🌎 Inside Cloverleaf Infrastructure’s power play #206

Our Q&A with Brian Janous on AI, data center demand, and the need for speed

Happy Monday!

While our bread-and-butter is what it says on the label, us climate tech venture capital nerds love an alternative earth financial engineering experiment. As the climate capital stack gets necessarily more complex, debt-for-nature swaps have seemingly picked up in frequency and size. What do SIDS, TNC, VCM, and Wall Street fees have to do with it?

Meanwhile, in the news, NIMBY mining tension and Made In America-only threats from Manchin put us between a rock and a hard place on sourcing metals for the clean energy transition. If implementable, new climate policy puts us back on track for <1.8 degrees of warming. Plus the world’s first ammonia-powered semi-truck and campuses gone re-wild.

In deals this week, Boston Metal nabs $120m for clean steel, Scythe stashes $42m for electric lawn mowing, and Noon Energy stores $28m for long duration storage.

Thanks for reading!

Not a subscriber yet?

📩 Submit deals, announcements, events & opportunities, or general curiosities for the newsletter here.

💼 Find or share roles on our job board here.

Small island developing states (SIDS) face a triad of crises: debt, climate change, and biodiversity loss. The pandemic exacerbated GDP concerns as tourism ground to a halt, and rising global interest rates are adding salt to the wound. Searching for solutions, several countries have turned to one of their most valuable assets to restructure their debt: nature. Ever thirsty for new financial engineering experiments, big global banks are there for the party.

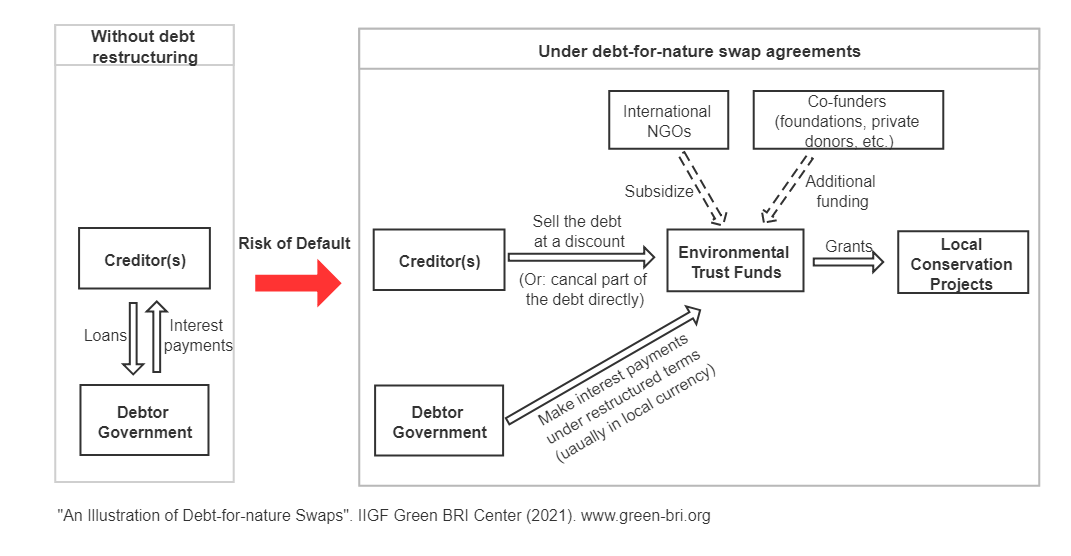

But first, what’s a debt-for-nature swap? 💰🔄🌳 When a country trades their debt with a foreign entity in exchange for funds to protect nature. These swaps involve discounting the value of the original debt contract, restructuring as “blue” or “green” bonds, and repaying original bondholders in cash from proceeds. Funds can be used for everything from establishing protected areas to researching the medical applications of plants. TED has a great explainer video.

📜 Rewind. Conservation International executed the first such swap in 1987 when it forgave $650k of Bolivian debt in return for the establishment of three conservation areas containing 13+ endangered species. During the following decades, copycat debt-for-nature swaps were limited given hefty administrative costs, small transaction sizes, and cheaper debt relief schemes (see: Heavily Indebted Poor Countries Initiative).

