🌏 The bits and bytes of grid tech

(Bonus edition) Part III: The software “middleware” layer for grid operators / utilities

Building a new energy future with guest column from Mark Tomasovic at Energize Ventures

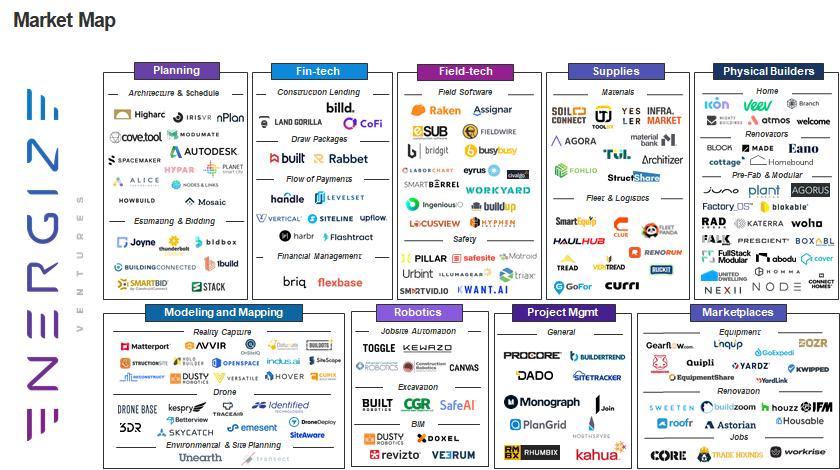

If you’re bullish on renewables, you’re bullish on construction.

To reach net zero goals, more than $4 trillion will need to be invested in renewable energy infrastructure globally by 2030, tripling the current installed base of wind and solar. The US is on track to reach $1 trillion in renewable energy investment in the next decade - but as Thomas Edison said, vision without execution is hallucination, and millions of renewable energy assets aren’t built in a day.

From forecasting cash flow to pouring concrete, the energy transition is a massive construction undertaking. As the world moves from centralized power plants to decentralized wind and solar assets, building these distributed energy resources presents unique execution challenges. Installing DERs across thousands of acres requires all hands on deck from a host of specialized teams not currently set up to scale. Procurement of the materials required for these projects (concrete, steel, aluminum, electrical) will drive a super cycle of demand for inelastic construction inputs. Moreover, historically poor construction labor productivity could hinder the industry’s ability to complete these projects on time.

There’s reason to remain optimistic. Due to COVID-19, construction project stakeholders have increased digital tools adoption. From the lender to the material supplier, construction firms are realizing the potential for software and robotics to increase productivity and improve project margins. Lowering renewable project soft costs can ultimately expedite timelines and increase the number of projects deployed. Construction tech is building the way to the renewable energy industry’s lofty goals.

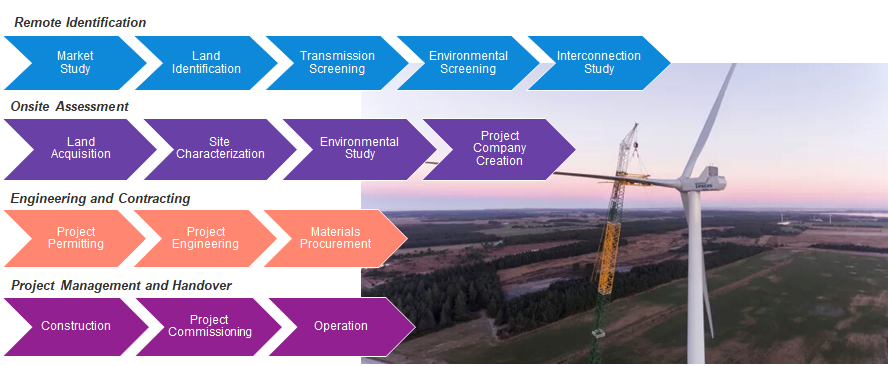

Renewable project development requires the careful coordination of several sequential project workflows. From engineering to environmental screening, much of the pre-construction work often occurs in silos - with specialists, consultants, and other “soft costs” (e.g. accounting, filing, legal, finance, etc.) embedded throughout. Each of these soft costs constrain bandwidth and ultimately slows the number of projects deployed.

Improvements in enabling technologies such as LiDAR, robotics, cloud, and machine learning have unlocked novel automation capabilities. Lenders, developers, contractors, and suppliers now have - for the first time – the ability to do more projects with less labor resources. Digital technologies can minimize soft costs by automating many project development workflows, and the output is more renewable energy.

For example, Aurora Solar automates rooftop solar engineering using satellite imagery and LiDAR technology, enabling solar installers to create a complete design and sales proposal using just an address and an electric bill.

Example innovators: Transect (environmental screening), Unearth (satellite-based work planning), Join (pre-construction collaboration), Envelio (interconnection screening), Briq (financial forecasting)

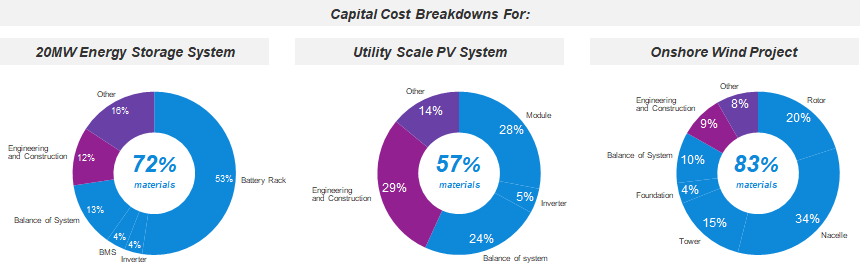

But pre-construction labor efficiencies only get us to the starting line. And unlike finance, IT, or media, the construction industry relies on physical materials to function. Building an unprecedented amount of renewable energy assets requires an unprecedented amount of materials.

