🌎 Inside Cloverleaf Infrastructure’s power play #206

Our Q&A with Brian Janous on AI, data center demand, and the need for speed

Breaking down COP outcomes for climate tech and the world

Happy Monday!

COP’s a wrap and amidst the (expectantly) relatively modest policy progress, in climate tech specifically, there’s lots of investment opportunity in phasing down coal, US-China dealings, reducing methane, driving banks towards climate.

Rebounding from the burst of pre-COP activity, fundings and news this week were a tad quiet with the exception of Rivian’s $70b IPO, Musk’s abiding Twitter tax antics, and some great graphical breakdowns from news joints.

Thanks for reading!

P.S. Our Chief of Staff role here at CTVC is still open through this Friday - please continue to ping with any questions or recommendations!

Not a subscriber yet?

After two weeks of wheeling and dealing in Glasgow, climate negotiators from all over the world came together to produce a middle-of-the-line agreement - with a late amendment on coal added by India that left COP26 President Alok Sharma fighting back tears.

The deal is miles past Paris, sprinkled with many small wins and a few big game changers, though ultimately falls short of 1.5C. Nations agreed on an interim target of 45% reduction by 2030 and net-zero by 2050. Next year countries are on the hook to come back with resubmitted emissions reduction plans - though it looks like perfect execution would only likely limit warming to 1.8ºC. This outcome was to be expected. As Michael Liebreich reminds us, the real significance of COP is the “process of moving from ambition to pledge to NDC to domestic policy to innovation to finance to action to monitoring.”

While countries move along the action curve, climate tech won’t wait. We synthesize the opportunities for startups from major COP26 outcomes, marked with a 🌱.

🏭 Coal phase down. Initially framed as a phase out of coal, China and India watered down the clause at the last minute to a phase down. The nuance here could make a big difference in how quickly industrial-heavy countries are forced to ratchet down their new coal buildout. From a small wins perspective, this is coal’s first mention in any COP text.

🌱 Accelerating deployment of renewables, pairing renewables with short-term and long-term energy storage solutions, creating a more flexible and reliable bidirectional grid including DERs to match the intermittency of renewables, devising other sources of clean baseload power (nuclear, geothermal, etc.)

🇺🇸 🇨🇳 US-China deal. The carbon superpowers issued a joint declaration on collaborating to cut emissions over the next decade. It primes the countries to “develop additional measures to enhance methane emission control,” welcome the Glasgow Leaders’ Declaration on Forests and Land Use, and recall “their respective commitments regarding the elimination of support for unabated international thermal coal power generation.”

🌱 Utilizing, mimicking, and matching China's manufacturing prowess to accelerate the picks and shovels (batteries, solar panels, etc) that will drive the energy transition; capturing a larger TAM for climate solutions through bidirectional international sales

💨 Methane pledge. 100+ countries committed to reduce emissions 30% by 2030. While the reduction isn't earthbending, a short-term pulldown on methane can have a significant emissions impact, as we wrote here. The global methane pact is already being put into action - with stricter EPA regulations on O&G methane leaking and monitoring as well as a bilateral agreement between US and China to enhance methane emissions control.

🌱 Ensuring better monitoring and plugging of methane leaks in O&G wells, developing creative solutions to reduce bovine burping (e.g., mixing cattle feed with seaweed), minimize waste that goes to landfills and enable a circular economy

🤝 Carbon-trading rules. For the first time, there are now international rules for carbon trading. These long-awaited standards create the foundation for establishing a robust, global carbon trading market that consolidates and harmonizes current bespoke credit systems. Rules set goalposts for how the currently fragmented landscape of voluntary and regulatory carbon offset markets should act and reduce the viability of low quality offsets.

🌱 Developing high-quality, internationally-fungible, UN-certified carbon offset projects with a focus on additionality, more rigor around carbon offset monitoring and verification, carbon trading markets which reward carbon removal permanence and eliminate double counting

🌳 Deforestation. More than 100 countries, representing 85% of the world’s forests, agreed to end deforestation by 2030. The pact includes some of the largest culprits, including Brazil, Russia, and China. The pledge, however, has already seen individual countries wavering or backtracking (e.g., Indonesia).

