🌎 Introducing Powerstack from Sightline Climate

A new weekly briefing on the moves and motives shaping power markets

US courts roll back Trump-era actions on offshore wind and DOE grant cancellations

Happy Tuesday!

For those of you in the US, you may have been off yesterday…but the federal courts are back in session. A spate of rulings in the last week have reinstated offshore wind projects (3 for 3 and counting) and $28m of Biden-era DOE grants.

And ICYMI, you placed your bets along with our experts in our 2026 Prediction Markets Outlook, with all the crowd favorites and long shots across everything from climate investment, power markets, and China's rise. But if you’re tired of reading, tune into the replay of our Investment Trends & 2026 Outlook webinar instead.

In deals, $410m for battery storage development across two deals, $200m for renewable project development, and $177m for biofuel production.

Thanks for reading!

Not a subscriber yet?

📩 Submit deals and announcements for the newsletter at [email protected].

💼 Find or share roles on our job board here.

CTVC is powered by Sightline Climate, the tactical market intelligence platform for energy and investment decision-makers.

What happened

Last week, the courts cut the power to Trump’s clean energy crackdown, batting down all three offshore wind stop work orders, and, just for good measure, reinstating $28m in Biden-era DOE grants.

First, three offshore wind projects halted by executive action are moving again. On Friday, a judge issued a preliminary injunction blocking the stop work order on Dominion’s Coastal Virginia offshore wind project, following a series of rulings that allowed for construction to resume on Equinor’s Empire Wind project and Ørsted’s nearly complete Revolution Wind project.

