🌎 Taxing times for CCUS #254

OBBB blows tailwinds through CCUS, but takeoff stalls

Fueled by nuclear’s comeback and a neglected fuel supply chain

Happy Monday!

Maybe it was Barbenheimer, but nuclear is in for 2024. However, there’s a catch. Nuclear was in the doldrums for years following Fukushima, with few new plants planned and stagnant investment in new uranium mines and enrichment facilities. Now as nuclear makes a comeback, increased demand combined with a neglected supply chain has fueled a uranium price spike.

In other news, Blackrock buys Global Infrastructure Partners to become the world’s second largest infrastructure manager, the US Supreme court hears case against the Chevron deference, and the UK goes green on steel, dropping 1.5% of national emissions, at the price of 2,800 jobs.

In deals, $364m for EV charging, $254m for data center heat repurposing, and $129m for alternate fuels.

Join us for a discussion and live Q&A this Thursday, Jan 25th on Sightline Climate’s 2023 climate tech investment trends and the outlook for 2024.

Thanks for reading!

Not a subscriber yet?

📩 Submit deals and announcements for the newsletter at [email protected].

💼 Find or share roles on our job board here.

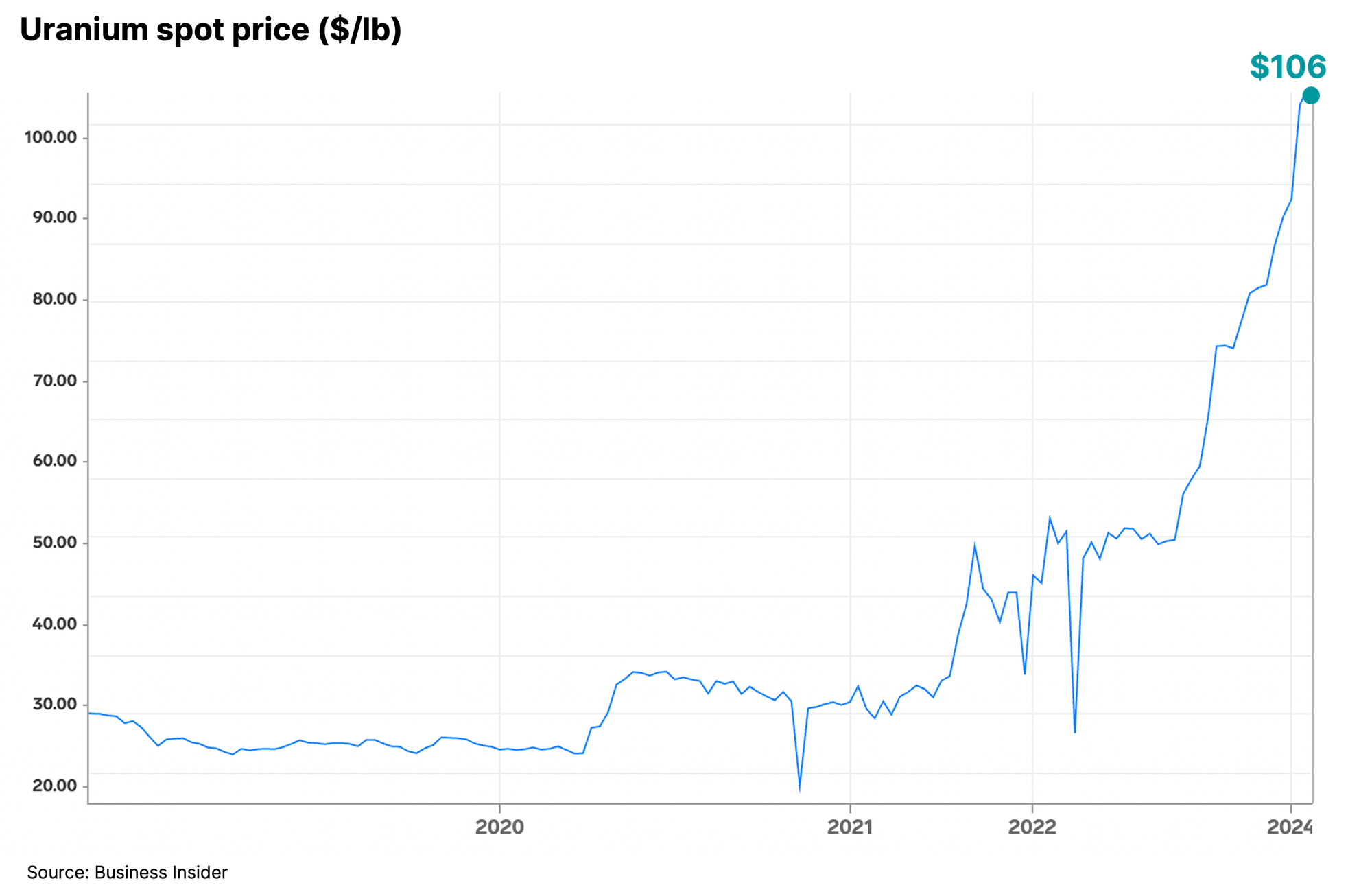

Uranium prices went nuclear on Monday, blasting past $100/lb for the first time since 2008. While prices spiked due to a shortage from the top global uranium producer, the supply-demand mismatch has been mushrooming for over a decade amid changing tides for more nuclear development.

