🌏 Spinning CO2 into clothes

Scaling “symbiotic manufacturing” with Rubi Laboratories

New brand, new software, and new funding for Carbon Direct to expand carbon management

Just in time as we come off our brief summer feature hiatus, we’re fortunate to go deep with Jon Goldberg of Carbon Direct to announce their new funding and growing mission to enable end-to-end carbon management. We cover the growth and evolution of quality in the CDR space, the IRA’s boost, where software and funding fits in, and shifting corporate appetites and accountability. All in, CDR is ripe for a platform play across various stakeholder groups and removal approaches and Carbon Direct is pretty well positioned to figure out what that should be.

It’s only been 3 years! What incredible growth for Carbon Direct and the broader CDR space. Take us back in time - what’s the founding story?

Our team has been working on carbon management for a long time. While the company was incorporated in 2019, our approach to science-based carbon management, removal, and utilization started well before that. My background is in energy markets investing from Goldman, Glencore, then a firm that I started called BBL Commodities. Along the way I got to know some pretty phenomenal scientists who had been researching and supporting policy in carbon management for their whole careers. We all had a similar goal: scaling the carbon management industry to the size required to meet climate models - a target which has only gotten steeper in the last few years or so.

We had a hypothesis that by bringing together various investing disciplines and areas of scientific expertise we could make a dent in this thing via advisory work and software to scale customer impact. So that's the broad origin story from when we started off in late 2019. We started working with clients in early 2020 and Carbon Direct has kind of taken off from there. Throughout, we haven't lost that initial touch point of the importance of a diversity of expertise, united by a foundational approach to addressing the science of CO2 management.

How has CD evolved from carbon advisory to an “end to end” carbon management platform?

We have always been focused on working with corporates and governments to solve broad carbon problems. We’re motivated by this big challenge of actually bringing carbon solutions to market, then supporting them to scale. We recognized early on that the complexity of this problem requires both scientific advisory work and scalable software to meet the needs of the market. Software is super important and key to our growth, but it also can’t solve everything.

We do a lot of educational work to help people understand the importance of carbon management to their business and what they can do about it. Our science-focused team is outcomes motivated - it’s not good enough to just drop a thick report on the desk at the end of a consulting engagement with a series of recommendations or research for theoretical applications of sustainable aviation fuels, or carbon removal technologies. We want to be there for the long ride with the people actually doing it. That’s why Carbon Direct is structured, albeit expansively, for hands-on involvement at every step of a company’s carbon management journey.

You launched a new brand earlier this week and the website breaks out Software, Science, and Insights - oh, plus a separate fund! How do the various initiatives across the Carbon Direct company ecosystem intersect and inform one another?

Scaling carbon management requires a lot of capital to be deployed commercially. Within our original structure, we have two separate companies - Carbon Direct Capital and Carbon Direct Inc. Carbon Direct Capital is an independent investment firm that makes growth equity investments into areas like carbon removal, carbon utilization, hydrogen, and point-source carbon capture, and can leverage Carbon Direct Inc to provide the science and technology underwriting.

Carbon Direct Inc. houses our Software and Scientific Advisory initiatives which create multiple touch points within the firm to help our clients achieve their carbon management goals. As clients come to us with their decarbonization challenges, we want to be able to help them across the board, including sometimes doing the initial carbon accounting work. Some of these solutions can best be done via software, which enables the broader distribution of work that we're doing.

Other solutions such as assessing CDR quality may be better fit for specific advisor and scientific engagements. We also generate insights by leveraging our team’s deep scientific and academic backgrounds to help the market better understand the policy and science needed to scale carbon management. We’re taking an umbrella approach to carbon management with a diverse portfolio of solutions for our clients.

Where do you see Carbon Direct playing along the carbon value chain?

The key is to be meaningful and impactful. While other areas of decarbonization are well-served by the existing market (e.g., power purchases), there remains significant gaps in achieving carbon removal - including assisting accounting issues, understanding scientific solutions, and successfully executing removals. Although the carbon removal market has garnered criticism for these gaps, we’re working hard to address them from start to finish.

As this industry continues to grow, understanding how projects are scaling up and reporting back to clients remains central to our efforts. It’s one thing to get super excited about a new CDR pathway, but it’s the nitty-gritty financing and contractual work that gets these projects over the finish line - and sustainably scales the CDR market going forward.

