🌎 Bright spots and sunsets in the OBBB #253

One Big Beautiful Bill ushers in new (and old) energy agenda

Happy Monday!

ICYMI, this newsletter made some headlines of its own on Friday. We shared an update on what’s been happening behind the scenes as Kim and co-founder Mark Taylor build a platform for CTVC data and intelligence beyond the inbox.

Getting back to other climate tech news, energy execs urge Congress to leave the IRA out of debt ceiling debates. Frontier makes its first set of carbon removal offtake agreements and Zimbabwe takes a hefty cut of carbon offset projects.

In deals this week, tech for reducing water usage pulls in $225M. Sustainable rare-earth magnets attract $75M and plant-based deli meats get a $30M slice.

No Friday newsletter content from us this week as we enjoy the holiday weekend. Have a safe and happy Memorial Day and we’ll see you back here on Tuesday!

Thanks for reading!

Not a subscriber yet?

📩 Submit deals, announcements, events & opportunities, or general curiosities for the newsletter here.

💼 Find or share roles on our job board here.

On Friday, Kim shared what’s next for CTVC.

TL;DR — CTVC raised $1.75M in pre-seed funding from leading climate investors, including John Doerr, Tom Steyer, Dawn Lippert, and AccelR8, to expand the newsletter into a market intelligence platform for the new climate economy. Decarbonization data veteran Mark Taylor, former head of product at BNEF, has joined the team as co-founder and chief product officer.

We tend to think of ourselves as analysts not bloggers (and don’t do a lot of back-patting), but it’s emblematic of the climate space how much love poured out from the crevices of the internet. You supported us as we started and hustled, and now we're long-term structured and financed to build this next chapter of CTVC for you—planeteers at the frontier of climate tech.

This is so awesome! @climatetech_vc has been putting out content that's so good, it just grows organically, for a few years now. I rush to read every new issue that drops.

— Sam Steyer (@SSteyer41) May 19, 2023

I'm always glad to see super formidable founders get funded to do something important! Go @KimberlyZou… https://t.co/HFR31CFmwp

From spot-on impressions and fitting puns, to accolades from founders, investors, and those who have lent a hand in building the newsletter, y’all certainly know us to a T. As they say, we feel “seen” 💚.

My best @KimberlyZou @SophiePurdom impersonation....

— Calvin, Science Person (@CalvinCupini) May 19, 2023

📩📊 CTVC, a London based, must-read newsletter turned climate intelligence platform raised $1.75M in Seed funding from John Doerr, Tom Steyer, Dawn Lippert, and AccelR8.https://t.co/i1NTNVHAzV

I open every @climatetech_vc newsletter in 5 mins, hot off the press. No email claims that esteemed status in my inbox!

— Sonam Velani (@sonamvelani) May 19, 2023

So proud of our @nyclimatetech friends @KimberlyZou, @SophiePurdom, & @TheNewGoldRush for growing their climate content & data off the charts (pun intended!)📈 https://t.co/9GAUw2qiyP

As we grow your go-to source on climate tech, we're expanding our platform based on these four pillars:

📊 Data-first, and further. The root of our reporting has always been our data. But to properly cover this ever-expanding and evolving ecosystem, we’re going further than funding. An alphabet soup of rounds doesn’t always translate into success, but real projects on the ground, commercial contracts, and partnerships do.

📰 Climate (and coverage) is one connected system. Climate tech solutions are connected and cyclical—clean electrons (renewables) need durable storage (batteries) to drive electrified transport (EVs) and zero-emission buildings (heat pumps). Our research approach to breaking down these markets will be as intertwined and relational as the clean electrons and molecules flowing through these systems. Sectors don’t stand in siloes.

🤝 Implementation takes integration. Net zero won’t be solved by startups and venture capitalists alone, nor will it be solved by corporates sticking to the status quo. It requires 1) corporates that buy and build, 2) governments that catalyze, 3) investors who fund and scale, and 4) founders who innovate. Similarly, our aperture will cover all four key sets of players.

⚒️ Bridging the innovation-deployment gap. As the market bridges from VC-backed innovation to real-world deployment, so will our coverage. If climate tech is to go the way of solar and wind, project development and financing for emerging technologies like green hydrogen and long-duration energy storage need a common language and set of data to scale.

