🌎 Lithium-ion is the benchmark in new LDES leaderboards #281

With long duration energy procurement surging, new rankings reveal who's pulling ahead

Happy Monday!

The EU’s Carbon Border Adjustment Mechanism has arrived. We did the math to figure out just how expensive it gets, and who’s most exposed.

In deals, $16bn for self-driving cars, $1.5bn for utility-scale energy storage development, and $270m for autonomous construction technology development.

In other news, the Trump administration’s $12bn critical mineral stockpile plan, the EU’s first voluntary standard for permanent carbon removals, and another mega-merger in shale.

Thanks for reading!

Not a subscriber yet?

📩 Submit deals and announcements for the newsletter at [email protected].

💼 Find or share roles on our job board here.

CTVC is powered by Sightline Climate, the tactical market intelligence platform for energy and investment decision-makers.

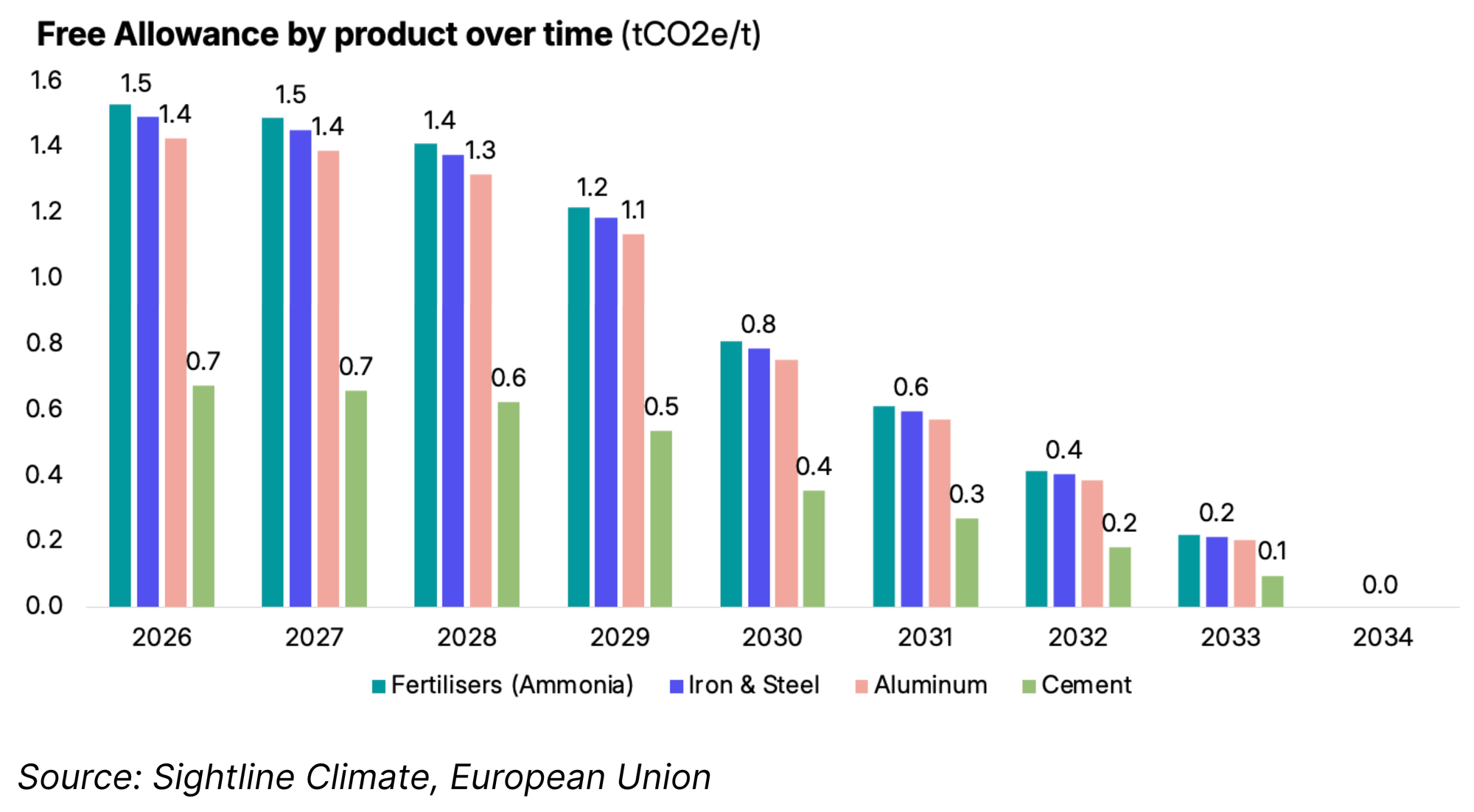

Last month, the European Union’s Carbon Border Adjustment Mechanism moved from paperwork to purchasing. Importers are facing some hefty sticker shock as their carbon bills start to roll in. According to Sightline Climate research, importers could owe up to $9.6bn (€8bn) in CBAM certificates across iron & steel, aluminum, ammonia, and cement by the end of 2026.

The EU passed CBAM in 2023 as a way of shielding domestic manufacturers from cheap, high-carbon imports, while raising the effective carbon price on heavy industry. Under the EU’s carbon market, the EU Emissions Trading System, industrial emitters must hold certificates for every ton of CO2 they emit. But until now, they were given ‘free allowances’ that covered most of their emissions. Those are now being phased out.

CBAM extends those carbon costs to importers. If a product entering the EU was made with high emissions, the importer must now pay a carbon price at the border, linked to the EU carbon market. That aims to prevent companies from shifting carbon emissions offshore, boost domestic industry competitiveness, and still advance decarbonization and remove free allowances.

Implementation, however, will hit hard. Free allocations are based on low EU ETS benchmarks, while many imports will be assigned much higher CBAM default emissions values if they can’t report product-specific embodied emissions.

