🌎 Bright spots and sunsets in the OBBB #253

One Big Beautiful Bill ushers in new (and old) energy agenda

Has the tech giant's quiet rollout of a feature aimed at reducing GHG emissions poisoned the public perception of DERs and energy efficiency measures?

Happy Monday!

Apple took a step toward smarter, cleaner iPhone charging, but may have soured some consumer sentiments on energy efficiency and distributed energy resource (DER) applications in the process.

Meanwhile, gas stoves and ESG are back in the culture wars crosshairs. SAFs are flying high and DOE plans to support further expansion of battery recycling capacity in the US.

This week in deals, $1.1B for waste diversion. Solar project developer Industrial Sun lands $90M (if you missed it on Friday, check out our breakdown of why it's so difficult to connect new renewable energy projects to the grid). And platforms for ESG monitoring and metrics raise $37M and $30M, respectively.

Thanks for reading!

Not a subscriber yet?

📩 Submit deals, announcements, events & opportunities, or general curiosities for the newsletter here.

💼 Find or share roles on our job board here.

iPhone users in the US have a lot of questions about a feature aimed at optimizing charging for low-emissions energy.

Apple rolled out clean energy charging in its October iOS update, but confusion—and emotions—about the feature surfaced last week (blame it on Pisces season, I guess).

The idea is to charge phones when “lower carbon emission electricity is available,” according to Apple. The flipside, of course, is that your phone charges more slowly when the electricity is coming from higher-emissions sources, which people began to notice last week.

Users can turn off or override this charging feature, but much of the outrage came from Apple's choice to make it enabled by default as part of this latest update. Unfortunately, this is many folks' first experience with “smart charging” and they’re associating it with the inconvenience of a dead phone battery.

As dynamic charging becomes a more common function of managing an increasingly electrified world, effectively communicating these changes to energy consumers is only going to become more important.

I’m glad Apple is working on dynamic charging to shift to low carbon hours…BUT the way they rolled it out isn’t great. Limited awareness, default position is opted in. We should demand better transparency and choice for clean energy solutions or it’s going to backfire. pic.twitter.com/jJHUkBDIn9

— Tim Latimer (@TimMLatimer) February 26, 2023

How it works: Matching charging to periods of peak clean energy production sounds logical enough at a high level, but the details on how Apple is calculating this are scarce.

The description within Settings > Battery > Battery Health & Charging, “Clean Energy Charging” is vague and even the support document for the feature doesn’t provide much more information about how Apple is forecasting the emissions of local energy grids.

Bad framing: With the lack of clarity around this feature, it’s difficult to understand the ins and outs of when your phone will charge, but easy to make a link between the inconvenience of underperforming tech and clean energy.

The rollout has been a great example of what not to do when it comes to nudging consumers toward behavior changes that reduce their carbon footprints. It opened Apple up to both “woke charging” accusations from conservative pundits and doubts about the real impact of this tool on GHG emissions from people in the climate space. And the flawed framing raises questions about how receptive people will be to adopting DERs and energy efficiency programs for more impactful applications.

Apple isn’t the only one. Microsoft pushed out an update for Xbox that makes the console “carbon aware,” able to do its updating and downloading in the early morning hours when regional carbon intensity is lower.

And there could be more to come from large consumer tech corporations that need to address their massive Scope 3 emissions, including those created by the ways people use their products.

🍎 Divert, a Concord, MA-based data-enabled waste diversion platform, raised $100M in growth equity and $1B in project finance from Ara Partners and Enbridge.

⚡ Industrial Sun, an Austin, TX-based developer of solar projects, raised $90M from EIG Global Energy Partners and Modern Energy Management.

💸 SESAMm, a Paris, France-based ESG text monitoring platform, raised $37M in Series B funding from AFG Partners, CEGEE Capital, Elaia, Elevator Ventures, NewAlpha Asset Management, Opera Tech Ventures, The Carlyle Group, and Unigestion.

💸 Novata, a New York, NY-based ESG metrics provider, raised $30M in Series B funding from Hamilton Lane, Ford Foundation, S&P Global Inc., Microsoft Climate Innovation Fund, Canson Capital Partners, Clearlake Capital, Hellman & Friedman, Kohlberg & Company, Lindsay Goldberg, and The Vistria Group.