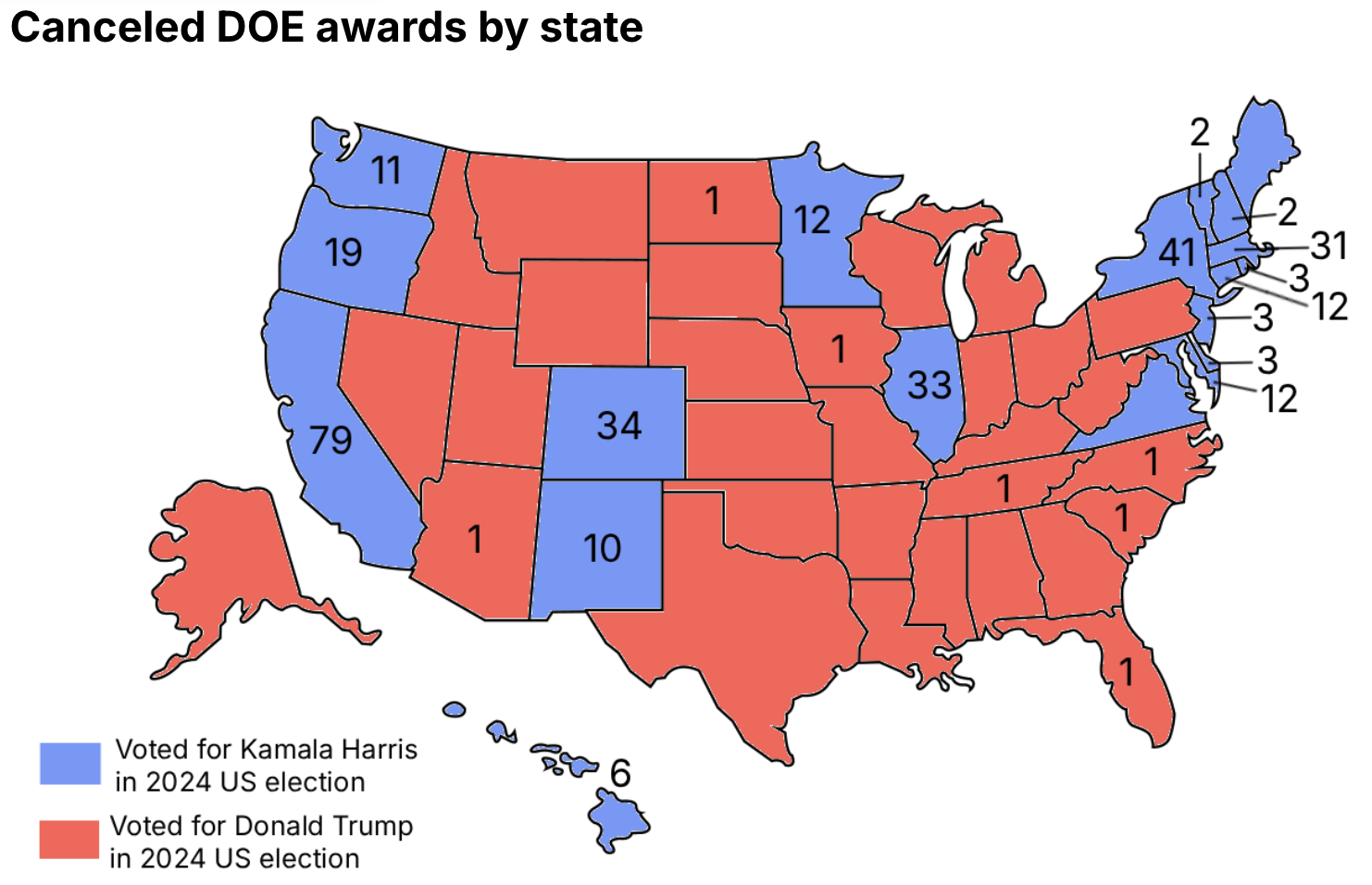

Second, a federal judge ordered the Department of Energy to reinstate nearly $28m in Biden-era grants that the Trump DOE abruptly canceled last October. (It voided more than 320 awards last fall, totaling more than $7.5bn). The judge ruled the cancellations violated the Fifth Amendment because the administration explicitly targeted awards in states that voted for Kamala Harris in the 2024 election.

Together, the rulings mark the most direct judicial pushback yet against Trump 2.0’s effort to unwind clean energy policy through funding freezes and administrative stops.

The grants-related ruling itself is narrow, only impacting the terminations of seven awards for programs including EV charging, a consumer EV education campaign, to a building performance resource hub. But it could open the window to reinstate more of the canceled awards.

