🌎 Get ready with me: Government grants edition 💅💵

A founder’s guide to winning non-dilutive funding with Elemental Excelerator

Infrastructure investing for impact with Banyan Infrastructure's Amanda Li

Amanda Li learned the hard lessons of sustainable project finance investing first-hand during the early days of Generate Capital as Employee #1. Now she’s teamed up to build Banyan Infrastructure, a software company that improves the efficiency - and therefore climate impact - of sustainable infrastructure investing. If banking analysts apply their customary level of siloed, exhaustive diligence and risk management to smaller, novel climate deployments, then the technologies which are currently at venture capital maturity will never deploy and have impact at scale. We Zoom in with Banyan Infrastructure Co-Founder and COO Amanda to spotlight her understated approach to expediting climate tech infrastructure deployment through software project management on the heels of a $8.2m Series A fundraise.

You’re in a cohort of a few other early Generate Capital employees who’ve since started climate tech companies. What’s in the water at Generate?

I joined Generate Capital as the first employee back when it was just Scott (see our CTVC profile with Scott Jacobs), Jigar, Matan, Scott G. and myself. Generate saw this huge funding gap in the market which required understanding how to invest properly in infrastructure-as-a-service across transportation, water, and energy.

Generate has come far - we started with a first close of ~$30m and now they’re at several billion AUM. Interestingly, of the earliest employees, five of us graduated on to start climate tech startups like Kanin Energy and PearlX.

What insight did you identify while at Generate that led to the founding of Banyan?

We saw a lot of friction with the sustainable infrastructure investing model in the early days. Infrastructure as a whole is a relatively complex asset class to invest in. It requires understanding the technical and operating risks, all of the counterparties, the many inputs that drive cash flows, and more. Diligence happens upfront, but also continues and expands on an ongoing basis - especially when you own and operate the asset. Project finance used to be mainly for big infrastructure, like bridges and roads and coal plants. Now, with sustainable infrastructure, we see a lot more investment happening in distributed and small scale formats. Applying the legacy methodology for financing a single billion dollar coal plant to a thousand million dollar solar plants means 1,000x more spreadsheets, PDFs, and counterparties to deal with. Sustainable infrastructure project finance needs a new way.

At Generate, I was right in the middle of that. So much of my time was spent copying and pasting between PDF, email, PowerPoint and Excel. Back when I worked at McKinsey doing digital transformations for banks, we were already starting to automate activities like credit card underwriting and mortgage servicing. I thought there has to be some technology out there for project finance - but the sector was just too nascent. Back then solar was barely bankable, why would third party systems service the industry?

Coming out of grad school, I met my now co-founder and CEO of Banyan, Will Greene, who’s a repeat entrepreneur in fintech and enterprise SaaS. We set off to build and have been on an incredible journey ever since!

Walk us through the steps of a project financing deal. Where does Banyan plug into that workflow?

