🌎 Overheard at LCAW #252

Climate, capital, and carrots in London's new playbook

Happy Monday!

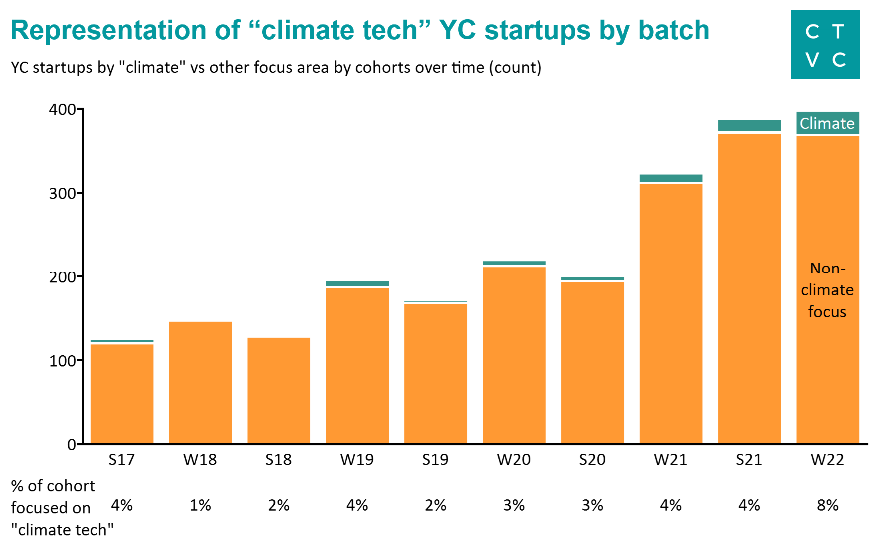

In this week’s issue, we look through YC’s more recent batches and categorize a few increasing bets across the climate landscape. As their cohort size increases, more and more climate companies emerge (especially versus other climate specific accelerators’ total amount of companies).

In fundings this week, a Paris based carbon management platform for real estate, a functional ingredients platform (featuring mycelia!) and an Israeli robotic beehive developer top the buzz.

In the news, Canada releases its $7B roadmap to net zero, Bitcoin miners get pressured by Greenpeace, and the UN’s sea-bed authority (wonder if they have a theme-song . . ?) evaluates deep sea mining. Also, three new funds raised this week - focused on BC clean energy, decarbonizing consumer goods (with Leonardo DiCaprio) and UK seed and pre-seed companies.

Thanks for reading! Or, if you’d prefer, check our CTVC deal-flow TikTok mashup.

P.S: Thanks for all the feedback and engagement with the updated Climate Capital List (who caught the pun?!), now filterable by geography, size and stage!

P.P.S: In rapid order, there’s 9 new climate investing roles live on the CTVC Job Board. There’s never been a better time to capitalize climate!

Not a subscriber yet?

Since its 2005 inception, Y Combinator (YC) has kickstarted the journeys of companies like Airbnb, Stripe, Instacart, and Coinbase.

We’re starting to see some green in the famous orange logo - while YC’s batches have (dramatically) increased in size, climate representation within those batches has also been increasing.

#️⃣ Record climate count. While the % climate of the total cohort remains in single-digits, YC climate cos still make up one of the highest N (count) per accelerator cohort. The W22 YC batch featured an all-time high of 29 climate tagged startups - vs the 23 and 19 respectively in climate-vertical accelerators like Activate and Elemental Excelerator.

🎉 Generalist success. Despite an expanding rolodex of climate-only accelerators (see our running list here), fledgling climate companies keep flocking to YC’s generalist program for its storied founder network, brand, and successes. YC might not have “better” climate learnings for founders, but it sure attracts smart folks and startup DNA.

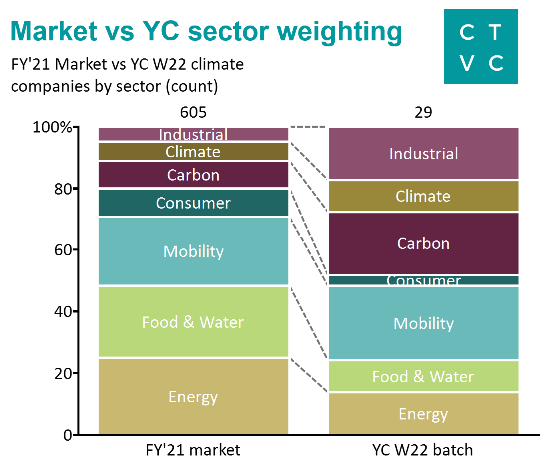

🌡️ Climate venture barometer. YC’s sector leanings also act as an early-stage barometer for where climate tech will focus next. In this recent batch, YC is underweight Energy and Food & Water relative to the 2021 climate venture funding market and overweight Carbon and Industrial which was a tiny <5% of the 2021 funding pie. This indicates more future venture appetite for Carbon (buoyed by Silicon Valley’s maniacal focus on CDR), and Industrial (representative of the biggest TAM and emissions impact if successful).

