🌎 A weak $11.3bn start to 2024

Poor performance this half as investment falls to 2020 levels, but some strong plays.

Fewer dollars, more climate innovation in 2022 climate tech market report

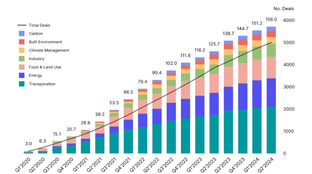

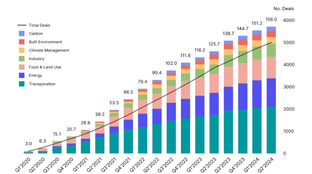

The market slowdown has officially hit climate land. 2022 funding was down 3% from the prior year as investors poured $40B+ into climate companies. But even a global slowdown isn’t slowing the rate of climate innovation - deal activity defied the odds and gained 40% versus 2021’s bonanza, with ~1,000 venture and growth-stage climate deals closed in 2022.

As the market tightens, we’ve reflected the same with our methodology. CTVC’s intention is to be the most accurate source of climate venture funding data - even as the market size retracts. The 2022 market report findings below validate your market survey sentiment and our dry powder predictions of a slower H2’22. We anticipate more, smaller deals, continued diversification into emerging climate technology sectors, and specialization as the mid and growth-stages stay dry into the new year.

💸 Climate tech companies raised +$40B across ~1,000 venture and growth deals in 2022

💰 2022 funding was 3% down from 2021’s peak, driven by a 24% drop in Growth stage funding

🪜 A tale of three stages: while the Growth stage dropped, the Middle of the market flattened, and (Seed, Series A) Early stage activity accelerated 61%+

📉 Round sizes were smaller at every stage, with sharper 30%+ declines in Later-stage

📈 Meanwhile, deal count grew ~40% up and to the right across every industry

💨 Carbon and Built Environment are emerging stars, multiplying 2.4x and 3.8x in funding respectively since 2021

💼 ~2,000 investors joined more than 1 climate deal in 2022. Of those, 613 invested in more than 5 climate deals last year

🌱 Specialist investment firms led the most deals in their respective industries

As we always say, climate tech is a theme not an industry - but even themes must be defined in pursuit of rigor. Our methodology for defining climate tech comes with two filters: 1) climate impact and 2) climate vertical. Companies must tick the box in at least one category for both filters in order to make the cut.

Climate impact: Climate tech companies must fulfill one or more of the below “climate impacts”

Climate vertical: In addition to having climate impact, companies must categorize into at least one of the 7 broad climate verticals below (skip to the end for a full definition). These verticals encompass 60+ sectors and 250+ technologies helping us mitigate, adapt, monitor, remove, and regenerate to our warmer and weirder world.

Asset class: This funding report captures defined Venture Capital and Growth Equity only. Where other market observers may promote larger climate market sizes, we stay true to our Climate Tech VC name and carefully exclude:

Now, without further ado, let’s get down to the data.

Subtle changes underlie the story of slow but steady diversification away from “clean tech” industries (63% of total count into Food & Land Use, Energy, Transportation) and towards fast-growing emerging innovation areas like Climate Management, Built Environment, and Carbon.

⚡ Energy - The electrons and fuel that power us

Sectors: new generation technologies (e.g., nuclear, solar, geothermal), energy storage, hydrogen and other low-carbon fuels, enabling renewables software, marketplace, and grid management platforms, DER and demand response tools, utility transmission and distribution services

🚗 Transportation - The movement of people and goods

Sectors: battery technologies, EV autos, EV charging and fleet management, electric micromobility and ridesharing, zero-emission planes, boats, and trains, urban public transport

🌾 Food & Land Use - The nutrients and resources that give us life

Sectors: alternative proteins, regenerative farming, vertical farming, sustainable fertilizer and animal feed, nature restoration and ecosystem services, remote sensing for crop yield optimization, autonomous farming equipment, water tech, and food waste reduction

🏭 Industry - The goods and raw materials we use every day

Sectors: low-carbon cement, chemical and plastics, steel, manufacturing, metals and mining, circular economy commerce, sustainable textiles and packaging, waste and recycling

🛰️ Climate Management - The data, intelligence, and risk associated with a changing climate

Sectors: emissions and sustainability reporting, ESG investing and fintech, earth observation through remote sensing, climate risk and intelligence platforms

🏠 Built Environment - The places we live and work

Sectors: sustainable building materials, low-carbon heating and cooling, prefab construction, energy efficiency, building electrification and energy optimization

💨 Carbon - The avoidance and removal of emitted carbon

Sectors: carbon offset marketplace and procurement platforms, carbon utilization, carbon removal and storage technologies, point-source CCS, verifiers and ratings enablers

***Note: Please note that some of our numbers are larger in this update than previous editions. We constantly update the dataset to have the most accurate data possible, including adding post-dated deals.

Poor performance this half as investment falls to 2020 levels, but some strong plays.

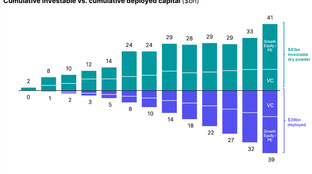

$82bn of new capital for climate tech in the past 6 months

A new interactive Climate Capital Stack Map