA Next, KRONE, Promus Ventures, PUSH Ventures, Schenker Ventures, and Speedinvest.

🥩 Uncommon, a Cambridge, United Kingdom-based cultivated meat developer, raised $30M in Series A funding from Balderton Capital, East Alpha, Lowercarbon Capital, Max Altman, Miray Zaki, Redalpine, Sam Altman, and Sebastiano Cossia Castiglioni.

🔋 On.Energy, a Miami, FL-based energy storage developer, raised $20M in Series B funding from Ultra Capital and Phalanx Investment Partners.

⚡ Everest Fleet, a Mumbai, India-based EV fleet management platform, raised $20M in funding from Uber.

☔ ClimateView, a Stockholm, Sweden-based climate transition planning and simulation platform, raised $15M in Series B funding from SEB Venture Capital, Sandwater, Polar Structure, Norrsken VC, NordicNinja VC, Hampus Jakobsson, CommerzVentures, and 2050.

🔋 Sicona Battery Technologies, an Alexandria, Australia-based lithium-ion silicon anode technology provider, raised $15M in Series A funding from Artesian VC, Chaos Ventures, Himadri Chemicals & Inds, Investible, Riverstone Holdings, and Waratah Capital Advisors.

👖 Unspun, a San Francisco, CA-based sustainable robotics fashion company, raised $14M in Series A funding from Lowercarbon Capital, SOSV, Modern Venture Partners, Climate Capital, and Signia Venture Partners.

🚗 Pebble, a Sunnyvale, CA-based electric RV manufacturer, raised $14M in Series A funding from Lightspeed Venture Partners, UpHonest Capital, and Visionplus.

⚡ Gridware, a Walnut Creek, CA-based developer of grid monitoring sensors for wildfires, raised $11M in Seed funding from Fifty Years, Lowercarbon Capital, Convective Capital, Hawktail Management, Kindergarten Ventures, Liquid 2 Ventures, Rebel Fund, TRAC, True Ventures, and Wireframe Ventures.

♨️ Helixintel, a Buffalo, NY-based HVAC management platform, raised $11M in Series A funding from National Grid Partners, Munich Re Ventures, Stellifi, and Motivate Ventures.

💨 Climate Vault Solutions, a Seattle, WA-based corporate climate sustainability platform, raised $9M in Series A funding from Inclusive Capital Partners, King Philanthropies, Thirdstream Partners, and Valor Siren Ventures.

⚡ Eturnity AG, a Chur, Switzerland-based renewables evaluation, design, and sales software provider, raised $9M in Series A funding from Alantra.

🌾 Vive Crop Protection, a Mississauga, Canada-based sustainable pesticides producer, raised $8M in Series C funding from BDC Capital, Co-operators, Emmertech, Export Development Canada, iSelect, Lex Capital, and Urbana.

⚡ Standard Fleet, a San Francisco, CA-based EV fleet management software provider, raised $7M in Seed funding from Canvas Ventures and UP2398.

♻️ Sensoneo, a Bratislava, Slovakia-based smart waste management solutions company, raised $7M in Series A funding from Crowdberry, European Innovation Council, Taiwania Capital Management Corporation, and Venture to Future Fund.

💨 Skytree, an Amsterdam, Netherlands-based on-site direct air capture provider, raised $6M in Seed funding from Horticoop and The Yield Lab Europe.

🍎 Fazla Gıda, an Istanbul, Turkey-based food waste tech company, raised $6M in Series B funding from 212, Esor Investments, Founder One, Turkey Development Fund, and Turkiye Teknoloji Gelistirme Vakfi.

☔ Reask, a Sydney, Australia-based climate risk modeling tools startup, raised $6M in Seed funding from Collaborative Fund, Hawktail Management, Macdoch Ventures, Mastry Ventures, SVA, and Tencent.

⚡ Dynelectro, a Copenhagen, Denmark-based solid-oxide electrolyzer developer, raised $5M in Seed funding from EIFO, Vsquared, and PreSeed Ventures.

⚡ HydGene, a North Parramatta, Australia-based producer of hydrogen using synthetic biology, raised $4M in Seed funding from Agronomics.

🌱 Omnevue, a London, UK-based ESG performance reporting platform, raised $3M in Seed funding from Elbow Beach Capital, Pi Labs, and Zone2boost.

⚡ Tem., a London, UK-based renewable energy marketplace, raised $3M in Seed funding from AlbionVC, Christian Deger, and Revent.

📊 EcoChain, an Amsterdam, Netherlands-based lifecycle assessment software provider, raised $3M in funding for its B2B Life Cycle Assessment software from Phase2.earth and Volta Ventures.

⚡ Axle Energy, a London, UK-based energy demand flexibility software startup, raised $2M in Pre-Seed funding from Eka Ventures and Picus Capital.

🚚 Telo Trucks, a San Carlos, California-based manufacturer of small electric trucks, raised $1M in Pre-seed funding from GoAhead Ventures, Underdog Labs, WorkPlay Ventures, and others.

