🌎 Inside Cloverleaf Infrastructure’s power play #206

Our Q&A with Brian Janous on AI, data center demand, and the need for speed

Where supply chains, energy production and sustainability meet independence

Happy Monday!

In this week’s issue, we headline sustainability’s tie up with resiliency - namely how our increasing wave of global energy interdependence has led to increased fragility and risk. Accordingly, on Friday, our feature will cover supply chain transparency and traceability.

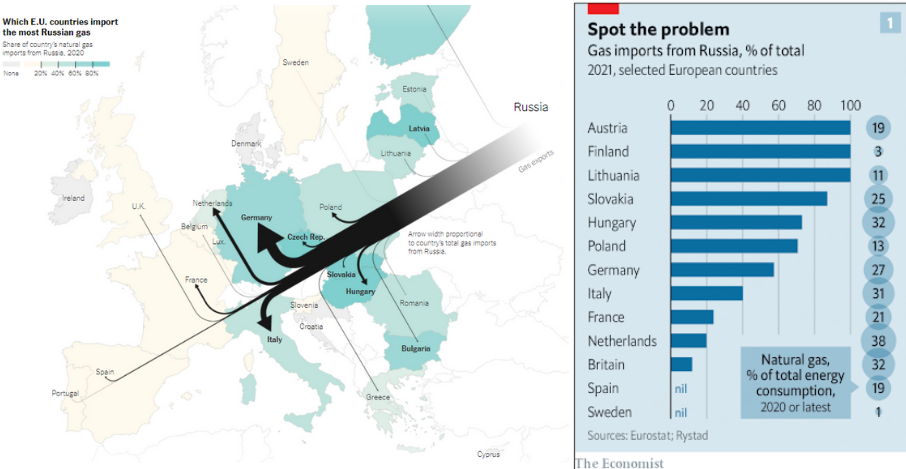

With Russia providing ~40% of Europe’s natural gas and ~25% of oil imports, the question of where and how alternative energies fit into both reduce climate risk and increase self sufficiency is increasingly top of mind.

We also cover $1.3B in climate tech funding this week! Big names like Palmetto, Hozon, Revel, Project Canary and Wildtype all raised significant rounds. Early stage climate tech is so far showing limited tapering.

Thanks for reading, and double thanks to everyone that responded to our survey HERE! 💚

Not a subscriber yet?

Sustainability and resiliency go hand in hand. We’ve been living through a “40-year wave of price-driven globalisation [that] has delivered an incredibly fragile web of supply chains, ready to fall over at the slightest provocation” as the astute Azeem Azar puts it. Semiconductor shortages first exposed the truth about centralization, and now the unfolding war in Ukraine and ricocheting impact on Russian-reliant EU gas prices emotionally drives the lesson home.

When the energy crunch hit back in October, we wrote that “reliance on foreign energy imports, as this event has demonstrated, is a risky business. The energy transition can drive domestic and independent power production, especially coupled with local and contextual clean energy plans that maximize renewable energy generation and storage. An energy shortage reliant on fossil fuels shows that it’s time to lean even more into renewables.” Five months later and the words resonate more than ever.

It’s no secret that Russia has historically been key to global energy security. In Europe alone, Russia has supplied ~40% of natural gas and >25% of oil imports. Import economics and country energy supply mixes are never easy enough to sum up with one picture (so we’ve got two!).

It’s the outliers that jump off the page - namely, that over a quarter of Germany’s large economy relies on natural gas, more than half of which is imported from Russia. Germany now finds itself vulnerable to Russia’s whims because of a deliberate politically-motivated and anti-scientific choice starting a decade ago to shut down their nuclear plants and ~20% of their power generation capacity.

The EU has long had a natural penchant for natural gas, even controversially designating it as a green investment earlier this month. This is the EU’s wake up call to permanently wean itself off natural gas, especially Russian gas. Even Germany - so intimately entangled with Russia that a former chancellor is the chairman of Rosneft, Russia’s biggest oil company - is likely shelving the Nord Stream 2 gas pipeline that links it to Russia.

