🌏 Spinning CO2 into clothes

Scaling “symbiotic manufacturing” with Rubi Laboratories

Closing the loop on decarbonized & resilient supply chains with Energy Impact Partners' Nina Litman

There are some things that you only notice when they stop working. We take reliable heating, plumbing and WiFi for granted, only for them to become major annoyances when they break down. Same goes for our supply chain. The invisible pathway that links Chinese mines to the device you’re reading this on went largely unnoticed. Then the pandemic happened - factories closed, shipping companies reduced schedules, buying habits changed - and the supply chain snapped.

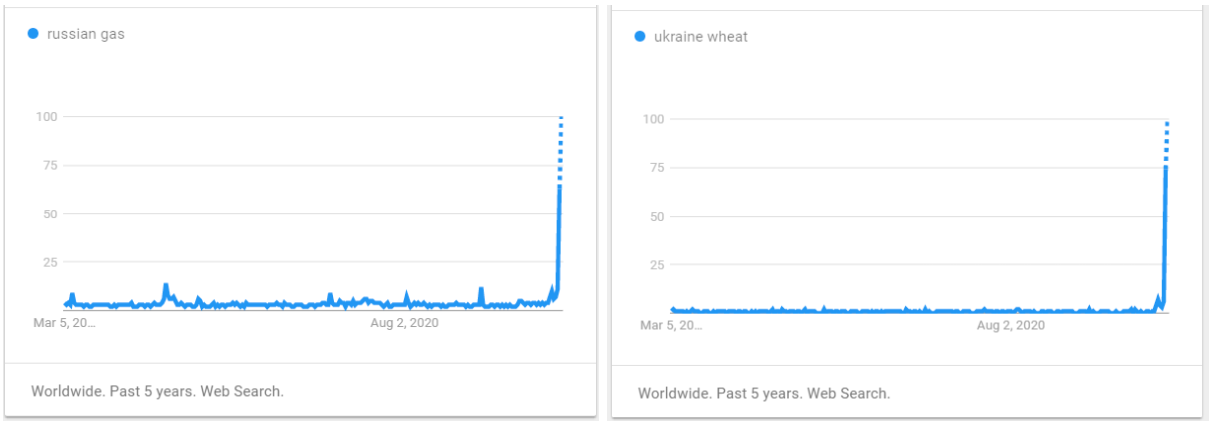

“Blame it on the supply chain” goes the common lament for headlines on shortages of everything from the never-ending chip shortage, the inability of garment giants to meet consumer demand to the intermittent availability of key construction materials. The sudden international obsession with topics like “Ukraine wheat” and “Russian gas” expose the vulnerability of our current system as never before.

The new attention is welcome – for too long businesses have been cavalier about what happens upstream. But crucially, supply chains are one of the most vital elements in reaching net zero. Fail to curb emissions during the manufacturing and movement of products, and our great decarbonization ambitions will flounder. The need for resilient supply chains is real – not only to minimize commercial losses and current PS5 shortages, but also to support rapid decarbonization throughout the economy and the deployment of responsible clean tech.

We need decarbonized and resilient supply chains.