A few representative examples from the YC climate cohort spanning the climate tech spectrum:

Keep on the lookout for:

Index access. Participating for $100k in each YC climate co in this batch would be a sub $3m total check which is relatively insignificant for the upside insider track information and learnings (and hopefully, future follow on opportunities) for large existing funds looking for an index into climate.

Hardware vs Software. YC has historically struggled with serving deeply technical founders in their Bio Cohorts. It’s worth watching the breakdown of hardware vs software climate companies in future YC cohorts. Or climate hardtech cos may be better served by a lab to market 2-year fellowship program like Activate, vs a 3 month accelerator like YC.

Orange gigacorns. YC has groomed many a unicorn and their rap sheet of gigacorns is slowly growing too (see: Solugen and Helion Energy). Other orange gigacorn fan favorites include: Pachama, Remora, Prometheus, Moxion Power, Noya, CarbonChain, Living Carbon, Sinai, and Heart Aerospace.

💨 Deepki, a Paris, France-based carbon management platform for the real estate industry, raised $166m in Series C funding from Highland Europe, One Peak Partners, Bpifrance, Revaia, Hi Inov and Statkraft Ventures.

🍄 MycoTechnology, an Aurora, CO-based functional ingredients platform utilizing mycelia, raised $85m in Series E funding from Oman Investment Authority, Nourish Ventures, Rage Capital, Alphacy Investment, Siddhi Capital, S2G Ventures, Tyson Ventures, Continental Grain Company, Bunge Ventures, Maple Leaf Foods, Evolution VC Partners, and Gaingels.

🐝 Beewise, an Israel-based developer of robotic beehives, raised $80m in Series C funding from Insight Partners, Fortissimo Capital, Corner Ventures, Sanad, Meitav Investment House, lool Ventures, and Atooro Fund.

🛰️ Pixxel, a Palo Alto, CA-based remote imaging company with applications in forest monitoring, methane emissions tracking and other climate uses, raised $25m in Series A funding from Radical Ventures, Seraphim Capital, Lightspeed Venture Partners, Blume Ventures, Sparta Group, and Inventus Capital.

🌎 Manifest Climate, a Toronto, CA-based climate intelligence platform, raised $24m in Series A funding from BDC Capital, Climate Innovation Capital, OMERS Ventures, Golden Ventures, Garage Capital, Active Impact Investments, Klass Capital and Bryker Capital.

⚡ David Energy, a Brooklyn, NY-based software-enabled retail electricity provider, raised $20.5m in Series A funding from Keyframe Capital, Union Square Ventures, Equal Ventures, BoxGroup, MCJ Collective, Toba Capital, and Turntide.

💨 Sourceful, a UK-based supply chain transparency startup, raised $20m in Series A funding from Index Ventures, Eka Ventures, and Coatue.

🛥️ Flux Marine, a Providence, RI-based electric boating startup, raised $15.5m in Series A funding from Ocean Zero, Boost VC, and Winklevoss Capital.

🔋 Electric Power Systems, a Logan, UT-based battery developer for electric aircraft, raised $13m in funding from JetBlue Technology Ventures and others.

🔋 Coreshell, a Berkeley, CA-based develop of a nanolayer coating for rechargeable batteries, raised $12m in Series A funding from Trousdale Ventures, Industry Ventures, Helios Capital Ventures, Entrada Ventures, Foothill Ventures and Asymmetry Ventures.

💨 Emitwise, a UK-based carbon management platform, raised $10m in Series A funding from Xplorer Capital, True Ventures, Outsized Ventures, and Arctern Ventures.

⚡ GA Drilling, a Slovakia-based ultra-deep plasma geothermal drilling company, raised $8m in funding from Nabors.

⚡ EdgeGrid, an India-based platform enabling the last-mile delivery of energy, raised $6m in Seed from Lighrock India, and Theia Ventures.

💨 Cemvita Factory, a Houson, TX-based biotech startup using microbes to turn carbon dioxide into useful products, raised $5m in funding from United Airlines Ventures and Oxy Low Carbon Ventures.

🌾 Leaf, a Los Angeles, CA-based data infrastructure company for agriculture, raised $5m in Seed funding from S2G Ventures, SP Ventures, Radicle Growth, and Cultivian Sandbox Ventures.

🌳 Treeswift, a Philadelphia, PA-based forest monitoring and data analytics company, raised $4.8m in Seed funding from Pathbreaker Ventures, Crosslink Capital, TenOneTen Ventures, Contour Venture Partners, Boom Capital Ventures, Yes VC, Susa Ventures, Draft Ventures, Anorak Ventures, S7 Ventures, Awesome People Ventures, Switch Ventures, Convective Capital, and Dorm Room Fund.

🌾 Plant Cartridge, a Kuala Lumpur-based agritech company that offers sustainable agriculture solutions, raised $3m in Seed funding from 500 Global and others.