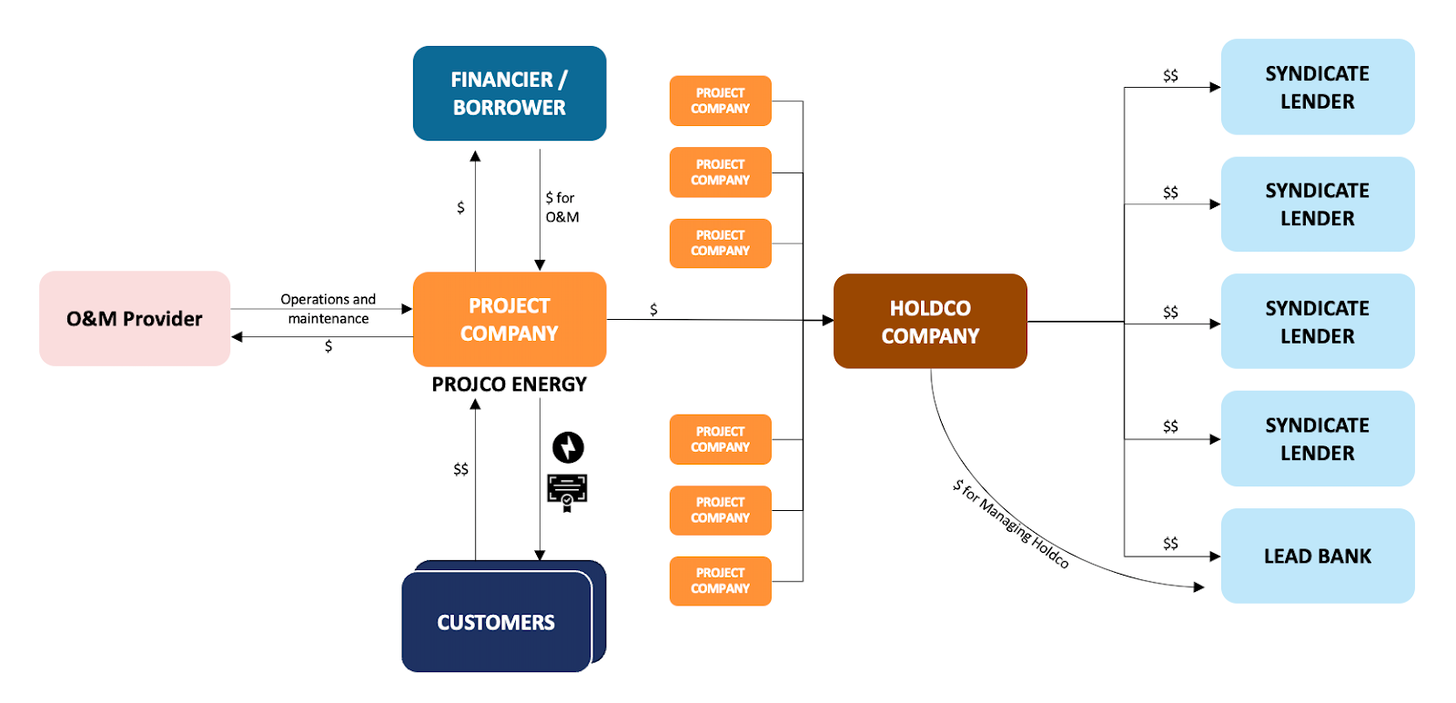

An example of a simplified project finance ecosystem with a syndicated loan on a series of projects. Banyan helps connect the data flowing between all the entities.

Like any deal, sustainable infrastructure projects need financing. Banyan starts at origination, where developers pass information to the future financier (or similarly when sponsors pass information to banks). Often, that process starts with a phone call and a data room with hundreds of different documents. To determine if it’s a good deal, the financier then assesses the risk of performance, production, technology, and the counterparties. It’s a massive checklist spanning multiple dimensions.

Instead, with Banyan, we automate the collection of this data and help with checking off the actions leading towards close. We then use that data to provide a framework to quickly determine if this is a good or bad deal, so the financier can make decisions faster and more consistently. Project finance doesn’t need to always be bespoke across technologies - Banyan’s modular approach systemizes diligence into similar sets of questions depending on the technology. For a solar plus storage asset, just adding the storage module can make a diligence process apples to apples.

After a deal closes, Banyan supports the financier with portfolio management like constant risk reassessment to ensure compliance. We collect information from SCADA systems, bank accounts, accounting software, and in-application workflows to assess key KPIs and covenants (like IRR or DSCR) and whether the actuals lived up to their forecasts. Banyan enables the asset owner or lender to be proactive rather than reactive with reporting. For example, the Banyan platform monitors DSCR, and can alert the financier in the event it drops below a specified limit, such as 1.25, allowing them to investigate before it has a chance to reach technical default.