CBAM looks forgiving on paper, but the math pencils out against importers. CBAM’s phase-in factor begins at 97.5%, which sounds generous. But those are absolute credit allowances, and they’re based on low EU emissions benchmarks, not on the much higher default emissions values that will be assigned to many imports. If an importer cannot provide verified emissions data, the EU assumes the worst and applies those pricier defaults. We dove into the math, by goods and trade flows.

📈 Winners

📉 Losers

Special thanks to Francesco Martella from Materia and Gabriel Rozenberg from CBAMBOO for their insights into CBAM for this piece!

🚗 Waymo, a Mountain View, CA-based autonomous driving technology developer, raised $16bn in Series D funding from Alphabet, Dragoneer Investment Group, DST Global, Sequoia Capital, Temasek, and other investors.

🏭 Bedrock Robotics, a San Francisco, CA-based autonomous construction technology developer, raised $270m in Series B funding from CapitalG, Valor Equity Partners, 8VC, Eclipse, Emergence Capital, and other investors.

🌡 Tomorrow.io, a Boston, MA-based weather and climate resilience platform, raised $175m in Growth funding from HarbourVest Partners and Stonecourt Capital.

🏭 Vention, a Montréal, Canada-based AI-powered automation manufacturer, raised $110m in Series D funding from Desjardins Capital, Fidelity Investments, Investissement Québec, NVentures, and other investors.

⚡ Lunar Energy, a Mountain View, CA-based home energy storage provider, raised $102m in Series D funding from Activate Capital Partners, B Capital Group, DCVC, Leitmotif, Prelude Ventures, and other investors.

⚡ Newcleo, a Paris, France-based nuclear reactor developer, raised $85m in Series A funding from Azimuth Capital Management, CERN’s pension fund, Cementir, Daneli, Ecoline, NEXTCHEM, and other investors.

🍎 GrubMarket, a San Francisco, CA-based food supply-chain platform, raised $50m in Growth funding from Flume, Future Food Fund, Liberty Street Funds, MY Securities, Portfolia Funds, and other investors.

⚡ Avalanche Energy, a Seattle, WA-based compact fusion reactor developer, raised $29m in Series A funding from RA Capital Management, 8090 Industries, Congruent Ventures, Founders Fund, Lowercarbon Capital, Overlay Capital, and Toyota Ventures.

🌱 R3 Robotics, a Luxembourg-based AI-powered robotic battery recycling platform for EV components, raised $17m in Series A funding from HG Ventures, Suma Capital, Oetker Collection, the European Innovation Council Fund, BonVenture, and other investors.

⚡Forerunner, a San Francisco, CA-based AI-powered flood risk management platform, raised $26m in Series B Funding from Wellington Management.

🌾 UBEES, a Paris, France-based ag-tech beekeeping platform, raised $9m in Series A funding from Capagro, Starquest Capital, and Newtree Impact.