Upward uranium price pressure built throughout 2023 due to diminished global mining productivity, geopolitical unrest, and increased commodities trading.

While not the core reason for high prices this month, uranium demand has been a steady market driver. Post-Fukushima, governments cooled on nuclear energy, but recent shifts recognizing nuclear's role in achieving net zero goals have led to demand outpacing supply.

Almost all uranium supply is accounted for in long-term utility contracts, which keeps growth steady. But near-term purchases can have an outsized effect on price. Cameco was forced to buy 8M lbs of the ore in Q4 2023 to fulfill their obligations, 3M lbs more than in the year’s earlier months.

Prices are projected to keep rising, creating opportunities for (old and new) mine operators and reactor developers to play.

More mines

Advancing reactors (and fuels)

⚡ Electra, a Paris, France-based ultra-fast EV charging network provider, raised $331m in Series B funding from PGGM, Bpifrance, Eurazeo, RIVE Private Investment, the SNCF group, and other investors.

🏠 Deep Green, a London, UK-based data center heat repurposing platform, raised $254m in funding from Octopus Energy.

⚡ INERATEC, a Karlsruhe, Germany-based synthetic fuels developer, raised $129m in Series B funding from Piva Capital, FO Holding, High-Tech Grunderfonds, Honda Motor Co., Planet A Ventures, and other investors.

🏠 Aira, a Stockholm, Sweden-based home energy efficiency platform, raised $63m in Series B funding from Temasek Holdings, Altor, Kinnevik, Collaborative Fund, Statkraft Ventures, and other investors.

🚗 Lightship, a San Francisco, CA-based electric RV developer, raised $34m in Series B funding from Obvious Ventures, Prelude Ventures, Alumni Ventures, Congruent Ventures, and TechNexus Venture Collaborative.

🌱 TrusTrace, a Stockholm, Sweden-based sustainable supply chain traceability platform, raised $24m in Series B funding from Circularity Capital, Fairpoint Capital, and Industrifonden.

🌾 SeeTree, a Tel Aviv, Israel-based tree intelligence platform, raised $18m in Series C funding from European Bank for Reconstruction and Development, HSBC Asset Management, Hanaco Venture Capital, Mindset Ventures, Orbia Ventures, and other investors.

⚡ Trojan Energy, a Stonehaven, UK-based on-street EV charging provider, raised $33m in Series A funding from BGF, Scottish Enterprise, Social Investment Scotland, Equity Gap, Alba Equity and other investors.

🧪 Zymochem, a San Leandro, CA-based bio-based product manufacturing platform, raised $21m in Series A funding from Breakout Ventures, Cavallo Ventures, GS Futures, KdT Ventures, and Toyota Ventures.

🥩 Mediterranean Food Lab, a Tel Aviv, Israel-based fermentation-based flavor solutions developer, raised $17m in Series A funding from Gullspång Re:food, Arancia International, Foodbridge, and PeakBridge.

🏭 Element Zero, a Perth, Australia-based zero-carbon metal processing platform, raised $10m in Seed funding from Playground Global.

🌾 Farm-ng, a Watsonville, CA-based modular off-road ag robotics manufacturer, raised $10m in Series A funding from Acre Venture Partners, HawkTower, and Xplorer Capital.

☀️ Tandem PV, a Stanford, CA-based perovskite solar technology developer, raised $6m in Series A funding from Uncorrelated Ventures and Planetary Technologies.

💧 Membion, a Roetgen, Germany-based innovative membrane bioreactor technology developer, raised $5m in Series A funding from TechVision Fonds and DeepTech & Climate Fonds.

🛵 LAND, a Cleveland, OH-based electric battery manufacturing, raised $3m in Series A funding from Nunc Coepi Ventures.

⚡ Enerdrape, an Ecublens, Switzerland-based prefabricated geothermal panel technology developer, raised $2m in Seed funding from Apres Demain and Romande Energie.

✈️ FlyORO, a Singapore, Singapore-based modular SAF blending technology platform, raised $2m in Seed funding from Audacy Ventures and Investible.

💨 Carbonaires, a London, UK-based carbon asset manager, raised an undisclosed amount of funding from KTM Capital.

📦 Vyld, a Berlin, Germany-based seaweed-based menstrual product developer, raised an undisclosed amount in Seed funding from the European Union.

🔋 Northvolt, a Stockholm, Sweden-based lithium-ion battery manufacturer company, raised $5bn in Debt funding from the European Investment Bank and the Nordic Investment Bank.

🔋 International Battery Company, a Sunnyvale, CA-based prismatic Li-ion battery manufacturer, raised $35m in Project Finance from Shastra VC, RTP Global and BEENEXT.

🚗 Alt Mobility, a New Delhi, India-based EV fleet leasing platform, raised $6m in Debt funding from EV2 Ventures, Eurazeo, Shell Ventures, LetsVenture, and Pitchright.