♻️ Circ, a Berlin, Germany-based circular clothing recycling platform, raised $25M in Series B funding from Zalando, Youngone, 8090 Industries, Circulate Capital, Vodia Capital, and City Light Capital.

🏠 BlocPower, a Brooklyn, NY-based urban building retrofitting startup, raised $24M in Series B funding led by Volo Earth Ventures and $130M in debt financing led by Goldman Sachs. Microsoft Climate Innovation Fund, Credit Suisse, Builders Vision, New York State Ventures, Unreasonable Collective, Kapor Capital, MCJ Collective, Tale Venture Partners also joined.

🌾 Hectare, a Rowlands Castle, UK-based software provider for agriculture supply chains, raised $20M in Series A funding.

🏭 SEPPURE, a Singapore-based developer of nanofilters for industrial chemical separation, raised $12M in Series A funding from Anji Microelectronics Technology Shanghai, Eastern Pacific Accelerator, Real Tech Holdings, Seeds Capital, and SOSV.

⛏️ VerAI, a Boston, MA-based AI mineral exploration and discovery platform, raised $12M in Series A funding from funds and accounts advised by T. Rowe Price Associates, Orion Resource Partners, Chrysalix Venture Capital, and Blumberg Capital.

👕 Rubi Laboratories, a San Francisco, CA-based company developing carbon-negative cellulosic textiles, raised $9M in Seed funding from Talis Capital, Tin Shed Ventures, Collaborative Fund, Necessary Ventures, and H&M Group.

✈️ PteroDynamics, a Colorado Springs, CO-based configurable VTOL aircraft manufacturer, raised $8M in Seed funding from CS Venture Opportunities Fund, Kairos Ventures, and Lavrock Ventures.

🛵 Velotric, a Shenzhen, China-based e-bike provider, raised $7M in Series A funding from Fosun Capital and Redpoint Ventures China.

🏠 Nyle Systems, a Brewer, ME-based heat pump water heater manufacturer, raised $6M in Series A funding from Aligned Climate Capital.

🏠 Domatic, a Palo Alto, CA-based smart home electrical wiring company, raised $4M in Seed funding from Brick & Mortar Ventures, Catapult Ventures, Alchemist Accelerator, and Third Sphere.

🌾 Inarix, a Paris, France-based real-time crop qualification platform, raised $3M in Seed funding from AFI Ventures, Ankaa Ventures, Label Investment, Newfund, and ResiliAnce.io.

☀️ Renovate Robotics, a Spokane, WA-based company developing solar construction robots, raised $3M in Pre-Seed funding from Alley Robotics Ventures, Climate Capital, SOSV, Newlab, and UpHonest Capital.

🧪 Genecis Bioindustries, an Ottawa, Canada-based startup turning food waste into compostable plastics, raised $2M in Series A funding from Amazon Climate Pledge Fund.

🚚 Qaptis, a Lausanne, Switzerland-based startup building mobile carbon capture devices for trucking, raised $1M in Pre-Seed funding from BlackWood Ventures, Cargill, and Plug and Play.

🌱 Asuene, a Tokyo, Japan-based carbon emission visualization platform, raised $1M in Series B funding from GLIN Impact Capital, GMO Venture Partners, and Sony Innovation Fund.

🧪 Provectus Algae, a Noosaville, Australia-based sustainable bio manufacturing platform, raised an undisclosed amount in Seed funding from CJ Bio.

🏠 PearlX, a Charlottesville, NC-based provider of smart grid infrastructure systems, raised an undisclosed amount of funding for a majority stake from Antin Infrastructure Partners.

SolarBank, a developer, owner, and operator of distributed solar power plants across North America, announced the successful completion of its IPO on the Canadian Securities Exchange.

Fifth Wall announced the close of $1.5B of new funds in 2022, including a $866M Real Estate Tech Fund III, €140M European Fund and $500M Climate Fund.

Hydrogen fuel takes flight: Air Company, the vodka-distiller turned sustainable aviation fuel maker (SAF), signed a $65M deal with the US Air Force to test if they can make SAF in remote locations such as an aircraft carrier. Meanwhile, Universal Hydrogen successfully flew a 40-passenger aircraft using primarily hydrogen during part of a record-setting 15-minute test flight.