The consequence will be to redouble the imperative of building resilience and self-reliance into supply chains. Where climate change is a compounding risk factor, climate tech can be a critical force multiplier for the energy transition and the increase in economy-wide resiliency. Rapid investment in technologies that aren’t dependent on fossil fuels or complex supply chains will enhance independence.

Like the ‘space race’ this is the ‘place-based race.’ Whoever can be fully independent first, limiting price and commodity risk, will win. We expect…

More (clean) supply. Solar, wind, and storage have come down the cost curve and are ready to be deployed at grid-scale. New technologies like nuclear small modular reactors are coming down the pipe and the holy grail of nuclear fusion is further on the horizon. and

More electric. As Saul Griffith puts it, “Electric induction cooking is Putin free”

More sectors. While energy resilience is currently in the teleprompter, the emphasis on resilience will spread to other high-emitting sectors (case: agriculture, transportation) with many exposed nodes (point: fertilizers, rare earth metals). Localized, modular, few inputs are the name of the game.

Though, timing matters. Russia (and China) are deftly using their indispensability in global energy markets and supply chains, timed with Peak Cheap Energy, to force an inflation-strained Fed to choose the US economy, or the USD.

🌱 Palmetto, a Charleston, SC-based clean energy marketplace and services platform, raised $375m in Series C funding from Social Capital, ArcTern Ventures, Gaingels, Lerer Hippeau, and MacKinnon, Bennett & Co.

🚗 Hozon, a China-based intelligent EV startup, raised $316m in Series D funding from CRRC Corp’s investment fund and Shenzhen Capital Group.

🛴 Revel, a Brooklyn, NY-based electric urban micro-mobility company, raised $126m in Series B funding from BlackRock Renewable Power, Toyota Ventures, Goodyear Ventures, Shell Ventures, Broadscale Group, Obsidian Ventures, the St Baker Energy Innovation Fund, and Knighthead Capital Management.

⚡ Project Canary, a Denver, CO-based ESG data platform for energy, raised $111m in Series B funding from Insight Partners, Brookfield Growth, Carica Sustainable Investments, the Canada Pension Plan Investment Board, Quantum Energy Partners, Energy Impact Partners, and Frontier Venture Capital.

🦐 Wildtype, a San Francisco, CA-based producer of cell-based seafood, raised $100m in Series B funding from L Catterton, Cargill, Bezos Expeditions, Temasek, S2G Ventures Ocean and Seafood Fund, Footprint Coalition, and others.

🛴 Beam, a Singapore-based micrombility startup offering e-scooter rentals, raised $93m in Series B funding from Affirma Capital, Sequoia Capital India, Hana Ventures, ICT Capital, EDB Investment, AC Ventures, RTP Global, and Momentum Venture Capital.

💨 H2scan, a Valencia, CA-based provider of hydrogen sensors, raised $70m in funding from LetterOne and GS Energy.

🛴 URent, a Russia-based e-scooter and bike sharing service, raised $27.8m in funding from MTS, VPE Capital, and VEN Ventures.

🏗️ LEKO Labs, a Luxembourg-based carbon negative construction company, raised $21m in Series A funding from 2150, Microsoft Climate Innovation Fund, Tencent, AMAVI, Rise PropTech Fund, Extantia, and Freigeist.

🚲 Zoomo, an Australia-based maker of electric last-mile delivery vehicles, raised $20m in Series B funding from Collaborative Fund, Mitsubishi UFJ, SG Fleet, WIND Ventures, COPEC, and Akuna Capital.

🚗 UFODrive, an Ireland-based electric-car rental company, raised $19m in funding from Hertz, Certares, Knighthead Capital, and others.

