🌎 Overheard at LCAW #252

Climate, capital, and carrots in London's new playbook

Plus, airline carbon neutrality program grapples with COVID

Happy Monday!

We’ve packed this issue with perspectives on green stimulus plans - the punchline is we’re not super excited they’ll amount to the hype, nor bridge the gap to the 2021 UN climate conference. But we’re hopeful that something worth scaling could come from the disruptions to the status quo.

We also profile airlines’ carbon offset program, highlight climate tech deals, news, and jobs.

Thanks for reading!

Not a subscriber yet?

Economic stimulus plans to spur growth out of the COVID recession are a unique opportunity (e.g. “never let a good crisis go to waste”) for tacking on policies to address the looming climate threat. Though they vary widely, these frameworks give us a glimpse into what a green economy post-COVID could look like. We’ve summarized what we’ve tracked down so far:

Europe: Even in its most immediate relief efforts, the EU has made climate change central to pandemic relief plans.

What else? Individual countries are also making their own pledges:

Spain to present its climate law to achieve net zero emissions by 2050 which would ban all new coal, oil, and gas extraction projects

France unveils its $8.8bn car rescue package with consumers getting up to 12,000 euros to purchase an EV

France and Austria plan to make their airline bailouts contingent on climate-friendly provisions

US: Despite much chatter in the news, the United States has yet to explicitly highlight climate considerations as part of its recovery strategy.

How big? Early on in the crisis, Speaker of the House Nancy Pelosi suggested an infrastructure package with climate friendly provisions like those in a $760 billion bill first proposed in January. (But don’t get too excited…)

What’s in it? Republicans quickly shut down the idea of a “climate” stimulus package. As a congressional aide who works on energy and climate said: “If we can label it green, that would actually probably decrease its chances of being included.” Democrats’ efforts have since revolved around blocking Republican attempts to bail out fossil fuel companies.

What else? The political gridlock hasn’t stopped non-government actors from proposing policies that support a green recovery:

On May 13th, over 300 companies held the “largest ever virtual lawmaker education and advocacy day” to lobby Congress to pass a recovery plan that recognizes the need for a clean energy economy

The Treasury Department is offering more time for wind and solar projects that previously qualified for federal tax credits to be completed

China: Leaders of the world’s largest emitter promised higher spending to revive China’s pandemic-stricken economy and curb surging job losses, but avoided launching a massive stimulus on the scale of the EU or Japan.

What else? Similar to the US and EU, the Chinese government does not have a homogenous approach to incorporating climate contingencies into its COVID relief stimulus proposals.

The Politburo Standing Committee, which sets headline economic and political strategy, defines ‘new infrastructure’ priority spending areas to include ultra-high voltage (UHV) power transmission, high-speed rail, and EV charging infrastructure.

Yet, NDRC is pushing forward with the construction of crude oil reserves and offering lower gas and electricity charges to key industries.

What does this mean?

Across the board, green stimulus packages are shaping up as less aggressive than climate advocates had hoped for. Many of the opportunities for systemic shifts towards climate-positive economic stimulus are being punted to state and provincial governments which will likely double down on business as usual approaches.

Why does it matter?

The UNFCCC Glasgow summit was the deadline for nearly 200 countries to announce their updated emission-cutting pledges under the Paris agreement. With the UN Climate Convention postponed for a full year until November 2021, and green stimulus plans coming up short, some fear that governments will feel no pressure to meet their Paris commitments.

What is likely to happen?

Above all else, COVID is a crisis of unemployment, and stimulus packages must prioritize getting people back to work as quickly as possible. We expect and hope to see policies that combine both and put people to work on green resiliency projects. We’ve seen green stimulus (e.g. solar financing policies coming out of the GFC) create seismic shifts before. Investors, businesses of all sizes, and job seekers alike will be waiting for the tip of the hat from lawmakers across the globe on whether this stimulus package will offer similar opportunities.

