🌎 Bright spots and sunsets in the OBBB #253

One Big Beautiful Bill ushers in new (and old) energy agenda

As metals become the new oils, electrostates ponder monopolies

Happy Monday! In this week’s issue, we thoughtstorm implications and likelihoods of metal-opolies; specifically, Indonesia’s idea to create an OPEC-style cartel for battery metals. While unlikely on the whole, it does show how geopolitics is reshaping to factor for the rise post-fossil fuel era.

News is calm this week ahead of COP, especially given the dramatic end to last year’s negotiations. The White House did announce $1.5b of IRA funding for pivoting national laboratories to climate, the UN food security programme announced $2b in funding for Egypt, and Deloitte found ~800m jobs vulnerable to ‘climate extremes’ in its latest report on green collar jobs.

In funding, a French battery manufacturer building a ‘megafactory’ raises $248m in funding, Solugen raises $200m for chemicals from enzymes, and an electric vertical takeoff and landing creator raises $182m.

Thanks for reading!

Not a subscriber yet?

📩 Submit deals, announcements, events & opportunities, or general curiosities for the newsletter here.

💼 Find or share roles on our job board here.

Move over Twitter, there’s no time like the present to work on climate.

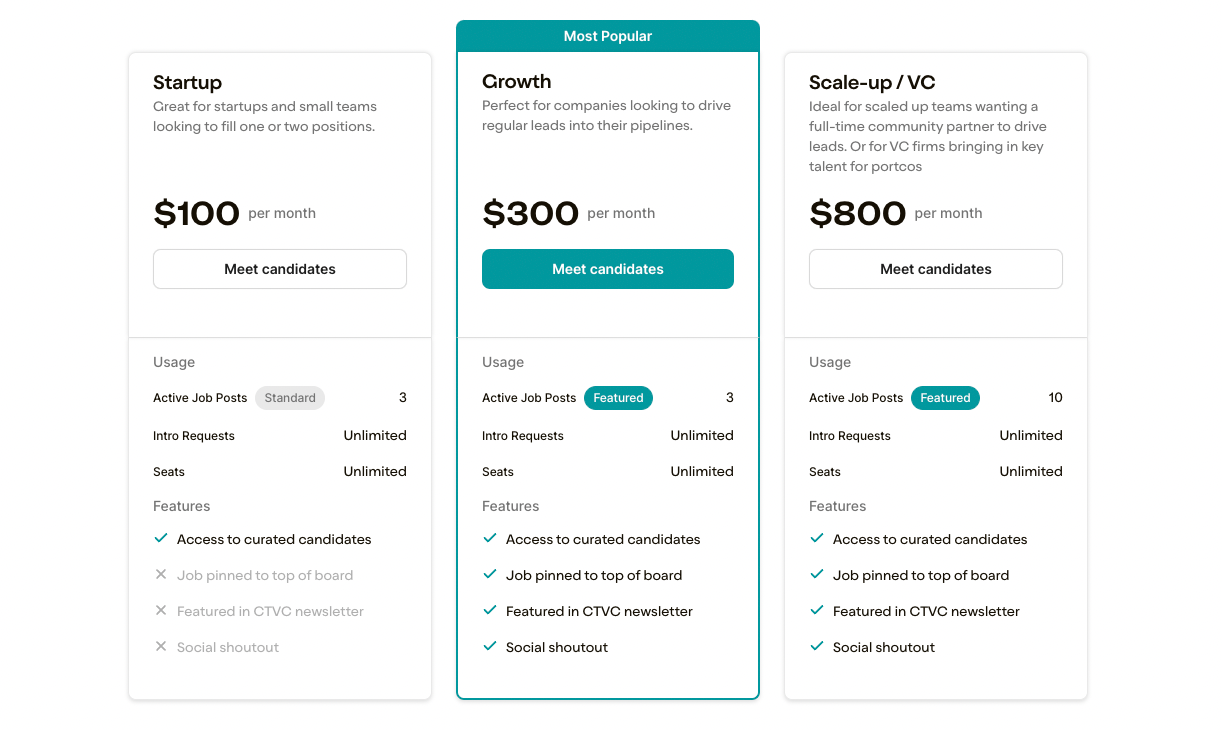

Since we launched the job board last August, we’ve made it easier to find and share meaningful climate opportunities. Now, we’re revamping our model to better help climate-first companies find top talent. Climate companies can now subscribe to be CTVC Partners, with the option to pick from 3 different monthly job posting tiers and cancel at any time.

Note: You will no longer be able to post a one-off job, but not to worry! For that spare one-off hire you can always subscribe and cancel before the subscription renews.