To all our readers, the newsletter will always remain free and in your inbox every week. Now with our dedicated research and data connectivity across the capital stack, we're structured sustainably so that you can keep turning to CTVC for fresh, proprietary analysis from the inside.

And if you want to be among the first to try out the CTVC insights platform, sign up for the priority access waitlist.

💧 Gradiant, a Woburn, MA-based water and wastewater treatment company, raised $225M in Series D funding from BoltRock Holdings and Centaurus Capital.

🏠 Kensa Group, a Truro, United Kingdom-based ground-source heat pump developer, raised $87M from Legal & General Capital and Octopus Energy.

🏭 Noveon, a San Marcos, TX-based sustainable rare-earth magnets developer, raised $75M in Series B funding from NGP Energy Capital Management and Aventurine Partners.

⚡ Kyoto Fusioneering, a Tokyo, Japan-based nuclear fusion technology company, raised $73M in Series C funding from Coral Capital, DBJ Capital, Global Brain Corporation, INPEX Corporation, J-POWER, JIC Venture Growth Investments, Kansai Electric Power, Mitsubishi Corporation, Mitsui & Co, MUFG Bank, and SMBC Venture Capital.

🚗 Ethernovia, a San Jose, CA-based ethernet system for electric vehicles, raised $64M in Series A funding from Western Digital Capital, VentureTech Alliance, Taiwania Capital Management Corporation, Qualcomm Ventures, Porsche, Fall Line Capital, ENEA Capital, and AMD Ventures.

🏭 iDEAL Semiconductor, a Bethlehem, PA-based energy-efficient electronics components company, raised $40M in Series C funding from Applied Materials.

⚡ Peak Power, a Toronto, Canada-based energy storage optimization software platform, raised $35M in Growth funding from Greenbacker Capital Management, Osmington, BDC Capital, Export Development Canada, Hatch, Sensata Technologies, and The Atmospheric Fund (TAF).

🏠 Kelvin, a Brooklyn, NY-based provider of intelligent HVAC solutions including radiators, raised $30M in Series A funding from 2150, Partnership Fund for New York City, and Schmidt Family Foundation.

🥩 Prime Roots, a Berkeley, CA-based plant-based deli meat producer, raised $30M in Series B funding from True Ventures, Pangaea Ventures, Prosus Ventures, Top Tier Capital, Diamond Edge Ventures, SOSV, Solasta Ventures, Monde Nissin, Alumni Ventures, Gaingels, Meach Cow Capital, The House Fund, and Hyphen Capital.

🏭 Alloy Enterprises, a Somerville, MA-based aluminum-additive manufacturing company, raised $26M in Series A funding from Piva Capital, Unless, Flybridge Capital, MassMutual Catalyst Fund, Robert Downey Jr.’s Footprint Coalition, Congruent Ventures, and Riot Ventures.

🛵 Brompton Bicycle, a London, UK-based foldable bikes and e-bikes company, raised $24M from BGF.

⚡ Odyssey Energy Solutions, a Boulder, CO-based company working on renewables development in emerging markets, raised $15M in Series A funding from Union Square Ventures, Equal Ventures, Twelve Below, Transition, Equator, MCJ Collective, Abstract Ventures, Founder Collective, and Climate Capital.

🏠 DeepCtrls, a Nanjing, China-based energy-saving platform for industry, raised $14M in Series A funding from China Merchants Venture, Guangda Jinkong Industrial Investment Fund Management, Sequoia Capital China, Shenzhen Capital Group, Source Code Capital, and Yuanqi Capital.

☔ Mitiga Solutions, a Barcelona, Spain-based natural disaster risk and resilience platform, raised $14M in Series A funding from Creas, Faber, Kibo Ventures, Microsoft Climate Innovation Fund, and Nationwide Ventures.

🌱 Pledge, a London, UK-based carbon accounting for logistics company, raised $10M in Series A funding from Zinal Growth, Base Partners, ACE & Company, Lowercarbon Capital, and Visionaries Club.

🏠 Quilt, a Redwood City, CA-based producer of advanced residential heat pump systems, raised $9M in Seed funding from Lowercarbon Capital, Gradient Ventures, Incite Ventures, MCJ Collective, Garage Capital, Climate Capital, and Spaceadet.