🥑 Apeel Sciences, a Santa Barbara, CA-based company focused on food waste, raised $250m in funding from GIC, Viking Global Investors, Upfront Ventures, Tao Capital Partners and Rock Creek Group (Oprah Winfrey and Katy Perry also joined). The company adds a plant-derived coating to fresh produce which slows the spoilage process. Crunchbase has more here.

⚡ Commonwealth Fusion Systems, a Cambridge, Mass.-based fusion energy startup, raised $84m in Series A2 funding from Temasek, Equinor, Breakthrough Energy Ventures, Khosla Ventures, The Engine, and others. Fusion energy generates flexible clean energy by merging atoms, but up until this point fusion reactors have consumed more energy than produced. Bloomberg has more here.

🏨 SmartRent, a Scottsdale, Ariz.-based provider of smart home automation solutions, raised $60m in Series C funding from Spark Capital, Fifth Wall, Energy Impact Partners, the Amazon Alexa Fund, and Bain Capital Ventures. The SmartRent system allows residents and property managers to automate climate and lighting reducing energy usage. VentureBeat has more here.

🍽️ Dishcraft Robotics, a San Carlos, CA-based “cloud dishwashing” service, raised $20m in Series B funding from Grit Ventures, First Round Capital, Baseline Ventures, and Fuel Capital. Dishcraft collects and cleans dishware and cutlery for foodservice businesses, saving single use plastic and takeout containers from ending up in landfills. TechCrunch has more here.

🌊 Nautilus Data Technologies, a Pleasanton, CA-based developer of commercial-scale water-cooled data centers, closed a $100m capital partnership with Orion Energy Partners. The funding supports the commissioning of a 6.0MW data center which uses water cooling technology that significantly reduces computing energy, water consumption, pollution, and GHG emissions. More here.

🐝 BeeHero, a Palo Alto, CA-based “pollination as a service” startup, raised $4m in seed funding from Rabobank’s Food & Agricultural Innovation Fund and Plug and Play. The company uses sensors to better monitor and deploy beehives in order to increase natural pollination of crops. TechCrunch has more here.

🌾 Saturas, an Israel-based precision irrigation startup, raised $3m in Series B funding from Gefen Capital, Hubei Forbon Technology, and Trendlines Agrifood Fund. The company’s technology for measuring stem water potential provides a highly accurate method to reduce water usage and improve crop quality. More here.

🌱 Rise Gardens, a Chicago-based indoor hydroponic gardening startup, raised $2.6m in seed funding from True Ventures. Rise sells at-home indoor planting systems built to look like furniture (since shelter-in-place, sales have increased ~750%). TechCrunch has more here.

♻️ Greyparrot, a London-based startup focused on improving recycling efficiency, raised $2.2m in seed funding from Speedinvest and Force Over Mass. With global recycling rates at a mere 14%, the company aims to use AI to recognize different types of waste and maximize recycling efficiency. TechCrunch has more here.

How will the pandemic affect airlines’ long-term emissions reduction efforts?

The aviation industry committed to carbon neutral growth with plans that increasingly relied on carbon offsets. The pandemic may change those plans.

