🌎 Inside Cloverleaf Infrastructure’s power play #206

Our Q&A with Brian Janous on AI, data center demand, and the need for speed

A big week for Earth Day announcements and fundings

Happy Monday!

Hope you enjoyed our feature with Reilly Brennan from Trucks VC - it got us all moving. Later this week, we’ll set the foundation of the sustainable cement industry with the winners of the Carbon XPRIZE!

Take us to the casino! Looks like we hit on (most) of our predictions last week:

In this issue, we break down what we’d need to achieve Biden’s targets (tl;dr - a lot!) and cover the latest news and fundings - including Misfit’s $200m mega round, Berkeley’s Carbon Trading Project massive new database of carbon offset projects, and a mesmerizing wind turbine timelapse.

Thanks for reading!

Not a subscriber yet?

President Biden announced on Thursday America’s aim to slash its greenhouse gas emissions 50-52% below 2005 levels by 2030. The long-awaited commitment kicked off Biden’s Climate Summit, a two-day giant Zoom session bringing together 40 world leaders as part of Biden’s grand gesture to put the US back in the driver’s seat on climate.

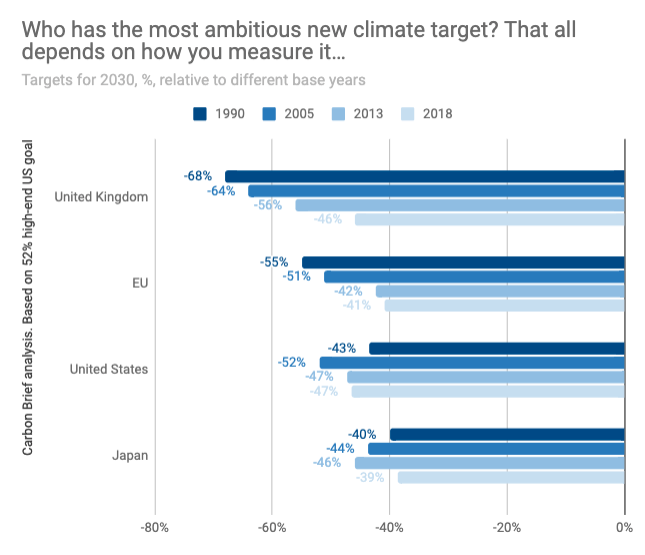

Not willing to play second fiddle to the US, the UK, EU, Japan, and a host of cities (700+ cities in 53 countries, to be exact) also boasted competitive emissions reduction targets. How do the commitments compare? A lot depends on the year you start counting.

The US chose 2005 as its baseline – when emissions peaked – while the UK and EU benchmarked off of 1990 – when emissions began declining. Some purists could argue therefore that the US’s cuts, while significant, aren’t as large as other wealthy industrialized nations. This positioning is just jockeying for a phantom podium unless herculean financial, human, and scientific capital are deployed to the goals quickly.

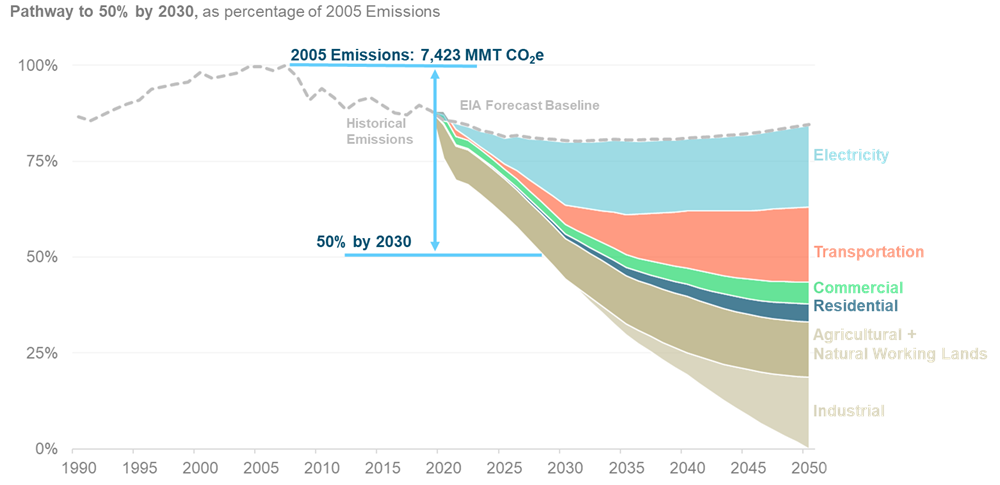

But let’s get to the good techie action. Sector by sector, what does the US need to do to get to 50% reduction?