🌱 FLINTpro, a Fort Collins, CO-based land-sector emissions management solutions platform, raised $9M in Series A funding from Understorey Ventures, Pollination, Persei Venture, Ananta-OM, and Synovia Capital.

🏭 Glassdome, a Camas, WA-based regulatory compliance and emissions tracking platform for manufacturers, raised $9M in Series A funding from Atinum Investment, Crit Ventures, Dunamu, Lotte Chemical, Murex Investments, and Primer Sazze Partners.

🏠 SaveMoneyCutCarbon, a London, UK-based marketplace for energy efficiency products, raised $6M in Growth funding from Barclays Sustainable Impact Capital, IW Capital, and Low Carbon Innovation Fund.

🌱 StepChange, a New York, NY-based corporate sustainability platform, raised $4M in Seed funding from Antler, BEENEXT, Genesia Ventures, Global Founders Capital, Saison Capital, Seedstars, Speciale Invest, and Whiteboard Capital.

🌱 Tangible, a San Francisco, CA-based platform that helps building developers measure carbon footprints and find low-carbon materials, raised $3M in Seed funding from Asymmetric, Deco Ventures, Fifty Years, Foundamental, Pi Labs, and Redstone.

🌾 Resurrect Bio, a London, UK-based crop-health technology company, raised $2M in Seed funding from UK Innovation & Science Seed Fund, AgFunder, and Shake Climate Change Accelerator.

🍎 Figorr, a Lagos, Nigeria-based real-time, cold-chain solutions company, raised $2M in Seed funding from Atlantica Ventures, Jaza Rift Ventures, Katapult, and VestedWorld.

🛵 Tier Mobility, a Berlin, Germany-based electric scooters company, raised an undisclosed amount from Speedinvest, Northzone, Mubadala, Goldman Sachs, and SoftBank.

🛰️ Amini, a Nairobi, Kenya-based environmental data platform, raised an undisclosed amount in Pre-Seed funding from Pale Blue Dot, RaliCap, and W3i Fund.

🚗 Kofa, an Accra, Ghana-based electric motorcycles and battery swapping company, raised an undisclosed amount in Seed funding from Mercy Corps Ventures, Shell Foundation, UK’s FCDO, and Wangara Green Ventures.

⚡ dcbel, a Monteral, CA-based producer of bidirectional EV chargers, raised an undisclosed amount of funding from The Volvo Cars Tech Fund.

⚡ Low Carbon, a London, UK-based renewables investing and asset management company, raised $388M in debt from ABN AMRO Fund, ING Group, Commonwealth Bank of Australia, and Intesa Sanpaolo.

⚡ PosiGen, a Metairie, LA-based household efficiency solutions company, raised $250M in a debt facility from Brookfield Asset Management.

⚡ Ambient Fuels, a New York, NY-based green hydrogen project developer, raised $250M from Generate Capital.

⚡ M-KOPA, a Nairobi, Kenya-based energy financing company, raised $255M in debt financing from Standard Bank Group, International Finance Corporation, FMO, British International Investment, Mirova, and Nithio Holdings, and equity investment from Sumitomo Corporation, Lightrock, Latitude, Blue Haven Initiative, and Broadscale.

⚡ Accelergen Energy, an Austin, TX-based renewable power and storage developer, raised $30M from Leyline Renewable Capital.

💨 Susteon, a Cary, NC-based DAC and SAFs developer, raised $400K from Aviation Climate Taskforce.

🚗 VinFast, a Hai Phong, Vietnam-based EV manufacturer, announced a SPAC merger with Black Spade Acquisition Co.

☀️ Anza Renewables, an Oakland, CA-based solar and storage procurement platform, completed its spin-off from Borrego Energy, along with raising an undisclosed amount from Energy Capital Partners and Angeleno Group.

☀️ Evolar, a Uppsala, Sweden-based Perovskite tandem solar cell technology company, was acquired by First Solar for $38M (with additional payment up to $42M based on milestones).

⚡ Plants & Goodwin, a Bradford, PA-based service provider plugging orphaned oil and gas wells, was acquired by Zefiro Methane.