Lithium-ion battery recycling company Li-Cycle scored a $375M conditional loan from the US Energy Department to expand their NY battery recycling plant. The first-of-its-kind facility in Rochester recycles old lithium-ion batteries into chemicals that can be used for batteries of more than 200,000 EVs a year.

Climate adaptation in real time: France is preparing to enforce water restrictions as the driest winter on record puts the country in a “state of alert” for droughts this summer.

Gas stoves…again! The US Consumer Product Safety Commission voted to seek public input on gas stoves, a potential first step in regulating the appliances. In case you missed the whole debate, here’s our refresher.

ESG’s getting political: Congress cleared a measure to block a Labor Department rule that allows retirement plan managers to incorporate climate and social considerations into their investment decisions. The effort by conservatives to bring ESG into the culture wars could make this measure President Biden’s first veto.

Transport is now the biggest sector for GHG emissions, and industry—not power—is the second-biggest emitter in the US. These are just some stats from BNEF’s comprehensive 2023 report that lays out wins and losses on EVs, emissions, energy storage, and climate adaptation.

Financial institutions are ‘woefully behind’ on deforestation risk, according to non-profit Global Canopy’s Forest 500 Report. Although half of the companies and financial institutions with the most exposure to and influence on tropical deforestation have public commitments to meet net zero by 2050, 40% have yet to set a single policy.

Biodiversity funds are approaching the $1T mark after tripling their assets in 2022. And regulation is catching up: The EU is preparing to implement its recent ban on imports of seven commodities tied to deforestation.

Climate VCs got twitterpated this week over the age-old Bits vs. Atoms debate.

The battle over mining for li-ion battery materials while minding impact continues as US mines plan openings on conservation sites. For a closer look at lithium: The company running the only active lithium mine in the US is considering reopening a North Carolina hard rock mine from the 1940s to 1980s as EV adoption drives growing lithium demand.

In the meantime, Ford's F150 Lightning strikes the hand that supplies it—the Amazon.

SAFs took off in the news this week: United’s new garbage mascot left us scratching our heads but intrigued. Watch Oscar the Grouch explain SAFs! Then go deeper, with Air Bp on SAF feedstocks and production pathways.

Ten documentaries from the Wild & Scenic film festival to watch!

THE DAC ATLAS won’t make you shrug and covers the role of DAC, the tech, siting, and scoring considerations.

Scope 3 remains a thorn in the side of corporate emissions. A new study from Microsoft and TCS finds that 84% of major firms don’t have science-based supply chain emissions targets.

