🌎 Bright spots and sunsets in the OBBB #253

One Big Beautiful Bill ushers in new (and old) energy agenda

Why climate tech venture startups are uniquely aligned with the American Jobs Plan

Happy Monday!

We had a blast writing last week’s feature with the generous and gregarious Abe Yokell from Congruent, and were completely blown away by the love from all of y’all reading it. What seemed to resonate most was the depth of the journey, the reminder that we’re all in this together, and normalizing the tough times while celebrating the brightness of the future.

In this week’s issue, we highlight NVCA’s breakdown of the American Jobs Plan - tl;dr - it’s a big deal for climate tech, and if it works, it’ll be a big deal for America.

We also share a few big battery and freight fundings, and in the news a fascinating feature on lithium mining as the new commodity hustle. Jigar Shah switches seats as a guest on The Interchange detailing his new mandate to transform the DOE with $40b, plus a meatless Eleven Madison and 3D printed wood carvings.

Oh, and of course lots of jobs and ways for you to apply for funding.

Thanks for reading!

Not a subscriber yet?

The National Venture Capital Association (NVCA) dropped a report that we might as well have commissioned ourselves. The American Jobs Plan and the Startup Ecosystem argues that VC-backed businesses are uniquely positioned to impact (and be impacted by) the challenges targeted by the American Jobs Plan: climate change, access to economic opportunity, and competitiveness with China.

The American Jobs Plan is all about the US getting its mojo back. Central to rebuilding faith in American exceptionalism, abroad and at home, is the creation of new companies and jobs - lots of them. “The path to greater economic opportunity for American workers runs through technological progress and long-term investment,” writes NVCA’s Justin Field. Venture capital holds a special key to unlocking such growth - especially in climate tech. Now is the time to build back better.

We list interesting takeaways, some of which serve as third-party affirmation of claims we’ve made, below:

🔬 Venture-backed companies spend an astounding amount of money on R&D and jobs. NVCA surveyed venture-backed companies and found that 80% of companies spend >70% of their budget on two activities: wages and R&D. Astoundingly, 15% of companies spend >80% (!) of their budget on R&D. By comparison, the most innovative F500 companies spend 25% of their revenue on R&D.

🇺🇸 What’s policy got to do with it? The Jobs Plan dedicates $180b to R&D investment and technology commercialization. The $110b Endless Frontiers Act and the $31b State Small Business Credit Initiative (SSBCI), in particular, will support early-stage startups.

🌱 Climate tech startups will be the backbone of future industry, but need support to stand up. Due to their lack of collateral, high upfront costs, and often distant revenues, climate tech startups are off-limits to debt and more traditional small business financing mechanisms.

🇺🇸 What’s policy got to do with it? Proposed climate tech tax and direct investment incentives include ⚡️extensions of the clean energy production and investment tax credits, 🏗 tax credits for carbon storage and decarbonization of heavy industry, ⛏an expanded CCUS tax credit with a refundability mechanism, 🚗$174b for electric vehicle deployment and infrastructure, ☀️$46b in government procurement of domestically-sourced clean energy products, 💧$111b for water infrastructure upgrades and recycling programs, 🔌$100b in upgraded power infrastructure, and additional support for climate-related 🌾 agriculture programs.

🏭 American climate tech will bring key manufacturing and supply chains back domestically. Strong leadership in manufacturing is needed to take advantage of the US’ world-class facilities and talented workforce, as well as to limit the industry’s carbon footprint.

🇺🇸 What’s policy got to do with it? The proposed $300b for manufacturing and small business programs includes 💾$50b for semiconductor manufacturing and research, 💪$50b for a Commerce Department office to support domestic production of critical goods, and a further 🔨$52b for manufacturing economic development programs in rural areas suffering from coal job losses.

🔋 Solid Power, a Louisville, CO-based maker of solid-state batteries for electric vehicles, raised $130m in Series B funding from Ford and BMW.

🚂 Einride, a Sweden-based developer and provider of electric and autonomous freight tech, raised $110m in Series B funding from Temasek, Soros Fund Management, Northzone, and Maersk Growth.

⚡ Mainspring Energy, a Menlo Park, CA-based power generation company, raised $95m in Series D funding from Devonshire Investors, FMR, Princeville Capital, 40 North Ventures, Chevron Technology Ventures, Khosla Ventures, Bill Gates, ClearSky, AEP, KCK, and Equinor.

🌱 Ecocem, an Ireland-based green cement company, raised $27m in funding from Breakthrough Energy Ventures and Breakthrough Energy Ventures-Europe.

🚲 Zoomo, an Australia-based e-bike company, raised $12m in Series A funding from AirTree Ventures, Clean Energy Finance Corporation, Maniv Mobility, and Contrarian Ventures.

🔋 Energy Exploration Technologies, an Austin, TX-based lithium extraction technology company, raised $20m in funding from Obsidian Acquisition Partners, Helios Capital, and the University of Texas.

