🌎 Two climate investors on raising in today's tough market

Q&As with Sophie Purdom, who just closed first-time Planeteer Fund I, and John Tough, who recently closed Energize Capital's mega-fund Ventures Fund III

Late breaking ‘Inflation Reduction Act’ changes odds for the better w/ Rhodium’s Ben King

Editor’s Note: In the time since we initially wrapped this feature, the Inflation Reduction Act dropped, changing the initial answers and summary in Rhodium Group’s ‘Taking Stock 2022’ treatise on net greenhouse gas impact trends. Associate Director Ben King has since updated and annotated their report, and we’ve updated some of our analysis and commentary accordingly to accommodate these developments.

The Rhodium Group, a foundational economic policy think tank and analysis group, helps set the standards for accounting for the net impact of climate change today. In their most recent annual report, the dearth of climate policy success initially indicated odds of a 24-35% cut in US net GHG emissions.

Upon Manchin’s reversal and the sudden passing of the Inflation Reduction Act, Rhodium’s estimates indicate a likelier scenario of a 31-44% cut of US net GHGs below 2005 levels by 2030. Climate innovation stands to pick up the difference, and in our Q&A with Rhodium we explore the intersection of investment, policy and shifting corporate priorities towards meeting Paris targets. Tl;dr - innovation plays a critical role for harder emissions reductions towards the target cuts, and policies and funding bills like the IRA will shape the market landscape across climate tech for decades to come.

What’s the history of Rhodium Group and the Taking Stock report?

Rhodium Group was founded in 2008 to cover practice areas including Chinese economics, social and political development, and energy and climate change. For the last eight years, we’ve put together our annual Taking Stock report on energy and climate, which projects where US emissions are expected to go over the next 10-15 years. We put out these annual reports to equip policymakers and other stakeholders with an understanding of where the US is headed absent substantial policy changes today.

What are the key assumptions and math driving the scenarios?

Rhodium Group uses a model called the National Energy Modeling System (NEMS), which is the same tool that the US Energy Information Administration (EIA) uses to produce their Annual Energy Outlook. We take NEMS, update it with our own assumptions, then produce our own policy forecasts.