🌱 SupplyShift, a Santa Cruz, CA-based supply chain emission reduction platform, was acquired by Sphera for an undisclosed amount.

⚡ Heliox, a Best, Netherlands based provider of fast charging infrastructure for electric vehicles, was acquired by Siemens for an undisclosed amount.

I Squared Capital, a Miami, FL-based investment firm, announced the close of a $1.2bn fund that invests in climate infrastructure investments.

Vidia Equity, a Munich, Germany based investment firm, announced the close of its $452m industrial decarbonization fund.

Blue Earth Capital, a Baar, Switzerland-based investment firm, raised $378m for its private equity climate impact strategy that invests in growth stage climate companies.

Sandwater, an Oslo, Norway-based investment firm, announced the close of its $133m fund that invests in early-stage impact companies.

Kost Capital, a Copenhagen, Denmark-based investment firm, announced the launch of its $27m fund that invests in food tech start-ups.

Can’t get enough deals? See full listings and deal analytics on Sightline Climate

BlackRock acquired Global Infrastructure Partners for $12.5bn to become the world's second largest infrastructure manager behind Macquarie. This acquisition points to BlackRock’s continued enthusiasm for infrastructure as an asset class and signals a move to diversify from rocky public and private markets.

Mitsubishi committed $690m to the largest green hydrogen project in the world. The project, Eneco Electrolyzer, will have a production capacity 30 times higher than any current green hydrogen project and a capacity of 800MW.

The Supreme Court heard arguments challenging the Chevron Deference, which allows agencies discretion in interpretation where government texts are ambiguous. This ruling could significantly curtail federal authority over environmental regulation, including EPA’s ability to regulate greenhouse gas emission reduction.

Tata Steel announced it will shut down two blast furnaces at Britain’s largest steel mill in Wales, and replace them with an electric furnace. Although 1.5% of the U.K.’s emissions could be turned off overnight, it will take a costly toll on 2,800 jobs (more than 8% of the local population).

Shell sold its Nigerian oil operations for $1.3bn to local entities, shifting responsibility for past spills and ongoing remediation, a move indicative of brown-spinning. Concurrently, a coalition of 27 investors with a 5% stake in Shell, including Europe’s largest asset manager Amundi SA, advocated for emissions targets aligned with the Paris Agreement. The resolution will be presented for a vote at Shell's annual meeting in May.

Following last week's Hertz U-turn and other automakers' retreats, Ford hit the brakes and reduced production of F-150 Lightning trucks by half, due to lower-than-expected demand. Meanwhile, Hyundai introduced a $7,500 cash bonus for EVs, as a response to strict IRA EV tax credit requirements.

The market for trading unused energy tax credits in 2023 is estimated to be between $7-9bn, exceeding expectations. The surge in value came on the heels of the IRS's preliminary guidelines on IRA tax credit transferability issued in June 2023. The recent report by Crux provides insights from the six months post-IRS announcement.

10 low-carbon cement startups formed the Decarbonized Cement and Concrete Alliance (DC2), including Sublime System, Brimstone, and Carbon Built. The alliance aims to promote policies and public sector procurement of green building materials.

Another week, another fusion deep-dive.

A nuclear battery that could generate electricity for 50 years.

AI’s newest catch? Detecting microplastics in wastewater.

Davos puts climate on the backburner.

NY gets hot for district heating networks.

Human-led flights steering endangered birds to safety.

A wind farm in Texas gets blowback from U.S.-China relations.

Refreezing the Arctic one spray at a time.

Amazon deforestation halved last year.

Call it ‘soil’ power, a new fuel cell can harvest energy from soil microbes.

💡 Gener8tor Carbon Removal: Apply to the gener8tor Carbon Removal Accelerator by Feb 4th and receive support for your early stage startup developing DAC and CDR technologies.

💡 EDICT Internships: Apply for EDICT’s 2024 summer internships by Feb 5th for opportunities to work for various climate organizations and develop professional networks.

📅 World ESG Summit: Attend the World ESG Summit from Feb 19th - 21st in Saudi Arabia to interact with passionate professionals, investors, and experts and explore actionable strategies to integrate ESG principles within business.

📅 DistribuTECH International: Register to join the DistribuTECH International conference highlighting innovative technologies powering homes and buildings from Feb 26th - Feb 29th in Orlando, Florida.

Editor @Sightline Climate

Venture Partner; Commercial Associate, Climate @Deep Science Ventures

Analyst @G2 Venture Partners

Investment Associate @Avesta Fund

Head of Sales @Yard Stick

Channel Sales & Partnerships Lead; Implementation Manager @Sailplan

Community Program Manager; Founders Program Manager @Work on Climate

Business Development Manager @Isometric

VP, Fundraising; Sr. Associate, Structured Investments & Tax Equity @Generate Capital

Lead UX/UI Designer, Head of Engineering @Zero Homes

Program Manager, Climate Operations @Google

📩 Feel free to send us deals, announcements, or anything else at [email protected]. Have a great week ahead!

OBBB blows tailwinds through CCUS, but takeoff stalls

One Big Beautiful Bill ushers in new (and old) energy agenda

Climate, capital, and carrots in London's new playbook