🌎 Inside Cloverleaf Infrastructure’s power play #206

Our Q&A with Brian Janous on AI, data center demand, and the need for speed

Lots of capital to weather the so-called “climate tech winter”

Happy Tuesday!

In this issue, we cut through the doom-and-gloom headlines to pit data vs myth and sort out the amount of dry powder ready to weather climate companies through any such recession. In short, we’re in a healthy spot. Even in a pull-the-plug scenario, there’s ample committed climate capital for strong companies to continue growing - and hiring.

In fundings, EcoVadis raises $500m for sustainability ratings, followed by a CA based eVTOL startup netting $145 and $80m for more energy efficient motors. In the news, KKR argues for the $1.5-2T energy transition opportunity as Matt Levine argues for keeping oil majors public for more accountability (contra Harold Hamm’s offer take-private shale producer Continental Resources).

Thanks for reading!

Not a subscriber yet?

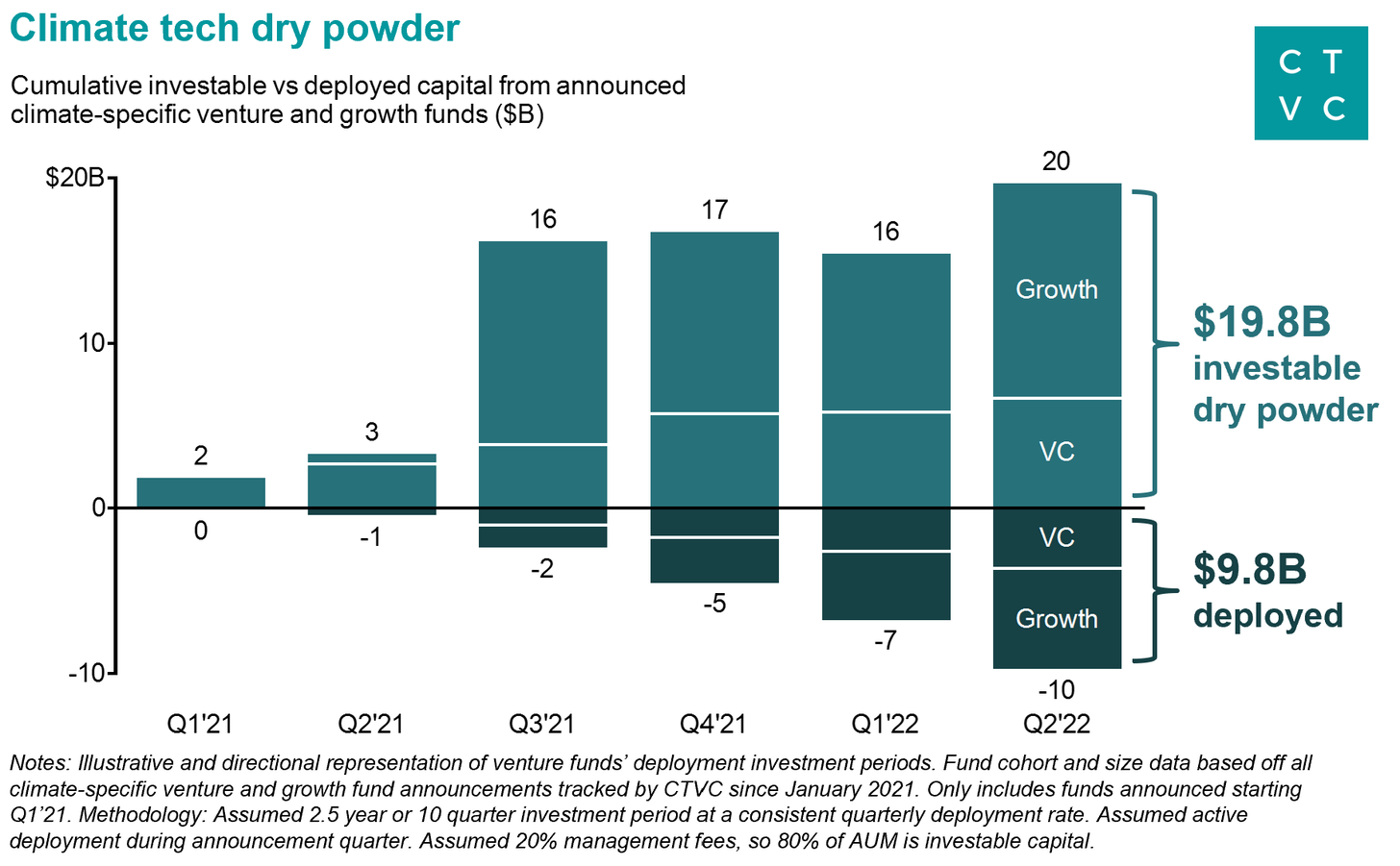

Over the past 18 months, we’ve tracked 78 new climate venture and growth-stage investment funds. Given the time it takes to raise a new specialized investing vehicle, fund announcements arrive as lagging indicators after cycles of strong market promise - likewise, as the tourists from other sectors return back to more familiar pastures, these dedicated funds will delay any ensuing waves and maintain stability.