For job seekers, no changes necessary. Keep scrolling and clicking your way into climate!

Indonesia, the world’s largest nickel producer, floated the idea this past week for the creation of an OPEC-style cartel for battery metals. Why care? Hypothetically such a structure could fundamentally shift the supply-demand dynamics of the metals market with far-reaching implications for the future of the energy transition.

As CTVC readers know, the energy transition is a metals transition. With global power tilting from Petrostates towards countries privileged with access to rare earth metals and minerals, it’s no surprise that wannabe Electrostates like Indonesia are considering resource governance mimicry. Let’s take a quick history detour to understand how another well-known commodity cartel altered the dynamics of oil markets.

The download on OPEC. The Organization of Petroleum Exporting Countries was established in 1961 to coordinate oil prices and production. Its 13 member countries produce ~40% of the world’s crude oil and ~60% of traded petroleum. This supply concentration (purportedly) allows OPEC to influence global oil prices.

A battery metals cartel could (hypothetically) create a similar dynamic for critical metals, allowing producing nations to control commodity prices by coordinating supply. By turning the dial on supply to drive higher prices, metal cartel countries could increase their revenues - and simultaneously effectively govern the pace of the energy transition by setting a cap on the availability of metals for electrification.

The hold up. It’s easy to see the appeal of cartelization to a country like Indonesia (which has bucked geopolitical trading norms before). The management of a cartel, however, is tricky business and ultimately unlikely to work in practice:

While a cartel is practically unlikely, the value proposition for Electrostates to claim greater geopolitical influence is wholly legitimate - and growing as demand continues to outpace supply. Nationalization (essentially internal cartelization…) and international asset ownership currently outstrip the effectiveness of global cooperation and coordination. Metal-oploies will have to wait.

🔋 Verkor, a France-based company battery manufacturer building a battery “megafactory”, raised $248m in funding from Groupe IDEC, European Investment Bank, Demeter, and Bpifrance.

🌿 Solugen, a Houston, TX-based developing chemical products from enzymes in nature, raised $200m in Series D funding from Refactor Capital, Lowercarbon Capita, Kinnevik, Temasek Holdings, Fifty Years, and Baillie Gifford.

🚁 Volocopter, a Germany-based company manufacturing electric vertical takeoff landing (eVTOL) vehicles, raised $182m in Series E funding from NEOM and Gly Capital Management.

🔋 Kuntian New Energy, a China-based company providing anode materials for lithium-ion batteries, raised $137.4m in funding from SK China, Sany group, Sinopec Capital, GF Qianhe Investment, Fosun Capital, and CICC.

♻️ AMP Robotics, a Louisville, CO-based developer of robotics and infrastructure for waste management and recycling, raised $91m in Series C funding from Congruent Ventures, Wellington Management, Blue Earth Capital, Sidewalk Infrastructure Partners, Tao Capital Partners, XN, Sequoia Capital, GV, Range Ventures, and Valor Equity Partners.

💨 Project44, a Chicago, IL-based company providing supply chain visibility that allows companies to track carbon emissions from cargo, raised $80m in funding from Generation Investment Management, A.P. Moller Holding, CMA CGM, Goldman Sachs Asset Management, TPG, Emergence Capital, Chicago Ventures, Sapphire, 8VC, Sozo Ventures, and Omidyar Technology Ventures.

🚗 The Mobility House, a Germany-based company providing EV smart charging and V2G integration, raised $50m in Series C funding from Ventura Capital, Mercuria, Green Gateway Fund, SP Group, Mitsui & Co, Mercedes Benz, and Alliance Ventures.

🚗 Xeal, a Los Angeles, CA-based company providing EV charging solutions, raised $40m in Series B funding from Keyframe Capital, ArcTern Ventures, Moderne Ventures, Ramez Naam, Nexus Labs, Wind Ventures, and Alpaca VC.

♻️ Samsara Eco, a Australia-based recycling company utilizing enzyme-based technology to break down plastic, raised $35m in Series A funding from Breakthrough Victoria, Temasek, Assembly Climate Capital, DCVC, and INP Capital.

🛩️ VoltAero, a France-based aircraft manufacturer using electric-hybrid propulsion, raised $31.7m in Series B financing from Tesi.

🚗 ElectraEV, a India-based electric mobility which integrates and supplies EV powertrains systems across passenger and commercial vehicle segments, raised $25m in funding from GEF Capital Partners.

🌏 Hygenco, an India-based company providing green hydrogen, green ammonia-powered solutions, raised $24.9m in funding from SBICAP Ventures.

