🌎 Inside Cloverleaf Infrastructure’s power play #206

Our Q&A with Brian Janous on AI, data center demand, and the need for speed

New NSA report highlights interdependence of energy and freedom

Happy Monday! In this week’s issue, we dig into the NSS’s report detailing the climate crisis as the ‘existential challenge of our time’ – key highlights include linking our domestic work with our international credibility, our industrial base as critical for innovation, and supply chain challenges and foreign energy reliance as critical trade and security levers.

In fundings this week, $125m for indoor farming, and $30m for textile recycling, along with Lightrock’s new $834m climate tech fund and HY24’s $2B to invest in the hydrogen value chain.

In the news this week, GM goes energy electric, the World Bank launches a new fund for carbon credits, Microsoft adds carbon accounting to the 365 suite, and states take on Biden’s nationally unfunded climate corps programming.

Thanks for reading!

Not a subscriber yet?

📩 Submit deals, announcements, events & opportunities, or general curiosities for the newsletter here.

💼 Find or share roles on our job board here.

Last week the White House released a much-anticipated 360-degree national security manifesto, with climate change at the center. The ~50 page strategy document includes no fewer than 63 mentions of “climate” and 50 mentions of “energy”, with decarbonization and its derivative impacts represented throughout every priority from China to the Arctic, democracy to STEM education, critical minerals to cyberdefense.

The climate crisis’ centerpiece role as “the existential challenge of our time” is unprecedented in these National Security Strategy docs, which read as a point in time litmus test of the administration’s summary leanings. By contrast, the Obama administration’s 2015 strategy described climate change as just “an urgent and growing threat.” With today’s shrinking window of opportunity:

Tensions will further intensify as countries compete for resources and energy advantage—increasing humanitarian need, food insecurity and health threats, as well as the potential for instability, conflict, and mass migration. The necessity to protect forests globally, electrify the transportation sector, redirect financial flows and create an energy revolution to head off the climate crisis is reinforced by the geopolitical imperative to reduce our collective dependence on states like Russia that seek to weaponize energy for coercion.

Policy action at home lends to credibility abroad: “This domestic work is key to our international credibility, and to getting other countries to up their own ambition and action.”

Autocrats have accelerated the energy transition: “Events like Russia’s war of aggression against Ukraine have made clear the urgent need to accelerate the transition away from fossil fuels. We know that long-term energy security depends on clean energy.”

Trade with allies is key to decarbonization cooperation: "Our steel agreement with the EU, the first-ever arrangement on steel and aluminum to address both carbon intensity and global overcapacity, is a model for future climate-focused trade mechanisms.”

The document reads like a thesis mashup of American Dynamism meeting the climate reality. NEC Director Brian Deese set the stage in an affiliated speech summarizing the “widespread reassessment of globalization, and uncertainty about America’s productive potential” up against a complex set of global serial shocks from the pandemic, supply chain disruptions, Putin’s war, inflationary pressures, and competition with China. The conclusion: America needs a Modern Industrial Strategy. One in which strategic public investment is the backbone of a strong industrial and innovation base in the 21st century global economy. And just in time - the passing of the IRA marks the transition from an era of R&D science policy to the trappings of the start of a deployment industrial policy.

Innovation is a defense strategy. Climate is perceived as no longer just a “threat multiplier”, but equally as an opportunity generator. Investing in climate innovation, particularly supply-side innovation, will “sharpen [American] competitive edge for the future.” Innovation gets a hefty 24 mentions throughout the document with hat tips to IRA, the CHIPS Act, and the National Biotechnology and Biomanufacturing Initiative. Another case in point - the activation of the Defense Production Act earlier this year to scale clean energy.

America seeks to outcompete China’s deployment game with innovation and the new Modern Industrial Strategy. While barbs against Russia throughout the doc remained targeted to constraint, the authors held back no broad swings against China’s authoritarianism: “[The PRC] also continues to endanger the world with inadequate action on climate change domestically, particularly regarding massive coal power use and build up.” The NSS evidently believes that investing in American innovation and strategic public funding will play a fundamental role in shaping our competitive dynamic with China. Yet, while the IRA and other policies move the elbow of the free market hand to aligned industries, China can just entirely redirect it - Chinese climate tech deals rebounded from $5.6B in 2020 to $8.7B in 2021.

TL;DR, climate tech has a multifaceted value prop. It’s fair to say that despite competition, a climate win for one is a win for all as the world moves towards preventing a 1.5 °C warming scenario. At the same time, the National Security Strategy makes the case for climate tech as a powerful tool in securing a stable geopolitical future.

🌾 Soli Organic, a Harrisonburg, VA-based indoor farming company, raised $125m in Series D funding from CDPQ Infra, XPV Water Partners, S2G Ventures, B.V., Movendo Capital, and Cascade Asset Management.