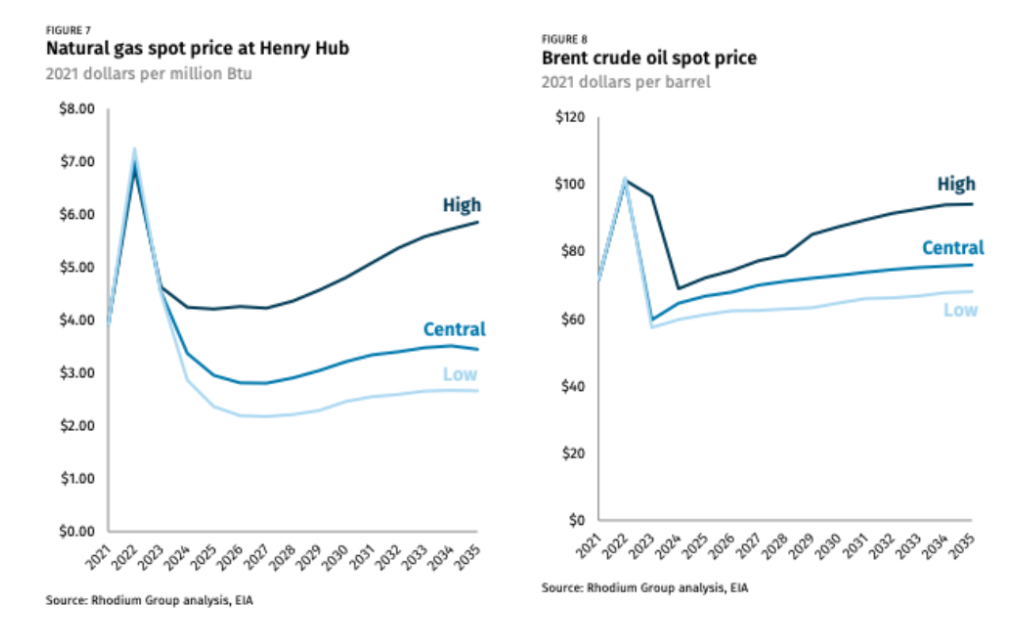

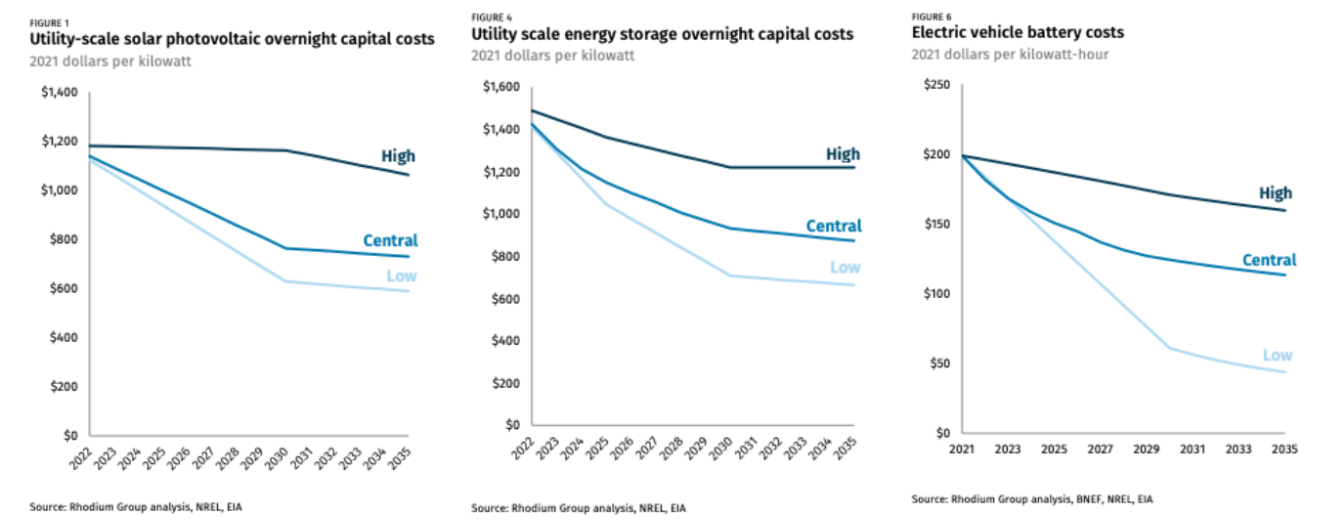

The biggest thing that we change relative to the EIA is using updated tech cost and performance assumptions, largely from the National Renewable Energy Lab (NREL). The NREL benchmarks where they think solar, wind, and geothermal costs are headed down the line. We also take a hard look at the assumptions around oil and gas markets. So our updates reflect both near term turbulence in the market - something that’s obviously particularly relevant this year - but also analyst assumptions around things like Brent Crude prices and how those might fluctuate within our time window through 2035. The third big set of things that we update in our assumptions is around macroeconomic growth in the US economy based on the Congressional Budget Office, IMF, big banks, and other NGOs’projections.

Our model optimizes across energy production and consumption - from oil and gas production, availability of solar, wind, geothermal, and hydroelectricity as well as the demand coming from buildings, transportation, industry - to create a least cost energy system that meets the system’s policy and physical constraints. All of these factors feed into each other, for example, cheaper solar leads to more renewables development and in turn, less natural gas production because of satisfied demand.

We try to create bounding scenarios around a central case which help folks understand where the US could be in 2030, 2035, and beyond.

[Prior to the release of the IRA] you found that the US is on track to reduce emissions 24-35% by 2030 absent policy action. Why is this a rosier outlook compared to Taking Stock 2021?

There are a few factors behind this. This year, projections of US economic growth have lowered from a 2.1-2.2% to 1.8-1.9% average annual growth rate through to 2035. The compounding effect of this lower growth rate is significant. A lower GDP in the model means less industrial output and less demand for fuels and feedstocks. This also flows through to less energy used in freight transportation, as well as in less disposable income in consumers’ pockets. All of these flows have knock-on effects, reducing overall greenhouse gas emissions.

The other major change since last year is an upwards revision of expected fossil fuel prices driven by the war in Ukraine. More expensive oil and gas drives further adoption of cheaper renewables, which decreases emissions. Our lowest emission scenario (35% reduction by 2035) assumes a combination of very cheap wind and solar and relatively expensive oil and gas prices.

Is this then an argument for degrowth as the solution for decarbonization?

We wouldn’t suggest that’s the best way to decarbonize the economy. COVID and the following economic recession brought a meaningful reduction to GHG emission, but at a substantial cost to society in economic and public health terms. There certainly is an unintended knock on effect of reducing emissions, but it’s not how we think about the right decarbonization path going forward.

So, how should we think about the role innovation should play in decreasing emissions-intensity (vs degrowth)?

We've talked about some of the major drivers, GDP and fossil fuel prices, but continued improvements in cost and performance of cleantech absolutely play a role in decreasing emissions intensity. In the power sector, technological improvement and learning have enabled wind and solar to reduce both their upfront and expense costs, making them more cost competitive against oil and gas.