According to the NYT, within each of these sectors, the following will be needed to reach 50% emissions reductions by 2030:

⚡ >50% of electricity from renewable energy (+20% from today)

💨 CO2 released from new natural gas plants to be captured and buried

🛑 All 200 remaining coal plants shut down

🚙 2/3 of new cars and SUVs sold to be battery-powered (+97% from today)

🏢 All new buildings heated by electricity instead of natural gas

🏗 Cement, steel, and chemical industries adopting strict new energy-efficiency targets

🛢 O&G producers slashing methane emissions by 60%

🌲 Expanding regenerative forestry and agricultural practices to pull 20% more CO2 from the air than today

...and yes, those giant goals are all part of a lengthy required checklist for 50 by 30! If you’re into visuals, check out this WSJ interactive chart about the scope of the necessary transformation.

This sounds big. Where will the challenges lie? The speed of the transformation to an economy less reliant on fossil fuels has many excited and many others fearful. Namely:

💸 Transformation of this scope and speed will require incredible injections of federal capital. As such, the US is reviving Mission Innovation among hundreds of other spending avenues to jumpstart renewable energy research, development, and deployment. Prudent and effective federal investment here will be key - and is far from a certain bet.

💡 Climate technology readiness is still in its early innings, especially for harder-to-decarbonize sectors where hydrogen and CCS are heralded as the primary pathways to unlock net zero. The IEA has estimated that only 25% of CO2 reductions in their Sustainable Development Scenario come from currently mature technologies.

🔌 With the swift transition to renewable energy, utility operators are worried about jeopardizing the reliability of the grid and risking rolling blackouts.

🚗 The auto and fossil fuel industries expect steep job losses given the transition to renewables and EVs. Assembling an electric car, for example, takes 1/3rd less workers compared to an internal combustion engine.

🇨🇳 The transition will require more, different raw materials and manufacturing. Some are concerned that the US could become more reliant on China’s resource access and manufacturing prowess.

Despite technology readiness, grid reliability, job accessibility, and foreign policy concerns, Biden is taking the first steps to build back the US as the leader of the good kind of climate change.

🍏 Misfits Market, a Philadelphia, PA-based subscription service for “ugly” produce, raised $200m in Series C funding from Accel, D1 Capital Partners, Valor Equity Partners, Greenoaks Capital, Sound Ventures, and Third Kind Ventures.

🔋 SES, a Boston, MA-based maker of rechargeable batteries for electric vehicles, raised $139m in Series D funding from General Motors, SK, Temasek, Applied Ventures, Shanghai Auto, and Vertex.

🌱 Hungry Planet, a St. Louis, MO-based plant-based meat producer, raised $25m in Series A funding from Post Holdings, Peatos, and TRIREC.

✈️ Universal Hydrogen, a Los Angeles, CA-based hydrogen aviation startup, raised $20.5m in Series A funding from Playground Global, Fortescue Future Industries, Coatue, Plug Power, Airbus Ventures, JetBlue Technology Ventures, Toyota AI Ventures, Sojitz Corporation, and Future Shape.

🛰️ Satellite Vu, a UK-based thermal footprinting satellite technology company, raised$5m in Seed funding from Seraphim Capital.

💨 Oxygen8, a Canada-based manufacturer of high-efficiency HVAC and Energy Recovery Ventilation Systems, raised $4m in Seed funding from Greensoil PropTech Ventures and other strategic investors.

⚡ PowerX, a Brooklyn, NY-based home energy saving startup, raised $4m in Seed funding from SpringTide Ventures, Antler Global, and executives from Tesla and SpaceX.

🐟 Kuleana, a San Francisco, CA-based maker of plant-based tuna, raised $3m in Seed funding from Y Combinator, Astanor, Good Seed Ventures, Cruise founder Kyle Vogt, and Alexis Ohanian.

🍏 Swarm Engineering, an Irvine, CA-based provider of food supply chain software, raised $2.7m in Seed funding from S2G Ventures, Serra Ventures, Wells Street Capital, and others.