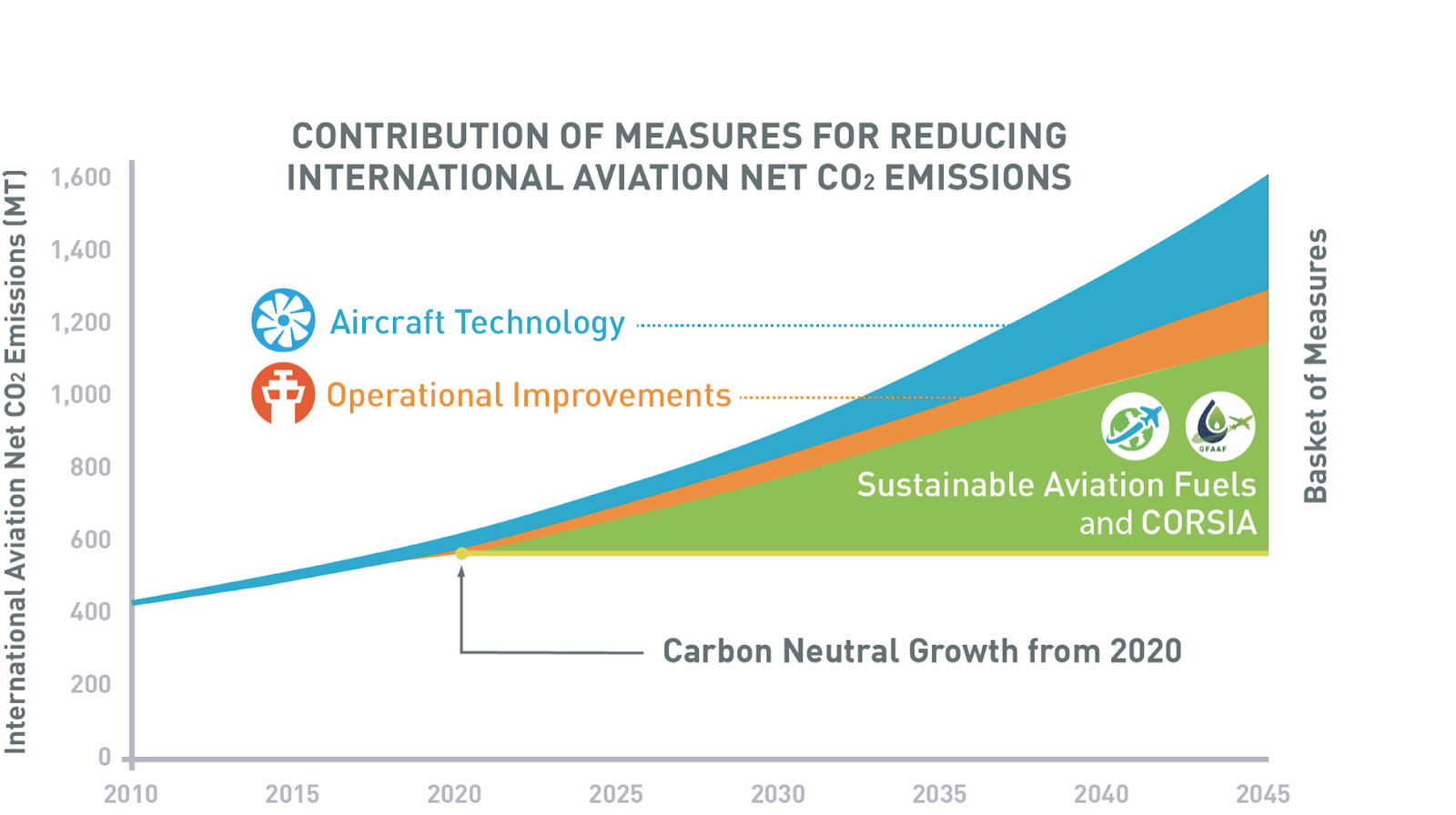

Emissions from aviation have long bewildered reduction efforts. Airlines emissions are significant (2.4% of 2018 global GHG emissions) and expected to triple by 2050. Even in the face of tripling demand, there are few levers for decarbonization because jet fuel is particularly difficult to replace with a low-carbon substitute.

Despite the challenge, in 2016 the International Civil Aviation Organization (ICAO) committed to “carbon neutral growth from 2020 [onward].”

What does this mean?

ICAO is a United Nations agency whose 193 Member States are charged with ensuring that their local civil aviation operations and regulations conform to ICAO standards. The ICAO’s carbon neutral growth agreement calls for annual fuel efficiency increases of 2% through more efficient aircraft and by developing and deploying alternative jet fuels. The pandemic has accelerated this effort. Many airlines have sped the retirement of less fuel-efficient aircraft, improving the overall performance of their fleets.

