🌎 The UK digs deep for critical minerals #285

England strikes lithium and comes up with geothermal gold

Happy Monday!

This week, we’re digging into the bottleneck defining the AI boom: power. Google just scaled demand response across its AI data centers, Equinix locked in 1GW of advanced nuclear, and developers everywhere are scrambling for electrons before they pour concrete. We cut through the hype in our new Data Center Powering Models report, out now.

In other news, the Treasury drops new guidance on solar & wind tax credits, DOE fast-tracks nuclear pilots, and CATL pauses operations at a lithium mine that feeds 6% of global supply.

In deals, $325m for sustainable data center development, $250m for renewable energy projects, and $235m for eVTOLs.

Plus, ICYMI, our CTVC x New York Climate Week tracker is here! Check it out, and keep submitting events to us to include here.

Thanks for reading!

Not a subscriber yet?

📩 Submit deals and announcements for the newsletter at [email protected].

💼 Find or share roles on our job board here.

As AI demand surges and interconnection timelines stretch into years, securing scalable, reliable power is now the gating factor in the race to build. Developers are scrambling for solutions.

Earlier this month, Google became the first major tech company to scale demand response across its AI data centers, dialing back usage during peak stress events to help stabilize the grid. Meanwhile, last week, data center giant Equinix signed agreements with three advanced nuclear developers (Radiant, ULC-Energy, and Stellaria), bringing its nuclear pipeline to over 1GW.

Advanced tech partnerships, grid deals, and flexible AI loads are just a few of the strategies emerging to get power online fast. But with projections diverging wildly and press releases outpacing reality, we wanted to cut through the noise. So in CTVC/Sightline Climate fashion, we built the dataset we wished existed: tracking who’s building what, where, and how they plan to power it. The result is our new Data Center Powering Models report — part of our full Sightline client coverage of data centers, tariffs, supply contracts, and cost benchmarks.

The AI boom is creating a new class of infrastructure players. Data centers once measured in tens of megawatts are now being announced at the gigawatt scale; larger than power plants themselves. Development is increasingly power-first, but faces on-the-ground constraints: multi-year interconnection delays, decade-long clean energy project timelines, and rising electricity costs. That means new procurement strategies, novel tariffs, and entirely new infrastructure plays are becoming strategic differentiators.

Earlier this month, we released our Data Center Powering Model report, mapping the six powering models actually being deployed — from grid-tied clean to RNG microgrids — and lays out the trade-offs in cost, speed, emissions, and scalability. As we’re showing below, excess existing generation is one of the fastest ways to get power, but it’s also restrictive. Data centers need to be scaled to meet the power, not the other way around. Backup power can act as a ‘bridging’ solution, but it’s expensive. Renewable microgrids seem great, but they’re tough to balance if totally disconnected from the grid. At the other end of the spectrum, we’ve seen some hyperscalers investing in SMRs (like Equinix), in the hopes that one day powering a data center will be as simple as building a tiny nuclear power plant next to it.

We also dive into the economics: who’s paying for grid upgrades, how tariffs are evolving, and where developers are stepping in to fund their own generation. Case studies across the US and Europe show how different markets are handling the crunch — from Nevada’s clean transition tariffs to Dublin’s requirement for on-site backup to spots where extra capacity is attracting developers.

The winners in this race won’t be the ones with the splashiest announcements, but the ones that can lock in reliable, affordable, and scalable power ahead of the curve. With many new announcements topping 1GW and carrying a median $800m price tag, these builds are large enough to reshape entire regional power markets, forcing utilities, regulators, and communities to rethink how new infrastructure gets placed and priced.

