🌎 Bright spots and sunsets in the OBBB #253

One Big Beautiful Bill ushers in new (and old) energy agenda

Conversation with AMP Robotics, Congress’ new stimulus bill, and the latest fundings

Happy Monday!

Is it us, or is 2021 just 2020 with bangs? What a year - even a coup couldn’t shake equities. At a $600B valuation, each Tesla car that rolls off the factory line is worth $1.25M to the company.

The “momentum” strategy has simultaneously driven Tesla (bull bet) and Bitcoin (bear bet) to new highs. Momentum generally works well, until it doesn’t. Investor (and environmentalist) Jeremy Grantham, famous for calling the 2000 and 2008 downturns, predicts that this bubble will burst in the spring.

In this issue, we sort out value in recycling with AMP Robotics, highlight climate implications of the stimulus bill, and feature exciting news like Hank Paulson joining TPG’s climate fund and the latest fundings from Boston Metal, SilviaTerra, and more.

Thanks for reading!

Not a subscriber yet?

Just before the end of the year and after months of stalemate, US Congress passed a 5,593-page COVID relief bill (~1.75-ft of stacked paper) with $35B worth of climate policies and energy funding scooby snacks that make us really excited for the incoming admin. We (as well as the IEA, World Bank, among others) have been calling for green stimulus policies that incorporate climate measures since early May - and it looks like Congress actually came through.

What is included in the 2 foot high bill

🔋☢️Emerging technology R&D: In addition to earmarking $4B-5B R&D funding to solar, wind, and storage tech, an additional $20B will be committed to CCS, advanced nuclear, and smart grid technologies.

🌳A win for carbon sequestration: Buying time for the nascent industry, CCS facilities can now start construction before 2025 (instead of 2023) while still qualifying for the 45Q tax credit.

😷Phaseout of HFCs: The US will phase out 85% of the harmful GHG by 2030. This breakdown from the Rhodium Group projects a cumulative 900m tons of CO2e reduction from both CCS and HFC policies.

☀️💨Green tax credits galore: Congress extended tax credits for carbon capture, and investment and production tax credits for solar, on-shore, and off-shore wind facilities.

🚧New regulations on methane monitoring: In reauthorizing the Pipeline and Hazardous Materials Safety Administration (PHMSA) program, the bill updates regulations for new pipeline infrastructure to include methane leak detection and repair.

What failed to make the cut

⚡🚗EV or storage tax credits: Despite the recent EV hype, Congress left out tax incentives for EVs or standalone storage, though the incoming Biden Administration might have something up their sleeve (ahem… Motor City Michigan’s Jennifer Granholm).

❄️A ban on Arctic drilling: While the absence allowed the Trump Administration to hold a historic auction for leases in the untouched Arctic National Wildlife Refuge, barely anyone showed up.

⚖️Environmental justice provisions: Besides the meager increase in funding for the Weatherization Assistance Program (*cough* WAP), the bill lacks provisions to alleviate the heaviest climate burdens from falling on low-income communities and communities of color.

