🌍 EU CBAM’s €8bn price tag #282

We did the EU carbon math

Happy Monday!

We know it’s the dog days of summer, but September (and New York Climate Week) is right around the corner 🎉 You’ve been asking, and today, we’re delivering: the CTVC & Planeteer @NYCW’25 Events Tracker! Hosting something at NYCW? Submit your events to us at this link.

In deals, $904m for hydrogen across two deals, $292m for energy storage, and $30m for mineral extraction.

In other news, EPA to get rid of Solar for All, the end of US green hydrogen ambitions, and the UK’s industrial decarbonization plans.

Thanks for reading!

Not a subscriber yet?

📩 Submit deals and announcements for the newsletter at [email protected].

💼 Find or share roles on our job board here.

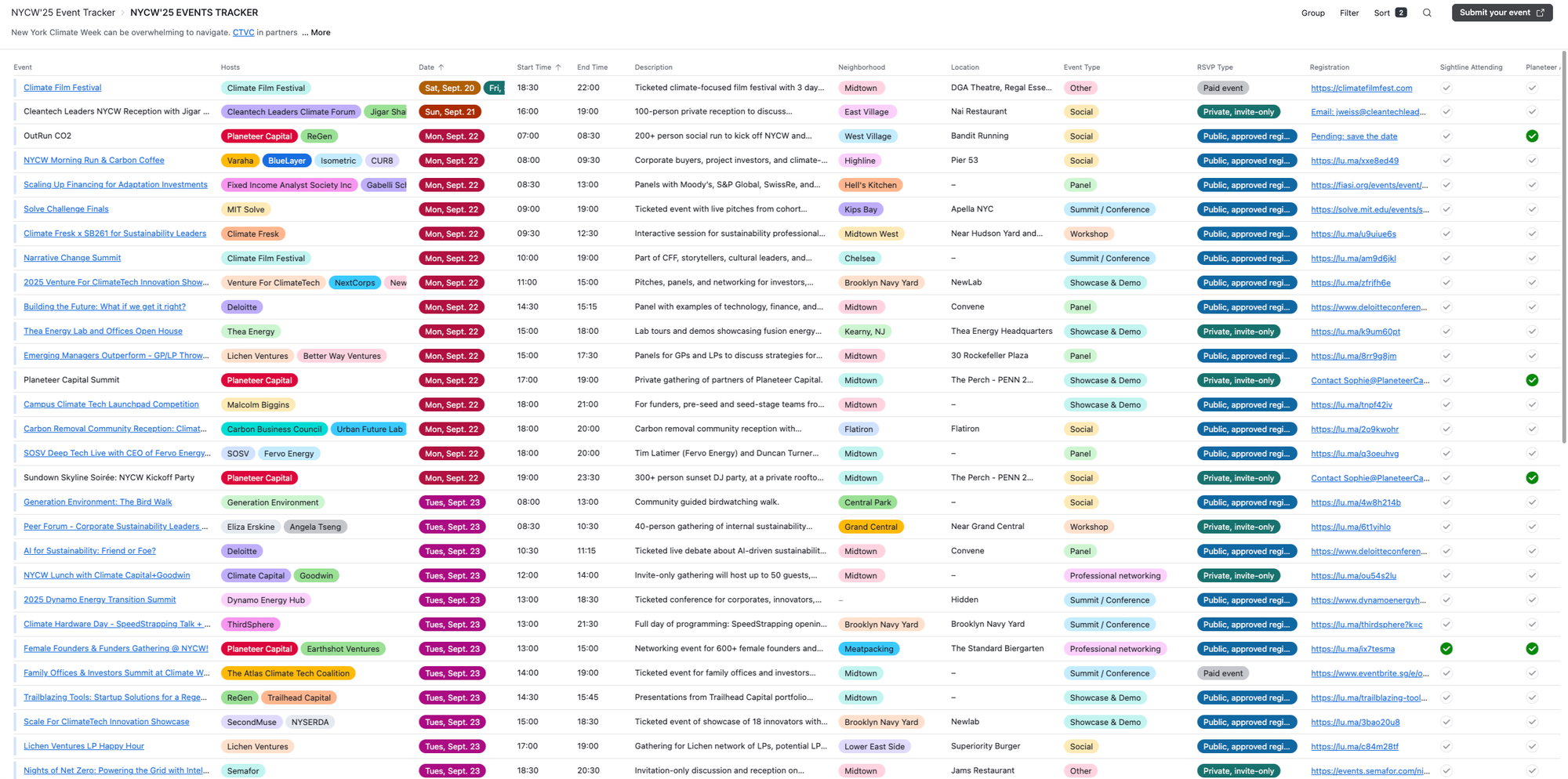

We’re officially in the “mark your calendars and start overbooking yourself” phase — just over a month until New York Climate Week 🥳Without a plan of attack, NYCW can feel like a sweaty sprawling mess that has you double-booked for two equally great panels ten blocks apart (or in a completely different borough 🤦♂️). So, we’ve braved the calendar coordination for you and are back with our method for the madness: our third annual CTVC & Planeteer @NYCW Events Tracker!

You’ve been asking and today we’re delivering a brand new version of the tracker, this time on Airtable, for superior filtering capabilities and, for the first time, a calendar version! Filter it by date, type of event, location – anything you want.

And in a big first, there’s a calendar version – so you an also see all of the events living in the tracker on a calendar view of the week, where you can click into the events for more info.

Our tracker of NYCW events for climate tech founders, funders, and friends is open-source, completely free and powered by your submissions from last month’s call-out. This is a living doc which will get ever more resource rich as the events keep rolling in – so keep on submitting here!

Think of using our list for a friendly filter on events most relevant to the climate tech community of founders and funders specifically. It’s a pro move to cross reference this curated list with other more comprehensive trackers like the Climate Group’s official list and Climate Cities one.

