🌏 High-flying fuels

The runway for sustainable aviation fuels

The current EV charging market is quite fragmented, with the financing and installation build-out dependent on the customer and location.

The current EV charging market is quite fragmented, with the financing and installation build-out dependent on the customer and location. The majority of EV owners are charging at home, with ~75-80% of EV owners in the US having access to home charging. Other options include community-based or public charging. Workplaces, such as Yahoo and Apple, have directly financed chargers on their corporate campus as capex costs for slow chargers (Level 1 or 2) aren’t that high. There are also companies like Sparkfund which work with EV charging vendors such as EV Connect to provide Charging-as-a-Service by cutting upfront costs and turning the purchase decision into a monthly operational expense. Major EV public charging networks such as EVgo, ChargePoint, and Electrify America already cover the US and are continuing to expand.

From a customer experience perspective, the major issue with these bespoke charging networks is lack of interoperability. If I’m a ChargePoint customer, I have to use a ChargePoint-specific app or payment card, which limits my range options for other charging stations. Meanwhile Tesla users must carry around an adapter so they can plug in to non-Superchargers. Since the OEMs aren’t playing nice on the hardware charging side, we’re relying on third parties to develop dongles and other adaptable hardware. You can make an analogy to the early cell phone landscape – before iPhones came out, you picked your cell phone carrier (e.g. the electric vehicle) and then your phone (e.g. the charger). There’s a lot of innovation in the space (check out Freewire’s mobile charging units), but we’re missing the interoperability component which will allow EV charging to be as accessible as it’s fossil-fuel rival gas stations.

Looking forward, utilities are natural suitors for owners and managers of EV charging networks. They love putting low cost capital to work, and already hold the key to the electricity supplied to these chargers. Some utilities, including Innogy, Enel, E.On, and Vattenfall, have already emerged as owners and operators of charging networks. However, utilities have historically been slow to adopt new technologies, and generally have experience building poles and wires not distributed charging networks. Given the speed of how EV markets are developing, utilities can focus on what they do best – owning and operating on the backend, while linking up with players such as ampUp to design and operate the customer-facing front-end.

Interested in more content like this? Subscribe to our weekly newsletter on Climate Tech below!

The runway for sustainable aviation fuels

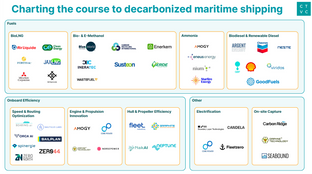

Well-to-wake pathways to cleaner shipping

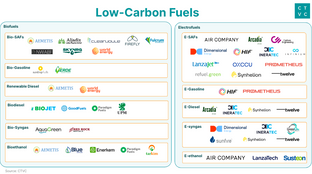

The cost and complexity challenges of creating drop-in alternative fuels