👚 Worn Again Technologies, the UK-based textile recycling company, raised $30.8m in funding from Sulzer, Oerlikon, and H&M.

☀️ SunDrive Solar, an Australia-based solar cell manufacturer using copper, raised $21m in Series A funding from Virescent Ventures, Main Sequence Ventures, Grok Ventures, and Blackbird Ventures.

🐄 AgriWebb, a Australia-based livestock management platform, raised $15.9m in Series B funding from iSELECT Fund and Germin8 Ventures.

🌳 Propagate Ventures, a Denver, CO-based platform helping farmers scale agroforestry, raised $10m in Series A funding from The Nest, Agfunder, TELUS Pollinator, Techstars, and the Grantham Neglected Climate Opportunities.

☀️ Solestial, a Tempe, AZ-based company developing solar technology for space, raised $10m in Seed funding from Airbus Ventures, AEI HorizonX, GPVC, Stellar Ventures, and Industrious Ventures.

🌍 Net Purpose, a UK-based sustainable investing platform, raised $9.8m in Series A funding from ETF Partners, M-Tech Capital, Exceptional Ventures, Illuminate Financial and Revent increased their commitments.

🧪 Synonym Biotechnologies, a New York, NY-based financing and development platform for bio-manufacturing facilities, raised $6.3m in Pre-seed funding from Andreessen Horowitz, Giant Ventures, Blue Horizon, and Thia Ventures.

💨 Parity, a Canada-based HVAC operations company, raised $5.8m in funding from Wyse Meter Solutions, RET Ventures, and ArcTern Ventures.

💨 Climatiq, a Germany-based API platform tracking companies’ carbon footprints, raised $5.8m in Seed funding from Singular and Cherry Ventures.

🌎 Continue AI, a New York, NY-based sustainability intelligence platform, raised $5.7m in Seed funding from Maple Capital, Grove Ventures, Ride Ventures, Liquid 2 Ventures, and Kindergarten Ventures.

💨 Carbonfuture, a Germany-based carbon removal credit marketplace, raised $5.4m in Seed funding from Carbon Removal Partners, Übermorgen Ventures, WiVenture, 4impact Capital, and Sustainable Future Ventures.

🚗 Vecmocon Technologies, an India-based manufacturer of EV components, raised $5.2m in Seed funding from Tiger Global Management and Blume Ventures.

🗑️ Waste4Change, an Indonesia-based startup developing digital waste management infrastructure, raised $5m in Series A funding from AC Ventures, Barito Mitra Investama Junerosano, Urban Gateway Fund, SMDV, Paloma Capital, Living Lab Ventures, Delapan Satu Investa, and Basra Corporation.

💨 Iconic Air, a Morgantown, WV-based provider of a carbon accounting platform for energy-intensive industries, raised $5m in Seed funding from XYZ Venture Capital, Garuda Ventures, the GTM fund, and Country Roads Angel Network.

💨 MOF Technologies, a UK-based carbon capture company reducing industrial emissions, raised $4.3m in Series A funding from Clean Growth Fund and Barclays Ventures.

⚡ Solarize, a Germany-based software company developing microgrid operation software, raised $4.2m in Seed funding from Point Nine and Picus Capital.

♻️ GreenPlaces, a Releigh, NC-based software company helping companies reach sustainability goals, raised $4m in Seed funding from Felicis and Bull City Ventures Partners.

🐛 FlyFeed, an Estonia-based insect farming company producing high-nutrient protein, raised $3m in Seed funding.

🍎 Smart Apply, an Indianapolis, IN-based company developing precision sprays for orchards, raised $3m in Seed funding from Serra Ventures, VisionTech Angels, and Frontier Angels.

🌾 Switch Bioworks, a San Carlos, CA-based developer of nitrogen fertilizer, raised $2.3m in funding from Emerson Collective, Acre Venture Partners, and Astanor Ventures. Fortune.

🌎 Earthmover, a Nyack, NY-based climate data company, raised $1.7m in Pre-seed funding from Costanoa Ventures.

⚡ Infinium, a Sacramento, CA-based developer of electrofuels, raised an undisclosed amount of funding from SK Innovation.

✈️ Universal Hydrogen, a Hawthorne, CA-based green hydrogen distribution company raised funding from American Airlines.

Westinghouse Electric, a nuclear services business, was acquired by Brookfield Renewable Partners and Cameco for $7.9B.

Alternus Energy, an Ireland-based renewable energy producer, is going public at an implied $863m via merger with SPAC Clean Energy Acquisitions Corp.

Dragonfly Energy, a Reno, NV-based lithium ion battery developer, has gone public through merger with SPAC Chardan NexTech Acquisition 2 Corp.

Hy24 raised $2B for its Clean H2 Infra Fund, aiming to invest exclusively in hydrogen value chain projects.