And yes — we’ll be hosting Sightline & Planeteer’s own lineups throughout the week. If you’re coming to town, let us know. We’d love to see you there!

⚡ Bling Energy, a Lisbon, Portugal-based solar energy developer, raised $17m in Growth funding from BlueCrow Capital.

⚒️ Disa Technologies, a Casper, WY-based sustainable mineral extraction technology provider, raised $30m in Series A funding from Evōk Innovations, Constellation Technology Ventures, Halliburton Labs, Valor Equity Partners, and Veriten.

🌱 Tanso, a Munich, Germany-based emission management software platform, raised $14m in Series A funding from Fortino Capital, henQ, Capnamic Ventures, and UVC Partners.

🏭 PeroCycle, a Cambridge, England-based closed-loop steelmaking technology developer, raised $5m in Seed funding from Anglo American and Cambridge Future Tech.

🏠 Bisly, a Tallinn, Estonia-based automated energy platform for buildings, raised $5m in Seed funding from 2C Ventures, Aconterra, Pinorena Capital, and SmartCap.

💨 LiORA, a Calgary, Canada-based soil remediation platform, raised $3m in Seed funding from BDC Capital, Conexus Venture Capital, PIC Investment Group, WTC Ventures, and other investors.

⚡ HydrogenXT, a Houston, TX-based clean hydrogen infrastructure developer, raised $900m in PF debt funding from Kell Kapital Partners.

🔋 Pulse Clean Energy, a London, England-based utility-scale battery storage assets developer and owner, raised $292m in PF debt funding from ABN AMRO, CIBC, Investec, NatWest, Nord/LB, and Santander.

🔋 Endua, a Brisbane, Australia-based modular electrolyzer developer, raised $4m in Grant funding from Australian Government - Department of Industry, Science and Resources.

☀️ Stellar PV, a Townsville, Australia-based solar ingot and wafer manufacturer, raised $3m in Grant funding from the Australian Renewable Energy Agency.

💨 SeaO2, an Amsterdam, Netherlands-based water-to-e-SAF and carbon removal developer, raised $1m in Grant funding from Topsector Energy.

🔋 Powin Energy, a Tualatin, OR-based battery energy storage system developer, completed an asset sale for an undisclosed amount to FlexGen.

☔ Sust Global, a San Francisco, CA-based climate risk data provider, was acquired by Institutional Shareholder Services (ISS Sustainability Solutions) for an undisclosed amount.

☀️ Enverus, an Austin, TX-based energy data analytics platform, was bought out by Blackstone Group for an undisclosed amount.