The transportation industry is following similar trends. Using EV battery prices from Bloomberg New Energy Finance, our most optimistic scenario shows that EVs could make up as much as 62% of light-duty vehicle (LDV) sales by 2035. In that low emissions scenario, gasoline is getting more expensive while EV battery prices are declining. Clearly, innovation plays a vital role in making clean alternatives attractive and economically accessible while decreasing overall emissions intensity.

How did you define the universe of technologies you included in the scenario?

We start from the suite of technologies that EIA uses – wind, solar, and conventional power sources – then expand that to include emerging technologies. For instance, we've expanded the model to include Allam cycle plants, a combined natural gas and CCS technology that currently has its first large-scale deployment by a company called NET Power. We talk to developers and VCs on the ground, and when there's enough of a consensus that a certain technology is at commercial stage, we work to incorporate that into our model and reports.

How do emerging clean technologies like green hydrogen, carbon capture and direct air capture play a role?

While these emerging technologies are on the verge of commercialization, largely from the investments related to last year's Infrastructure Bill, we’re not seeing a lot of deployment under the current policy. They play a minor role in our current modeling, but are important investments nonetheless to determine what additional policy could do through 2035 and beyond to achieve decarbonization goals.

How do you define innovation vs deployment? At what stage, does deployment “count” in your analysis?

We typically look at it from a capacity or volume perspective. For instance, NET Power’s first plant is a 50 MW scale plant that’s already up and running. They’ve got a 300 MW plant expected to run in the next couple of years, which represents meaningful commercialization progress.

Likewise, when we think of DAC, we think of plants that are on the million-ton-per-year scale. So far, very small demonstrations have been set up (mostly internationally) but we’re looking to find the next level up. It's certainly a subjective decision – an art, not a science – despite working in a very scientific field. We grapple with questions like: what truly represents commercial scale? Where and when does the transition happen?

Last year, we added the Allam Cycle technology and small modular reactors, as those appear to be getting closer to commercial viability. There's obviously a suite of technologies out there, and it's an ongoing challenge to stay up to date on the latest state of the art.

What are the assumptions around technology cost and performance over time? Have we reached the end of the learning curve?

There is a flattening out of CapEx cost reductions particularly at 2030 and beyond. There have been such immense cost declines over the past 10 years, where at some point, we’re starting to hit the physical limits. This level of cost reduction on current technology can't sustain itself forever, but there's certainly opportunity for breakthroughs even in incumbent technologies. Maybe something like solar perovskite gets a toehold in the market and drives a step-change in solar costs. But it’s tough for us to capture those edge cases in our scenario modeling.

How are you incorporating land use and carbon sequestration assumptions?

We source our land use assumptions from the US biennial report, which has two different pathways - 1) maintaining the high level of sequestration that we've seen over the past decade, or 2) reflecting the worsening ability of natural lands to serve as a carbon sink. On top of that, we layer on technological removal solutions such as direct air capture or ethanol fermentation which can act as a carbon sink if you’re doing CCS on it. Our sequestration assumptions fall under the carbon removal in the bottom right of Figure 2.

Last year, we put out a report called Pathways to Paris, which modeled a set of policies - from federal, state, to even corporate actions - that would get us to our 50% Paris target. Part of those policies included meaningful federal investments in forests and working lands to amplify their ability to serve as carbon sinks. We can even go beyond current best practices on soil and forest conservation with new technologies on the horizon.

There are also land use considerations separate from their drawdown potential. Solar and wind deployment are more land-intensive than other energy resources, which we’ve represented as declining solar supply in already-saturated regions.

Industrial emissions is the only sector where emissions are rising. What’s the case for this? What are technology or policy levers to bring this down?

That's one of the most interesting findings in this year’s report. There have been significant emissions shifts across sectors as certain technologies scale and become economical. In the early 2010s, the power sector was the largest emitting sector, but with continued decarbonization progress, we saw transportation overtake the power sector as the largest emitting sector in the US in 2016. By virtue of the economics of clean energy technologies, we see a continued decline in power sector emissions. Likewise in transportation, declining EV battery prices and more aggressive federal regulations for fuel economy are driving down transportation emissions in the next decade.

So the last big sector left standing is Industry. There isn’t a clear industrial decarbonization technology where we're seeing a major market uptick because the economics aren't there yet. Absent meaningful policy pushes, we can’t project any major decarbonization in the industrial sector.

In power, we have solar and wind; in transportation, we have EVs as the market winner. But in industry, there's still a major question around what the equivalent of that is. There are a range of solutions out there like CCS. We’ve seen a modest amount of CCS retrofits happening in certain industrial sectors that are economically enabled by the current tax credit regime. For example, ammonia production and natural gas processing plants release a very pure stream of CO2 that's easy and cheap to capture, and you can use the 45Q tax policy to finance that today. But unfortunately, 45Q is set to expire in a couple of years (which the IRA would extend through to 2032). It’s also set at a level today where you can't get into that next tranche of industrial CCS opportunities - refineries, cement manufacturing facilities, and iron and steel facilities - where retrofits are technically possible but the economics don't pencil with the current policy.