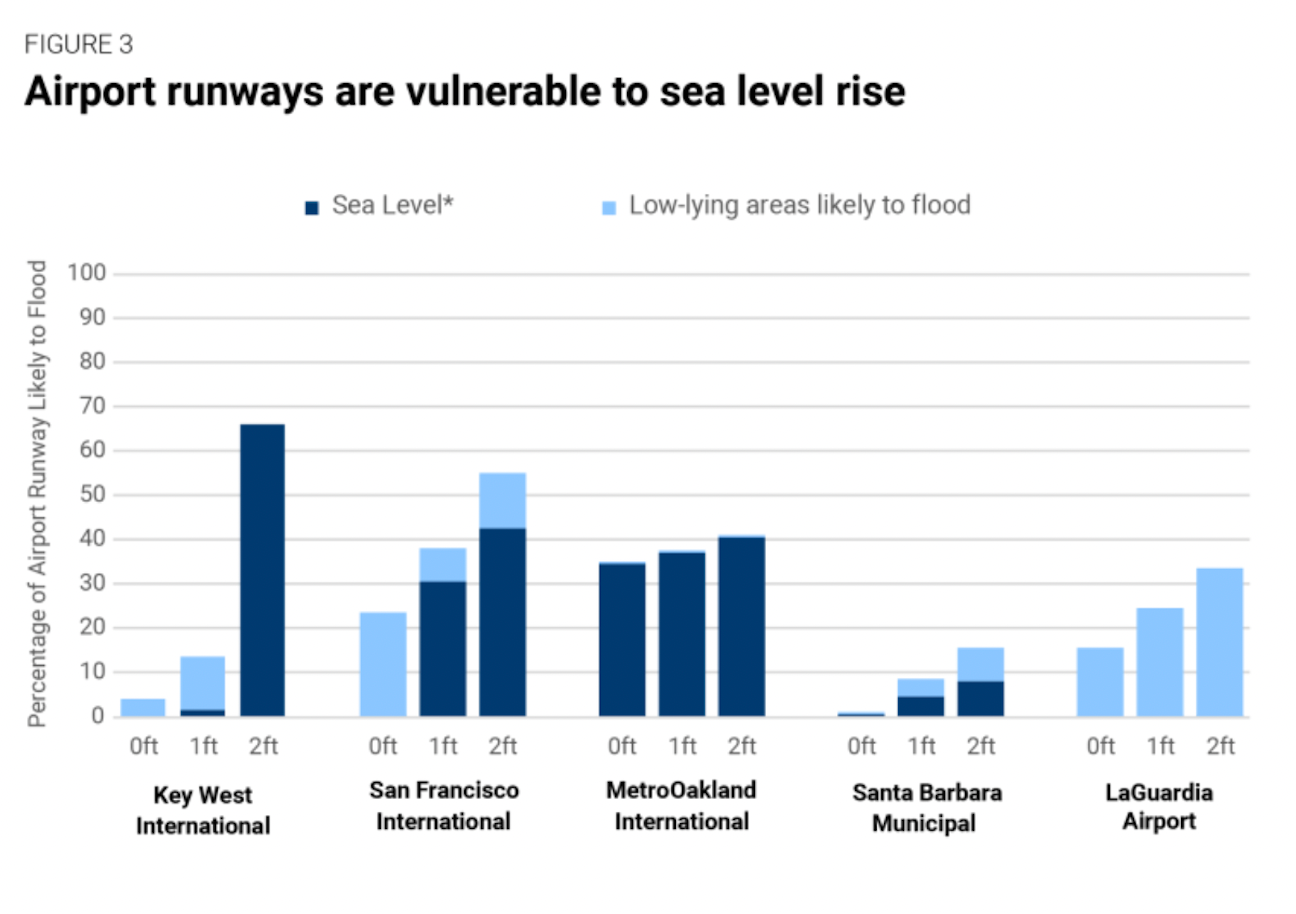

America’s airport runways are not ready for landing. LGA and SFO top the high flood risk list, with no federal funding for adaptation planning, per Brookings.

24 year old Pakistani climate activist Ayisha Siddiqa is Time’s Woman of the Year.

Geoengineering to the moon! Quite literally, as moon dust may shield us from overheating.

🗓️ CERAWeek: Attend or livestream various sessions of CERAWeek from Mar 6th - 10th to learn about navigating the world of energy, climate, and security. Kim will be attending so say hi!

🗓️ GSB Climate Summit: Register to join Stanford GSB’s fifth annual climate, business, and innovation summit on Mar 8th. This student-run event will explore challenges and solutions to climate change.

🗓️ MIT Climate & Energy Europe Semifinal: Register to join the various MIT Climate & Energy Competitions, which are student-led competitions for climate startups. The Europe Semifinal in Paris, France is on Mar 9th, the US Semifinal in Somerville, MA is on Mar 16th, and the Grand Final in Cambridge, MA on Apr 13th.

🗓️ ClimateRaise AMA: Register to view ClimateRaise’s Ask me Anything with Bettina Grab on Mar 16th to learn about marketing your early-stage climate tech startup.

🗓️ The Engine Tough Tech Talent: Register for the Engine’s Talent Fair, on Mar 24th, to engage with Tough Tech founders looking for various candidates to join their teams.

🗓️ Techonomy Climate Conference: Join on Mar 28th for this one-day, in-person gathering of climate experts, industry giants, entrepreneurs, investors, and government officials. Register now for a CTVC discount including access to all programming, breakfast, lunch, and closing reception.

Investor @Orion Resource Partners

Climate VC Associate @At One Ventures

Senior Analyst, Investment @Generate Capital

Research & Operations Associate @Molecule Ventures

Sales Development Representative @Waterplan

Freelance Product Designer @Pledge

Communications Manager @Heirloom

Chief of Staff @Generate Capital

Chief of Staff to the CEO @ClimateAi

Feel free to 📩 send us new ideas, recent fundings, events & opportunities, or general curiosities. Have a great week ahead!

One Big Beautiful Bill ushers in new (and old) energy agenda

Climate, capital, and carrots in London's new playbook

US plays popcorn politics with biofuels and beyond