👚 Smartex, a Portugal-based company making textile manufacturing more efficient with their machine vision driven software, raised $24.7m in Series A funding from Lightspeed Venture Partners, Build Collective, H&M Group, DCVC, HAX, Spider Capital, Momenta Ventures, Bombyx Capital Partners, and Fashion for Good.

💨 Starfire Energy, an Aurora, CO-based developer of carbon-free ammonia production, raised $24m in Series B funding from Samsung Ventures, AP Ventures, Çalık Enerji, Chevron Technology Ventures, Fund for Sustainability and Energy, IHI Corporation, Mitsubishi Heavy Industries, Osaka Gas USA, Pavilion Capital, and Rockies Venture Club

🏠 Aro Homes, a San Francisco, CA-based company designing and building carbon-negative homes, raised $21m in Series A funding from Innovation Endeavors, Western Technology Investment, and Stanford University.

♻️ Protein Evolution, a New Haven, CT-based recycling company using enzymes to break down textiles and plastic, raised $20m in Seed funding from Collaborative Fund, Redbird Ventures, Nextrans, New Climate Ventures, Good Friends, Eldridge.

🏢 Runwise (prev. Heat Watch), a New York, NY-based building control software platform, raised $19m in Series A funding from Fifth Wall, Rudin Management, SOJA Ventures, MCJ Collective, Derive Ventures, Helium-3, Silence VC, The Cannon Project, Waterman Ventures, Initialized Capital, Notation Capital, Susa Ventures, NextView Ventures, XY Ventures, Soma Capital, and Friedman Management.

🚗 AMP, a Santa Fe Springs, CA-based company providing energy management solutions for e-mobility, raised $17.3m in Series A funding from Ecosystem Integrity Fund and Helios Climate Ventures.

💨 Boston Materials, a Billerica, MA-based manufacturer of reclaimed carbon-fiber products, raised $12m in Series A funding from Good Growth Capital, GS group, PTT Global Chemical, Valo Ventures, Gatemore Capital Management, ACVC Partners, and Accelr8.

☀️ SolarSquare Energy, a India-based company providing rooftop solar services, raised $12m in Series A funding from Lowercarbon Capital, Elevation Capital, Rainmatter Foundation, and Good Capital.

🛰️ AiDash, a San Jose, CA-based company providing climate resilience through satellite and AI products, raised $10m in funding from SE Ventures.

🛰️ ConstellR, a Germany-based satellite water monitoring company, raised $10m in Seed funding from Lakestar, VSquared, FTTF, IQT, Amathaon Capital, Natural Ventures, EIT Food, OHB Venture Capital, Next Humanity, and Seraphim.

⚡ ECO STOR, a Norway-based provider of energy storage systems, raised $10m in Series B funding from Farvatn Private Equity, Agder Energi, Covalis Capital, and Klaveness Marine.

🌿 Sistema.bio, a Mexico-based company converting animal manure into natural fertilizer, raised $9.9m in funding from Native.

🏢 Audette, a Canada-based company creating actionable data-driven decarbonization plans for commercial real-estate portfolios, raised $9.5m in Seed funding from Buoyant Ventures, Energy Impact Partners, Active Impact Investments, Johnson Controls, Osgoode Properties, Powerhouse Ventures, Turnham-Green Capital, and Undivided Ventures.

🧆 NuCicer, a Davis, CA-based company enhancing protein content of chickpeas with a genome-guided breeding platform, raised $7m in Seed funding from Leaps by Bayer, Lever VC, Blue Horizon, and Trellis Road.

🌍 Util, a UK-based data analytics company providing sustainability intelligence, raised $6m in Seed funding from Eldridge, Luxembourg Stock Exchange (LuxSE), the Chicago Board Options Exchange, and Oxford Science Enterprises.

🌊 SeaQurrent, a Netherlands-based renewable tidal energy company, raised $4.8m in funding from EIT InnoEnergy, PMH Investments, Invest-NL, the FOM and NOM.

👚 Treet, a San Francisco, CA-based platforming enabling fashion companies to resell their goods, raised $3.5m in Seed funding from First Round Capital, Bling Capital, Techstars, Interlace, Alante Ventures, BAM Ventures, and BBG Ventures.

🚗 MoEVing, a India-based company full stack electric mobility, raised $2.5m in Seed funding from JSW Ventures.

💨 Carbonx, a Paris-based startup providing access to carbon removal projects, raised $900K in Pre-seed funding from angel investors.

🚜 Sabanto, a Chicago, IL-based company manufacturing autonomous tractors, raised funding from Cooperative Ventures.

