🌏 Spinning CO2 into clothes

Scaling “symbiotic manufacturing” with Rubi Laboratories

According to the World Bank, the fashion industry is responsible for 10% of annual global carbon emissions – more than all international flights and maritime shipping combined. It’s also the second-biggest consumer of water globally.

The $2.5 trillion fashion industry was already facing challenges and deemed “broken” before the pandemic amplified its problems. COVID-19 halted in-store traffic, disrupted value chains, and limited clothing demand from remote and unemployed workers.

With the virus expected to cause double-digit reductions in sales demand, brand-name retailers are shopping for new strategies, namely adopting more sustainable practices to appeal to the ever growing rank of conscious consumers. According to the World Bank, the fashion industry is responsible for 10% of annual global carbon emissions – more than all international flights and maritime shipping combined. It’s also the second-biggest consumer of water globally. With such a hefty environmental footprint, the fashion industry is undergoing a transition towards decarbonizing their value chains.

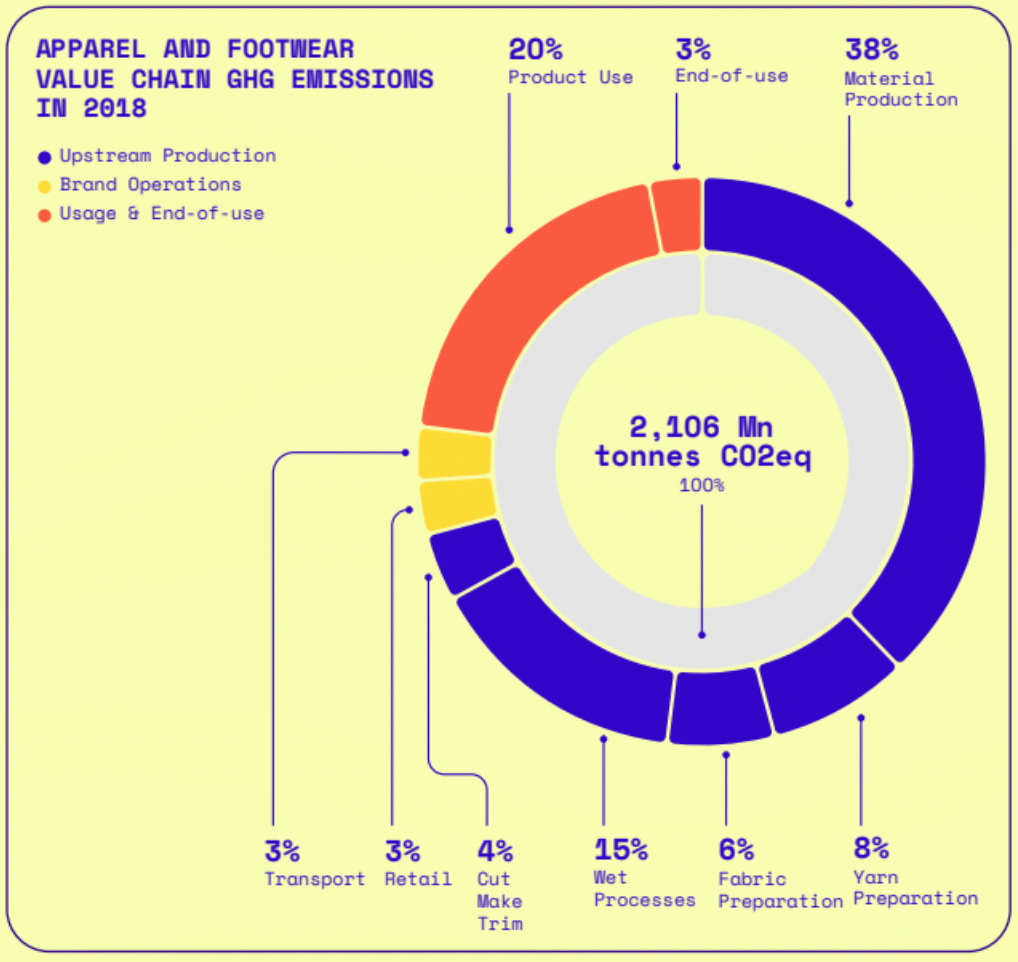

The fashion value chain’s emissions are broken into 70% Upstream and 30% Downstream activities. The majority of upstream emissions are generated from the energy used to produce and process fabrics, as well as to manufacture the garments themselves. Fertilizers and chemicals used to cultivate and treat materials (e.g., cotton) are also significant sources of emissions. Downstream emissions result from the transportation and packaging involved in distribution, product usage itself (e.g., washing and drying), and end of life (e.g., incineration or landfills).

Fashion’s emissions from upstream activities like industrial processing and distribution are hardly unique to the industry alone. In fact, long-term pathways to decarbonization will rely on the energy (and vehicle) transition of our economy as a whole, outside of solely the fashion industry. Material processing (e.g., spinning, weaving, and knitting) requires enormous energy usage, as does the HVAC systems in factories. According to McKinsey, ~80% of energy-related savings can be derived from energy efficiency improvements and the transition to 100% renewables. The key decarbonization levers unique to the fashion industry come down to choosing / developing sustainable raw materials and innovating circular closed-loop business models. We’ve outlined below the companies and technologies innovating in these areas.

Natural fibres: These plant or animal-based materials, including cotton, hemp, wool, silk, linen, and bamboo, are sustainable alternatives to synthetic fabrics derived from petroleum and require less chemical-intensive treatment procedures. GOTS-certified organic cotton is 50% less emissions-intensive than conventional cotton due to limited use of pesticides and fertilizers.