The project financing lifecycle continues through to creating leverage via finding additional debt, a sale, or secondary market access. Maybe the financier wants to bundle and sell assets to recycle their capital so they go to market to work with a larger bank. Banyan then repeats those origination steps where we again support their processes, diligence, and then the portfolio management for that new counterparty. Since we already have the complete historical performance, our answers significantly expedite decision-making for the next party. Using Banyan means that project participants across the financial stack - e.g., the developer, owner operator, first lender, syndicate lenders, and broader markets - only need to answer “this is a 10 MW project” once at the beginning.

This is a simplified view of project finance and doesn't expand on the more complicated structures where a software solution becomes even more enabling.

What project financing and management tools do project developers use today and why aren’t they up to snuff?

Excel. And it is great for complex modeling, but not for tracking a thousand line items across multiple documents with varying format and different conversions. To track performance of their operating assets, banks receive an email from an owner operator who downloaded information from O&M software, converted this data to PDFs, before email. The bank then finally compiles this data by re-uploading the data into different systems and spreadsheets. Alternatively, building internal tools to manage this is so expensive and time consuming! If every fund makes a custom internal tool, then trading assets and doing deals together becomes incompatible across systems with each person having a different language to describe the asset. At a traditional big infra shop which does 2 deals a year, maybe the analyst isn’t having a good time with the system incompatibility - but the MD doesn’t feel it. Now with smaller, sustainable infrastructure deals, the entire team feels the need. As more funds and banks enter the sustainable investing arena, we’re really seeing a huge demand for risk management software like Banyan to make smaller deal management efficient and profitable.

How big is the market for sustainable infrastructure financing?

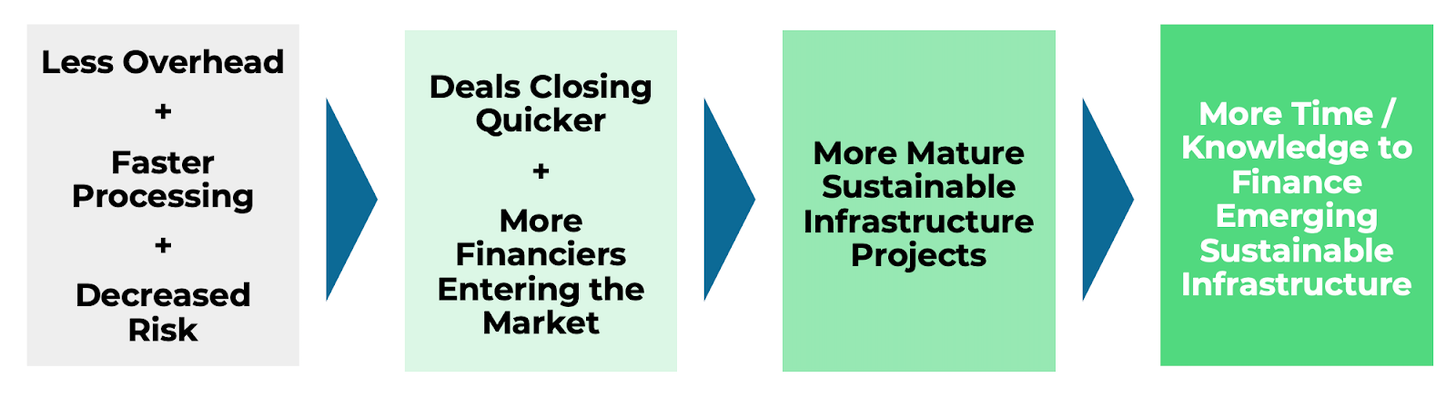

Instead of talking about TAM, we actually estimate our market size as the loss at scale of money left on the table from inefficient deal-making. McKinsey estimates $3.5T of missing annual net zero financing. Capital is certainly flowing, but without technology like Banyan, we're probably leaving $60B on the table that could otherwise be directly invested.