🏭 Polaron, a London, England-based AI-driven materials intelligence platform, raised $8m in Seed funding from Futurepresent, Racine2, and Speedinvest.

♻️ Recupere Metals, a Paris, France-based advanced copper recycling provider, raised $6m in Seed funding from SISTAFUND, Earth Capital, Endgame Capital, Norrsken Evolve, Ring Capital, and other investors.

⚡ Powerwave, a Toyohashi, Japan-based wireless power transmission developer, raised $6m in Series A funding from Archetype Ventures, Energy Environmental Investment, Incubate Fund, Mitsubishi UFJ Capital, SMBC Venture Capital, and other investors.

📦 Sparxell, a Cambridge, England-based biodegradable pigment manufacturer, raised $5m in Seed funding from Swen Capital Partners, Alpha Star Capital, and Cambridge Enterprise.

💨 pHathom Technologies, a Halifax, Canada-based carbon capture and durable ocean storage solutions for coastal bioenergy and industrial facilities developer, raised $3m in Seed Funding from Propeller Ventures, New Brunswick Innovation Foundation, Invest Nova Scotia, and Carmeuse Ventures

♻️ LOOPARTS, a Sendai, Japan-based molten salt electrolysis recycling technology developer, raised an undisclosed amount in Seed funding from Kyoto University Innovation Capital (KUIC).

⚡ Amperon, a Houston, TX-based AI-powered energy forecasting and analytics platform, raised an undisclosed amount in Corporate Strategic investment from Samsung Ventures.

⚡ Aypa Power, an Austin, TX-based utility-scale energy storage developer, raised $1.5bn in Debt funding from Canadian Imperial Bank of Commerce (CIBC), Wells Fargo, Natixis Corporate & Investment Banking, Royal Bank of Canada, Société Générale and other investors.

⚡ Digital Halo, a Singapore-based sustainable data center developer, raised $47m in Project Financing Debt from Rizal Commercial Banking Corporation (RCBC).

⚡ Terra Energy, a Miami, FL-based residential solar subscription provider, raised $70m in Debt financing from Banesco, Breakwall Capital, and First Horizon Bank.

⚡ Vorn Bioenergy, a Regensburg, Germany-based bioenergy project developer, raised an undisclosed amount in Project Finance Debt funding from ING Capital.

🏭 ST Telemedia Global Data Centres, a Singapore-based data center developer, signed a definitive agreement to raise an undisclosed amount in PE Buyout funding from KKR and Singtel at an implied valuation of $10.9bn.

🏠 Multiway Infra, a São Paulo, Brazil-based data center infrastructure provider, was acquired by Kingspan for an undisclosed amount.

🏭 Vracs de L'Estuaire, an Oudalle, France-based cement manufacturer and supplier, was acquired by Titan Group for an undisclosed amount.

🏭 TreeToTextile, a Stockholm, Sweden-based next-generation cellulosic fiber technology developer, was acquired by Lenzing for an undisclosed amount.

🏠 Cosmix, a Bengaluru, India-based plant-based protein developer, was acquired by Marico at an implied valuation of $41m.

📦 KOKO Networks, a Nairobi, Kenya-based clean cooking equipment provider, announced Bankruptcy / Out of Business.

Mundi Ventures, a Madrid, Spain-based venture capital firm, completed a first close of $885m for Kembara, its fifth fund to date, focused on deep tech and climate technologies across Europe and the US.

Daphni, a Paris, France-based science-driven venture capital fund, completed a final close of $311m for its Blue Fund to back early-stage, research-led European innovation.

Voyager Ventures, a San Francisco, CA-based climate-focused venture capital firm, closed $275m for its latest fund, Fund II, to invest in early-stage climate technology companies.

Slate Venture Capital, a Paris, France-based climate-focused venture capital firm, completed a first close of $157m of its inaugural growth fund targeting European B2B climate technology companies.

Footprint Firm, a Copenhagen, Denmark-based venture capital firm, closed $90m for its Footprint Fund I, an Article 9 deep tech fund, backing climate technology startups.

This is a sample of deals available for Sightline clients. Can’t get enough deals?

The Trump administration is moving to build a $12bn stockpile of rare earths, while imposing targeted tariffs as part of a broad push to counter China’s dominance in critical minerals. The strategy aims to secure minerals essential for defense, tech, and clean energy.

