🌎 Inside Cloverleaf Infrastructure’s power play #206

Our Q&A with Brian Janous on AI, data center demand, and the need for speed

BNEF courageously helps make sense of a market that doesn't make sense

Happy Monday!

Good mix of plastics and recycling deals this week, including Repeats Group’s $113m raise to produce recycled polyethylene, Polycarbin’s $2m for single-use plastics resource management, and Matter’s seed funding to tackle microplastic pollution.

In our favorite graph of the week, BNEF published their 2050 outlook on carbon offsets – tl;dr, supply and demand are both unverifiable and relatively make-believe, but if levers align, more than $500b in market size will come online by 2050. Stay tuned for a CTVC deep dive into carbon markets - as it turns, carbo loading isn’t all that easy to digest!

In this week’s news, DoE launches the thousand-strong Clean Energy Corps, the Fed stress tests will incorporate climate, and California committed $37B to climate action over the next five years (and not to be outdone, SVB committed $5B in loans and financing to climate by 2027!)

Thanks for reading!

Not a subscriber yet?

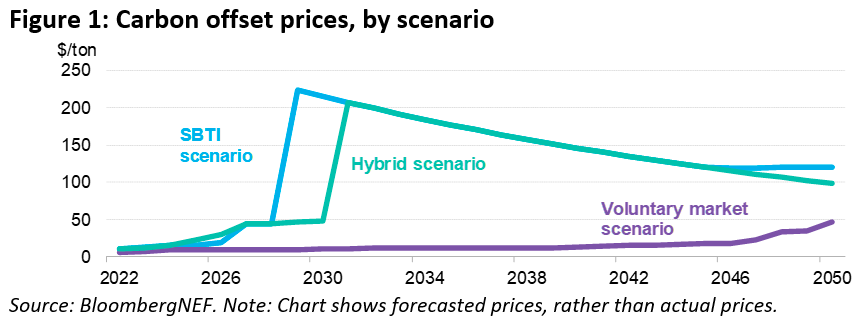

BloombergNEF courageously published a long-term outlook on carbon offset prices.

In their earnest words “Chart shows forecasted prices, rather than actual prices” - or, as we used to say in management consulting, the recommendations are ‘illustrative’ and ‘directional’. It’s veritably impossible to forecast with any semblance of certainty the price of a ton of carbon in a voluntary market where both supply and demand could swing wildly in either direction at any time, and without an invisible guiding hand, cause the entire scheme to collapse.

Prices could be as low as $47/ton or as high as $120/ton by mid-century. The outcome is most sensitive to:

In the 🟪 scenario, if the market parallels today’s, with primarily corporate demand and no restrictions on the definition of what constitutes a “carbon offset”: (1) supply will vastly outgrow demand all the way out to 2050; (2) prices will remain unsustainably low, hovering around $11/ton on average in 2030 and $47/ton in 2050. This means that corporates can prolong relying on worthless credits instead of operationally reducing emissions.

In the 🟩 and 🟦 scenarios, if the voluntary market is restricted to only removals (i.e., no avoidance credit and mostly permanent drawdowns): (1) the market will be undersupplied around 2030; (2) prices will shoot up over $200/ton on average. This means that high prices will drive many companies out of the offset market, perhaps helping quality but underscoring the supply shortfall of carbon removals.

Key Takeaways:

🔋 Hydrostor, a Toronto, ON-based long-duration energy storage solution provider, raised $250m from Goldman Sachs Asset Management.

🍄 MycoWorks, an Emeryville, CA-based producer of a mushroom-based leather alternative, raised $125m in Series C funding from Prime Movers Lab, SK Networks, and Mirabaud Lifestyle Impact & Innovation Fund.

♻️ Repeats Group, a Netherlands-based plastics recycling platform focused on producing recycled low-density polyethylene, raised $113m in funding from Ara Partners.

🥩 Starfield, a China-based plant-based protein company, raised $100m in Series B funding from Primavera Capital Group, Lightspeed China Partners, and Joy Capital.

🔋 Viridi Parente, a Buffalo, NY-based developer of lithium ion battery storage technology, raised $95m in Series C funding from B. Thomas Golisano, Ashtead Group/Sunbelt Rentals, and National Grid Partners.

🚚 EVage, an India-based all-electric commercial vehicle startup, raised $28m in Seed funding from VC RedBlue Capital.