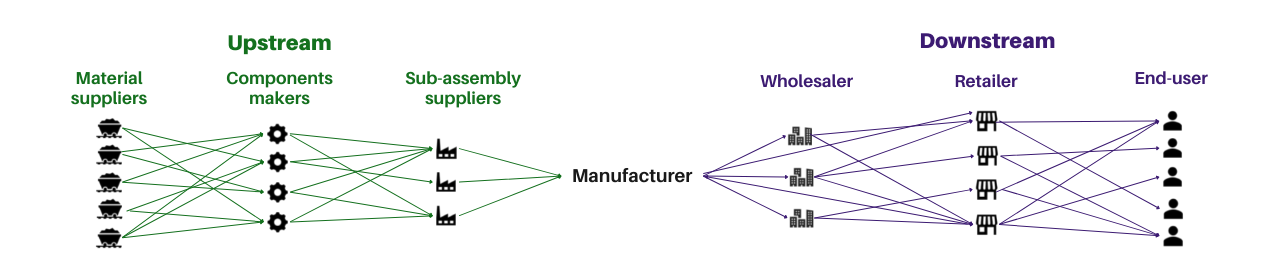

A renewed understanding of supply chains is long overdue. Even the language used to describe them illustrates how obsolete our thinking has become. The word ‘chain’ works to the extent that it implies many links and phases, but it also symbolizes something that is linear, simplistic and strong. The global system of materials, manufacturing, shipping and selling is non-linear, complex and vulnerable - more akin to an intricate and interconnected ‘network’ or ‘web’ than a chain. Multi-faceted supply networks have been designed for efficiency and cost optimization - not for transparency and resilience. Now, they are operating in an environment where risks and disruption are commonplace.

First, a quick GHG emissions reporting refresher (sometimes we forget, too):

🏭 Scope 1 is GHG emissions created by a company directly, like running the company’s own vehicles or machinery

⚡ Scope 2 is indirect emissions, like buying electricity from power companies

🛍️ Scope 3 is all emissions that a company is indirectly responsible for from suppliers, partners and customers

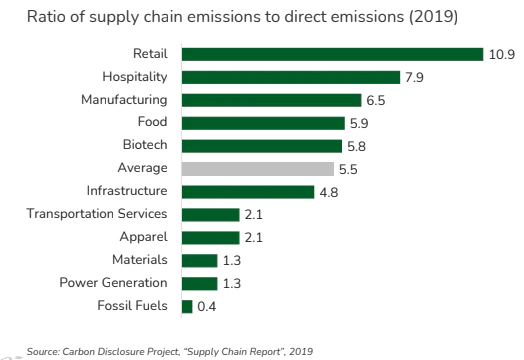

The smaller Scopes 1 and 2 can be monitored. However, Scope 3 GHGs are massive, diffuse, and inherently more complicated to reign in. Across industries, Scope 3 generally accounts for 60% of total emissions, but the proportions fluctuate by sector.

Consumer goods and retail industries take the cake for having the biggest Scope 3 carbon ratios. Their Scope 3 is thought to be 11x larger than Scope 1 and 2 combined, with ~90% of retailers’ carbon emissions occurring “deep within supply chains.” Naturally, measuring and tracing Scope 3 emissions is a problem in and of itself – just 16% of companies can do so at an advanced level.

Let’s take the example of the battery value chain. (If battery supply chains get you revved up, plug in to our sparky previous feature.)

⬇️ Start with raw materials (mining lithium, cobalt, nickel, manganese)

⬇️ Form the materials into components (anodes, cathodes, electrolytes)

⬇️ Ship and assemble in gigafactories

⬇️ Distribute downstream through a network of battery wholesalers (CATL, LG Chem)

⬇️ Sell as EVs and storage via end-“retailers” (Tesla, Fluence)

A value chain is only as strong as its weakest link. Novel transparency and traceability advancements in processing, tracking, and valuation technologies mean better visibility and data for supply chain decarbonization (quantify emissions) and resilience (qualify risks).