👕 Arda Biomaterials, a Southwark, London-based company transforming waste feedstocks into biomaterials, raised $1M in Pre-Seed funding from Clean Growth Fund, Plug and Play, Satgana, and Serpentine Ventures.

🏠 Enersee, a Brussels, Belgium-based AI-driven energy management software provider, raised $1M in Seed funding from Peak.

💸 Raise Green, a Somerville, MA-based crowdfunding marketplace for climate solutions, raised $1M in Seed funding from Connecticut Innovations and Sky Ventures Group.

⚡ Noodoe, a Walnut, CA-based EV charging solutions provider, raised an undisclosed amount of funding from ABM Industries.

🔋 KORE Power, a Coeur D'alene, ID-based lithium-ion battery manufacturer, raised $850M from the US Department of Energy’s Loan Programs Office. DOE also announced an additional $192M in new funding for battery and recycling tech.

🔋 SK on, a Seoul, South Korea-based EV battery manufacturer, raised $400M in growth funding from ENGZ Holdings, JPT Holdings, Wert Holdings, and MBK Partners.

☀️ CubicPV, a Bedford, MA-based solar wafer and perovskite manufacturer, raised $103M from Breakthrough Energy Ventures, Hunt Energy Enterprises, and SCG Cleanergy.

🔋 Granite Source Power, a Middleton, DE-based battery energy storage developer, raised $40M from New Energy Capital.

Galway Sustainable Capital, a Washington, D.C.-based sustainable infrastructure investment firm raised $250M for its fund from Macquarie's Green Investment Group's Energy Transition Solutions fund.

Share new deals and announcements with us at [email protected]

Forum Mobility is building a 96-truck charging depot in California—the company’s largest so far and a significant step towards the state’s goal of decarbonizing trucking by 2035. This trend is also in line with an expansion of public EV charging ports nationwide.

Hosts of COP28 proposed welcoming oil and gas companies to participate more fully in the UN climate summit talks taking place in the United Arab Emirates later this year. Activists opposed the proposition, further highlighting the tensions and credibility issues that COP process has faced in recent years. At the Bonn Climate Conference last week, constituents struggled to make progress on climate finance, equity, and other issues ahead of COP28.