This $60B market comes from basic SaaS benefits. Think: work allocated to humans instead of software, increased risk due to lack of transparency, and slower transaction speeds. Then on top of that there are additional gains in the spreads created from liquidity and facilitating a marketplace. In the same way that it’s now so easy to get a mortgage (banks instantly bundle mortgages and give them to larger banks, which then bundle them even further), there’s no reason why the same level and type of financial innovation can’t happen for sustainable infrastructure. Bonus: These are the bundled products large funds and banks are looking for to meet their sustainability goals without greenwashing! Eventually, all sustainable infrastructure financing could be on Banyan. We’re early today, with over $1B flowing through the platform.

Who’s involved in this emerging sustainable infrastructure ecosystem?

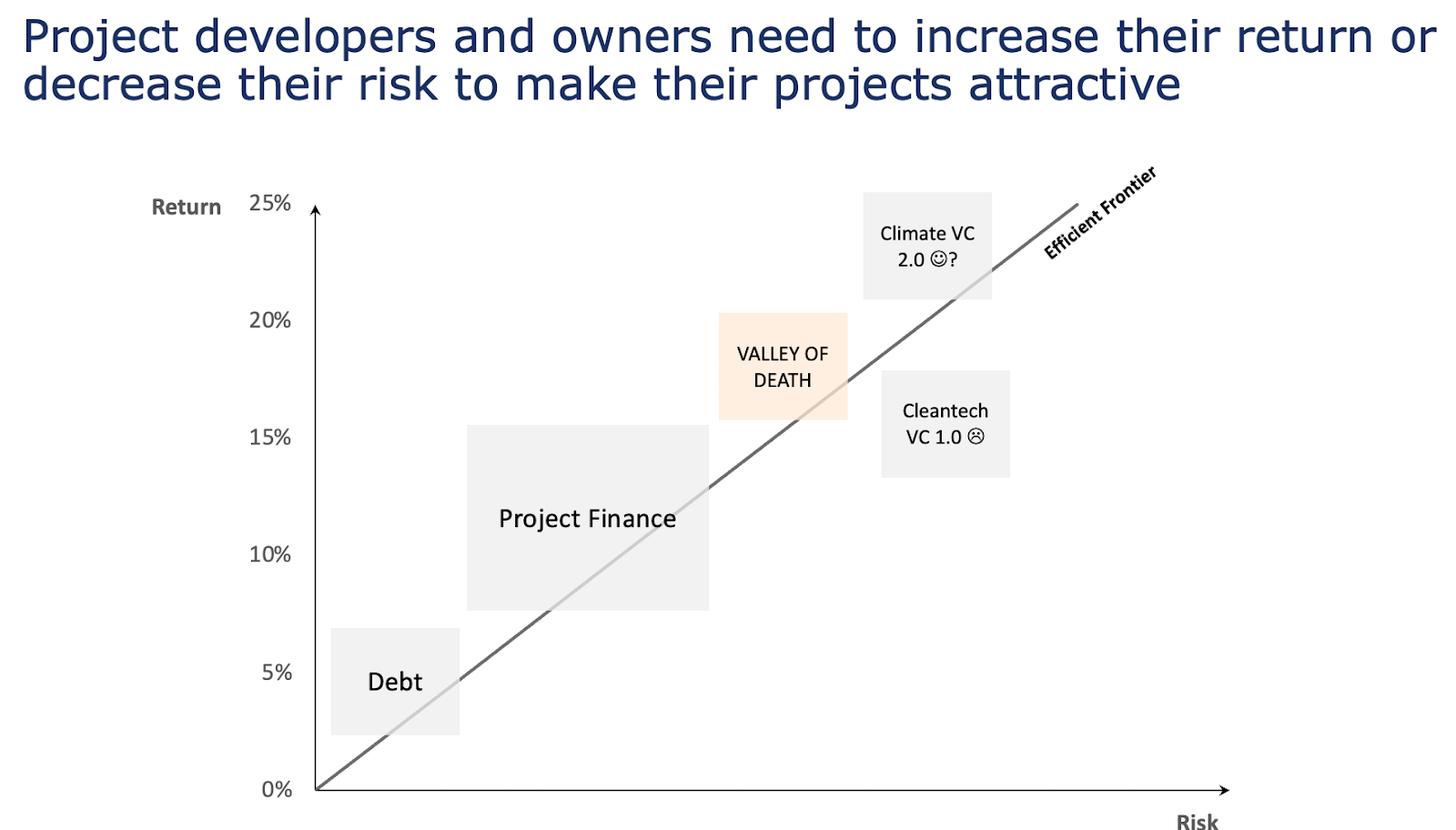

A huge amount of capital is being committed toward sustainable infrastructure from some of the largest players like pension funds, sovereign wealth funds, and large-scale banks who are attracted towards these forward looking, stable, long-term yield investments. The commitments are followed by a raft of new, exciting funds announcements. Unfortunately, we still see a “valley of death” at the commercialization stage.

In the venture capital space, everything’s focused on getting to the first deployment. But there’s a huge trough after the first few commercial assets before being bankable by project finance facilities. A number of innovative groups like Green Banks or new funds who are blending capital sources have jumped to task and are leaning forward to write checks. Relative to the size of the problem, it remains an aggressive gap - we actually consider ourselves as a part of the solution.

Tools like Banyan enable the project financiers, who traditionally take less technical risk on more mature technologies, to get comfortable with exploring and entering new markets. Software also provides deal making and diligence capacity at a time when funds are crunched on capacity. Increasing efficiency in areas like solar and energy efficiency while freeing up funds’ capacity means that investors can allocate time to explore new areas like green hydrogen or carbon capture.