⚡ RenewaFi, a New York, NY-based marketplace for renewable energy, raised $3m in Seed funding from First Round Capital, Floating Point, BoxGroup, Powerhouse Ventures, and Arcadia CEO Kiran Bhatraju.

Evok Innovations, a British Columbia-based clean energy venture fund, announced its first close of $300m.

Regeneration VC, a Los Angeles, CA-based venture fund backed by Leonardo DiCaprio focused on decarbonizing consumer goods raised $45m.

Climate VC, a UK-based fund launched to invest in over 100 climate tech companies within the next 3 years, across pre-seed and seed.

Canada, the world’s 4th largest oil producer and 10th largest emitter, released its first roadmap to meet its 2030 climate targets, spending $7B to cut GHG emissions 40-45% below 2005 levels. In the same week, Alberta selected six proposals to develop Canada’s first carbon storage hubs.

Environmental groups sent a message to Bitcoin miners, “Change the Code, Not the Climate”. In an attempt to reduce Bitcoin’s carbon footprint, Greenpeace and the Environmental Working Group announced a campaign to pressure miners to adopt cleaner practices.

The International Seabed Authority (a UN body) is meeting this week to determine the future of deep-sea mining. One of the biggest fears is limited knowledge of deep-sea ecosystems and the potential effects of mining on the marine environment.

In new analysis from EDF, the shipping industry is floating into billions in climate disruptions, up to $25 billion a year of additional costs due to worse weather. While ships face obvious risks, port disruptions prove operationally and economically more costly, like 45 days of closure and $65m it took to repair the Port of Dalian in China.

FirstSolar and SunPower are teaming up! The largest residential solar company and the only major US solar manufacturing will partner up to produce SunPower’s future solar needs. FirstSolar aims to manufacture most of their panels in the coming 18 to 24 months.

The Energy Transitions Commission captures the current state of CO2 removal technologies in its “Mind the Gap” report.

Energy and power. New reporting from the New York Times uncovers Joe Manchin’s financial ties to West Virginia coal, while the Washington Post investigates Hunter Biden’s multimillion dollar deals with CEFC China Energy.

With gas prices rising, electric cars are now 3-6x cheaper to drive in the U.S.

An incredible battery taxonomy from our friends at Intercalation Station.

Green Beantown. The Boston Red Sox pledge to go carbon neutral.

Oh frack. Fracking giant Continental Resources plans major investment in carbon sequestration.

Work on Climate maps existing research on the climate workforce, highlighting five things we still don’t know about climate jobs.

BloombergNEF tracks climate funds that have raised $2.8bn in the past three months.

On a recent episode of Catalyst, Shayle Kann and Nat Bullard ask, “Will this carbon market boom be different?”

🗓️ MCJ Action: Join MCJ Collective in their new monthly series, “MCJ Action,” on April 6th as they welcome Adam McKay, writer, director, and producer of Don’t Look Up, to the spotlight to discuss climate action.

🗓️ LACI's Spring Power Day: Power Day includes pitches of pilot projects by LACI startups and is by invite only for an audience of investors and those working in corp dev/ procurement/ tech scouting in cleantech. Those interested in potentially attending should message [email protected] or [email protected] for more details about April 7th.

🗓️ The Business of Climate: On April 8th join an interactive discussion with Anne Hoskins (Chief Policy Officer, SunRun) and Peter Minor (Director of Innovation, Carbon180) about topics including when startups should think about policy involvement and how to build and operate a policy team.

🗓️ Overture Insights: Join on April 8th for a conversation with Jim Coulter, Co-Founder of TPG, and Overture regarding the role of private equity in addressing the climate crisis.

🗓️ NREL Industry Growth Forum 2022: Entering its 27th year, the National Renewable Energy Laboratory’s Industry Growth Forum aligns promising startups with venture capitalists looking for their next great cleantech investment, and will convene in person on April 13-14th in Denver, CO.

🗓️ Access to Success: On April 14th Greentown Labs will hold an afternoon-long event for investors and underrepresented founders to convene and connect, featuring a discussion on prioritizing DEI in climate finance; reverse pitches from VCs who are leading unique DEI initiatives; and breakout sessions.

Investor @Piva Capital

Investor @Seaya Ventures

Associate @Revent

Analyst @JPMorgan Center for Carbon Transition

Portfolio Engagement Lead, Climate Fund @Toyota Ventures

Sustainable Investments Manager @Pepsico

Venture Associate, Climate Innovation @Wellington Management

VP, Market Development @Galvanize Climate Solutions

Carbon & Sustainability Lead @Infyos

Fractional COO @Trailhead Capital

Sr Product Manager, Sustainability @John Deere

Research Intern @Tangible

Feel free to 📩 send us new ideas, recent fundings, events & opportunities, or general curiosities. Have a great week ahead!

Climate, capital, and carrots in London's new playbook

US plays popcorn politics with biofuels and beyond

Groundbreaking results from the geothermal developer’s main project