The ICAO plan relies heavily on market-based measures, primarily carbon offsets. By 2045, offsets are expected to account for a substantial proportion of carbon neutral “growth.” In contrast to emission-reducing measures like more efficient aircraft and less polluting fuels, offsets permit companies to operate as usual - an attractive option when reducing carbon output is costly or impractical.

Since emissions from international flights are excluded from the UN Framework Convention on Climate Change (UNFCCC), ICAO designed a separate global carbon market to purchase offsets.

The offset program, called “CORSIA” (Carbon Offsetting and Reduction Scheme for International Aviation), is to be phased in over several years. Member States can opt in to a voluntary pilot phase from 2021 through 2023.

2019 and 2020 averaged emissions levels determine the baseline from which airlines must then decrease or offset their emissions to avoid exceeding this carbon neutral threshold.

The pandemic could significantly affect this calculation. With air traffic plummeting in 2020 and recovery expected to take months or years, the 2019-2020 emissions average will be much lower than anticipated when agreed on in 2016. The lower baseline would obligate airlines to offset more emissions than they’d expected starting in 2021, coupled with a drop in passenger revenue.

Why does it matter?

Prior to the pandemic, airlines had expected to gradually phase in emission reduction and offsets measures to accommodate ~3% annual growth.

On March 30, 2020, the International Air Transport Association (IATA), the trade association for the world’s airlines, called on ICAO to change the carbon emissions baseline. IATA recommended that CORSIA measure emissions for 2019 alone to determine its baseline.

Changing the baseline to 2019 could save airlines an estimated $15B in reduced carbon offsetting costs but eliminate airlines’ offset obligation during the pilot phase. As airlines continue to operate at lower capacities, their emissions will be below 2019 levels, ergo postponing the time when they would be obligated to buy offsets.

A decision about whether to adjust the baseline is expected by the end of June. The two sides are split: airlines depict this as a matter of survival, and activists claim the airlines are shirking commitments that they already pledged.

What does this mean for climate tech?

Depressed air travel and contentions over baselines may postpone the effect of any offset program for years. As a result, CORSIA should leverage this blip in emissions to look beyond offsets to fundamental technological and operational innovations that could permanently decarbonize the sector. Low and no-emission aircraft that can carry many passengers over long distances are likely years away. Thus, any incremental improvements in efficiency are essential to chipping away at the impact of airline emissions. Now’s the time!