Walk through a case of how you’d engage with a corporate on their CDR strategy.

We begin by helping companies understand the technical pathways of decarbonization and the prices necessary to properly execute their goals. We scope out the amount of residual emissions and put together portfolios of high-quality, durable carbon removal (both engineered and nature-based). Then we go one step further to track the carbon removal project’s lifecycle from start to finish, monitoring the development and implementation nuances that accompany a lot of these solutions.

As the CDR market and supply proliferates, what’s the right way to similarly scale CDR quality assessment?

As someone who has spent their career in commodity markets, I think the parallels between commodity markets and scaling carbon markets are often stated incorrectly. Carbon removal can’t be commoditized because there are very different verticals of removal. However, all markets require some form of offtake agreements or financial contracts, which we can bring to bear in the marketplace. What we hope to do at Carbon Direct is to provide the heterogenous, scientific, and vertical-specific context on these diverse pathways, combined with the commercial sensibility to make it easier for people to transact this stuff. There’s a core balancing act between market making and nuanced understanding of the risks and scaling challenges of individual CDR verticals - which is why we’re continuously tapping into both sides.

Who bears the cost, risk, and responsibility for assessing the risk of these projects?

The responsibility is on all parties involved in the transaction. Someone who's selling a carbon credit making that claim has a responsibility to make sure it’s accurate. The buyer also has a responsibility to do their homework because they're going to be reporting it to their stakeholder. If you're going to say that you're doing it, it's incumbent on you to actually check that work.

Then there are third parties. We would love to continue working with registries and see them get better over time. It’s in everyone’s best interest for registries to do well. Perhaps in a perfect world, you’d have a government or governing entity looking over all these things, otherwise everyone in the market has a bit of a responsibility to ensure quality.

Going back to scalability, it sounds like software is part of that ability to efficiently serve more customers. What areas do you see Carbon Direct building out software solutions?

First we’re looking at our B2B clients. One example I can share is work with a company called Scope3, whose customers are buying carbon removal credits to minimize the carbon impact of digital ad campaigns. Through software, we can connect those companies to our supply, manage inventories, and make sure they’re buying the right credits. We’re enabling way more people to engage with carbon removal.

On the supply side, we've done a lot of intake understanding the dynamics of the different supply. We're continuously updating our understanding of the types and pricing of projects in the market, and giving iterative feedback to enable better quality projects. Software helps us do this all more efficiently. We can now collect more data and help buyers understand how their purchases have done over time and show where their CO2 has been removed and monitored.

We’re also doing a lot on the reporting side of things, to help companies manage stakeholders and make better decisions. And this fall we’re excited to release our baselining tool to help with emissions measurement, really bringing the end-to-end vision to life.

There are a multitude of startups going after corporate carbon offsets. How is CD positioned to win in the API carbon offsets space?

The key differentiator is that we have the fundamental ability to evaluate CDR projects and provide scientific expertise, with technology acting as the multiplier to amplify this work. You can get all this information from the supplier, but if you don’t understand it or can’t assess it, it’s not useful. You need to have the scientific context to evaluate the information coming in - and then scale it though software tools via an API.

While the VCM remains supply constrained, how are you positioned today vs in the future as the market grows?

It’s important to have relationships both on the supply and demand in order to bring more high quality carbon removal into the market. Software is fantastic, but at the end of the day the carbon market is tied to the physical management of CO2 - the actual removal of carbon and the policy to incentivize and inform the industry. We feel like we’ve now built the expertise in all of these things.

You’ve worked with a client list that represents ~60% of the tonnes transacted on the VCM in 2021. Tell us about customer engagement so far, and what types of customers you anticipate working with in the future.

We’ve gotten to work with companies across all different sectors of the economy, with the tech community primarily acting as the big early mover in the space. That’s great, but the bulk of emissions really come from industrial, aviation, and other transport sectors. Our 50+ clients really represent a cross-section of all these different industries - which has really informed our approach to software for carbon management. We're building software for carbon management at large, not for one specific company or sector.

How has the general corporate appetite for carbon credits shifted given current economic conditions?