⚡ Pattern Energy Group, a San Francisco, CA-based renewable energy developer and operator, sold their Japanese assets to NTT Anode Energy and JERA.

Morgan Stanley, a New York, NY-based investment firm, held a first close of $500M for their 1GT climate private equity strategy (1GT).

TDK Ventures, a San Jose, CA-based investment firm, raised a $150M fund to invest in energy and climate tech startups.

The World Meteorological Organization warned that El Niño may push global temperatures past 1.5 degrees C. This makes it near certain that one of the next five years will be the world’s hottest on record (though temporarily hitting that temperature threshold is not the same as reaching an average of 1.5 degrees across many years).

Over 100 clean energy executives signed an open letter urging Congress to protect the Inflation Reduction Act after US House Republicans passed a bill to limit spending amid debt ceiling negotiations.

Zimbabwe will take 50% of all revenues generated from offset projects developed on its territory, inducing uncertainty and caution for carbon credit projects around the world. The African nation is currently the world’s 12th largest creator of offsets, with 4.2 million credits from 30 registered projects last year.

The US Energy Department announced $251M to back nine projects in multiple states for developing or expanding large-scale carbon storage and transport. It's the first wave of funding from programs in the 2021 US bipartisan infrastructure law.

Frontier’s first set of offtake agreements will pay Charm Industrial $53M to remove 112,000 tons of carbon dioxide between 2024 and 2030 and store them underground in abandoned oil wells. Meanwhile, Microsoft purchased ~2.8M tons of carbon removal credits from Ørsted.

The White House released a comprehensive plan aimed at fixing the US energy transmission system through permit reform. Though the plan calls for the US Congress to pass legislation, it also acknowledges the ability of different federal agencies like the DOE to accelerate projects through designations such as the National Interest Electric Transmission Corridors, which were designed in the Energy Policy Act of 2005 but have yet to be used.

Ahead of the G7 summit in Hiroshima, Japan emphasized that rich nations must step up financial and technical support to poorer countries to help them tackle climate change and pursue decarbonization. In 2009, developed countries promised to provide $100 billion annually to vulnerable states affected by climate-linked disasters from 2020 to 2025, but never met that target.

Denmark’s Topsoe A/S is preparing to spend $300M on a US hydrogen electrolyzer factory in the latest example of the Biden administration’s federal incentives drawing foreign investment. Since the passage of the IRA in 2022, investments in US production of clean energy and climate technologies both domestically and from abroad have soared.

Damningly direct causation: a study linked 19.8 million acres of forest fire directly to the emissions caused by fossil fuel and cement companies.