🏭 ndustrial, a Raleigh, NC-based software provider optimizing industrial facilities across the supply chain, raised $6m in Series A funding from ENGIE New Ventures, Clean Energy Ventures, Orion Energy Systems, Lineage Logistics Ventures, and Clean Energy Venture Group.

⚡Piclo Energy, a London-based energy flexibility trading platform, raised £4.7m in Series A funding from Clean Growth Fund and Mott Macdonald Ventures.

🏭 Emvolon, a Boston, MA-based startup converting wasted natural gas into chemicals raised $1.5m in Seed funding from The Engine.

🔋 ESS, a developer of long-duration iron flow batteries, is going public via SPAC Acon S2 Acquisition Corp, at a $1.1b valuation.

In its first significant step under the Biden administration, the EPA proposed regulating HFCs down by 85% over 15 years. The super potent hydrofluorocarbon greenhouse gas is often used in refrigerants in the cold chain - a widely overlooked but essential sector which will be the focus of our Friday feature!

Methane might just be the climate change silver bullet according to a new United Nations report which finds that slashing methane emissions by 45% by the end of the decade will avoid 0.3°C of global warming by 2045.

Germany scoops the prize for most ambitious national climate commitment, moving up its target to reducing 65% of its 1990 baseline carbon emissions by 2030. The urgency was driven by a ruling from Germany’s top court that the lack of climate policy unfairly burdens future generations.

Stateside, Washington earns gold as the most climate-ambitious US state after passing an economy-wide carbon cap that will reduce GHGs by 95% by 2050. Meanwhile Hawaii is the first US state to declare a climate emergency.

On the opposite end of the climate spectrum, China now makes up more than a quarter of the world’s emissions - exceeding those of all developed countries combined.