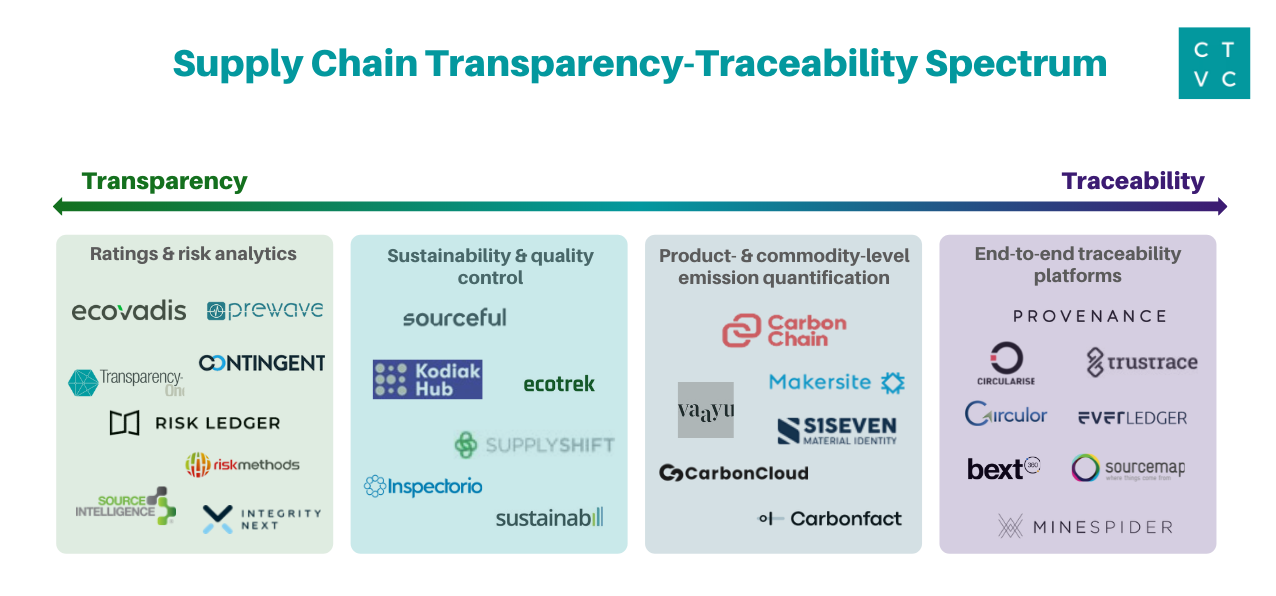

Supply chain transparency and traceability have been thrown around as interchangeable terms, but there’s some distinct nuance.

🔭 Transparency - wide angle lens mapping the entire supply chain. A company understands (e.g. components, names of suppliers, facility locations, etc.) what’s happening across its supply chain - to the level of internal disclosure and public press communication. The carrot: customers are estimated to be willing to pay a 10% premium for transparently produced products. The stick: transparency decreases the likelihood of ESG scandals and product shortages.

🔍 Traceability - magnifying glass zoomed in on individual components. A company knows the history of components from their origin to end-of-life disposal. The carrot: brand storytelling about green dedication from the perspective of the journey of a specific product. The stick: avoid regulatory snafus and component reliability failures.