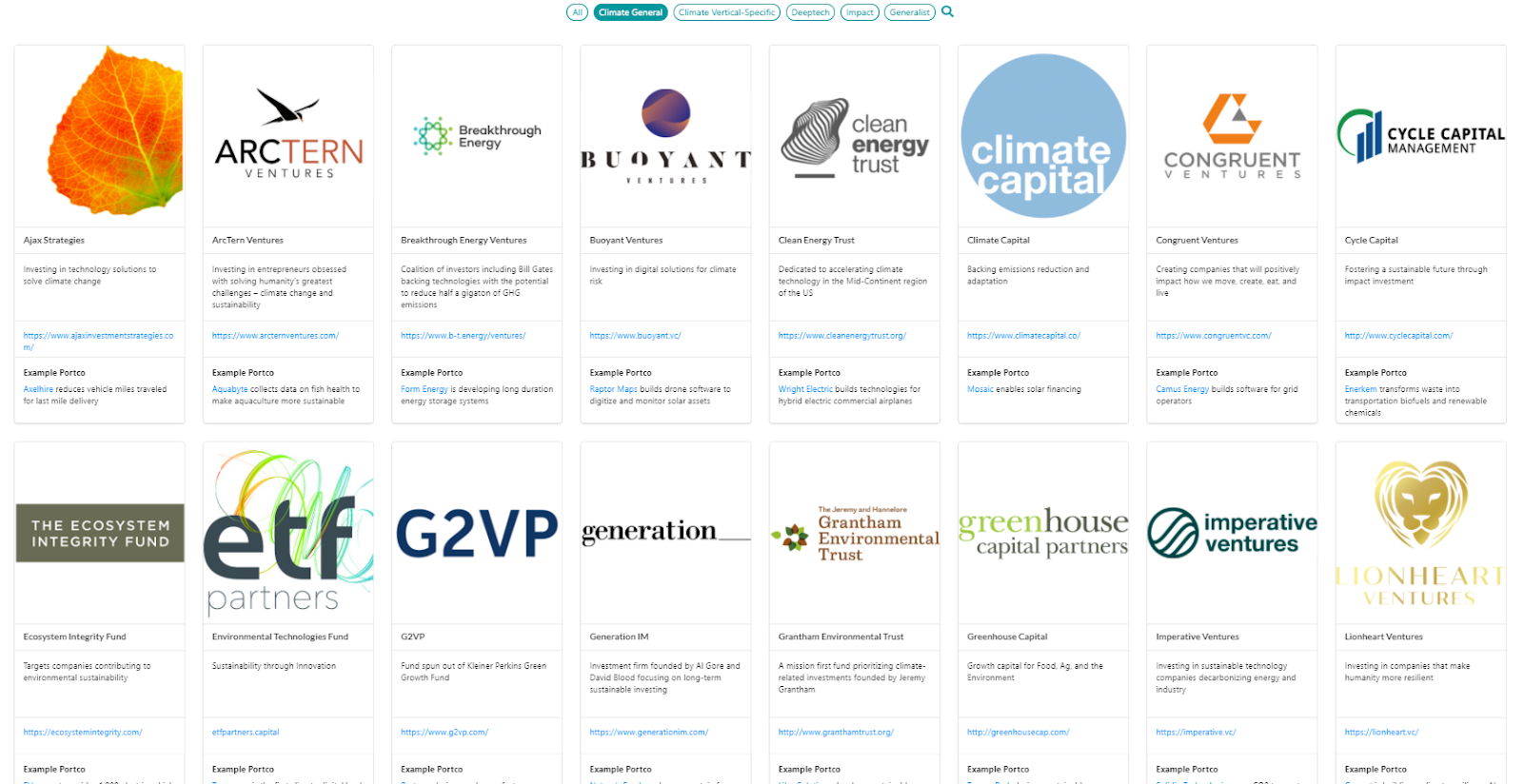

New year, new list! We’ve released an updated version of our popular Running List of Climate Tech Investors, complete with a snazzy new format, search functionality, and more detail on each fund. Keep the submissions coming, and please share with climate founders who are raising in the new year. We made this webpage for them - these funds are on our short list of VCs who we would (and did) call when fundraising.

If you’re a founder, send us an email and we’ll share what’s behind the list.

⚡ Octopus, a UK-based renewable energy supplier, raised $200m from Tokyo Gas, as part of a joint venture agreement. More here.

💨 BayoTech, an Albuquerque, Canada-based producer of on-site hydrogen, raised $157m in funding from Newlight Partners, Cottonwood Technology Funds and Sun Mountain Capital. More here.

⚡ Fluence, an Arlington, VA.-based energy storage company, raised $125m in funding from the Qatar Investment Authority. More here.

♻️ AMP Robotics, a Denver, CO-based developer of robots for sorting recyclable materials, raised $55m in Series B funding from XN, GV, Valor Equity Partners, Sequoia Capital, Sidewalk Infrastructure Partners, Congruent Ventures, and Closed Loop Partners. More here.

🏗️ Boston Metal, a Woburn, MA.-based company using molten oxide electrolysis to green metal making, raised $50m from Breakthrough Energy Ventures, Prelude Ventures, The Engine, Devonshire Investors, Piva Capital, and others. More here.

🥩 Air Protein, a Pleasanton. CA.-based alternative meat company, raised $32m in Series A funding from ADM Ventures, Barclays and GV. More here. (We featured CEO Lisa Dyson here.)

🍎 Too Good To Go, a Denmark-based startup combating food waste, raised $31m in funding from Blisce, with earlier investors also participating. More here.

🦐 New Wave Foods, a New York, NY-based maker of a shrimp alternative, raised $18m in Series A funding from NEA, Evolution VC Partners, Tyson Ventures, and others. More here.

💨 SilviaTerra, a San Francisco, CA-based carbon offset marketplace, raised $4.4m in Seed funding from Version One Ventures and Union Square Ventures' climate tech fund. More here.

USV (featured in our last issue) raised $151.3m for a climate-focused fund. More here.

Cycle Capital Management, a Montreal-based venture firm focused on clean-tech startups raised $114 m.