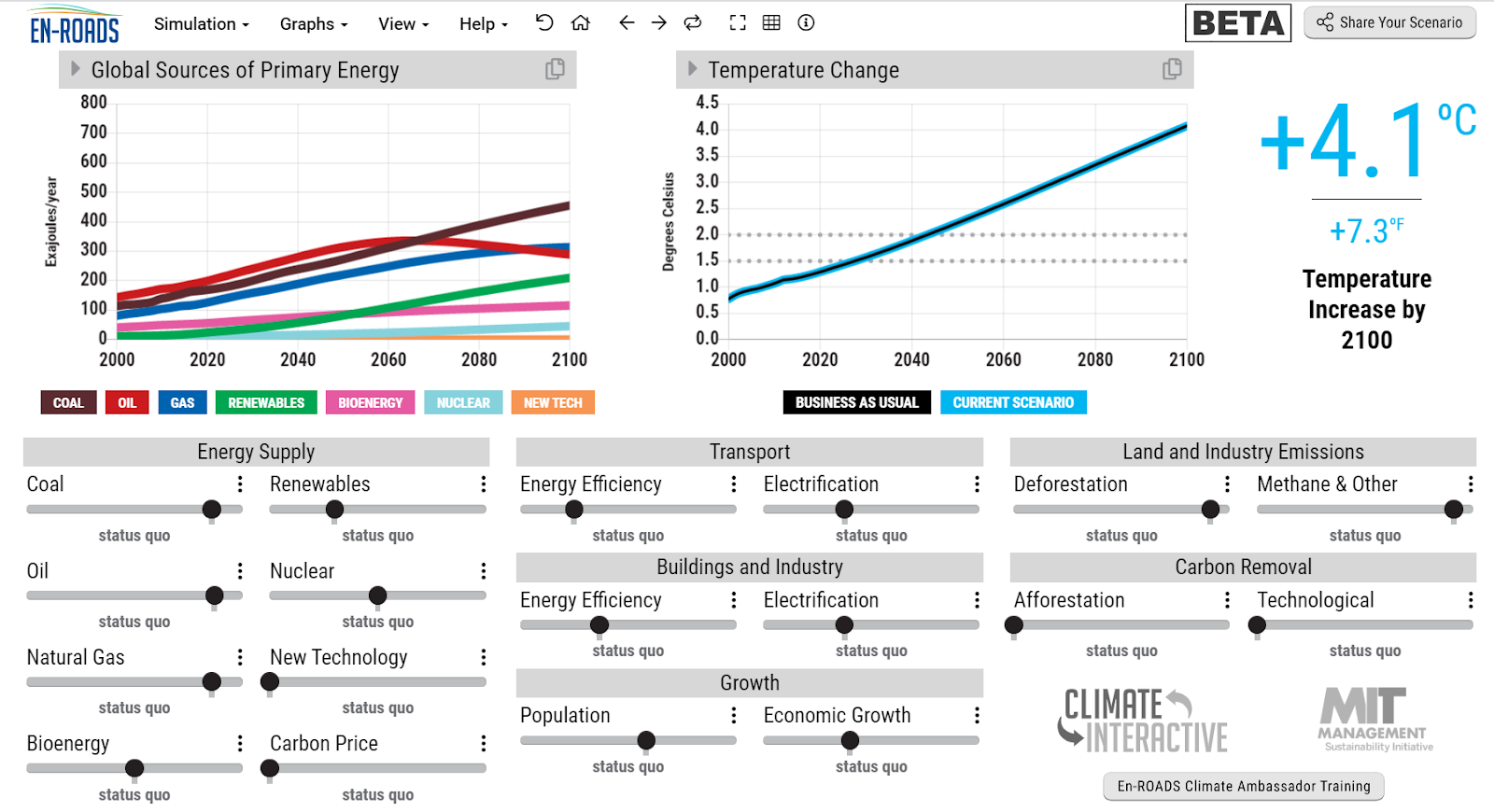

Climate Interactive: A nonprofit think tank that grew out of MIT Sloan, Climate Interactive has developed a climate policy simulator En-ROADS - play around with it yourself to see what it takes to reach our 1.5-2°C goal (disclaimer: we’re more than 4°C today…)

NYTimes: With global temperature rising, so have the number of songs mentioning climate change. Here are the “The Hot 10”.

Science: Invasive plants release more CO2 than native plants in a study of 160 mini ecosystems in New Zealand. Some may argue that we’ve got bigger fish to fry, but understanding invasive plants’ impact on carbon soils is super relevant in context of mass afforestation carbon offset projects.

Adidas & Allbirds: These two companies are teaming up to co-create a performance shoe with the lowest carbon emissions. Read more about the partnership here.

Medium: Flybridge VC investor, Jeff Bussgang’s annual Rocket Ship Startup List includes a hearty number of climate tech ventures.

Urban Environmentalists: Join SFBay x SoCal for Happy Hour on Saturday (6/6) from 6-8pm PT for an informal social hangout.

SJF Ventures’ portfolio companies are hiring for more than 100 positions on the venture firm’s new job board.

Project Manager, Operations Engineer @Apeel Sciences

VP of Strategy, Partnership Manager @Powerhouse Ventures

Product Manager @Upstream Tech

Portfolio Management Analyst, Operations Manager @Wunder Mobility

Software Developer, Microgrid Engineer @Heila Technologies

Feel free to send us new ideas, recent fundings, or general curiosities. Have a great week ahead!

Climate, capital, and carrots in London's new playbook

US plays popcorn politics with biofuels and beyond

Groundbreaking results from the geothermal developer’s main project