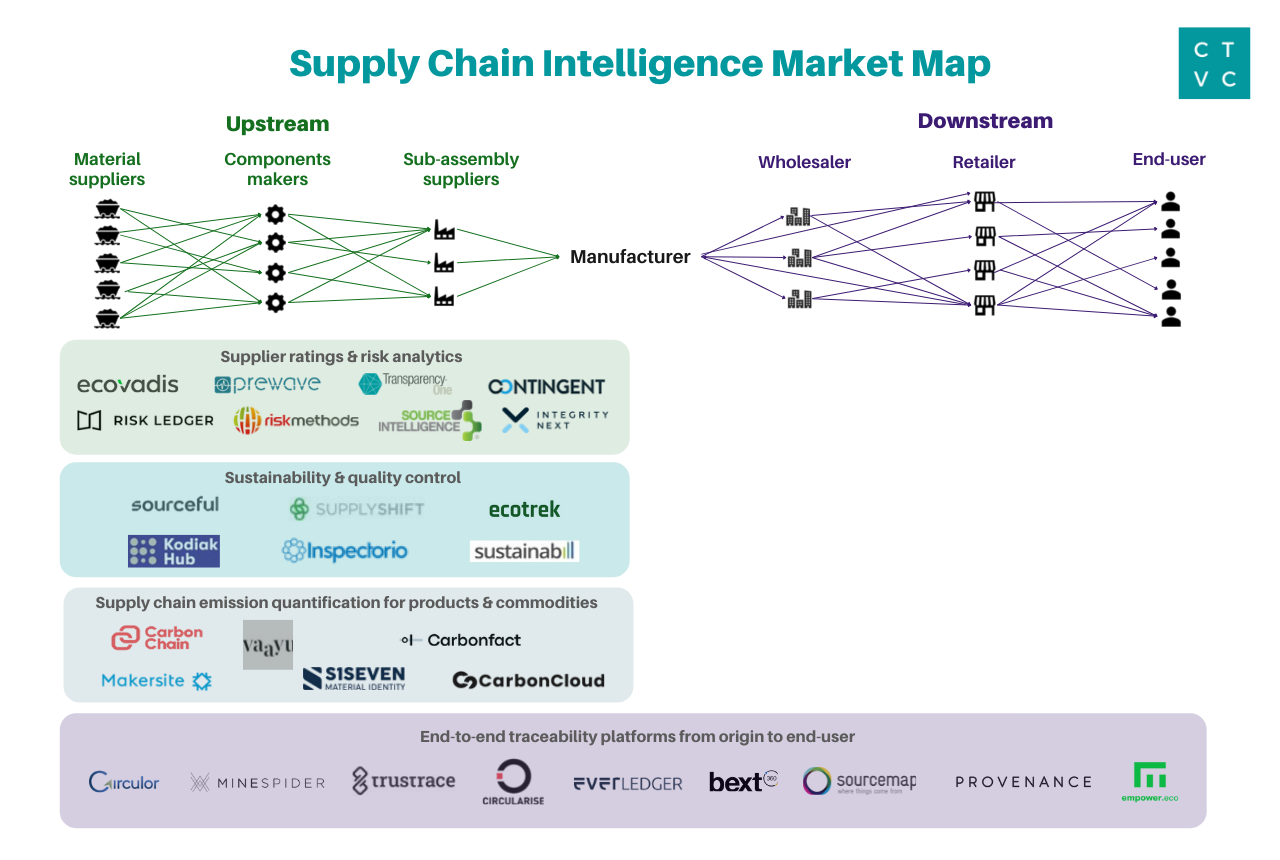

🟩 Ratings & risk analytics tools enable companies to identify, map, and engage with their supply chain network. These tools support firms in spotting concentrations of risk (e.g. regulatory disruptions, climate-related events), understanding vast networks of suppliers, and also in facilitating real-time monitoring within a unified platform.

Prewave, a spin-out from the Vienna University of Technology, detects risks (e.g. labor unrest, human right issues, air pollution) by sorting through vast amounts of scraped multilingual text data. The risk intelligence platform maps risk signals and early warnings to the true physical location within extended supply networks, enabling companies to respond to events quickly.

Innovators: Prewave, Ecovadis, Contingent, TransparencyOne, Risk Ledger, riskmethods, Source Intelligence, IntegrityNext

🟦 Sustainability & quality control platforms bring together a complete picture of multi-tier supply chains to help companies meet compliance, quality, and sustainability requirements across the lifecycle of a product.

Supplyshift makes relationship management software to streamline data exchanges between suppliers and buyers while strengthening collaboration and communication.

Sourceful offers its customers a global network of responsible and carefully monitored suppliers so companies can better source environmentally conscious inputs with the ability to offset the rest through carbon removal projects.

Innovators: Sourceful, Kodiak Hub, Ecotrek, SupplyShift, Inspectorio, sustainabill

🔲 Product & commodity-level emission quantification differs entirely sector by sector. There’s a strong verticalization play afoot as startup emissions wizards build bottoms-up from the product/ commodity emissions layer and automate carbon accounting for the broader supply chain.

CarbonChain aims to measure the precise carbon footprint of virtually every asset and commodity via this bottom-up approach. The company has developed a database covering over 48,000 physical assets, heavy industry equipment and supply chain activities, spanning everything from mining, farming, and shipping to smelting and refining.