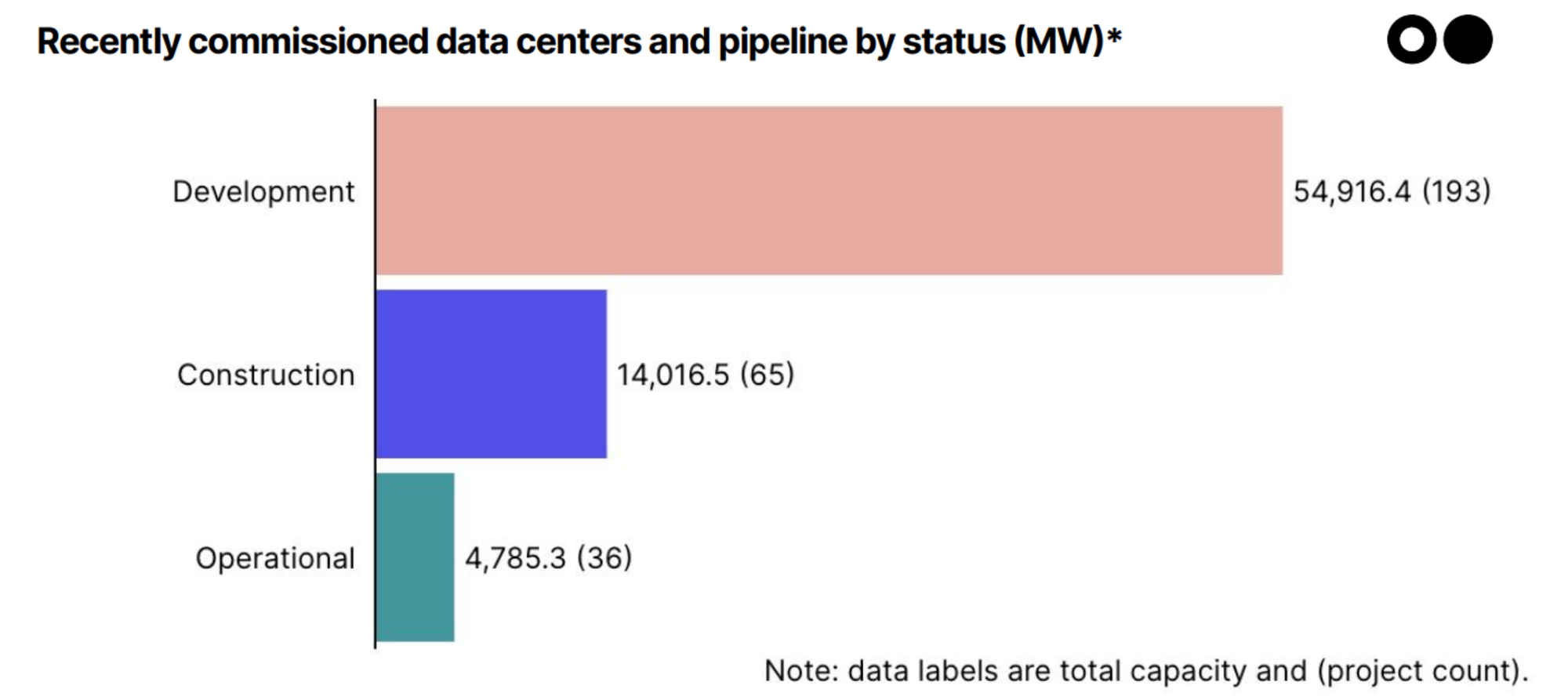

That’s where our approach is different. Most datasets stop at forecasts — sweeping top-down projections of where demand might go. We’ve gone bottom-up, building a project-level pipeline of nearly 300 announced sites totaling 73.6GW, with details on how each center plans to power itself:

It’s not just about location and size. This granularity matters because all these moving parts of powering models determine cost, emissions, and whether projects actually break ground. The actionable dataset shows where equipment manufacturers and utilities can find clients, and where novel tech is being deployed. It also reveals the results of policy and regional dynamics that shape how tech gets deployed. Our Data Center Powering Models report aims to surface the real demand signals that utilities, developers, and investors are trying to plan around.