🌱 Better monitoring of forests using advanced tools like satellite imagery to keep deforestation committers accountable and leveraging innovation like drone-based seed planting to accelerate reforestation

🏦 Financial institutions. The former Bank of England Governor Mark Carney whipped banks, investors, and insurers into committing $130T in sustainable investing assets and getting to net zero by 2050. Despite the 450+ firms on the list, his posse failed to include the major Chinese banks which are the primary financiers of coal.

🌱 ESG tracking tools to ensure the transparency of financial flows, innovative financing mechanisms to fund the buildout of early-stage climate tech into physical infra projects

💸 Climate aid. Developed countries previously committed $100B per year to fund poorer countries’ clean development, but barely a penny has left their pockets. At this year's COP, some countries like India refused to participate in negotiations without $1.3T of emissions reparations. COP text left off here to properly set up a mechanism for providing financing for countries struck by catastrophic climate events.

🌱 Budgeting more resources internationally to assist to climate disaster resilience and response, developing climate tech that applies to both developed and developing countries, applying learnings from clean-tech scaling and deployment to other contexts

🔋 Ample, a San Francisco, CA-based EV battery swapping company, raised $30m in funding from The Blackstone Group and Banco Santander.

🌱 Novata, a New York, NY-based startup reporting ESG metrics for PE firms and private companies, raised $21m in Series A funding from Ford Foundation, S&P Global, Hamilton Lane, and Omidyar Network.

🏢 Microshare, a Philadelphia, PA-based provider of Smart building data solutions to multinationals and public institutions, raised $15m in funding from the Avenue Sustainable Solutions Fund.

🍎 TreeDots, a Singapore-based B2B marketplace for reducing food waste, raised $11m in Series A funding from Amasia, East Ventures, Active Fund, Seeds Capital, and angel investors.

💨 Evergrow, a San Francisco, CA-based fintech company focused on carbon offsetting projects, raised $7m in Seed funding from XYZ Venture Capital, Congruent Ventures, First Round Capital, Garuda Ventures, MCJ Collective, and Skyview Ventures.

⚡ Jedlix B.V., a Netherlands-based smart charging services platform provider, raised $5.7m in funding from Osaka Gas, Skagerak Energi, and Mobilize.

🌲 Overstory, a Netherlands-based monitoring platform aimed at stopping deforestation and wildfires, raised $3.9m in Seed+ funding from CapitalT, Moxxie Ventures, Omidyar Technology Ventures, Toba Capital, Overwater Ventures, Climate Capital, Pale Blue Dot, MCJ Collective, Powerhouse, and Futuristic.vc.

💨 Abatable, a UK-based carbon offsetting start-up, raised $3m in Seed funding from Y-Combinator, Blue Bear Capital, Global Founders Capital, Keiki Capital, and Alumni Ventures.

🚗 BasiGo, a Kenya-based EV startup, raised $1m in pre-Seed funding from Climate Capital and Third Derivative.

Electric truck and van maker Rivian is going public, valuing the company at nearly $70b.

Energy Impact Partners raised $1b+ for its second fund focused on climate solutions [See our interview with Sameer!]

Overture VC launched a new venture fund focused at the intersection of climate and government.

Azolla Ventures launches out of Prime Coalition.

While the final proposal from Glasgow didn't spark much joy, the many, many pledges throughout the COP season could close our emissions gap by as much as 9%.

Away from the final proposal, John Kerry may be on to something with a new carbon market structure. Downplaying his talks on trading carbon credits, the new market would force much needed rigorous carbon accounting.

The UK becomes the first G20 country to make climate disclosures mandatory for companies. Starting April 2022, corporations with more than 500 employers and £500m in annual turnover will report potential climate risks.

Despite decades of bad PR, France will restart building nuclear reactors this decade. Macron touted the plan as a cornerstone of the country’s energy independence and carbon neutrality—making this the start of a possible renaissance for the largest zero-carbon electricity resource.