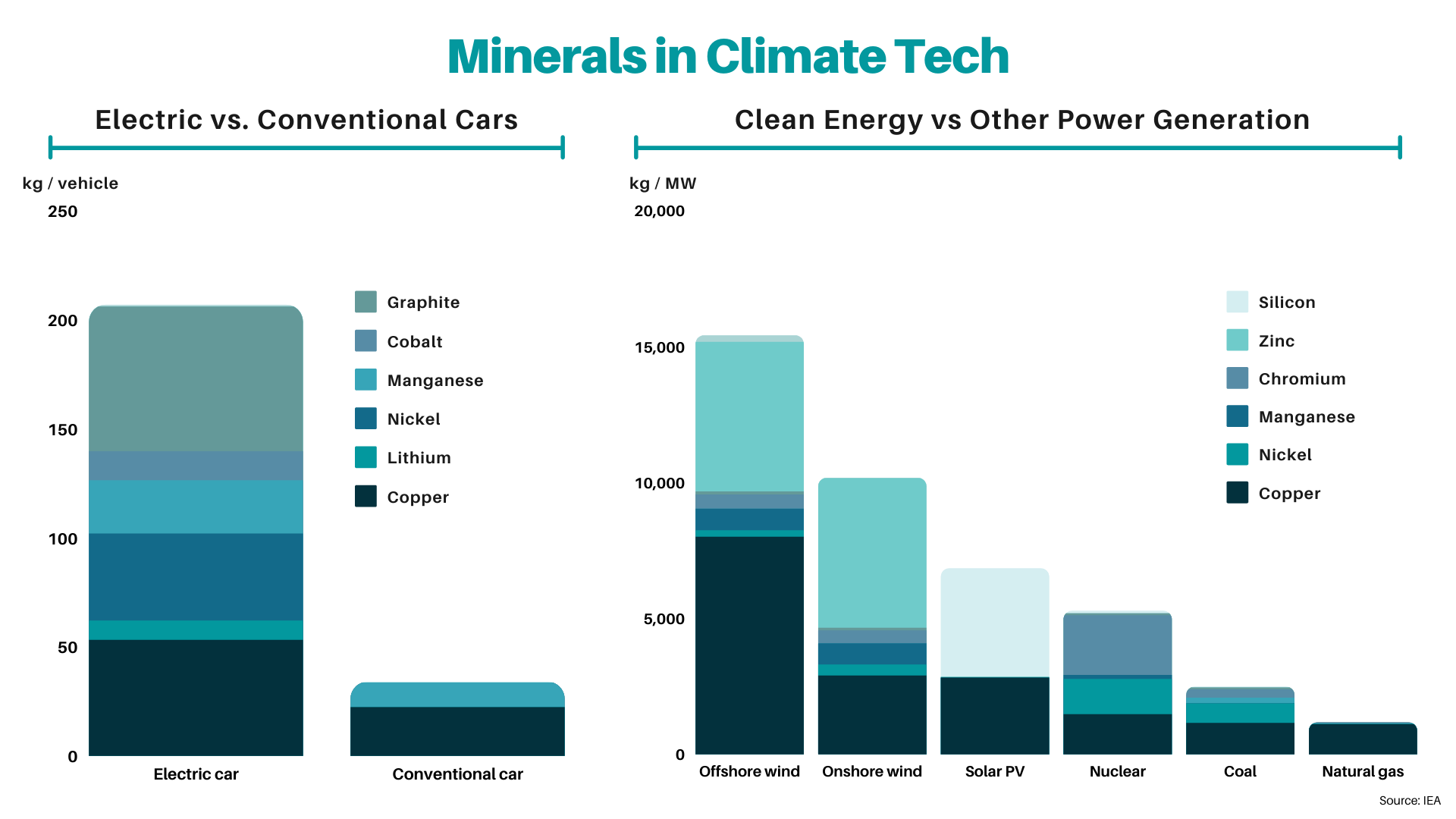

Lithium mining is the new gold mining. Meeting renewable and battery development timelines requires significant volumes of rare earth elements and a breaking IEA report indicates a supply shortage.

Well, dam. Hydrodam operators and their long-time environmentalist nemeses bridged the divide on a $63b proposal to upgrade and expand hydropower.

Secretary Deb Haaland doesn’t take rest days. The Bureau of Land Management approved the 350MW Crimson Solar Project, the first renewable project on federal lands since the 2018 mid-Obama years.

Arrival is partnering with Uber to build an electric vehicle for Uber’s ride hailing services. The EVs will hit the road starting in 2023, in time to affect those big commitments to go 100% electric.

Recent cyberattack on pipeline operator, Colonial Pipeline, illustrated the fragility and severe reliance on a single entity - a worry that runs deep for the electric grid as well.

The legendary head of the Yale endowment, David Swensen, who revolutionized institutional investing with the “Yale Model,” died. He impacted many in the sustainable investing space and his legacy lives on far and wide.

Y’all love lists. Here’s a list of climate tech ML companies sourced by our friends at Work on Climate.

Greentown Labs Houston opens its doors to 25 inaugural startups.

Pretty graphics of coal plant economics driving home the point that 80% of US coal plants are uneconomic.

Before they’re (also) all gone, an incredible interactive rendering of the internal combustion engine.

Transition transformation. BNEF’s Nat Bullard shares lessons from Equinor’s transformation from an oil company to now boasting 49% of earnings from renewables.

Transition transformation 2.0. Cadillac starts Lyriq EV production nine months ahead of schedule. Don’t discount the expertise and capability of legacy OEM’s in the EV race.

Colorado’s State Legislature landed some A+ puns while debating a bill to legalize the composting of human remains. The bill was introduced last year, but “it ended up dying during the COVID session,” but upon “resurrection” Representatives urged their colleagues to “Look alive!” since “We know you dug it before.” ☠

Eleven Madison revamps its opening menu to be entirely plant-based.

Shine bright like a lab-grown diamond. Pandora will no longer use mined diamonds in any future jewelry collections.

Desktop Metal’s Forust uses sawdust to 3D print wooden objects.

When life gives you geothermal, make lemonade. A Nebraska farmer grows citrus year-round and now he wants you to do the same.

If you had $40b to solve the climate crisis, what would you do with it? Jigar Shah discusses his new professional conundrum at the DOE on The Interchange.

Our prolific friend Azeem Azhar published a book, The Exponential Age, aptly about accelerating technologies’ transformation of society - including renewables technology!

Axios dropped five 5 minute videos to Get Smart on climate technology.

💡 The Heritage Group Accelerator: Apply by May 12th to this Techstars program that supports disruptive companies in construction, specialty chemicals, environment and energy.

💡 Swire Pacific Innovation Challenges: Don't miss the May 14th deadline to apply for fully-funded projects in energy, food and circularity with a global sustainability conglomerate.

💡 Urban Future Prize Competition: Climate tech startups and climate justice organizations in New York can apply by May 17th to win $160k across 3 prizes.

🗓️ Elemental Interactive: Join Elemental for a 3-day virtual event from May 19-21 featuring roundtable conversations on topics like how investors can foster more Equity & Access and investor insights into climate tech.

Manager of Innovation & Venture @Orsted

Director of Development and Partnerships @First Street Foundation

Director of Corporate Communications @CarbonCure

Partnerships, Outreach, and Recruitment Intern @Activate

Operations Manager @Heirloom

Software Engineer @David Energy

Software Engineer @Spoiler Alert

Private Equity Impact Investment Associate @Partners Group

Investor @Green Angel Syndicate

Forestry Technician @Terraformation

Development Analyst @Fervo Energy

Feel free to send us new ideas, recent fundings, or general curiosities. Have a great week ahead!

One Big Beautiful Bill ushers in new (and old) energy agenda

Climate, capital, and carrots in London's new playbook

US plays popcorn politics with biofuels and beyond