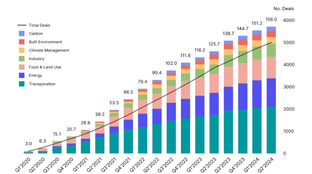

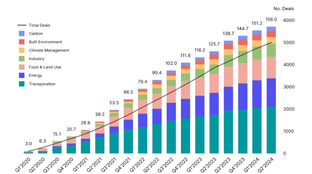

🌎 A weak $11.3bn start to 2024

Poor performance this half as investment falls to 2020 levels, but some strong plays.

An update from Kim as CTVC prepares to go beyond the inbox

We first put pen to paper in early 2020, when “climate tech” was still healing from the scars of Cleantech 1.0. Sophie and I built this newsletter on the foresight that climate change is not just a crisis but also an opportunity—and a trillion dollar one at that.

We’ve been keeping the pulse on climate tech ever since, from reporting on the meteoric rise of climate venture funding surpassing $40B to US climate legislation’s triple whammy (IRA, IIJA, CHIPS). We started from data up, tracking early-stage funding, founders, and investors. As the venture funding market boomed, so did our coverage. We helped draw the climate tech map as definitions were still evolving. We dove into new sectors, from carbon markets to mining and broke down the capital stack and public funding necessary to bring these solutions to light.

Last year, I began to feel another major shift underfoot. What started out as a pandemic-era side project was now being opened twice a week by decision-makers at corporates, investment firms, financial institutions, and governments. (Fun fact: most of you open each issue within 5 minutes of it hitting your inbox 🤯). With every new feature, we found our inbox overflowing with readers asking to double-click into our charts and data. And we kept seeing CTVC pop up in investor decks, conferences, and equity research.

Right on time, I met Mark Taylor. As one of the OG analysts at BNEF, Mark has been on the frontlines of cleantech since the true early days (pre-Bloomberg acquisition) and built the sector insight offerings in CCS and geothermal from scratch. He then went on to head product development with a global team in London, where he was a member of BloombergNEF’s executive management committee and an integral part of the company’s growth strategy and—just as important—its execution.

Mark is a seasoned executive, a thoughtful product architect, and dedicated team builder. He is a climate visionary with 15 years devoted exclusively to thinking about what’s next in decarbonization. From our first conversation, the signal was clear that Mark was the missing partner we'd been looking for who could help us build our insights beyond the inbox and would ensure we delivered to our audience a true product that they deserved. Mark is everything that CTVC needs to move into its next phase, and I am thrilled that he is joining as co-founder.

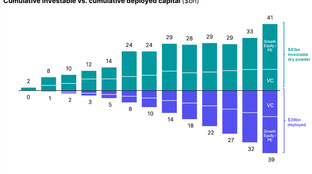

In the summer, Mark and I talked to readers sitting at corporates, investment firms, governments, and financial institutions. Despite ~$100B of dry powder marked to fund climate and a legislative goodie bag of incentives, no one quite knew where to start. Dollars and strategies were being marked for decarbonization, yet the playbook on how, when, and where to deploy was still being written.

CTVC has built the leading voice in climate innovation and now we’re expanding our platform to meet the growing demand for deeper data and insights—based on the four pillars below:

1) Data-first, and further. The root of our reporting has always been our data. We’ve been obsessively tracking the thousands of companies and capital allocators pushing for a low-carbon future and built the taxonomy for climate tech from the ground up. But to properly cover this ever-expanding and evolving ecosystem, we’re going further than funding. An alphabet soup of rounds doesn’t always translate into success, but real projects on the ground, commercial contracts, and partnerships do.

2) Climate (and coverage) is one connected system. Climate tech is a mental framework for building a low-carbon future. That framework is how we understand, decarbonize, and adapt to our warming world. Solutions are connected and cyclical—clean electrons (renewables) need durable storage (batteries) to drive electrified transport (EVs) and zero-emission buildings (heat pumps). Our research approach to breaking down these markets will be as intertwined and relational as the clean electrons and molecules flowing through these systems. Sectors don’t stand in siloes.

3) Implementation takes integration. While I was an investor at Energy Impact Partners, I observed firsthand the realistic challenges of disruptive innovators and corporate customers partnering on scalable implementation. Net zero won’t be solved by startups and venture capitalists alone, nor will it be solved by corporates sticking to the status quo. It requires 1) corporates that buy and build, 2) governments that catalyze, 3) investors who fund and scale, and 4) founders who innovate. Similarly, our aperture will cover all four key sets of players.

4) Bridging the innovation-deployment gap. As the market bridges from VC-backed innovation to real-world deployment, so will our coverage. Deep decarbonization of the global economy still requires new technologies to come up the curve, and there are still hard problems to solve. If climate tech is to go the way of solar and wind, project development and financing for emerging technologies like green hydrogen and long-duration energy storage need a common language and set of data to scale.

All these plans take greater horsepower to execute. We're lucky that a meaningful group of longtime supporters share our vision and have come aboard as investors and advisors. We’ve raised $1.75M in pre-seed funding from leading climate investors including John Doerr, Tom Steyer, Dawn Lippert, and AccelR8. Alongside our investors, we’ve assembled an advisory board of experts who have built the leading research platforms Lux Research, GTM, and BNEF, including Matthew Nordan, Shayle Kann, and Michael Wilshire.

I’ve left my role at EIP to double-down on CTVC. Mark has joined the team as Co-founder and Chief Product Officer, bringing his decade-plus experience building research products and tools. We also brought on Grace as Executive Editor to drive forward CTVC’s narrative and market coverage and Oliver as part of our ever-growing research team (p.s. we're hiring!). Sophie continues to write, serve on the board, and build the CTVC platform while investing real dollars via her new early-stage climate venture fund, Planeteer Capital—more to come here!

We’re already working with a select group of early clients, ranging from major financial institutions, energy and industrial corporates, to late-stage investors. Keep an eye out 👀 and mark your calendars 📅 for a platform deep dive in early fall! In the meantime, for those interested in a peek behind the curtain, we’d love to hear from you!

As we grow CTVC, our core mission will remain the same: accelerate climate tech deployment. Thanks to you, we’ve built the leading source in climate tech with a 50,000+ strong community. To all our readers, the newsletter will always remain free and continue to hit your inbox every week. Now with our dedicated research and data connectivity, you can keep turning to CTVC for fresh, proprietary analysis from the inside.

Literally can’t get enough? Come join us! We’re hiring engineers, researchers, and data analysts.

Poor performance this half as investment falls to 2020 levels, but some strong plays.

$82bn of new capital for climate tech in the past 6 months

A new interactive Climate Capital Stack Map