🌱 Fast forward. Debt-for-nature swaps are back in vogue!

🤨 The reckoning. It’s challenging to measure the efficacy of debt-for-nature swaps in meeting their intended biodiversity targets. One thing’s for sure though: Wall Street gets a cut of these huge transactions. Likewise, there is a chance these structures and the huge swaths of land they protect could add an alternative to supply-constrained voluntary carbon credit markets that seek to develop projects in similar geographies.

🏭 Boston Metal, a Woburn, MA-based producer of clean steel, raised $120m in Series C funding from ArcelorMittal XCarb, Microsoft Climate Innovation Fund, and Siteground Capital.

🏗️ Gropyus, a Vienna, Austria-based sustainable homes developer, raised $109m in Series B funding from Vonovia.

🏠 Tado, a Munich, Germany-based developer of smart thermostats , raised $47m from Bayern Kapital, Kiko Ventures, Trill Impact, and Zürcher Kantonal Bank.

🌿 Scythe, a Longmont, CO-based producer of electric autonomous lawn mowers, raised $42m in Series B funding from Alumni Ventures, Amazon Alexa Fund, ArcTern Ventures, Energy Impact Partners, Inspired Capital Partners, and True Ventures.

⚡ Lynkwell, an Albany, NY-based EV managed charging platform, raised $30m from Warren Equity Partners.

🔋 Noon Energy, a Palo Alto, California-based long duration energy storage startup, raised $28m in Series A funding from Clean Energy Ventures and Aramco Ventures.

🏠 Ecozen, a Pune, India-based developer of sustainable cold chain technology, raised $25m in Series C funding from Caspian Impact Investments, Dare Ventures, Hivos-Triodos Fund, IFA Global, India Exim Bank, Nuveen Investments, and Omnivore.

🥩 Meati, a Boulder, CO-based startup producing fungi-based meat, raised $22m in Series C funding from Revolution Growth and Rockefeller Foundation.

🔋 FUERGY, a Bratislava, Slovakia-based provider of energy storage and management solutions, raised $17m from ProPartners.

⚡ Renaissance Fusion, a Fontaine, France-based nuclear fusion company, raised $16m in Seed funding from HCVC, Lowercarbon Capital, Norrsken VC, and Positron Ventures.

⚡ AMPECO, a Sofia, Bulgaria-based EV charging management startup, raised $13m in Series A funding from BMW i Ventures, Cavalry Ventures, and LAUNCHub Ventures.

🏠 Aedifion, a Cologne, Germany-based building energy efficiency platform, raised $13m in Series A funding from Bauwens Digital, BeyondBuild, BitStone Capital, Drees & Sommer AG, Momeni Ventures, Phoenix Contact Innovation Ventures, and World Fund.

🐄 Rumin8, a Perth, Australia-based startup developing seaweed feed supplements for livestock, raised $12m in Seed funding from Breakthrough Energy Ventures, Harvest Road, Prelude Ventures, and Sentient Impact Group.

☔ Floodbase, a Brooklyn, New York-based flood modeling platform for high risk markets, raised $12m in Series A funding from Lowercarbon Capital, Collaborative Fund, Floating Point, and Vidavo.

🔋 Log 9 Materials, a Bengaluru, India-based battery manufacturing platform, raised $11m in Series B funding from Anicut Capital, Cornerstone Ventures, Kube Opportunities’ LO Fund, Piva Capital, RTBI, and SiriusOne Capital.

⚡ Kuva Systems, a Cambridge, MA-based methane monitoring and quantification platform, raised $11m in Series A funding from Clean Energy Venture Group, Climate Innovation Capital, Dräger, and LaunchPad Ventures.

🏗️ Plantd, a Durham, NC-based maker of carbon-negative building materials from renewable grass, raised $10m in Series A funding from American Family Ventures.

💨 Senken, a Berlin, Germany-based carbon credit trading platform, raised $8m in Seed funding from Obvious Ventures, Offline Ventures, Inflection Point Ventures, Kraken Ventures, and Climate Capital.