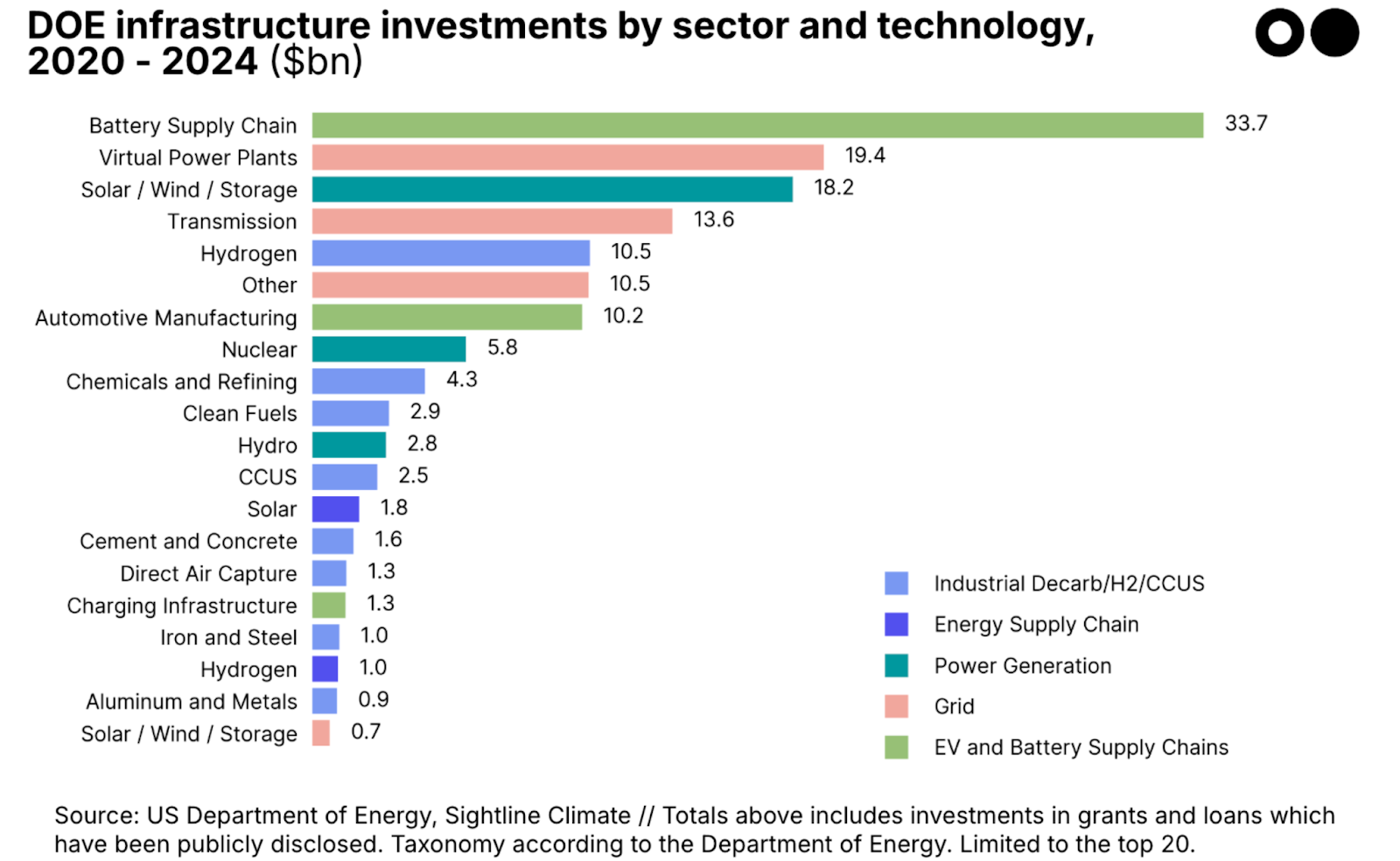

These awards were part of the Biden-era push that deployed record levels of federal capital into the energy transition. Trump’s DOE froze much of that funding on taking office and formally terminated 321 awards last fall during the government shutdown. Now the agency faces hundreds of copycat lawsuits from other organizations that had their awards cancelled.

Offshore wind presents a parallel pattern. In December, the administration froze five large East Coast wind projects, citing vague national security concerns. These projects were years into development and, in some cases, more than 80% complete. Affected projects included Ørsted’s Revolution Wind, Equinor’s Empire Wind, and Dominion Energy’s Coastal Virginia Offshore Wind. Developers and states sued almost immediately, and in these three cases, won. One Trump-appointed judge on the case questioned whether the administration’s security concerns applied to construction at all, noting they appeared focused on turbine operation. The government failed to rebut that argument in its filings.

These cases expose a core vulnerability in Trump 2.0’s clean energy rollbacks. Courts are drawing a line between legitimate policy shifts and punitive action. In the funding case, public admissions, rushed executive actions, and politically explicit framing created legal liabilities. Still, the DOE has said it disagrees with the ruling, and may retry it in court, so the battle isn’t over yet.

With offshore wind, the administration tried to weaponize uncertainty, betting projects would collapse before courts could intervene. That bet is starting to wobble. Judges are increasingly skeptical of last-minute halts backed by thin justifications, especially when billions in sunk capital and grid planning are on the line.

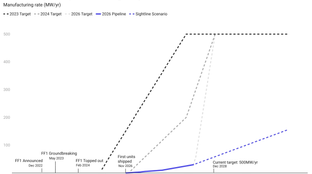

The wobble matters beyond US developers. Offshore wind uncertainty froze the US expansion plans of European turbine and component manufacturers that were counting on East Coast demand to justify factories, ports, and vessel investments. As projects stalled, those suppliers pulled back. Meanwhile, China’s offshore wind buildout has swung into oversupply, pushing down global turbine and component prices. If US projects restart under court protection, they may do so with cheaper imported equipment rather than the local supply chains policymakers originally hoped to build.

✈️ JetZero, a Long Beach, CA-based blended wing body jet manufacturer, raised $175m in Series B funding from B Capital Group, 3M Company, Northrop Grumman, RTX Ventures, and United Airlines Ventures.