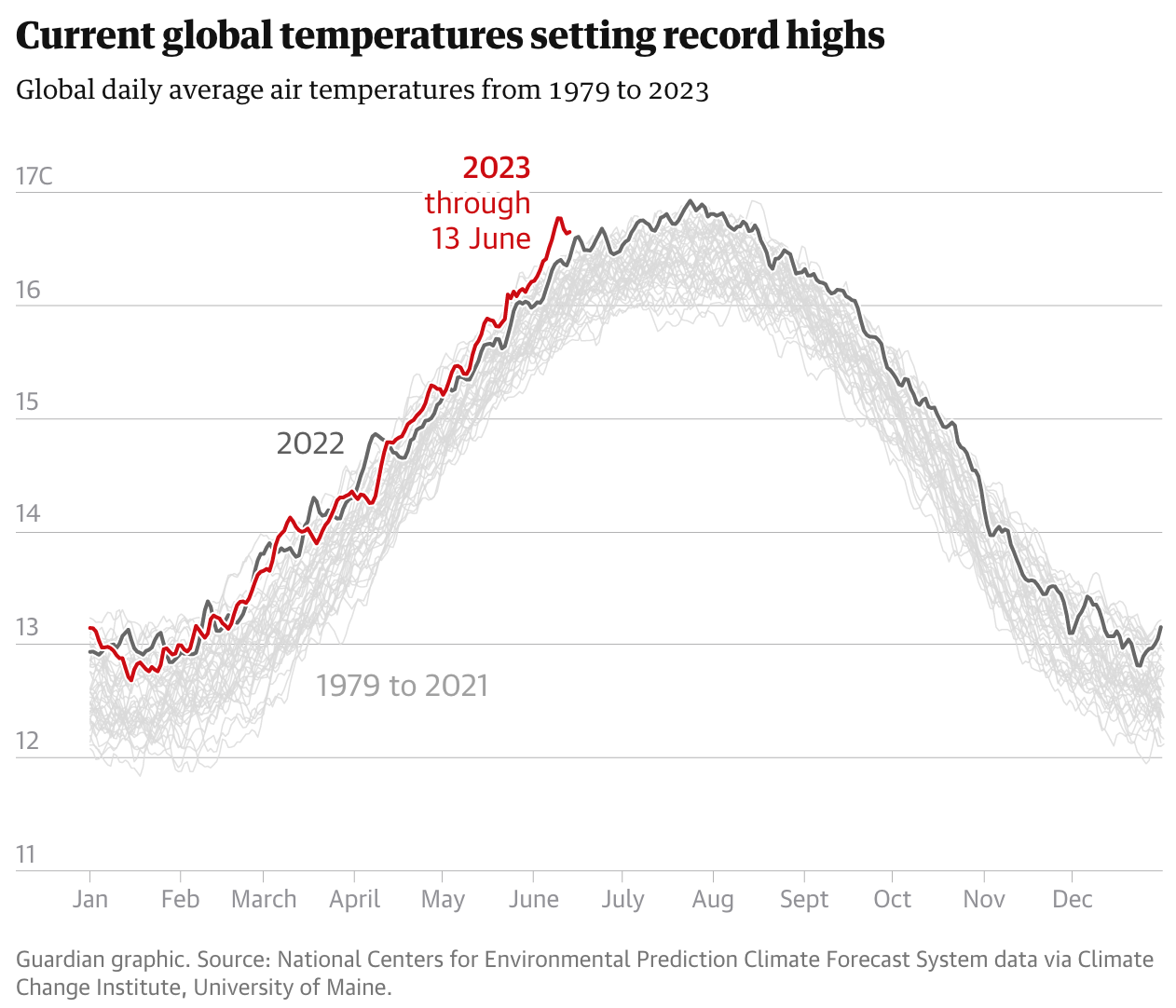

Global average temperatures are setting record highs this month, leading scientists to predict 2023 could be the hottest year in recorded history. This trend is further exacerbated by NOAA reporting that it had recorded the highest ocean temperatures ever for May.

Norsk Hydro ASA, a Norwegian firm, has produced the world’s first batch of aluminum using green hydrogen—a step towards decarbonizing production of the metal.

The landmark youth climate trial, which has been more than a decade in the making, began on Monday in Montana. Listen to the kids taking the climate change fight to court.

The U.S. Department of Energy (DOE) announced $135 million in funding for 40 projects that will reduce the carbon footprint of the industrial sector

National Grid, an energy company in the UK, has been in talks to bring two coal-fired plants out of retirement as it looks ahead to winter blackouts.

Georgia is becoming a hub for electric vehicle production following plans by Hyundai, Kia, and Rivian to set up factories there. The industry’s growth has been touted as a win for Georgia’s economic development by the swing state’s GOP leadership… who mostly ignore the fact that climate change is a driving force in the EV transition.

New Jersey is the first US state to require that climate change be taught at all grade levels.

Seeing CO2: NASA visualizes the carbon dioxide added to Earth’s atmosphere over the course of 2021 by source and geography.

The recent SCOTUS Sackett v. EPA decision affects a whopping 51% of US wetlands. Croak.

The most delayed, over-budget project in history: meet the world’s largest fusion reactor.

Watt breach? Potential Russian cyberattack strikes DOE and other federal agencies.

Critical vulnerability in EVs risks widespread grid blackouts and is an urgent plea for auto-electric collaboration.

Shifting gears in EV design: Toyota's new EV mimics a manual transmission, vroom vroom and all!

From landfills to livestock, South Korea leads the way recycling 1.4B tons of food waste per year.

A spicy survival tale of the quest to save climate sensitive plants—using chili peppers.

Heat pumps are putting Oompa Loompas out of a job at the chocolate factory.

💡 American-made solar prize: DOE launched the 7th round of its solar innovation competition, offering $4.2M in prizes. Learn more during a webinar on July 11. Sign up to compete by September 27.

🗓️ AWS State of Climate Tech VC: Register to join Sophie, Bessemer, Amogy, and more at this panel and happy hour on July 13 in NYC on the state of climate tech investment and tips for founders who are fundraising.

💡Market Shaping Accelerator (MSA) Innovation Challenge: Apply to the University of Chicago’s inaugural accelerator challenge by July 21. The MSA will award up to $2M to teams for ideas and developments of market-shaping proposals for important innovation areas, including climate change.

💡Foundation for Energy Security and Innovation (FESI) Idea Challenge: The new DOE non-profit foundation, aimed at speeding up adoption of clean energy tech, is seeking big ideas on how to form novel public-private partnerships for innovation. Learn more and submit an idea by July 31st to the Federation of American Scientists.

💡Decarbonization Technology Challenge: Startups developing innovations to decarbonize energy (in the TRL 4-8 range) can apply before Aug 11 for a chance to win up to $1M in piloting invites innovators from across the globe to enter for a chance to win up to $1 million in piloting opportunities with ADNOC.

Principal @Obvious Ventures

Business Development @InRange Energy

MBA Finance & Strategy Intern @InRange Energy

Business Operations Manager @Verne

Cofounder/CTO @Flip

Founder In Residence, Zero Emission Steel @Deep Science Ventures

People @Patch

Product Marketing @Patch

Director of ABM & Demand Generation @ClimateAi

Climate Solutions Manager @ClimateAi

Innovation Program Manager @Urban Future Lab

Feel free to 📩 send us new ideas, recent fundings, events & opportunities, or general curiosities. Have a great week ahead!

OBBB blows tailwinds through CCUS, but takeoff stalls

One Big Beautiful Bill ushers in new (and old) energy agenda

Climate, capital, and carrots in London's new playbook