While renewable energy assets don’t consume fuel, these new energy facilities require more upfront materials than their fossil predecessors. Onshore wind plants require 9x the minerals compared to gas-fired power plants, and standard 2 MW wind turbines require 400 tons of concrete, iron, and steel. The majority of the lifetime costs for wind turbines - and the majority of capital costs for all renewable assets - are the materials required to build them.

Sourcing, procuring, and transporting this enormous new volume of materials will be a massive challenge, with the geographically remote nature of renewables increasing the supply chain complexity. Innovations across planning tools, supply chain trackers, and online marketplaces are easing subcontractors’ sourcing and purchasing of the right material for the job. From expediting equipment rentals to purchasing electrical conduit at the click of a button, digital technologies are streamlining the materials management and delivery process and preventing construction delays.

Example innovators: Agora (construction materials marketplace), Infra Market (construction materials marketplace), GoExpedi (digital equipment supply chain), Equippo (used equipment marketplace), Dozr (equipment rental marketplace)

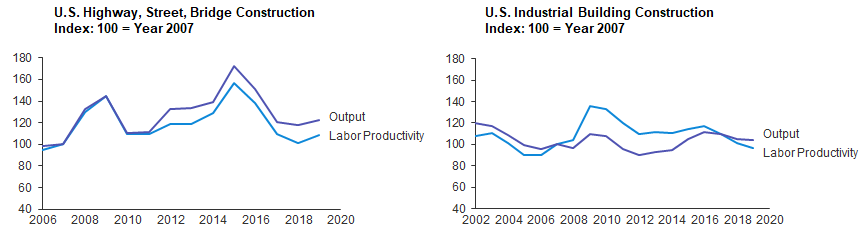

Lagging other industries like manufacturing which have seen significant increases in productivity over the last two decades, construction productivity at the job site has comparatively stagnated.

😵 Every construction project is a prototype. With each new project comes a new assortment of conditions, regulations, contractors, and standards. This variability at the job site has kept construction productivity flat for the last 20 years. In fact, because of these complexities, 98% of megaprojects incur cost overruns or delays.

👨👨👦 General contractors and sub-contractors are often family-run businesses with razor-thin margins. These two factors lead to low willingness to spend the business’ cash flow on digital innovation. Historically, 36% of construction employees have been hesitant to try new tech because they feel as if they’re borrowing from the family’s money.

🚧 Construction is a high-risk industry. Imagine building an infrastructure project and telling the project manager to “move fast and break things.” Construction safety is of utmost importance, and introducing change often introduces new risk. Instead construction firms often prefer to minimize process changes and stay with “the way things have always been done.”

However, with the right product and go-to-market strategy, digital technology can tactically alleviate these headwinds.

📞 Field-based software, for instance, helps improve scheduling and increase transparency between subcontractors on the job site. Increasing communication on-site minimizes the variability that has historically caused construction re-work and delays. A clever startup go to market strategy allows subcontractors to use the software for no cost if they’re working for a GC who’s a customer.

Example construction management software: Sitetracker, Procore, Rhumbix, Assignar, Raken, Fieldwire

💸 A second example is reality capture on the job site. Many GCs and subcontractors are averse to new technology because it cuts into their cash flow margin. However, new reality capture tools (like 360 degree photos) can actually help these contractors get paid faster. By documenting construction progress through reality capture devices, the project lender gains a real-time visualization of project progress, and the increased transparency expedites the disbursement of funds to the GC and subcontractors.

Example innovators: DroneDeploy (drone data analytics), Structionsite (construction visualization), Openspace (construction visualization), Doxel (construction visualization)

🦺 Finally, digital technologies can help improve safety on the job. Computer vision platforms help the site foreman automate the identification of job site risks by analyzing real-time video. Machine learning platforms prioritize risk by probability and consequence, enabling companies to tackle the most critical hazards first. Today it is simply unacceptable for workers or civilians to get hurt by a construction project. With today’s degrading US infrastructure and desire to execute projects faster than ever, it's critical that construction firms characterize and prioritize risks appropriately to ensure that no one is injured on the job site.

Example innovators: Safesite (safety management), Matroid (computer vision), nPlan (risk analysis), Urbint (predictive maintenance), Smartvid.io (predictive analytics)

Special thanks to Mark Tomasovic and the team at Energize Ventures, an alternative investment manager focused on accelerating innovation for energy and sustainable industries. Earlier this week, Energize Ventures announced the close of their $330m Fund II. If you’re an entrepreneur building digital technology in the energy, infrastructure, climate, cyber, or mobility space, or looking to energize your career at a company putting software to work for climate, the team would love to hear from you!

(Bonus edition) Part III: The software “middleware” layer for grid operators / utilities

Part II: How grid tech is the rails of the energy transition

The Goldilocks effect in geothermal HVAC systems