This week we “talked trash” with Matanya Horowitz, founder of AMP Robotics, about his vision to transform recycling through deep learning and robotics. AMP just announced its $55M Series B raise from a powerhouse of investors, and Matanya paints a compelling picture for how AMP’s disruption of the unit economics of recycling will revolutionize material use. [We’ve edited the newsletter version lightly for length; visit our website for the full feature].

You just closed a $55m Series B. Congratulations! Take us back in time - how did AMP Robotics get started?

I've always been fascinated by robotics and was studying for my PhD at Caltech, while looking for applications of deep learning in industry. Recycling was particularly exciting as the sector is beleaguered by a core technical challenge: the inconsistency of the material stream during sorting. The goal is to create this pure stream of #1 or #2 plastics or cardboard, but every item is smashed, folded, or dirty in some way. This inconsistency has prevented much of existing manufacturing automation from entering the recycling industry, but is a great fit for new deep learning capabilities.

I got really excited when I saw the unit economics for recycling facilities. A lot of people think that recycling is driven by some sort of governmental mandate, but it’s really the economics. However, the cost of sorting inconsistent waste erodes away most of the value. The materials might be worth $50 or $100 a ton, but just running the recycling facility nets out to $80 a ton. There’s a huge opportunity for automation to reduce this cost, and significantly change the unit economics.

What does the waste and recycling market look like today and what are the challenges you’re solving for?

Today’s industry has been defined by one major event: Southeast Asian markets stopped importing global waste. North America and Europe used to send a majority of our waste to buyers in China in particular, where these markets had a huge need for raw commodities and buyers were so hungry for material that they were willing to accept low quality. Unfortunately, after salvaging the value, they'd basically throw the garbage in rivers, creating some pretty big environmental problems. Different governments stepped in to shut down these markets, and either banned the import of recycled materials or established very high standards for quality. As a result, there's a glut of low quality recyclable material in the market and prices have been driven down.

This creates an interesting challenge. Recycling facilities typically have two avenues to improve their quality: they can either (1) invest a lot of capital in infrastructure to restructure processes or (2) hire a lot of people to manually sort everything. With our robotic system, we’ve created a third way: a system that costs and functions a lot like hiring a person. Deployment is quick and doesn’t require retrofitting of their existing lines, and takes up roughly the footprint of a person.

What does AMP’s robot look like, and what can the AI do?

Our core technology is a vision system for material identification. It is built on a color camera connected to a GPU which performs inference using a neural network to identify, for example, bottles from cans. Our main product, Cortex, uses that information for sorting. At the front of the conveyor belt, our vision system looks at the material and sends a signal to the robot to sort the material into the facility’s existing infrastructure, like a chute or bin. The robot is very fast, so it sits inside a safety cage where it’s bolted onto the existing conveyor belt.

Existing industry infrastructure is essentially mining machinery adapted for recycling. They use physical properties of the material to coarsely separate it. Those machines can be very high throughput, but lose out on high accuracy. As such, recycling facilities have to augment these machines with people to clean up all the mistakes that pass through. That's the kind of work that our robots can do - we fit them around those existing screens.

What challenges are your waste customers facing?

It surprises many people that waste is actually a really good business to be in! Especially if you have a landfill or if you're a hauler. You get very steady cash streams, it's recession proof since people don't stop producing trash, and, as a result, typically has very low cost of capital.

Our customers do face significant challenges with manual labor. It’s typically a very high turnover, pretty nasty job with lots of hazards. The labor pain point is so acute that even from the beginning, these owners were willing to place pretty large contracts with a startup. If this can substitute for a person, they’re willing to place that bet.

This begs the anti-robot question. What do you say to people concerned about robots and automation taking away jobs?

The rate of turnover in waste sorting is so high that recycling facilities are usually understaffed. As a consequence, they're not able to wring out the maximum value from the material, produce lower quality material, and lose stuff to the landfill. Robots augment human jobs and allow facilities to more or less fully staff, and run multiple shifts. Our robots don't mind working overnight. They don't mind getting stabbed with hypodermic needles and other nasty things, and can't get COVID.

Further, the environmental consequences of not operating recycling facilities efficiently are pretty high. Profitable operation of these recycling facilities is the major driver to unlocking entire categories of salvageable material processing. We had a project in Denver with GFL, where our robot made it economically worthwhile to separate out and recycle coffee cups. Otherwise, most coffee cups across the US get trashed even if you put them in the recycling bin.

How much of the sorting problem is a technological problem versus a consumer education and behavior problem?