⚡ Virtual Peaker, a Louiseville, KY-based distributed energy resource management platform, raised $16.6m in Series A funding from Moore Strategic Ventures and Emerson Ventures.

🌲 Living Carbon, a San Francisco, CA-based startup developing fast-growing trees for decarbonization, raised $15m in funding from Aydin Senkut, Lowercarbon Capital, Goat Capital, Prelude Ventures, Floodgate, MCJ Collective, Homebrew Ventures, EQT Foundation, and others.

⚡ ev.energy, a UK-based managed EV charging software provider, raised $12.8m in Series A funding from ArcTern Ventures, Energy Impact Partners, and Future Energy Ventures.

💨 Nori, a Seattle, WA-based blockchain-based carbon removal marketplace, raised $7m in Series A funding from M13, Toyota Ventures, and Placeholder.

♻️ Resourcify, a Germany-based digital platform for waste management and recycling, raised $5.6m in funding from Ananda Impact Ventures, Speedinvest, Sennder and Schüttflix, Innovationsstarter Fonds Hamburg, and the High-Tech Gründerfonds.

🌱 Yali Bio, a San Francisco, CA-based developer of a synthetic biology platform to make climate-smart foods, raised $3.9m in Seed funding from Essential Capital, Third Kind Venture Capital, S2G Ventures, CRCM Ventures, FTW Ventures, and First-in Ventures.

🥩 99 Counties, a Chicago, IL-based regenerative meat marketplace, raised $3.8m in pre-Seed funding from OMERS Ventures, Union Labs, GV, and Supply Change Capital.

🔋 Chargeup, an India-based EV battery swapping network, raised $2.5m in pre-Series A funding from Capital-A, Anicut Capital, and others.

🛴 Taur, a UK-based e-scooter manufacturer, raised $1.75m in Seed funding from Trucks VC.

💨 Cecil, an Australia-based platform for managing carbon and natural capital assets, raised $1.6m in pre-Seed funding from Tenacious Ventures, Macdoch Ventures, and Global Founders Capital.

Aspen Power, a Dallas, TX-based distributed generation project financing platform, raised $120m in funding from Ultra Capital, Redball Power, and others.

Revent, a European early-stage VC announced the close of its debut climate, health, and impact-focused fund at $68m.

Aera VC, a Singapore-based climate tech venture firm, announced a $30m first close of its new fund investing in startups accelerating the planet toward a sustainable future.

Bluesource, the largest carbon credit developer in North America, and Element Markets, a leading RNG and environmental commodities company, announced their merger to form a combined entity under majority ownership by TPG Rise.

Taking decarbonization to his own hands, Atlassian founder Mike Cannon-Brookes, along with asset managers Brookfield, attempted to buy out Australia’s largest utility to speed up their coal plant retirements. While the bid to buy AGL failed, the utility felt the pressure and announced their $725m Energy Transition Fund, funding decarbonization without giving up control over the company.

The aptly named HyDeal Ambition brings together a coalition of 30 European energy companies aiming to deliver 3.6 million tons of green hydrogen by 2030. The plan starts with blending green H2 into existing pipelines then building out dedicated hydrogen pipelines starting in 2025. Meanwhile stateside, SoCalGas goes big proposing Angeles Link, the largest US green hydrogen infrastructure system based in the Los Angeles basin.

The Louisiana court ruling blocking the Biden administration from increasing the social cost of carbon to $51 per ton is having knock-on effects. The social cost of carbon estimates the toll that additional emissions cause to society and is critical to federal decision-making from environmental regulations, infrastructure projects, oil and gas permitting, and even international climate talks.

California, New York, and New England saw their electric sector emissions rise this past year—all because of nuclear plant retirements. While the electric sector takes two steps forward with continued renewables and storage deployment, we can’t afford to take three steps back and retire valuable zero-carbon resources, less the US end up more oil dependent like Germany.