💰 ClimateWorks Foundation, a San Francisco, CA-based global philanthropic organization, in partnership with Howden Foundation, Laudes Foundation, Quadrature Climate Foundation, and The Rockefeller Foundation, launched $50m Adaptation and Resilience Fund to back local solutions that help communities confront severe climate risks.

This is a sample of the deals available for Sightline Climate clients. Can’t get enough deals?

The EPA said it plans to cancel all $7bn in Solar for All grants, the last surviving funds from the Greenhouse Gas Reduction Fund, last week. The program had aimed to bring rooftop and community solar to low-income communities, but is now caught up in political and legal battles following allegations of fraud and an ongoing audit. If terminated, it would strip a major avenue for equitable clean energy access, slowing solar deployment in disadvantaged areas and undermining climate justice goals.

The EIA’s new Annual Energy Outlook 2025 shows US hydrogen will remain overwhelmingly gray through 2050, with natural gas SMR supplying over 80% and electrolysis staying under 1%. The modeling assumes only policies in place as of Dec 2024 — reflecting the Trump administration’s stance against subsidizing green hydrogen. This effectively sidelines green hydrogen growth, signaling a major setback for clean hydrogen deployment in the US.

The UK government has advanced 10 carbon capture projects into negotiations, including five priority facilities linked to the HyNet CO2 transport and storage network in the North West and North Wales. The expansion—covering cement, hydrogen, waste-to-energy, and power—marks a significant boost for HyNet, the UK’s second-largest industrial cluster, though transport and storage constraints mean direct air capture is deferred for now.

BP Ventures has closed its San Francisco office and sold select green investments to refocus capital on fossil fuel–linked technologies, marking a shift away from speculative climate tech. In other company news, bp also announced its largest oil and gas find in 25 years at Brazil’s Bumerangue block, a potential major production hub, positioning the project as both an upstream expansion and a possible CCS-for-EOR project.

The new moonshot: NASA is fast-tracking plans to put a nuclear reactor on the moon by 2030.

A radioactive wasp nest was found at a South Carolina nuclear waste site, prompting a sting operation to dispose of it safely.

South Africa’s going full sci-fi safari — scientists are adding tiny radioactive chips to rhino horns so poachers get caught at borders before the animals get caught in the wild.

On big weird tweet.

From jet engines to server engines — Rolls-Royce teams up with INERATEC to fuel data centers with CO2-made e-diesel instead of fossil diesel.

CDP’s new report – The Disclosure Dividend 2025.

Microplastics aren’t that fantastic.

New commissioner at the Nuclear Regulatory Commission.

📅 Rocking Manhattan: Join us on September 20 in New York City (map link) for a fundraising row-a-thon around Manhattan, hosted by Rocking the Boat. Support the rowers, cheer on team Yeah Buoy!, or become a corporate sponsor.

💡 L’Oréal Sustainable Innovation Accelerator: Apply by September 30, 2025 to join a €100m, five-year program supporting startups, SMEs, and innovators with ready-to-pilot solutions in low-carbon processes, sustainable ingredients, plastic waste elimination, water resilience, nature-based solutions, and inclusive business models.

💡 State of Climate Tech Fundraising 2025 Survey: Share insights on how climate tech startups have raised capital in the past 6–12 months. Hosted by Extantia, the short eight-question survey aims to capture 2025 fundraising trends.

Senior Software Engineer @Sightline Climate

Senior Product Designer @Sightline Climate

Senior Account Executive @Sightline Climate

Project Manager @Rune

Fleet Operations Manager @Rune

Electrochemical Research Associate II/III or Scientist @SiTration

Senior Process Engineer @SiTration

Founding Consumer Product Analyst @Optiwatt

Investment Analyst @38 Degrees North

Sr. Analyst/Associate - Corporate Development @Aspen Power

📩 Feel free to send us deals, announcements, or anything else at [email protected]. Have a great week ahead!

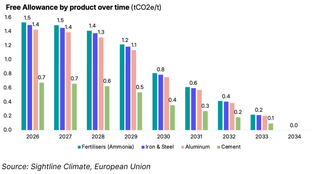

We did the EU carbon math

With long duration energy procurement surging, new rankings reveal who's pulling ahead

A tale of two public debuts