❄️ Bluon, an Irvine, CA-based provider of an app for HVAC-R technicians and a non-HFC refrigerant), raised $28m in Series B funding from Ecosystem Integrity Fund, MKB, Ferguson Ventures, and Superseed Ventures (read more about the cooling economy of HVAC here).

🔋 Qnovo, a Newark, CA-based battery management software startup, raised $24m in Series C funding from BorgWarner, OGCI Climate Investments, Constellation Technology Ventures, US Venture Partners, and RockPort Capital.

🛍️ RESPONSIBLE, a UK-based circular fashion startup, raised $7m in Seed funding from Barclays Sustainable Impact Capital, Techstart Ventures, and angel investors.

✈️ ePlane, an India-based electric flying taxi startup, raised $5m in Seed funding from Speciale Invest, Micelio, 3one4 Capital, and others.

⚡ HeyCharge, a Germany-based provider of underground charging solutions, raised $5m in Seed funding from BMW i Ventures and Statkraft Ventures.

💨 Skyven Technologies, a Dallas, TX-based Energy-as-a-Service company which funds and de-risks capital projects to reduce carbon emissions caused by process heat, raised $4m in Seed funding from VoLo Earth Ventures, Global Founders Capital, and the SWAN Impact Network.

💨 Carbonfuture, a Germany-based carbon removal marketplace, raised $2.8m in Seed funding from Ubermorgen Ventures, seed + speed Ventures, and Wi Venture, and angel investors.

♻️ Polycarbin, a Los Angeles, CA-based resource management platform for single-use plastics, raised $2m in Seed funding from Ringbolt Capital, VoLo Earth Ventures, and angel investors.

💨 Praan, an India-based provider of outdoor air purification systems, raised $1.6m in Seed funding from Social Impact Capital, Better Capital, Paradigm Shift Capital, and Avaana Capital.

⚡ Voltpost, a Brooklyn, NY-based EV charging company that transforms lampposts into public smart charging stations, raised $1.3m in Pre-Seed funding from Good News Ventures, SSC Venture Partners, and other investors.

♻️ Matter, a UK-based microplastic recycling startup, raised $505k in Seed funding from Builders Vision’s Rising Tide Fund.

Early Tesla investor The Westly Group raised $300m to invest in startups focused on transforming industries including energy, transportation and technology.

Vancouver-based VC firm Chrysalix Venture Capital announced the close of its Chrysalix RoboValley Fund with ~$100m to dedicate to intelligent systems for resource-intensive industries.

SpeedInvest announced an $91m Climate and Industry Opportunity Fund to support European startups focused on industry decarbonization.

LG Chem’s battery subsidiary LG Energy Solutions raised $10.8b in its IPO.

Sustainability neobank & investing platform Aspiration acquired Carbon Insights, a Denver, CO-based company translating spending behavior and transactions into carbon footprints.

Schneider Electric acquired renewable energy platform Zeigo to expand and support renewable energy procurement.

Atlas Organics, a commercial composting company, raised $200m from Generate Capital to expand its organic waste processing operations nationwide.

LanzaJet, a sustainable aviation fuels company, raised $50m from the Microsoft Climate Innovation Fund for a SAF plant in Georgia.

The White House is starting 2022 with a bang in clean energy policy - holding a record-breaking 7 GW offshore wind lease sale, improving efficiency of reviews for clean energy projects on public lands, launching a new Building a Better Grid initiative to accelerate the deployment of new transmission lines, and funding regional clean energy job training.

Meanwhile at the Department of Energy, US Secretary Granholm established the Clean Energy Corps, aiming to attract 1,000 additional workers to focus on the clean energy transition. Using the $62B from the Bipartisan Infrastructure bill, this hiring marks the largest expansion of the department since just before the US oil crisis in 1977.

Those who wanted a more climate-friendly US Federal Reserve Chair may be in luck. Not only has Sarah Raskin been vocal on economic climate risks, Biden will nominate her to head the climate-risk stress test modeling for the Fed.

Lithium to the moon! EV popularity and supply chain worries send the mineral’s price to record-breaking prices past $40,000 a tonne. With no end to increasing prices in sight, governments (France and California), EV companies (Tesla), and mining giants (BHP) all scramble to secure deals to ensure the consistent influx of key battery minerals.