Changing human behavior could solve significant problems for the industry. Several recycling facilities have actually burned down because people put batteries in the recycling bin. Those batteries end up cracking in the facility and causing fires. Same issue with propane canisters and aerosol containers. Fire is a huge risk in recycling facilities because of the air flow and paper flying around at high speeds. If consumers actually sorted materials accurately, that would have a massive effect on economics and safety.

Changing consumer behavior is challenging, and as a society, we've been trying for a long time. Deep learning offers a new set of tools to adapt to bad consumer behavior. Our ultimate goal is to make “dirty recycling facilities” profitable. Imagine if technology could viably sort through a heterogeneous mixed garbage stream, to extract optimal value and universal recycling adoption without relying on human behavior.

In the meantime, we can provide jurisdictions a deeper level of information and insights to drive quick wins on consumer education - like what we did in Toronto. We can identify specific contaminants and provide precise data about recycling errors to tighten the feedback loop with consumer education.

For more on recycling waste, Matanya recommends checking out Recycling Partnership for recycling tips or reading Takedown, the story of a mob business built around waste removal. AMP Robotics is also hiring for engineering, finance, operations, and business development positions.

Hank Paulson is getting back into finance, this time to lead climate investments at the helm of TPG’s Rise Fund.

The Brexit deal (which finally got done) has significant climate easter eggs including a clause where the UK-EU agreement would be suspended if either side breaches their 2015 Paris Agreements. No wonder the UK is ahead of the pack in decarbonization.

Tesla delivered ~500,000 EVs in 2020, the largest sales jump among carmakers during the pandemic. TSLA stock price also jumped 6% at the news, making Elon Musk the richest person in the world. “How strange…”

Apple is hot on Tesla’s heels targeting 2024 to produce its own self-driving electric vehicle labeled under “Project Titan”. Maybe Tim Cook is regretting passing on Elon Musk’s meeting request to sell Tesla?

Massachusetts follows California and New Jersey to ban the sale of gas-powered cars by 2035.

To let climate tech companies focus less on raising capital and more on developing and scaling their innovations, Brewer Stone from Fortune proposes that the US create a Climate Solution Fund (CSF).

Towering over all other wind turbines (and most skyscrapers) with enough power to light up an entire town, GE's 722-ft diameter monster wind turbine has set a new standard for size in renewables.

TechCrunch covers 2020’s boom in climate SPACs - with a shoutout to our SPAC performance analysis.

The NYT profiled Mike Strizki, the only person on the East Coast who owns and drives a hydrogen electric car. We found his house on AirBnb. Let us know if you stay!

A town in Poland uses 8 clams to determine water quality and automatically shut off supply.

A guide to electrifying and climate-proofing your home.

A mesmerizing Sankey diagram shows the relative flows of the US’s various energy sources since the 1800s.

Tune in to Elemental Excelerator’s new podcast Scaling to Zero featuring conversations with EEx entrepreneurs.

Join the Women of Color Collective in Sustainability, the only digital collective and community dedicated to advancing women of color in sustainability, and subscribe to their monthly newsletter.

Albert Wenger released a near-final version of his book, The World After Capital. Be sure to check out our interview about USV’s climate tech fund.

💡 SustainTech Xcelerator: Innovators developing nature-based solutions can apply by January 15th to be considered for funding, resources, and support.

💡 Climate Camp: Apply by February 10th to join Terra.do in partnership with Moxxie Ventures and Techstars for a new, six-week bootcamp for venture investors interested in building their own climate tech investment thesis.

💡 Oceans Prize: Submit solutions to eliminate plastics from our oceans by April 24th for a chance to win $100,000.

💡 Greenhouse Innovation Program: Apply for the Centre for Climate Change Innovation’s new 12-month innovation program for London-based climate positive technology startups.

Summer Internship Program @Elemental Excelerator

Government & Utility Intern @AmpUp

Sustainability Ventures Analyst @Plug and Play

Financial Data Analyst @Sunpower

Product Strategy Analyst @Form Energy

Founding CTO @Caesar Sustainability

Carbon Principal Engineer @AWS

Software Engineer @Myst AI

UX Engineer @SilviaTerra

Firmware Engineer @unspun

Head of Growth Marketing @Recurrent

Global Program Director @SunFund

Head of Operations @Third Derivative

Feel free to send us new ideas, recent fundings, or general curiosities. Have a great week ahead!

One Big Beautiful Bill ushers in new (and old) energy agenda

Climate, capital, and carrots in London's new playbook

US plays popcorn politics with biofuels and beyond