❄️ Blue Frontier, a Florida-based innovator in sustainable building cooling solutions, raised $1m in Seed funding from VoLo Earth Ventures.

Congruent Ventures, a San Francisco, CA-based early-stage climate tech investor, raised $175m for its second fund.

Not willing to play second fiddle to the US, before Earth Day the EU reached an agreement to reduce net GHG emissions by at least 55% by 2030 - 5% greater than Biden’s proposal.

700+ cities in 53 countries have joined ranks with the US in committing to halve emissions by 2030 and reach net zero by 2050.

GFANZ (honestly, cool acronym!) or The Glasgow Financial Alliance for Net Zero launches before COP26 with 160 firms and $70T AUM as the largest financial industry effort yet to promote science-based reporting and net zero emissions by 2050.

The United Mine Workers of America, the largest US coal miner’s union, announced their support of President Biden’s green energy transition plan in exchange for a robust jobs transition strategy.

Short seller, Scorpion Capital, labels battery SPAC darling QuantumScape a “pump-and-dump SPAC scam by Silicon Valley celebrities” causing the stock to drop 15% in response to the scathing report. QuantumScape was quick to fight back over Twitter.

Net Power plans to use carbon capture to build the US’ two first commercial net-zero emissions gas plants. But the pilot projects don’t come cheap, clocking in at $6,000/kW - on par with advanced nuclear.

Meanwhile, Exxon proposed a $100b Houston-based carbon capture megaproject. So far the 50m tons of CO2e/ year proposal has fallen on deaf ears with key open questions like, who’s paying?

We predicted for Earth Day that a big tech co would announce a big pot of climate funding. What we didn’t see coming? Cisco (?!) to commit $100m over 10 years to fund climate nonprofit grants and impact investments.

Amazon continues to flex its renewable buying power, now claiming to be the largest corporate buyer of renewables globally with 206 projects (8.5 GW) and in Europe (2.5 GW).

The Carbon XPRIZE went to two carbon-sequestering cement companies: CarbonBuilt and CarbonCure. Check your inbox later this week for our feature with the two winning CEOs!

Woah! Treasure trove! The just released Berkeley Carbon Trading Project's Voluntary Registry Offsets Database boasts a monster of a database of all carbon offset projects listed globally.

In time for Earth Day, the newest status symbol of the ultra wealthy: trophy trees.

B Corp Climate Collective and Oxford University released an arsenal of tools for companies on the path to net zero. (In a familiar format!)

Mesmerizing timelapse of an offshore wind installation.

High point of the weekend? When renewables made up 91% of California’s electricity demand!

From cover to cover, Closed Loop Partners CEO Ron Gonen makes the case for circularity in The Waste Free World.

NYT released an interactive online picture book about climate change for kids.

The Prime Minister of Denmark’s argument in Foreign Policy for her confidence in the country’s green future – including targets for decarbonizing maritime shipping.

Algorand commits to being the first carbon neutral blockchain network through offsets and proof-of-stake.

‘Mars sucks.’ – Earth

💡 Development Finance Corporation (DFC): Established climate tech fund managers investing in developing nations should apply on a rolling basis to the DFC for $10-$400m in equity or debt financing.

💡 Accelerate at Circularity 21: Apply by May 7th to pitch on stage at the annual GreenBiz conference.

🗓️ The Wave Summit: Register now for a free virtual event spotlighting and supporting women in bio on June 10th hosted by Petri.

Senior Associate @BHP Ventures

Synbio Associate @Lowercarbon Capital

Director of Investment Relations @LACI

Director of Sustainability @McDonald’s

Head of Marketing @Building Ventures

Chief of Staff to the CEO @ClimateAi

Climate Data Scientist @ClimateAi

Teaching Assistant @Terra.do

Director of Business Development @ClearTrace

Program Director; Technology-to-Market Advisor @ARPA-E

Policy Analyst @Elemental Excelerator

Feel free to send us new ideas, recent fundings, or general curiosities. Have a great week ahead!

Our Q&A with Brian Janous on AI, data center demand, and the need for speed

England's new election ushers in a new test of clean energy and climate tech

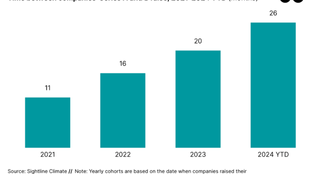

H1'24 funding totaled $11.3 billion, down 20% from H1 2023.