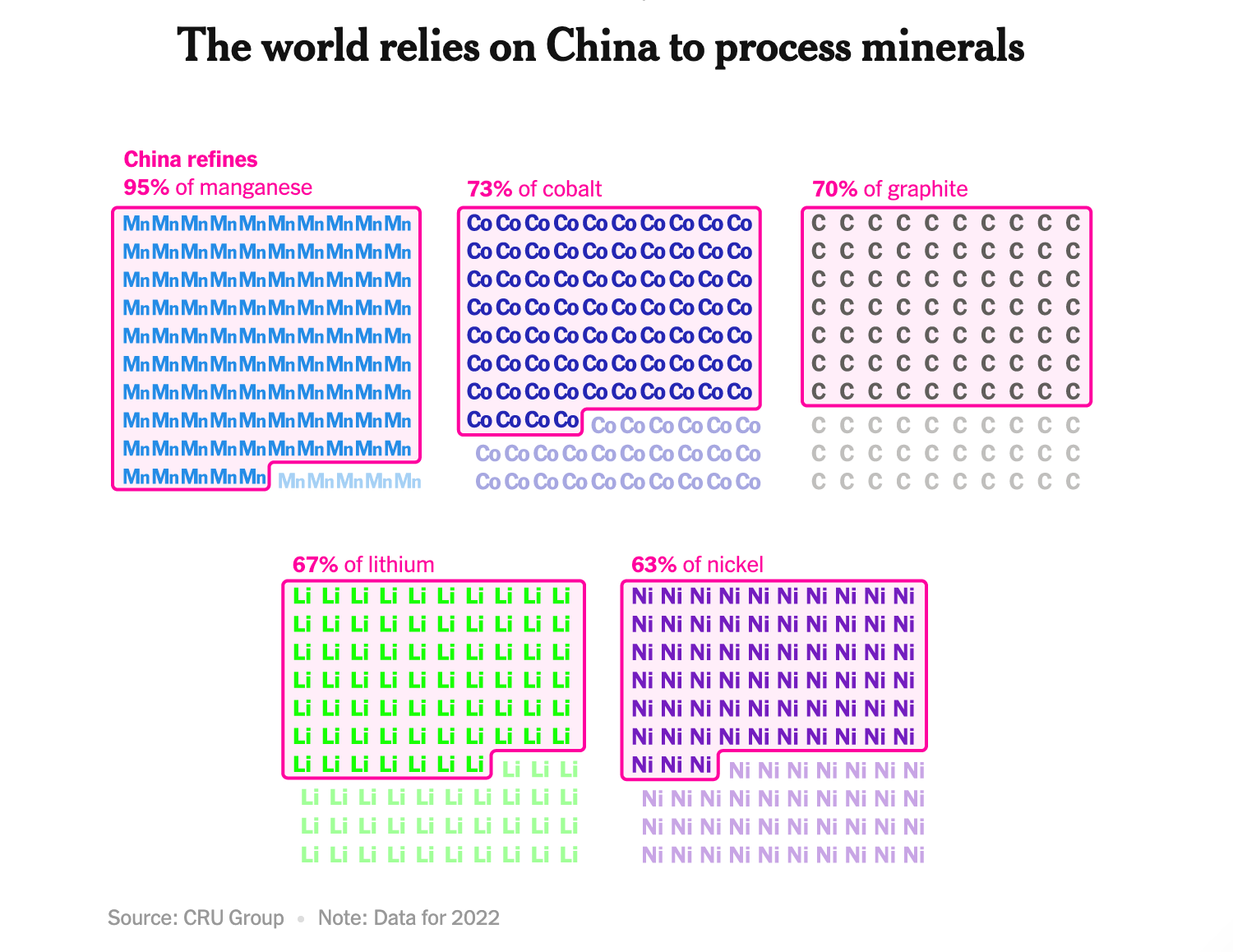

China is the key input to EV batteries. Nifty visualizations from the NYT show the nation’s control of the mining and refinement of rare minerals for EVs.

If humans can’t build solar fast enough, robots could speed construction—and cut costs.

When trash becomes an unexpected nursery, well-intended ocean garbage patch cleanup could destroy ecosystems.

Silicon Alps: Climate tech venture in Europe.

Grid operators are sweating it out as most of the US faces higher risk of summer blackouts.

How rooftop solar is keeping Lebanese lights on.