During the final days of COP26, major automakers, countries and businesses pledge to phase out new gasoline car sales by 2040. While significant, 2040 might be too late, with analysts signaling that an earlier phase down year would avoid crucial emissions.

It’s the end of the US conglomerate era. GE will split into three separate companies focused on energy, aviation, and healthcare. Mitigating risks drove the decision to split, laying the potential groundwork for oil and gas companies—like Shell—considering a split from their clean power and drilling exploration companies.

It just got harder to meet clean energy goals in Massachusetts—all because of Maine voters. Despite their voting record on climate policies, Maine voters voted against new transmission lines from Canada that would bring hydro power into New England, losing out clean power that could fill 10% of the region’s electricity demand.

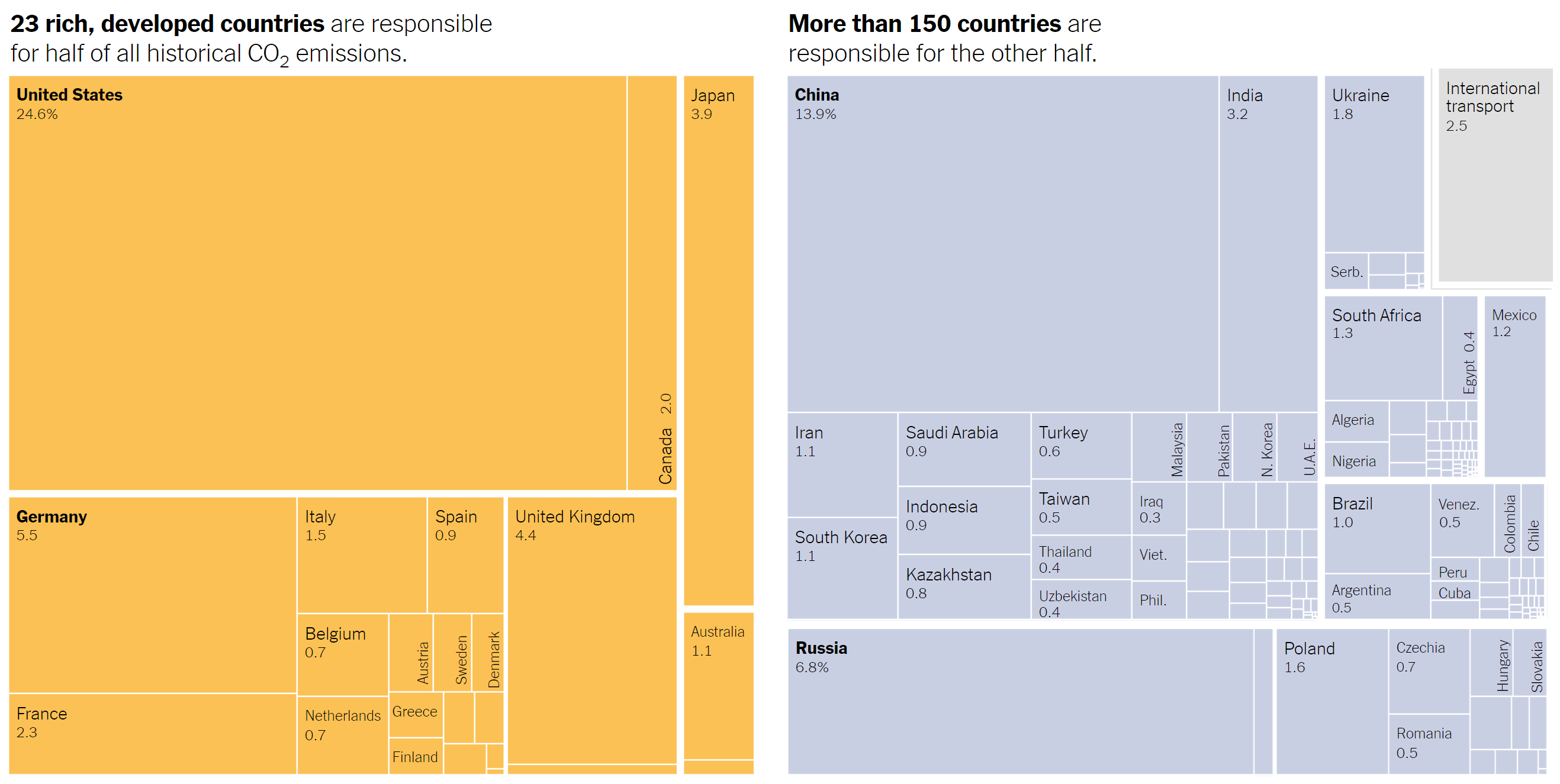

NYTimes breaks down the historical responsibility of CO2 emissions by country, with nice graphics (mekkos!) to boot.

Energy professor rockstar Jesse Jenkins breaks down every policy in Biden’s Build Back Better Bill line-by-line in this Google Sheet.

Now that’s a tough job. WSJ profiles Patti Poppe, PG&E’s new CEO.

For the second year running, Bloomberg Green’s list of green billionaires is a party of Elon and Chinese clean tech suppliers and manufacturers.

As emissions from plastics are set to overtake those from coal: Philly recycling yard ignites, with smoke visible for miles.

The little-known Earth Engine That Could. Google’s satellite data powers nonprofits with climate intelligence data.

In case your bookshelf isn’t yet full of recent climate tomes - Saul Griffith’s Electrify: An Optimist's Playbook for Our Clean Energy Future makes a clear call to action: clean our energy supply, electrify all energy demand, and we can (mostly) decarbonize America.

EV battery re-use is a big business.

Vintage cars get electrified back to life with Ford’s new $3,900 crate motors. Plus Hyundai’s “new” 35-year old EV model.

Cities ranked by their per capita transportation emissions. Unsurprisingly, Houston loses. Where does your city stand?