🏠 Aira, a Stockholm, Sweden-based residential heat pump manufacturer and energy platform, raised $174m of Growth funding from Altor, Kallskär, Kinnevik, Lingotto, and Temasek Holdings.

⚡ Green Genius, a Vilnius, Lithuania-based solar-plus-storage project developer, raised $75m of PF Debt funding from Nord/LB and Nordic Investment Bank (NIB).

⚒️ Vulcan Elements, a Durham, NC-based rare earth magnets manufacturer, raised $65m of Series A funding from Altimeter and One Investment Management (OneIM).

⚡ National Renewable Network, a Sydney, Australia-based network of solar and storage systems, raised $44m of Series A funding from Ecotone Partners, Electrifi Ventures, Infradebt, Investible, and Virescent Ventures.

🛵 Ultraviolette Automotive, a Bengaluru, India-based electric motorcycle manufacturer, raised $21m of Corporate Strategic funding from TDK Ventures.

💨 Equatic, a Santa Monica, CA-based carbon removal developer, raised $12m of Series A funding from Temasek Trust and Kibo Invest.

🌾 Saga Robotics, an Oslo, Norway-based developer of autonomous robots for agriculture, raised $11m of Seed funding from Aker Carbon Capture, Blystad, Hatteland, MP Pensjon, Melesio, and other investors.

🔋 3DC, a Sendai, Japan-based developer of graphene materials for energy storage, raised $9m of Series A funding from ANRI, 77 Capital, KSP, Kyoritsu, Mitsui Sumitomo Insurance Venture Capital (MSIVC), Mitsubishi UFJ Capital, and other investors.

🥩 Prefer, a Singapore-based bean-free coffee producer, raised $4m of Seed funding from At One Ventures, Chancery Hill Capital, and Forge Ventures.

🛰 Manastu Space, a Mumbai, India-based green propulsion systems developer, raised $3m of Series A funding from Capital-A, Bhagnani family office, Capital 2B, E2MC, and Indian Angel Network.

🏠 Evolution Data Centres, a Singapore-based sustainable data center infrastructure developer, raised $325m of PE Expansion funding from Warburg Pincus and Zero Two.

⚡ United Solar Group, a Dubai, United Arab Emirates-based renewable energy project developer, raised $250m of PF Debt funding from International Finance Corporation.

✈️ Eve Air Mobility, a São Paulo, Brazil-based eVTOL developer, raised $230m of Post-IPO Equity funding from Brazilian Development Bank (BNDES) and Embraer.

🌾 AcreTrader, a Fayetteville, AR-based farmland investment online platform, was acquired by Proterra Investment Partners for an undisclosed amount.

🥩 Daring Foods, a Los Angeles, CA-based plant-based chicken developer, was acquired by v2food for an undisclosed amount.

🏭 Kelvion, a Herne, Germany-based energy-efficient thermal management solutions provider, was acquired by Apollo for an undisclosed amount.

This is a sample of the deals available for Sightline Climate clients. Can’t get enough deals?

The Trump administration issued new Treasury guidance on wind and solar tax credits that eliminates the 5% safe harbor provision but preserves other key eligibility pathways. Projects can still qualify by showing “physical work of a significant nature,” including off-site manufacturing, which softens the blow of the changes. While developers face tighter timelines and looming foreign content restrictions, the rules, set to take effect September 2, help allow many utility-scale projects to move forward with more certainty.

In other US government news, the DOE has selected 11 companies, including Oklo and Terrestrial Energy, for a fast-tracked nuclear pilot program that bypasses Nuclear Regulatory Commission licensing to accelerate advanced reactor deployment. The program, authorized under Trump’s executive order, aims for at least three reactors to reach criticality (sustaining a fission chain reaction) by July 4, 2026. It could be a boost for US next-gen nuclear innovation, but it also raises concerns over regulatory oversight.