⚡ Startorus Fusion, a Xi’an, China-based fusion power technology developer, raised $143m in Series A funding from China International Capital Corporation (CICC), Shanghai Intellectual Property Fund, Huacheng Venture Capital, MSA Capital, SummitView Capital and other investors.

⚡ Type One Energy, a Middleton, WI-based stellarator fusion power developer, raised $87m in Convertible Note funding.

🏠 Accelsius, an Austin, TX-based thermal management solutions provider, raised $65m in Series B funding from Johnson Controls and Legrand.

🚗 BillionElectric, a Vadodara, India-based e-Mobility-as-a-Service (eMaaS) platform, raised $25m in Growth funding from SBI Ventures.

🌾 MYCOPHYTO, a Grasse, France-based regenerative agricultural biotech developer, raised $19m in Series A funding from BNP Paribas, Bpifrance, Innovacom, CDG Invest, Crédit Agricole CIB, and other investors.

🛰 SkyFi, an Austin, TX-based satellite imagery and geospatial analytics platform, raised $13m in Series A funding from Beyond Earth Ventures, DNV Ventures, J2 Ventures, Rsquared VC, TFX Capital and other investors

⚒️ Transition Biomining (Transition Metal Solutions), a San Francisco, CA-based biomining technology developer, raised $6m in Seed funding from Transition VC, Astor Management, Climate Capital, Juniper Ventures, Kayak Ventures, SOSV, and other investors.

🌾 SenseUP, a Köln, Germany-based eco-friendly pesticide and parasiticide developer, raised $3m in Seed funding from undisclosed investors.

🌬 GreenTech, a Coimbatore, India-based renewable energy and efficiency services provider, raised $3m in Seed funding from Transition VC.

🏗 CLT Toolbox, a Melbourne, Australia-based structural design software developer, raised $3m in Seed funding from Electrifi Ventures, Energy Lab, Giant Leap Fund, Impact Ventures, Understorey Ventures and other investors.

☔ Birdseyeview, a London, England-based climate risk analytics platform, raised an undisclosed amount in funding from 24 Haymarket, ACF Investors, European Space Agency, and SFC Capital.

⚡ Aer Soléir, a Dublin, Ireland-based large-scale energy project developer, raised $210m in PF Debt funding from ABN AMRO, BayernLB, Canadian Imperial Bank of Commerce (CIBC), Nord/LB, and Siemens Bank.

☀️ Heelstone Renewable Energy, a Chapel Hill, NC-based utility-scale solar developer, raised $200m in Debt funding from Deutsche Bank.

⚡ Aspen Power, a Dallas, TX-based distributed generation developer, raised $200m in Debt funding from Deutsche Bank.

⚡ Inpasa Agroindustrial, a São Paulo, Brazil-based corn-based biofuels and food producer, raised $177m in PF Debt funding from Brazilian Development Bank (BNDES).

🥩 Aqua Cultured Foods, a Chicago, IL-based seafood alternatives producer, filed for Bankruptcy.

⚡ ElectriEase, a Rome, Italy-based EV charging infrastructure management platform, was acquired by Fortech for an undisclosed amount.

☀️ PVComplete, a Berkeley, CA-based solar project design software provider, was acquired by Enact Solar for an undisclosed amount.

⚡ Fundamentals, a Swindon, England-based grid voltage control solutions provider, was acquired by EA Technology for an undisclosed amount.

💰 Superorganism, a San Francisco, CA-based venture capital firm focused on biodiversity and nature-tech innovation, closed $26m for its first flagship fund..

💰 ALTÉRRA, an Abu Dhabi, UAE-based climate investment platform, closed $1.2bn for the ALTÉRRA Opportunity Fund.

This is a sample of deals available for Sightline clients. Can’t get enough deals?

President Trump and Northeastern governors are backing an emergency wholesale power auction in PJM that would force large tech companies to underwrite new generation through 15-year contracts, paying whether or not they use the electricity. The goal is to add capacity for data center load growth while shielding households and businesses from higher power bills.