🌾 Wasted, a Burlington, VT-based startup converting human waste into effective fertilizers, raised $8m in Seed funding from Collaborative Fund, Day One Ventures, Divergent Capital, Gratitude Railroad, Pure Ventures, and Third Sphere.

🧪 Melonfrost, a Brooklyn, New York-based microbe production platform, raised $7m in Seed funding from Alexandria Venture Investments and Refactor Capital.

🥩 Pigmentum, a Qiryat Shmona, Israel-based producer of plant-based food components, raised $6m in Seed funding from Arkin Holdings, Kibbutz Yotvata, OurCrowd, Tempo, and Tnuva.

🥩 EntoCycle, a London, UK-based insect farming tech company, raised $5m in Series A funding from Climentum Capital, ACE & Company, Lowercarbon Capital, and Teampact ventures.

⚡ WattCarbon, a Lafayette, California-based energy data platform for building decarbonization, raised $5m in Seed funding from True Ventures, Village Global, Jetstream Capital, Not Boring Capital, Keiki Capital, GreenSoil Investments, and Nexus Labs.

🥩 The ISH Food Company, a Wilmington, DE-based producer of plant-based seafood alternatives, raised $5m in Seed funding from Accelr8 and Stray Dog Capital.

💨 CarbonOrO, a Nijmegen, Netherlands-based CO2 capture company, raised $4m in Series A funding from ICOS Capital Management, Inpex, and Putifer.

🍎 Kanpla, an Aarhus, Denmark-based food waste management platform, raised $2m in Seed funding from henQ.

⚡ Tyba, an Oakland, CA-based modeling platform for solar and storage projects, raised $2m in Seed funding from Lorimer Ventures, MKT1 Capital, Powerhouse Ventures, Vista Ventures, and Wireframe Ventures.

🏗️ Neverwaste, an Esbjerg, Denmark-based maker of building panels from waste cardboard, raised $2m in Seed funding from Elbow Beach Capital and The Future Fund.

⚡ Refuel Green, a Dresden, Germany-based e-fuels production platform, raised $1m in Pre-Seed funding from High-Tech Grunderfonds and TGFS - Technologiegründerfonds Sachsen.

⚡ INERATEC, a Karlsruhe, Germany-based producer of low-carbon synthetic fuels, raised an undisclosed amount of funding from ENGIE New Ventures, FO Holding, High-Tech Grunderfonds, Honda Motor, MPC Capital, Planet A Ventures, and Safran Corporate Ventures.

Vision Ridge Partners, a Boulder, CO-based sustainable real assets investment firm, raised $700m for an annex to its $1.25B third fund closed in April 2021.

Britishvolt, a U.K.-based battery energy storage company with three hundred employees, went bankrupt.

Between a rock and a hard place. The Biden administration banned mining in northern Minnesota for the Twin Metals copper and nickel project after pushback from environmentalists and indigenous communities. Republicans criticized the move after Biden struck a deal for mining minerals in Africa advocating bringing mining into the US.

EV sourcing mandates continue its controversy. Sen. Joe Manchin now wants to block EV subsidies on cars that don't meet strict battery sourcing mandates from the US or its free trade partners, making most EVs currently ineligible for IRA tax credits.

The climate tech arms race may be working. Climate policy announcements from the past three months are now ambitiously aiming for a rise in global temperatures of no more than 1.8 degrees according to the Inevitable Policy Response, which has been tracking government and private sector climate policies since the UN’s climate November 2021 summit.

The UK’s competition watchdog is expected to ease antitrust rules on climate change initiatives to allow for more collaboration on climate action. Lloyd’s of London, a key insurance market for the energy sector, had previously cited competition rules as a reason it cannot ban its underwriting firms from insuring carbon-heavy sectors.

Solar supplier Qcells and Microsoft are partnering on a 2.5 GW direct renewable generation deal. The partnership comes at a time of plummeting renewables project construction and backed-up solar supply chains.

Form Energy will deploy two 10 MW / 1,000 MWh 100-hour iron-air batteries at two of Xcel Energy’s retiring coal plant sites. Meanwhile, small modular nuclear power is inching closer to reality. GE Hitachi, Ontario Power Generation have signed the first SMR nuclear commercial contract for the deployment of a BWRX-300 small modular reactor in Ontario.