We don’t see a slow down - if anything, more companies from an increasingly diverse range of industries want to come work with us. There’s less short-term volatility because carbon management requires implementing multi-year plans. We’ve seen that internal stakeholders care about carbon management and are taking it seriously, which is why they like our scientific approach. Employees and Investors don’t want to see companies spending money only to check the box on some kind of greenwashing exercise.

How does the IRA’s expanded 45Q credit change the fundamentals of the CDR market? (Particularly lower thresholds, $180/ ton price, upfront direct payment)

It’s massive. We can build a business based off voluntary commitments, but CDR can’t scale to the size that it needs to without significant government support. The IRA puts a $180 floor price on DAC, which sets a target for the level of work CDR companies need to do to get to that price point. On the buyer side, it makes it more palatable for companies to step up because they no longer have to bear $500-1,000/ ton costs all on their own. Jesse Jenkin’s group did some math on this that speaks to how dramatic of a change the IRA 45Q expansion will be for CDR.

What’s your take on the argument that IRA enabling direct decarbonization to be cheaper will diminish the need for CDR or carbon offsets?

The IRA has put climate action back on the national agenda - particularly direct decarbonization. I don’t think the IRA has diminished the need for CDR or carbon credits from the voluntary market, in fact it makes the impact of carbon credits larger by connecting to a more supportive policy for CDR. If you think about the breakdown of CO2 emissions, there are stock and flow CO2 emissions. The IRA helps address both by increasing support for capturing CO2 at the point of emissions, encouraging lower carbon fuels and also increasing price support for removal of CO2. Clients are looking at this increased support and seeing that their voluntary dollars can have more impact by more rapidly scaling CDR to a scale that matters, in combination with government support. That’s the way it should work!

One of the frameworks we use to guide our work is the Levelized Cost of Carbon Abatement that Julio published at Columbia SIPA. It takes a nuanced cost-level approach to comparing decarbonization strategies on a dollar per tonne of CO2 removed or abated basis and is a good way to think through options for both policy and investment in decarbonization and carbon removal.

Speaking of Julio, you’ve recently brought some heavy hitters onto the team. What do “carbon wrangler” Julio Friedmann, Chief Scientist and Nili Gilbert, Vice Chairwoman bring to the org?

We care a lot about hiring a great team, with various types of people and perspectives. We have software engineers teaching PhDs about APIs and PhDs explaining policy dynamics to software engineers, and it’s fantastic.

Julio has really amazing deep scientific expertise, but he also has policy experience. He understands the intersection of science and policy, and that comes into play for our business.

Nili has more of a market background, like I do. It’s been remarkable to work with her. We have known each other for a long time, and even prior to Carbon Direct we shared similar visions and understanding that you need money and market expertise to do this. She’s brought that lens, along with a deep passion for climate and carbon management.

Everyone is bringing their own skillset to the table, whether it's software, market, science, or policy. Even our science expertise is quite diverse. For example, Julio is an expert in engineered forms of carbon removal, but we have other experts who are deep on soil carbon or IFM (improved forest management). The single thread that brings us all together is that everyone takes the carbon management vision very seriously.

Congratulations on your $60M Series A, announced on Wednesday! Temasek and BlackRock’s Decarbonization Partners and Quantum Energy Partners led the round. What comes next for Carbon Direct?

We’ve set up the business to be successful, but if we’re going to hit our climate and carbon goals, we’re going to need help to achieve our big picture vision. We’re hiring pretty aggressively across science, software, sales, and all other functions. We have a London office, and want to expand our local presence in EMEA and Asia, where we have a large client list. We’re also making technology investments on the software side into our end to end carbon management platform. These are all the main catalysts we’re investing in with the new funds.

Excited to help direct carbon management with CD? Whether you’re looking to analyze the carbon efficiency of sustainable aviation fuel or buy carbon removal tonnes from engineered or nature-based suppliers, start here.

Scaling “symbiotic manufacturing” with Rubi Laboratories

How to build trust and collaboration in CDR with Isometric, starting with the science

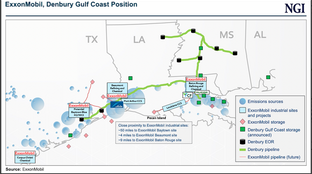

Exxon’s acquisition of Denbury fuels CO2 transport ambitions