There’s ample climate capital in the market to stay warm through a cold snap.

Since the start of 2021, 72 climate venture funds totaling $13B and 6 growth funds totaling $24B have been announced. Following some standard deployment assumptions, we expect that $10B of that reserved capital has been plowed into climate companies. Which, if assumptions hold, means that there’s ~$20B in the tank to fuel climate tech innovation.

Over the same period, CTVC has tracked $27B of venture funding across 844 early stage (Pre-Seed through Series C) climate deals. It checks out that 2/3rds of the capital from those 844 deals comes from non-climate first sources or funds raised before Q1’21. Strong syndicates are built on diversity of capital, which the past 18 months have enjoyed - as 2,000+ unique funds have participated in at least 1 climate deal. Though, it’s comforting to know that even in the most conservative of scenarios where those who are not mandated or structurally positioned to invest in climate pulled out, and that no further climate funds were raised, that the sector would still be able to support growth.

Climate is not unlike other sectors, where ample cash is available, albeit on the sidelines. Capital will likely flow towards earlier stage companies with a return curve further out, and into quality later-stage companies that have more traditional revenue return profiles. What does this mean?

🤓 For founders:

🤑 For investors:

🎉 For exits:

[Correction: Last week, we made a major single-letter typo. The Defense Production Act sports $900m - not $900b - in its earmarked funding pool. We’d be remiss if our typo distracted from the takeaway that the DPA is a tiny sum that’s split across a lot of important causes from baby formula, to COVID vaccines, to clean energy.]

🌱 EcoVadis, a Paris-based provider of supplier sustainability ratings, raised $500m in funding from Astorg, General Atlantic, GIC and Princeville Capital.

🚁 Overair, a Santa Ana, CA-based eVTOL startup, raised $145m in Series B funding from Hanwha Systems and Hanwha Aerospace.

⚡ Turntide Technologies, a Sunnyvale, CA-based developer of energy efficient electric motors, raised $80m in Series D funding from OGCI Climate Investments, SDCL Energy Efficiency Income Trust, Fifth Wall, and Meson Capital.

♻️ Moleaer, a Carson, CA-based developer of nanobubble technology enabling industries to reduce their footprint, raised $40m in Series C funding from funds managed by Apollo and Husqvarna.

⚡ C-Zero, a Goleta, CA-based developer of methane pyrolysis tech, raised $34m from SK Gas, Engie New Ventures, Trafigura, Breakthrough Energy Ventures, Eni Next, Mitsubishi Heavy Industries and AP Ventures.

🔋 Battery Smart, an India-based EV battery swapping network, raised $25m in Series A funding from Tiger Global, Catalyst Trustee, and Orios Fund.

♻️ Eureciclo, a Brazil-based recycling logistics company, raised $21m in Series B funding from Ória Capital, Tera, Rise Ventures, Endeavor Scale-Up, and Redpoint eventures.

⚡ Xendee, a San Diego, CA-based developer of DER planning and optimization software, raised $12m in Series A funding from Anzu Partners, Evergy Ventures, Surlamer Investments, and TravelCenters of America.

🌬️ Wind Catching Systems, a Norway-based developer of floating offshore wind designs, raised $10m in Series A funding from GM Ventures.

🏠 Ecoworks, a Berlin-based modular carbon-neutral housing retrofit startup, raised $8m fromBlackhorn Ventures, JLL Spark Global Venture, Zacua Ventures, PropTech1, Warema Group, and Motu Ventures.

🧊 Ecozen, an India-based provider of sustainable cold chain products, raised $6.9m in Series C funding from Dare Ventures, Hivos-Triodos Fund, and Caspian Impact Investments.

🌱 Terra.do, a Stanford, CA-based global climate career platform, raised $5m in Seed funding from Avaana Capital, SIG, TELUS Pollinator Fund for Good, Precursor, BEENEXT, City Light, Hummingbird Firm, Avesta, MCJ Collective, E8 Angels, C3, and Stanford Angels & Entrepreneurs, Albert Wenger, David Helgason, and others.

🏠 Ecolibrium, an India-based real estate energy decarbonization platform, raised $5m in Seed funding from Swordfish Investments and Unbound.

👚 Materra, a London-based producer of climate-resilient cotton, raised $4.5m in Seed funding from H&M Group, Bestseller’s Invest Fwd, Fashion For Good, Apex Black, and Perivoli Innovations.

☀️ Glint Solar, a Norway-based SaaS platform helping developers site solar projects, raised $3m in Seed funding from Wiski Capital, Statkraft Ventures, Momentum, Link Venture Capital, Antler, and 547 Energy.

💨 Travertine, a Boulder, CO-based carbon dioxide removal and industrial chemical production startup, raised $3m in Seed funding from Grantham Environmental Trust and Clean Energy Ventures.