Watch Al Gore tell it like it is at Davos 2023, reminding viewers that despite having “all the technologies we need” for a 50% reduction in CO2 emissions, we still lack “political will”.

BNEF released their Energy Transition Investment Trends report for 2022, tracking annual investments globally into the low-carbon energy transition. With tons of eye-catching graphics to choose from, we’re suckers for this chart of energy transition investments reaching parity with fossil fuel investments for the first time at $1.1T.

The US federal government just dropped a national strategy for natural capital accounting, recommending a 15-year adoption timeline to understand and track the “value of land, water, air and other natural assets”.

Researchers at the University of Birmingham in London uncovered a way to blast nearly all the emissions from blast furnaces used for steelmaking, while also cutting costs.

The billions of dollars in IRA tax credits are a huge win for US clean energy deployment, but the fine print on labor requirements stands in the way of scale. [Calling all tax credit experts! Drop us a message to join in our next tax credit deep dive.]

Amogy, a startup founded by four MIT grads, debuts the world’s first ammonia-powered semi-truck that can be refueled in just eight minutes. While you’re on a roll, listen to this podcast with Shayle Kann from Catalyst talking about “Ammonia: the beer of decarbonization”.

Ice, ice baby! Thermal storage companies are using cheap, clean power early in the day to freeze ice, which is melted down later in the day to cool buildings when power’s pricier. [Check out our report on the cooling economy]

Some analysts are referencing Shell’s recent acquisition of Volta as the beginning of a potential M&A boom for Green SPACs.

Europe is “doomed” if it doesn’t pass an equivalent response to compete with the IRA, says one of Tesla’s earliest investors.

College campuses are going wild with a movement to rewild campus greens with native species to protect biodiversity. Just in time for this report’s finding that the US is in short supply of the native seeds needed to combat climate change.

Debunk your parents’ home appliance myths and learn about real ways to save energy and money with this helpful home appliance guide.

A report from the Asia Society Policy Institute evaluates China’s climate, energy, and industrial efforts to peak emissions before 2030 and achieve carbon neutrality before 2060.

JFK goes solar with the largest rooftop solar array in NYC and at any US airport terminal.

Fire tweet of the week 🔥

💡West Gate Entrepreneurship Program: Innovators working on energy efficiency, sustainable transportation, and renewable power can apply by Feb 14 to access expertise at NREL and the Colorado School of Mines' facilities.

💡 Prospect Mining Studio: Startups innovating across the metals and mining value chain can apply by Feb 22 for the venture studio between Newlab and Vimson Group.

🗓️ Advancing Climatech and Clean Energy Leaders Kickoff: Join Greentown Labs and Browning the Green Space (BGS) on Feb 23 to celebrate the kickoff of their joining accelerator program and hear from BIPOC leaders.

🗓️ Climatetech Intern Fair: Calling all students and soon-to-be graduates! Register for Greentown Lab’s annual Intern Fair on March 2.

💡 The Greenhouse: Apply by March 6 to this 12-month innovation programme for pre-seed climate positive startups.

Investor @G2 Venture Partners

Summer Intern @G2 Venture Partners

Climate VC Fellow @At One Ventures

Tech Investor @Pillar VC

Venture Programme Intern @Marble

Venture Science Associate, Climate @Marble

Internship/Co-op Program @Electric Hydrogen

Sr Project Manager, Infrastructure Project @Electric Hydrogen

Head of Sustainability Reporting @Macquarie

Senior Sustainability Strategy Lead @Pokemon

Deputy CEO @Sustainable Energy for All

Sr Manager, Environmental Sustainability - Scope 3 @Disney

Sales Director @Canopy

Feel free to 📩 send us new ideas, recent fundings, events & opportunities, or general curiosities. Have a great week ahead!

Our Q&A with Brian Janous on AI, data center demand, and the need for speed

England's new election ushers in a new test of clean energy and climate tech

H1'24 funding totaled $11.3 billion, down 20% from H1 2023.