Ireland has reopened grid connections for new data centers around Dublin, but only for projects that can fully self-supply power on-site and feed electricity back to the grid, reflecting ongoing reliability concerns as data centers approach a quarter of national power demand.

The UK secured a record 8.4GW of offshore wind in its latest auction, the largest ever in Europe, unlocking £22B in private investment. Projects cleared at an average £90.91/MWh, ~40% cheaper than the cost of building and operating a new gas-fired power plant.

CATL signed a record $17.2B deal to supply 3.05 million tons of LFP cathode material from 2026–2031, the largest on record. The deal comes as lithium carbonate prices in China have surged more than 70% since December, prompting the world’s largest EV battery maker to lock in long-term supplies and deepen vertical integration in key battery materials.

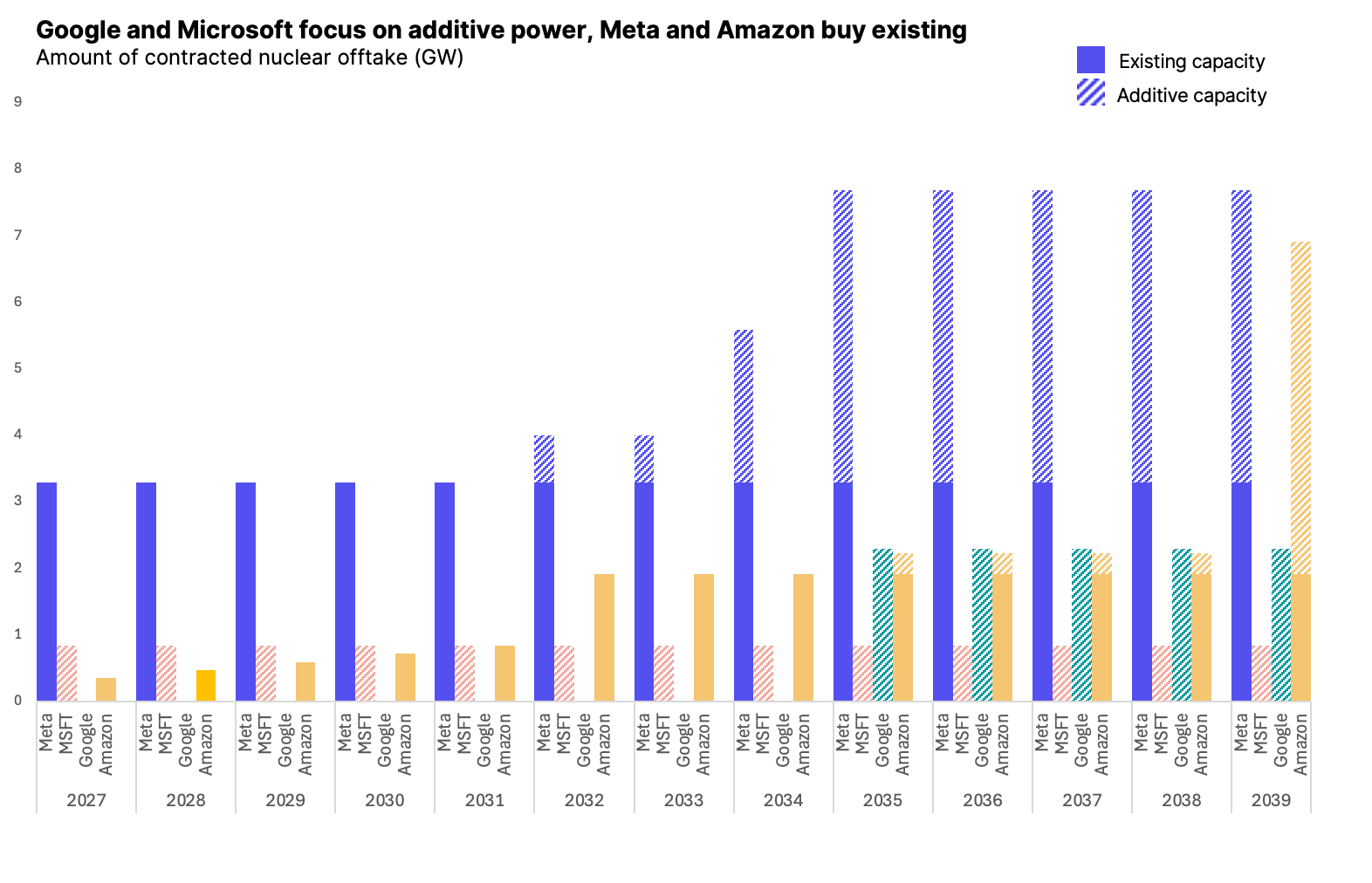

Meta signed a slate of nuclear deals with Oklo, TerraPower, and Vistra to secure up to 6.6GW of power by 2035 for data centers and AI, combining new advanced reactors with long-term PPAs from existing plants in Ohio and Pennsylvania. Meanwhile, Amazon bought the 1.2GW Sunstone solar-plus-storage project from bankrupt Pine Gate Renewables for $83M, following in Google’s footsteps to vertically integrate into the power stack. And Microsoft pledged to fully cover power and grid infrastructure costs.

Clients can get a deeper look into hyperscaler power play strategies on the Sightline platform here.

US greenhouse gas emissions rose 2.4% in 2025, outpacing economic growth and ending two years of declines. The increase was driven mainly by buildings (+6.8%), due to colder weather and higher heating demand, and the power sector (+3.8%), as higher gas prices and rising data center load pushed more coal generation.

EPA finalized a rule ending the monetization of health benefits in air pollution rules, easing rollbacks for coal and gas plants and undercutting a key analytical basis for emissions regulation despite criticism that it ignores well-established public health gains.

BP will take a further $4B–$5B write-down on its green energy businesses, bringing total impairments since 2023 to roughly $20B, as the company pulls back from renewables and hydrogen and refocuses on oil and gas after admitting its transition assumptions were overly optimistic.