🏍️ Aventon, a Brea, CA-based electric bike manufacturer, raised funding from Sequoia Capital China.

BDC (The Business Development Bank of Canada) has raised $400m for their second Climate Tech Fund aimed to invest in low-carbon technologies.

WaveTech, a Honey Brook, PA-based company providing battery technology is going public with a $228m implied enterprise value via Welsbach Technology Metals Acquisition Corp.

Amazon is committing $53m of its Climate Pledge Fund towards investing in climate technology startups headed by women.

When world leaders touch down in Egypt this week, they’ll be stepping into a country that’s almost 2°C hotter today than it was at the start of the 20th century. Yet, very few countries have actually ramped up their climate action. According to Climate Action Tracker, only 21 countries have submitted updated national climate commitments, while another 172 countries have not updated their targets at all. Corporates’ track record isn’t much better - 93% of corporate commitments are on track to fail without more aggressive action.

The White House announced the Net-Zero Game Changers Initiative, a $1.5b investment to upgrade America’s national laboratories under IRA alongside a new road map of five priority areas for US net-zero technologies: power grids, aviation, fusion energy, efficient buildings, and net-zero fuels and industrial products.

French President Emmanuel Macron promised to plant 1b trees by 2030 – 10% of the country’s current forested area – after wildfires destroyed 72,000 hectares of forest this summer, 6x more than the average of the last 10 years.

The United Nations’ International Fund for Agricultural Development will invest $2b to boost food security in Egypt. The program comes as Africa, which has contributed little to climate change in the form of emissions, struggles with more frequent droughts and floods.

Electric school buses will get a $1b boost to cover the costs of nearly 2,300 new EV buses, quadrupling the nation’s current fleet.

Deloitte finds that ∼25% of today's global workforce or over 800m jobs are "highly vulnerable" to climate extremes. On the flip side, substantial decarbonization investments and policies could create 300m additional Green Collar jobs by 2050. Meanwhile, a call to action from Microsoft highlights the need for more workers with specialized training in environmental issues.

Elemental Excelerator announces Cohort 11 with a focus on hard-to-decarbonize industries like maritime, buildings, and construction including CTVC friends Banyan Infrastructure, Nitricity, Transaera, and Vesta.

Reverse, reverse! British PM Rishi Sunak will attend COP27 after all.

Amazon and USAID team-up to invest in women fighting climate change.

Wavemaker Impact, Breakthrough Energy Ventures, and Temasek team up to tackle rice decarbonization.

MRV 123s. A call to action from Carbon180 for high accountability carbon removals.

The Solar Utility Vehicle of the future is here, and looks an awful lot like a $25k minivan, complete with PV panels for doors.

Sylvera’s new analysis of 337m deforestation carbon credits challenges “fraud” assumptions with 40% achieving top quality marks.

Wild interactive satellite imagery visualizes four years of Amazon destruction under Bolsonaro’s administration.

Typology of cost reductions in CDR in a strong blog post by Grant Faber.

Helpful EV charging market map from The Westly Group for those of us who keep getting our cables tangled.

🗓️ Women in ClimateTech Cocktail Hour: Join leading women in climate on Nov 10 for an evening of discussion and drinks hosted by Lowercarbon Capital and WovenEarth Ventures.

🗓️ Carbon Removal Investors Academy: Register for AirMiners Investor Academy on Nov 17 for a mix of presentations and breakout sessions designed for active investors who want to better understand the carbon removal market to make first investments in the space.

🗓️ The Clean Fight: Tune in on Nov 17 to a conversation with leading Climate Tech founders from Sealed, Radiator Labs and Perl Street on project finance.

Note: Our job board is switching to subscription mode! Climate companies can now subscribe to be CTVC Partners, with the option to pick from 3 different monthly job posting tiers and cancel at any time.

Analyst @Keyframe Capital

Investment Analyst @Azolla Ventures

Principal @Azolla Ventures

Manager, Technical Review and Selection @Breakthrough Energy

Head of Corporate Carbon Procurement @Living Carbon

Independent Engineering Director @Earth Partners + OCED

Associate Director of Carbon Capture @Earth Partners + OCED

Strategic Analysis Director @Earth Partners + OCED

Micromobility Project Manager @EIT InnoEnergy

Feel free to 📩 send us new ideas, recent fundings, events & opportunities, or general curiosities. Have a great week ahead!

One Big Beautiful Bill ushers in new (and old) energy agenda

Climate, capital, and carrots in London's new playbook

US plays popcorn politics with biofuels and beyond