Across the Atlantic, the EU has launched the world’s first voluntary standard for permanent carbon removals, covering DAC, BECCS, and biochar. Coming after two years of negotiation, the move sets the stage for eventual integration with the EU Emissions Trading System and opens up a clearer market for these techs.

A huge new shale giant is emerging through Devon Energy’s $21bn takeover of Coterra Energy, reflecting broader consolidation, as maturing reserves and lower profits squeeze independent producers. The deal continues a two-year trend of mergers in the shale patch as companies seek scale and efficiency.

India’s 2026 budget included major boosts for funding for CCS, hydrogen, EVs, and energy efficiency. As the world’s third-largest emitter scales its energy transition, the budget shows the country’s priorities and offers big pushes ($2.2bn for CCS) into emerging sectors.

Across the Pacific, Australia’s latest long-duration energy storage (LDES) procurement round selected six vendors, all using lithium-ion, with prices about 10% cheaper than prior contracts. The results show the incumbent battery technology keeps getting cheaper, even in LDES.

In tech, Alphabet expects a sharp surge in 2026 capital spending, continuing a recent trend of big tech pushing capex to record highs. With capex outpacing revenue growth, a pattern seen recently at both Microsoft and Google, share prices have fallen.

The US Treasury and IRS released new proposed regulations on the 45Z clean fuel production credit, largely formalizing provisions already passed under the OBBB with no major surprises. The change could unlock $1–$1.5bn in additional 45Z market activity.

Voltus and Octopus are teaming up to bundle distributed resources into virtual power plants in capacity markets, to pool Octopus’ DERs like smart thermostats, EVs, and home batteries into accredited VPP capacity through Voltus’ platform. It’s a meaningful test of whether grid flexibility can scale quickly.

The Line falters: Saudi Arabia reconsiders its planned massive megacity.

Drax’s biomass tracker: where every pellet has its paper trail.

Musk’s space-based data centers play or a liquidity ploy?

Climate change comes to Milan’s mountains in the Winter Olympics.

A US federal judge ruled that the fifth and final offshore wind project the Trump administration had blocked could continue construction.

Another judge ruled the DOE violated the law by secretly selecting climate-skeptical researchers to work on a major government report on global warming.

Nearly $2.2bn for next-gen geothermal in 2025, an 80% year-over-year increase, per a new IEA primer.

When the owner owns the story: Bezos, the Post, cuts its world-class climate team.

Proof that nature still steals the show, in Wildlife Photographer of the Year.

Mission re-powering: Turning air power into electric power.

📅 Decarb Connect North America 2026: Two-day conference focused on linking industrial decarbonization with commercial value across hard-to-abate sectors on February 10–11 in Houston, TX.

💡 Venture For ClimateTech – Cohort 6: Apply by February 20 to join a six-month nonprofit accelerator program supporting climate tech startups with high-impact innovations facing long paths to market and capital-intensive commercialization challenges.

💡 Pilots at BAT: Apply by February 24 to participate in a real-world piloting program at the Brooklyn Army Terminal in New York City, designed to help climate tech startups validate and scale technologies across buildings, energy systems, mobility, and urban infrastructure.

📅 Power Trading & the Battery Revolution: Join Commodity Trading Club in partnership with Lucid on February 26 in Zurich, Switzerland, for a VIP panel discussion and networking dinner exploring the intersection of power trading, batteries, and energy markets.

💡 Ocean Enterprise Accelerator: NOAA is looking for US-based startups working on new ocean data technologies and services. Applications are due March 3.

Junior Account Executive, @3V Infrastructure

Associate, @Foundry-Logic, Inc.

Summer Research Intern, @Sightline Climate

Senior Associate – Clean Fuels, @Sightline Climate

Principal Analyst – Data Centers and Power Markets, @Sightline Climate

Data Analyst – Late-Stage Finance, @Sightline Climate

Associate, @Prelude Ventures

US Program Director, @Constructive

UK Programme Manager, @Constructive

Operations Manager, @Constructive

Summer Associate, @Grantham Foundation for the Protection of the Environment

Founding Account Executive, @Ezra Climate

📩 Feel free to send us deals, announcements, or anything else at [email protected]. Have a great week ahead!

With long duration energy procurement surging, new rankings reveal who's pulling ahead

A tale of two public debuts

US courts roll back Trump-era actions on offshore wind and DOE grant cancellations