Get the behind-the-scenes on CATL’s pricing power play.

The World Economic Forum’s Global Risks Report dropped climate-related risks down its list.

Davos is this week, and you can track private jets going to it.

Nat Bullard’s annual decarb slides are out. Is 194’s EV just a computer on wheels?

Good news: India and China both see coal drop for the first time.

Bad news: US greenhouse gas emissions ticked higher last year following two years of declines, according to a new Rhodium Group paper.

New research into the impacts of urban wildfires.

The first biomass-powered data center.

Solar supplied more power than coal to the ERCOT grid in 2025 for the first year ever, data shows.

Brookfield’s new whitepaper on the bull case for bulk renewables.

📅 Minneapolis Climate Week: Join us 3–6 Feb 2026 in Minneapolis, MN, USA for a community‑led series of workshops, tours, demos, conversation,s and gatherings advancing practical climate action across energy, water, food, materials, industry, policy, resilience and more

📅 The CDR Startup Journey: Join us Tuesday, 27 Jan 2026, 5:00 PM – 6:00 PM GMT on Zoom for the fourth webinar in the OpenAir Collective 2026 Carbon Removal Challenge series featuring founders from carbon dioxide removal startups sharing their journeys from academia to commercial deployment.

📅 Gridcog Unplugged: E-world edition: Join us on February 9 at Düsseldorf, Germany, ahead of E-world Energy & Water. An opportunity to engage with energy professionals over drinks, canapés, and a panel discussion featuring enspired, PwC, and Suncatcher.

Founding Account Executive @Ezra Climate

Associate @Prelude Ventures

Summer Associate @Grantham Foundation for the Protection of the Environment

Robot Software Engineer (Platform and Backend), Robot Software Engineer (HMI/UI), Electrical Engineer,Civil Engineer, Solution Engineer @Planted

Investment Associate, @Zero Infinity Partners

Summer Research Analyst – Environmental Markets, @Molecule Ventures

Full Stack Engineer, @Möbius Industries

Part-Time Inside Sales Representative, @Composer

📩 Feel free to send us deals, announcements, or anything else at [email protected]. Have a great week ahead!

A new weekly briefing on the moves and motives shaping power markets

England strikes lithium and comes up with geothermal gold

Small reactors, big power rankings