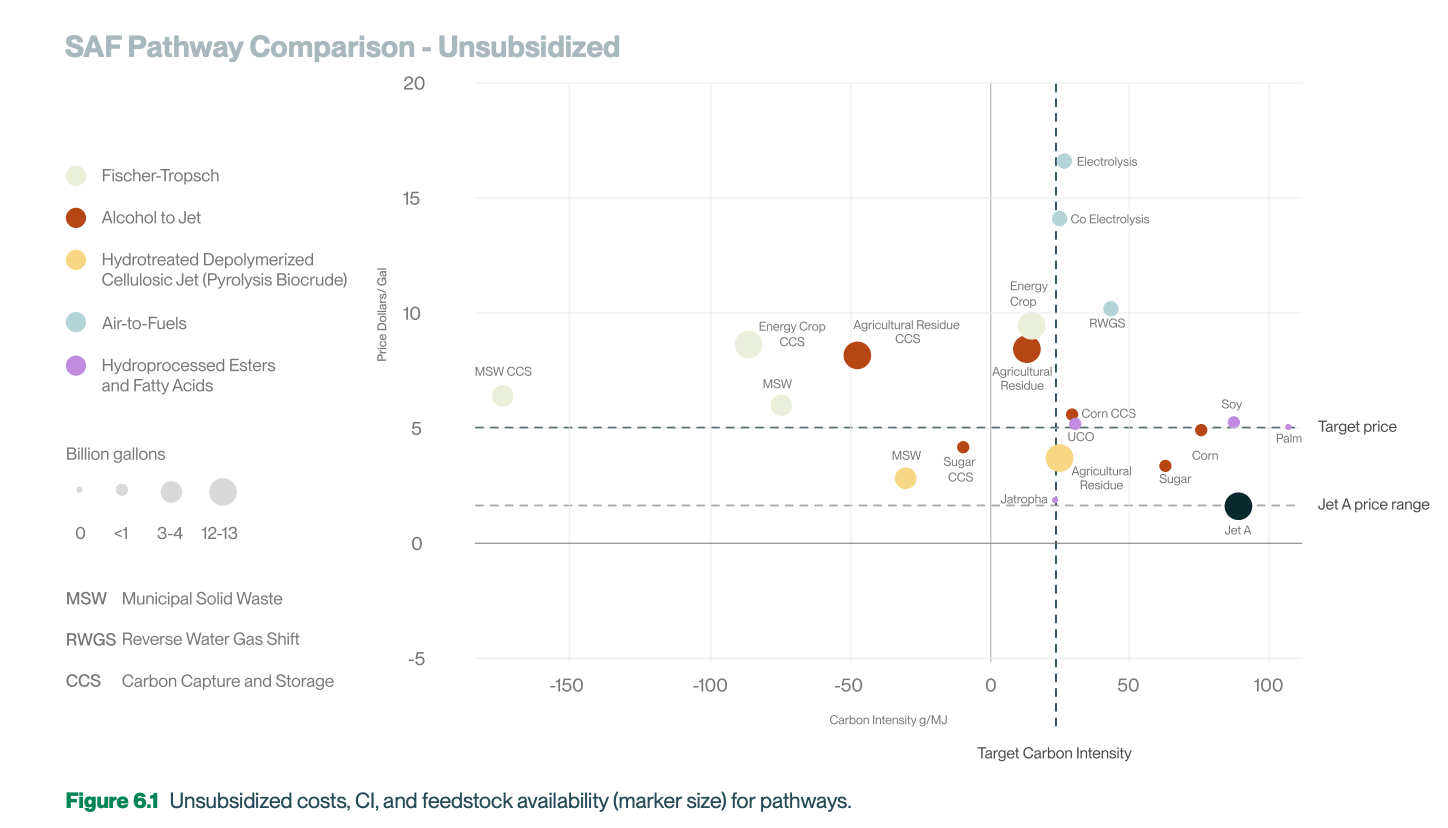

Get your SAF knowledge ready for take-off with this primer from Carbon Direct.

New paper proposes the math and an ultimate sticker price for climate reparations from 21 O&G Cos: $23.2T.

An enemy at the floodgates in Italy suggests a new battle against climate change across Europe.

Mosquitoes and allergies and superbugs, oh my! The health implications of climate change aren’t something to sneeze at.

💡 Village Capital: Apply by May 25th to the Climate Justice for Migrants and Communities of Color accelerator and apply by June 12th for the Dream Climate Tech Launchpad fellowship to receive investment-readiness training, mentorship, 1:1 coaching with an investment analyst, and financial support.

🗓️ London Tech Week: Attend London Tech Week’s ClimateTech Summit in Westminster on June 13th.

🗓️ Transition-AI: Get tickets to this in-person conference in Boston on June 15th to gather with experts charting a path forward with AI in the energy transition.

💡 Go Make 2023: Apply by August 4th to Greentown Labs and Shell’s accelerator for TRL 2-7 startups with innovations for carbon utilization and management.

Head of Engineering, DAC Venture, Associate, New Venture Creation @Deep Science Ventures

Investment Analyst @Revalue Nature

Senior Investment Associate - Climate @Remarkable Ventures

Energy Trading Analyst @Equilibriun Energy

Business Development Manager @Isometric

Director, Software Engineering @Thalo

Sr. Project Manager, Infrastructure Projects @Electric Hydrogen

Director, International Business Development @EnergyHub

Director, Innovative Climate Finance @US International Development Finance

Senior Project Manager, Chief of Staff @Euclid Power

Feel free to 📩 send us new ideas, recent fundings, events & opportunities, or general curiosities. Have a great week ahead!

One Big Beautiful Bill ushers in new (and old) energy agenda

Climate, capital, and carrots in London's new playbook

US plays popcorn politics with biofuels and beyond