⚡ Granular Energy, a Paris-based startup helping companies match energy consumption with zero-carbon power around the clock, raised $2m in Pre-seed funding from Seedcamp.

🏗️ Green Badger, a Savannah, GA-based SaaS developer for managing sustainable construction, raised $1.1m in Seed funding from Shadow Ventures, GroundBreak Ventures, Hamilton Ventures, and others.

⚡ Newtrace, an India-based green hydrogen electrolyzer, raised $1m in Pre-seed funding from Speciale Invest and Micelio Fund.

Blink Charging, a Miami, FL-based EV charging network, is acquiring SemaConnect, an EV charging infrastructure company, for $200m.

Temasek launched GenZero, a $5B investment platform company aimed at accelerating decarbonization globally.

Another climate changed summer begins. Nearly every part of the continental US is facing extreme weather - flash floods in Yellowstone, wildfires in Arizona and California, Midwest heatwaves up to triple-digit-high temperatures in Chicago, Memphis, and Indianapolis, and hail in Mexico covering cities in several inches.

Move over net zero, this is real net zero. NextEra Energy, one of the world’s largest utilities and renewables developers, is putting its stamp (quite literally a ™) on getting to real net zero by 2045. The utility plans to eliminate all carbon emissions without relying on offsets by significantly expanding its portfolio of solar, batteries, nuclear, RNG, and convert more than ⅔ of its natural gas power plants to run on hydrogen.

Also jumping aboard the hydrogen train, Big Oil players BP and TotalEnergies announced significant green hydrogen investments expanding into APAC. BP acquired a 41% stake in the 26 GW Asian Renewable Energy Hub in Australia, and TotalEnergies acquired a 25% stake in Adani’s New Industries to produce green hydrogen in India

Biden introduced several initiatives at the Major Economies Forum: reducing methane emissions from O&G, galvanizing $90B for clean tech scale up, making 50% of new cars sold electric by 2030, and raising $100M for alternative fertilizer. Facing pressure at the pump back at home, Biden hinted he may use the same Defense Production Act boosting clean energy last week to ramp gasoline output.

Two senators across the aisle introduced the Carbon Removal and Emissions Storage Technologies (CREST) Act, which would direct the DoE to accelerate R&D for carbon removal projects. Meanwhile, a new ARPA-E program launched with $39m in funding and 18 projects turning novel building materials and designs into a carbon sink.

Australia's new government pledges to cut emissions by 45% by 2030 compared to 2005 levels, signaling a material shift in climate priorities with the Labor-led government.

China is betting big on hydro, with plans to construct 200 pumped hydro stations with a capacity of 270 GW (!) by 2025, enough to meet 23% of the country’s peak demand. Next door, India is planning to hold its first offshore wind auctions for 10-12 GW capacity.

Brown spinning’s latest case and point. Billionaire Harold Hamm offered to take Continental Resources, a shale company drilling in Texas to North Dakota, private for $25B to take the company out of public scrutiny.

Cleaning clean energy. The importance of improving solar panel, wind turbine, and battery recycling.

American Carbon Registry follows Verra in developing new rules on carbon credit tokenization.

Bill Gates speaks with TechCrunch about key challenges and opportunities in the fight against climate change.

UPS pilots tiny electric delivery carts to cut emissions. Any name ideas for these vehicles?

Wyoming bets big on carbon capture to save its coal industry, but utilities push back.

A melting glacier forces Nepal to move Everest basecamp.

A new Net Zero Tracker from the New Climate Institute shows that climate commitments have proliferated with limited credibility.

“We think the energy transition is $1.5-2.0 trillion opportunity per year,” writes KKR CIO Henry McVey.

New research suggests that small modular reactors could produce more waste per unit of power than large powerplants.

Matt Levine argues that keeping oil companies in the hands of public index investors can help protect the planet.

💡 The Creative Destruction Lab Mentorship Program: Apply to the CDL-Climate Stream for technical founders tackling climate, natural resource and environmental challenges by July 31st.

💡 Frequency Bio: Apply by July 1st to Pillar VC’s free virtual program designed to help you explore launching a bio startup on August 1-5th.

💡 On Deck Climate Tech: Apply to On Deck’s 4th cohort to join founders, operators, investors, and advisors across the Climate Tech ecosystem starting on July 12th.

Product Marketer @Macro-Eyes

Senior Account Executive @Forerunner

Chief Engineer @Brilliant Planet

Full Stack Developer @SXD

Managing Director @Purpose Venture Group

Senior Analyst / Associate @Angeleno Group

Head of Research @RightHandGreen

Finance and Operations Analyst @Blackhorn Ventures

Manager, Investor Relations @Unreasonable Group

Principal (Investor), Investment Director @BHP

Feel free to 📩 send us new ideas, recent fundings, events & opportunities, or general curiosities. Have a great week ahead!

Our Q&A with Brian Janous on AI, data center demand, and the need for speed

England's new election ushers in a new test of clean energy and climate tech

H1'24 funding totaled $11.3 billion, down 20% from H1 2023.