California’s Governor signed a bill dedicating $37B over 5 years to climate action. While it’s no surprise that Gavin Newsom devoted most of the bill to mitigation efforts — including clean energy, electric vehicles, and methane leakages, the governor allocated more than $10B of funds to climate adaptation measures — wildfire, drought, and other climate resilience measures. While commendable, California’s investment in disaster mitigation still pales in comparison to the cost of disaster relief. Just the state’s fire department alone holds a budget of $2.9B and insurer Munch Re estimated that 2021 disasters caused $280B in damages.

2021 ranked 5th hottest year ever recorded on land (with the last 7 years being the hottest 7 years on record), and warmest ever in ocean temperatures. If you thought you felt “hot earth summer” in 2021, you were right - temperatures last year set more heat and cold records than any other year since 1994.

Silicon Valley Bank, a commercial bank focused on startups, committed $5B by 2027 in loans, investments and other financing to support climate tech companies.

QuantumScape, announced its first non-automotive partner, Fluence, to collaborate on putting their solid-state batteries into stationary energy storage solutions.

The FAA announced that it’s reducing emissions with better aircraft descents. Here’s how.

Order up. ChargeNet supersizes its presence in California with EV charging stations at fast food restaurants.

Companies like Nisolo are trying to use digital labels to make fashion more sustainable, but former Timberland COO Kenneth Pucker isn’t sold. In a recent HBR op-ed, Pucker called for better regulation of the fashion industry, like New York’s proposed Fashion Act.

Cleantech Group publishes its 2022 Global Cleantech 100, featuring Arcadia, Remora, and other leading startups.

Can cryptocurrency bring transparency and reliability to voluntary carbon markets? The jury is still out.

A two-way street. Reilly Brennan of Trucks Venture Capital covers the energy-saving potential of bidirectional batteries.

Britain’s green energy is being held together by undersea cables.

As Chevron recruits journalists for an in-house “newsroom,” climate activists scrutinize greenwashing PR firms.

Obvious Ventures’ Andrew Beebe makes 10 climate tech predictions for 2022.

A Greentech Media podcast reunion. Jigar Shah joins Shayle Kann on the Catalyst podcast to discuss the DOE’s loan to a first-of-a-kind hydrogen plant.

Beyond Meat becomes a tasty target for short sellers.

Beats by jay. An album of endangered bird sounds reached no. 3 on Australia’s top 50 albums chart, ahead of Taylor Swift.

🗓️ This is CDR: Join virtually on Jan 18th to hear Professor Holly Jean Buck of the University of Buffalo discuss equitable carbon removal policies through the lens of her new book, Ending Fossil Fuels.

🗓️ Creating Sustainable Value Chains through Blockchain: Join the Blockchain and Climate Institute on Jan 21st for the final episode of a 6-part series on blockchain’s role in the context of sustainable value chains.

🗓️ McKinsey, the net-zero transition: Join Mark Carney on Feb 1st to discuss the economic transformation that will be needed to achieve net-zero emissions by 2050, highlighting findings from a major new report looking at the implications for demand, capital spending, production costs, and jobs in sectors that produce 85% of overall emissions, with an in-depth analysis of 69 countries.

💡 The Climatebase Fellowship: Ready to accelerate your career in climate tech? Apply by Jan 30th to join a curated community of climate tech founders, investors, experts, and ambitious peers — and gain deep industry insight and hands-on experience by ideating, building, and presenting projects upon Demo Day.

The Department of Energy is hiring over 1,000 people to join the Clean Energy Corps!

Fixed Term Associate, Natural Climate Solutions @Just Climate LLP

Investment Analyst @Energy Impact Partners

R&D Energy Analyst @Lineage Logistics

Partnerships Analyst @Elemental Excelerator

Business Development Director, Green Finance @ClimateView

Editorial Assistant @Important, Not Important

Partnerships Lead - CO2 @Remora

Global Strategy Manager @Urenco

Director, Carbon Portfolio @DroneSeed

Feel free to 📩 send us new ideas, recent fundings, events & opportunities, or general curiosities. Have a great week ahead!

Our Q&A with Brian Janous on AI, data center demand, and the need for speed

England's new election ushers in a new test of clean energy and climate tech

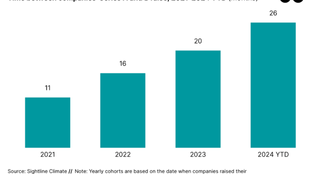

H1'24 funding totaled $11.3 billion, down 20% from H1 2023.