Lightrock raised $834m for its Climate Tech Fund, focused on investing in startups specializing in sustainable agriculture, clean energy, and decarbonization, among others.

Capital Dynamics raised $506m for its Capital Dynamics Clean Energy Infrastructure IX fund, aimed to invest in renewable projects across Europe.

New England Conservation Services, a Woodbridge, CN-based company providing residential energy efficiency services has been acquired by PosiGen Solar, a Metairie, LA-based company solar energy provider.

Solstice Power Technologies, a Cambridge, MA-based company distributing community solar power has been acquired by MyPower Corp, an investment firm specializing in renewable energy.

Spherics, a UK-based carbon accounting startup has been acquired by Sage Group, a UK-based accounting firm for SMBs.

BetterClimate, a corporate sustainability platform, was acquired by Watershed.

GM is electrifying past vehicles into energy. GM Energy will provide battery packs, EV chargers, solar panels, and energy management products as it seeks to take on rivals Tesla and Ford. The initiative includes a partnership with SunPower to install GM’s home energy systems integrating EVs, solar, and storage.

The World Bank announced that it is raising a fund dedicated to funding projects to reduce carbon dioxide emissions, predominantly in developing countries. Focus areas will nature-based climate solutions, financial solutions for climate action and sustainable infrastructure. The Scaling Climate Action by Lowering Emissions (“SCALE”) fund, to be launched during COP27 next month, will seek to generate high-quality carbon credits that allow low- and middle-income countries to access international carbon markets.

Microsoft is adding a carbon accounting and markets function to its enterprise 365 offering, jumping into the race to become companies’ preferred provider for emissions tracking and reporting. This comes on the heels of Salesforce’s recent announcement of a carbon credit marketplace, to be added on to its Net Zero Cloud sustainability management platform.

New Zealand’s government has proposed a levy on agricultural emissions by 2025 — a move that would be a world first. The system will charge farmers for methane, carbon dioxide and nitrous oxide emissions (including, yes - cow burps); while pricing is yet to be finalized, the government has said that farmers can recoup the cost by charging premia for greener products.

For those tired of waiting in traffic to get to the airport, Delta Air Lines is partnering with Joby Aviation to integrate the startup’s electric vertical takeoff and landing (eVTOL) service into Delta's existing booking process for travel door-to-door in five major cities.

This solar-powered town in Florida made a hercul-Ian effort to build for extreme weather events. This last hurricane, those efforts paid off when the lights stayed on throughout the storm.

Climate counter culture! Deep Tropics Music Festival is as clean as it is cool. Like-minded festivals are tapping into festival dancers' body heat to power dance floors.

Dogsledding culture and customs in Greenland could be the next victim of a changing climate.

14 actually good kids’ books on climate change.

Hot take in NYMag that the Climate Justice Movement is not helping climate, nor justice. The progressive left wants to empower communities, but stop infrastructure deployment required for a clean transition.

An EV set the new world record for the fastest acceleration from 0 to 60 in 1.46 seconds. Watch them do it here.

Biden’s vision of the Climate Corps is taking off nationally – but funded by state governments.

Climate risk might make Florida uninhabitable for all but the super rich.

🗓️ Venture Atlanta: Join Sophie on Oct 20 in conversation with Jon Shieber and Bill Nussey about climate’s trillion dollar opportunity at this large conference for founders and corporates.

🗓️ Recycling Lithium from Batteries: Register for this hybrid event at Stanford on Oct 20 to listen in on a fireside chat with Mike Lim, Partner at TRIREC, and Leon Farrant, Green Li-Ion’s CEO & Co-Founder, on how they are working together to revolutionize the battery industry.

🗓️ Women and Climate NYC October Dinner: Register for dinner on Oct 20 and discuss climate with other female identifying individuals – no professional climate experience necessary.

🗓️ Fuze - Igniting Energy Tech: Register for this two day event (Oct 26-27) taking place in Houston, TX to learn from and connect with others interested in and working on technology that will shape the future of energy.

Investment Analyst, Investment Associate @S2G Ventures

Principal, Partner @Climate Capital

Carbon Management PR/Communications Strategist @Great Plains Institute

Expert Network Strategy & Operations Manager @OnePointFive

Community & Growth Manager @OnePointFive

Director of Finance @Aeroseal

Principal Software Engineer @Aurora Solar

Feel free to 📩 send us new ideas, recent fundings, events & opportunities, or general curiosities. Have a great week ahead!

Our Q&A with Brian Janous on AI, data center demand, and the need for speed

England's new election ushers in a new test of clean energy and climate tech

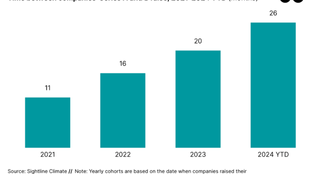

H1'24 funding totaled $11.3 billion, down 20% from H1 2023.