Recycled polyester (rPET): Made from recycled plastic bottles, rPET is 40% less emissions intensive than regular polyester because of material recycling and closed loop production methods. Brands such as Girlfriend Collective and Rothys are touted for their products made from recycled plastic bottles.

Tencel: Produced by Lenzing, Tencel is a branded form of rayon created by dissolving wood pulp and produces half of the emissions of conventional fibers. This synthetic material is typically used as an alternative to nylon and lycra in activewear (which is mostly derived from crude oil).

Econyl: Created by an Italian textile company, this fabric is recycled from synthetic waste including plastic, waste fabric, and fishing nets into nylon.

Other innovators: Natural Fiber Welding (reuses natural fibers), Bolt Threads (lab-grown fabrics), Evrnu (made from discarded clothing), Modern Meadow (plant-derived proteins), Galy (cotton from cells), Spiber (synthetic spider silk), Pinatex (leather made from pineapple)

Re-commerce: Online thrift stores (ThredUp, Thrilling, Renewal Workshop) and resale platforms (Trove) can extend the average product life by 1.7x and eliminate emissions from both ends of the value chain (upstream production and downstream end of life disposal).

Like all early-stage frontier innovation, the fashion industry’s path to decarbonization will accelerate as innovation turns to deployment, and scaling production benefits from the learning curve.

Sustainable textiles are currently more expensive and less yield-intensive compared to traditional petroleum-based fabrics, resulting in a price premium that relegates sustainability to only the high-end spectrum. Looking parallelly, the EV automotive industry models a premium into mass market approach to decarbonization. We’re now in the midst of an EV market gradually coming down from its luxury end-market (the early adopters) to catering to the mainstream, driven primarily by the cost decline of battery technology and widespread demand from sustainability-conscious consumers.

While a few steps behind, fashion industry players have started to scale up adoption of sustainable materials while driving down costs. Consumers are also waking up to climate change and demanding their fashion come from more sustainable, transparent, and circular value chains.

*If you’re interested in how your favorite brands rate in terms of sustainability, check out Good On You (which also delivers ratings through its app).

Interested in more content like this? Subscribe to our weekly newsletter on Climate Tech below!

Scaling “symbiotic manufacturing” with Rubi Laboratories

Closing the loop on decarbonized & resilient supply chains with Energy Impact Partners' Nina Litman

How supply chain traceability leads us to Net Zero