Another alternative pathway is hydrogen. Hydrogen today makes up a small part of the industrial economy in refining and ammonia production, but it could be expanded to be used as a fuel and replace natural gas or coal for combustion purposes, or as a feedstock in industrial processes. With clean green hydrogen, we’re talking meaningful reductions in industrial emissions. But clean hydrogen still faces a significant premium relative to natural gas-produced steam methane reforming (SMR) hydrogen, often called “gray” hydrogen in the literature.

The economics for clean hydrogen don’t pencil and there’s no regulatory forcing function. No industrial refiners would make that economic decision, except in limited demonstration cases which won't move the market writ large.

Why are there mismatches between Industry emissions impact and funding?

The lack of investment in industrial decarbonization is a vexing chicken and egg question. In finance, success begets success. Now that we’re starting to see large-scale deployments happening in the power generation sector, investors are more willing to throw more funding in. To bridge the gap, we need either government funding or some forcing regulatory function to get industry to make the necessary decarbonization investments.

How does the recent Supreme Court EPA ruling factor into our path to net zero? What federal action needs to be taken to ensure that we reach the original goals set by the Paris Agreement?

Last October, we released Pathways to Paris, a report that explains how we get to 50%. The report included meaningful congressional investment and aggressive regulations from the EPA, which are now trickier to achieve given the West Virginia v. EPA decision. There’s still a pathway to achieve the level of reductions the US has targeted, but a lot of other things have to go right from here on out. We need the EPA to push as hard as they can in this constrained environment to still regulate, a combination of likely still requiring CCS and hydrogen co-firing at new and existing coal and gas plants. They also need to push hard on GHG emission regulations for LDVs as well as medium and heavy-duty vehicles so we can see faster uptake of new technologies in the market.

Beyond US federal policy, what’s being done at the state level?

In Pathways to Paris we also included accelerated state climate action that outlines a more aggressive renewable portfolio and clean energy standards at the state level. Another interesting approach included was state action in the agriculture and waste sector to tamp down methane emissions in those sectors. Finally, we outlined HFC policies aimed to reduce the emissions of harmful climate pollutants. This is running the gamut of what states could do, but if the federal government isn’t going to do as much as expected, it doubles down the importance of states setting aggressive climate targets.

Big news! Manchin just agreed to a $370B climate bill. What are some of the significant takeaways and how it compares to previous BBB provisions?

We just released a note describing our estimates of the impacts of the bill. At a high level, we find that the legislation could reduce emissions to 31-44% below 2005 levels in 2030 – potentially putting the US on track to meet its climate commitments if paired with the sorts of aggressive policy actions we’ve been talking about. The bill has a lot of the most important components of the BBB provisions including long-term tax credits for clean electricity, clean fuels, carbon capture and sequestration, clean hydrogen, and direct air capture. It also includes incentives for clean energy technology manufacturing, authorization for major new loan guarantees, and a scaled-back tax credit for new electric and fuel cell vehicles. All in, if passed it’ll be the biggest thing Congress has done on climate – ever.

How can readers best put to use the Taking Stock report and ClimateDeck?

If nothing else, we hope that this report demonstrated that there is still a need for technology innovation. Current policy and markets simply won’t get us to the level of decarbonization needed to avoid the worst impacts of climate change. Even if we miraculously managed 50% reduction by 2030, we’d still only be halfway done - and still need to drive down arguably the hardest half.

We provide Taking Stock and ClimateDeck results at a 50 state-level so folks can actually look and see both where the emissions are coming from, and so that savvy investors can identify where to deploy capital into opportunities to reduce emissions.

Lastly, I hope that readers take away from the report that we’re not on track. A concerted, aggressive climate policy push will be required to combat climate change. Hopefully this analysis supports and amplifies the call from all quarters to do more on climate.

In light of the recent flurry of climate policy now (hopefully) on the docket, here’s the breakdown of current policies at the federal and state level affecting climate sectors.

Questions, thoughts, or comments? 📩 Send us a note!

Not a subscriber yet?

Q&As with Sophie Purdom, who just closed first-time Planeteer Fund I, and John Tough, who recently closed Energize Capital's mega-fund Ventures Fund III

A Q&A with Precursor's David Yeh and Mark1's Julian Ryba-White, new strategic partners in the ecosystem

A Q&A with the DOE LPO director Jigar Shah and Solugen CEO Gaurab Chakrabarti