Innovators: CarbonChain, CarbonCloud, Makersite, Carbonfact, S1Seven, Vaayu

🟪 End-to-end traceability platforms in climate tech have dual responsibilities: 1) gather emission data – often buried deep in the supply chain – to identify emission hotspots and 2) verify the origins and ESG credentials of assets.

Circulor is building traceability for industrial supply chains starting with the EV supply chain. Powered by blockchain, Circulor’s software tracks all relevant supply chain data from production and transport to recycling and disposal. In one case study partnering with the Rwandan government, the London-based company has developed a system ensuring that tantalum (a conflict mineral used in consumer electronics) is mined, processed, and transported under OECD-approved conditions.

Innovators: Circulor, Minespider, TrusTrace, Circularise, Everledger, Bext, Sourcemap, Provenance, Empower Eco

Bonus: Progress in tagging and validation technologies is enabling businesses to keep tabs on what’s-what in the supply chain. Closed Loop Ventures details this new wave of tagging tech. Physical tags are being replaced with RFID tech that can identify a specific object or package. The fast adoption of QR codes, NFC, and Bluetooth eliminates the need to keep an order book or manual databases - decreasing the likelihood of error. It isn’t too much of a leap to imagine information on carbon emissions being tracked along with dates of transfer.

There’s no Net Zero without Scope 3. Emissions reduction targets are all but out of scope (hah) without taking greater control of supply chains and partners. Corporates that do not introduce more effective means of managing their supply chains will become ever more vulnerable in the face of turbulent, unpredictable events. With a new array of tools at hand - from IoT to Blockchain - excuses are running short for not taking charge of (even complex) supply chains.

Verticalization in the face of specialization. Every supply chain has its own unique fingerprint - let alone the differences across industries. Understanding product-level emissions and the supply chain network for a metals & mining business is entirely different from a shoe brand. A verticalized go-to-market strategy makes sense for industry-specific solution players to land, then try to expand.

GHG to ESG. Emissions rarely occur in isolation from other ESG underperformance. Tracking carbon emissions permits the traceability of broader sustainability performance indicators, like water usage and biodiversity. Likewise, transparent supply chains enable trackability of other key vulnerabilities and risks including ethical issues like labor issues or geopolitical conflict (e.g. Ukraine/ Russia, Xinjiang/ China). It’s not enough to just measure carbon emissions, but global corporates need to understand their entire network of chains and identify the weakest links - both emissions- and risk- wise.

New isn’t always better. The appeal of the new-new shouldn’t trump ease of use, speed or affordability from legacy tech. Plowing money into a new blockchain platform that holds an anonymous digital ledger on every product in a value chain might not work as well as a system that uses NFC tags (a reliable technology that has been around much longer).

Prepare for takeoff - when regulation gets serious. A majority of the Innovators listed above are European, where UK and EU regulations already mandate climate-related risk disclosures. As SEC climate disclosure momentum grows, anticipate more homegrown US supply chain solutions. We expect these startups to solve for the heart of the SEC climate disclosure requirements: material impacts to public companies’ operations, associated Scope 1-3 GHG emissions, and climate-related financial metrics. We’re in the (mostly) voluntary stage of market development, just buckle up.

We’re grateful to be in a network with such strong sustainable supply chain linkers. Much gratitude to Hannah Friedman and Danielle Joseph from Closed Loop Partners and Nina Litman-Roventa from Energy Impact Partners for sharing their research, expertise, and time.

Scaling “symbiotic manufacturing” with Rubi Laboratories

How to build trust and collaboration in CDR with Isometric, starting with the science

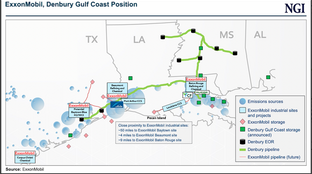

Exxon’s acquisition of Denbury fuels CO2 transport ambitions