Time’s 100 best inventions of 2021 features climate innovations galore: Allbirds x Adidas, Lyft’s e-bike sharing, in-road EV charging by Electreon, and hot startups like Watershed. Meanwhile on display at the Global Grad Show in Dubai: a desert robot that plants seeds, microplastic filter, and a lamp that grows algae.

Global meat consumption sets a new record.

After eight years off-the-map, photographer Vlad Sokhin releases a book connecting the impact of rising seas across spaces seldom seen.

Addressing the satirical energy crowd, we now have our own version of The Onion — The Sunion!

Watch John Oliver take on the grid.

🗓️ COP26 Debrief with Mark Carney: On Nov 19th, Watershed is hosting a conversation with Mark Carney, a driving force behind the finance industry’s demand for climate action, for a discussion on COP26, his newly-announced $130T climate plan, and how companies can stay in lockstep with investors to help ensure a net zero future.

💡 EV Open Innovation Challenge: Apply by Nov 19th to this launchpad for commercial ready EV charging products and an opportunity to work with Hyundai Motor Group and Kia, including $200k paid pilot opportunities.

💡 Equinor & Techstars Energy Accelerator: Apply by Dec 1st for this 13 week global, mentorship-driven program for founders shaping the energy sector.

We’re closing the submission form for the CTVC Chief of Staff role by EOD this Friday 11/19. Thanks to all of the amazing folks who have reached out so far!

Chief of Staff @Climate Tech VC

Chief of Staff @Noon Energy

Business Development Fellow @Noon Energy

Product Marketing Lead @Myst AI

Content Production Intern @Therma

Sales Associate @ClearTrace

Account Executive @Cloud to Street

Director of Marketing @Cloud to Street

Climate Solutions Lead @Pledge

Feel free to 📩 send us new ideas, recent fundings, events & opportunities, or general curiosities. Have a great week ahead!

Our Q&A with Brian Janous on AI, data center demand, and the need for speed

England's new election ushers in a new test of clean energy and climate tech

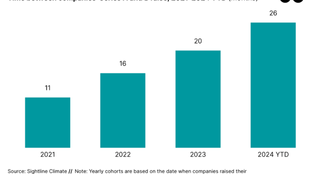

H1'24 funding totaled $11.3 billion, down 20% from H1 2023.