China’s CATL suspended operations at its Jianxiawo lithium mine — responsible for 3–6% of global supply — after its license expired, sparking an 8% surge in futures and double-digit jumps in lithium miner stocks. The move reflects growing pressure from Chinese authorities to rein in overcapacity following years of plummeting prices, likely at a market loss for these state-supported players. This could help Western lithium production and a more stable EV supply chain.

Ørsted, Europe’s largest offshore wind developer, announced a $9.4bn capital raise after Trump’s halt on a nearby Equinor wind project torpedoed its Sunrise Wind stake sale, triggering a record share price drop and credit downgrade. Ørsted blames Trump policies and high interest rates for the hit, reflecting rising financial and political risk for US offshore wind.

EPC Thyssenkrupp Nucera is pulling out of multiple US green hydrogen projects, citing infeasibility under Trump’s rollback of clean energy tax credits. As an established EPC player, the decision shows how policy uncertainty changes the project economics and calculations for US hydrogen deployment.

In other project news, World Energy shut down its Paramount refinery — once producing nearly half of the US’s sustainable aviation fuel — after losing airline contracts and facing cost overruns. The facility’s closure comes after the SAF tax credit was weakened and amid broader struggles across the SAF sector, where few projects have scaled and raw material constraints persist.

The DOE’s lift-off reports are back up!

This pro-nuclear power influencer poses with uranium rods on TikTok.

New report from New America on the new reality of climate change and housing.

These DOE vets got Constructive with new coalition-building nonprofit.

Stone cold data: An interactive map to show where enhanced rock weathering can work.

This endangered pigeon species is flying back from the brink.

New hybrid ferry is smooth sailing to New York’s Governors Island.

💡 State of Climate Tech Fundraising 2025 Survey: Share insights about your fundraising journey in the past 6–12 months in this short survey from Extantia, running through Aug 30th, to inform a new report on 2025 fundraising trends.

📅 SOSV VC-Founder Climate Tech Matchup: Join SOSV on September 8–12, virtually, for the opportunity to connect 1,000 climate tech startups and 1,000 investors for curated 1:1 meetings across sectors like energy, food & ag, CCUS, and more.

💡 EarthScale: UK startups can apply by September 7 for the opportunity to participate in a 12-month UK-wide programme supporting IP-rich climate tech startups at TRL 5–6. Designed for ventures with at least £500k raised, EarthScale offers £20k+ of in-kind support, including technical facilities, enterprise development, and regulatory navigation.

📅 21st Peninsula Climate, AI, Happy Hour + Potluck: Join us on August 26th in Redwood City, California, for an evening of climate and AI networking, short talks, and community potluck. Engage with founders, policymakers, and technologists shaping a sustainable future.

📅 FOAK Climate Hackathon: Join Earthics and Turnover Labs on August 23–24th in New York City for a 24-hour hackathon tackling real-world scaling challenges in climate infrastructure. Compete for $1,000 in prizes and help turn FOAK climate projects into reality.

📅 MCJ x Regenerative Roundtable: Headwinds and Tailwinds in Climate: Join MCJ’s Yin Lu and Daversa’s Caroline Rubach on August 25th for an expert-led virtual discussion on climate investment and hiring trends. It will explore market shifts, policy developments, and resilient climate sectors in this interactive session.

Senior Software Engineer @Sightline Climate

Senior Product Designer @Sightline Climate

Senior Account Executive @Sightline Climate

Project Manager @Rune

Fleet Operations Manager @Rune

Electrochemical Research Associate II/III or Scientist @SiTration

Senior Process Engineer @SiTration

Founding Consumer Product Analyst @Optiwatt

📩 Feel free to send us deals, announcements, or anything else at [email protected]. Have a great week ahead!

England strikes lithium and comes up with geothermal gold

Small reactors, big power rankings

Stricter foreign sourcing rules reshape clean energy tax credit eligibility