Last week, a federal judge banned future offshore oil and gas lease auctions indefinitely—meanwhile, offshore wind lease auctions raked in over $4B! The first-ever US offshore wind lease auction attracted the largest renewable developers and infrastructure funds to invest in the technology (we also learned what bight means).

Last year when the USPS unveiled their newly-designed electric duck trucks to replace 10% of its fleet, we thought they could do more. The USPS dashed those hopes this week, finalizing a $485b deal to buy 148,000 ICE vehicles to replace their aging mail-delivery fleet, citing EVs’ high total cost of ownership.

Banks are cashing in the carbon markets hype. UBS, Standard Chartered, and BNP Paribas are joining 4 major banks to develop Carbonplace, a new technology infrastructure platform enabling the trading of voluntary carbon credits.

Following in other PE behemoths' greener footprints, Apollo launched its own sustainable investing platform with plans to deploy $50B in climate tech and more than $100B by 2030.

TechCrunch covers the rise of climate tech investing (with lots of familiar CTVC charts!) and spotlights the strategies of 14 climate tech investors.

Peat can’t be beat on natural carbon capture. How can the guardians of Congo’s peatlands be rewarded for their conservation?

In meteorologists we trust. Why local weathermen and women may be uniquely effective climate communicators.

Airbus to test hydrogen-powered engine on A380 superjumbo.

Open-weather can help you track climate change with your own DIY satellite.

The Earthshot Prize releases a “Roadmap to Regeneration,” highlighting tipping points and solution areas like fashion, personal transport, and construction.

Though CDP disclosure continues to increase, Scope 3 reporting remains challenging for both companies and regulators.

For Saul Griffith, tackling climate change requires “an ethos of abundance rather than scarcity.”

Syn for the win. Synthetic biology could open new doors in sustainable manufacturing, with handy charts from BCG to guide the way.

The new video game Horizon Forbidden West envisions San Francisco after 200 feet of sea level rise.

gener8tor announces its inaugural climate tech accelerator cohort - including EV charging (itselectric), resi battery storage (blip energy), industrial heating (SolarSteam), circular economy (Mycocycle), and regenerative ag (Carbon Yield).

💡 Mining Cleantech Challenge: Apply by Mar 4th to Colorado Cleantech’s mining innovation pitch showcase which will highlight 10-12 startups digging deep into the development of new mining technologies.

💡 C3E Women’s Leadership: Nominate exceptional females working in clean energy by Mar 10th to help shine a spotlight on the female leaders in cleantech at the U.S. C3E Awards ceremony sponsored by the DOE , MIT, Stanford, and Texas A&M.

🗓️ NYU Stern Innovation for Impact: Join on Mar 4th to participate in NYU’s social innovation conference which will enable attendees to innovate solutions for global-scale problems and hear from social impact leaders on how to respond to crises effectively.

🗓️ Wharton Energy x CTVC: Tune in on Mar 10th to hear CTVC’s very own Co-Founders, Sophie and Kim, discuss the Climate Capital Stack as part of Wharton Energy’s “Intro to Climate Tech” series.

Commercial Strategy Manager @Invaio Sciences

Senior Computer Vision Engineer @Pano

Expert Network Community Manager @OnePointFive

Account Executive, Software Engineering Manager @Regrow Ag

Venture Capital Fellowship @At One Ventures

Summer Associate @The Engine

Managing Director, Carbontech @Columbia University

Associated VP, Partnerships @Energy Impact Partners

Feel free to 📩 send us new ideas, recent fundings, events & opportunities, or general curiosities. Have a great week ahead!

Our Q&A with Brian Janous on AI, data center demand, and the need for speed

England's new election ushers in a new test of clean energy and climate tech

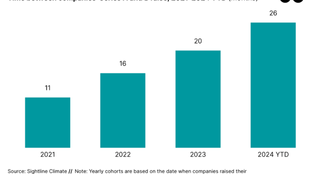

H1'24 funding totaled $11.3 billion, down 20% from H1 2023.