Simultaneously, we want to democratize data. Creating best practices for risks and processes across technologies accelerates the learning pace for the entire field, especially at a time where each fund is individually getting up to speed on underwriting new technologies like hydrogen. Without that shared understanding and increased capacity to explore new types of deals, we’re going to collectively move far too slowly on new innovation investments. Back at Generate Capital in 2014 we had the largest energy storage project finance facility in North America. Greentech Media dubbed it the Year of Storage, and yet, here we are 8 years later and many banks are only just starting to consider storage investments! Without accelerating the pace of bankability, all of the new venture-backed technologies of today will not be deployed at scale in time to help achieve our global 2030 climate goals.

Which climate technologies are ripe for project finance investment? Is it still just solar and wind?

The bulk of projects we see are still in solar, wind, and energy efficiency. We are however increasingly hearing more about EV charging, EV fleets, Waste Heat (Kanin Energy’s focus), Anaerobic Digesters, and Storage. Hydrogen is also coming up a lot even though we don’t see many transactions. Realistically speaking though, for newer technologies it’s really just innovative, smaller facilities that are exploring initial deployments.

How does Banyan impact decarbonization?

Banyan enables climate impact via efficient and faster financing which results in greater capital deployment directly into projects rather than overhead fund management costs. More, faster project deployments mean a cleaner grid, better water utilities, low carbon transportation, improved agricultural systems, and more. On top of that we are helping the crowd in capital, with more transparency around the risk, more standardization around risk, we can drive to more financing. We’re trying to bridge that “valley of death” so we can get to the $3.5 trillion that is needed.

What needs to be true to get faster adoption of earlier-stage climate technologies into the project finance pipeline?

A lot of the work is around making it look and feel more standardized across existing assets that are well understood. If you’re looking at specific risk metrics on how a solar project should perform, and you can use these same types of methodologies for newer types of technology, it makes it easier to approach this market without having to invest extra time and connect with special experts. If there’s a known way of doing this, it lets you get up to speed really quickly.

If you start a bank today, you can start a residential mortgage program really quickly, because there are “start a mortgage program for dummies” programs that let you get that going. We want banks to be able to do that for new sustainable infrastructure technologies. That being said, there are a lot of risks - counterparty risk, actual technology risk being just a couple - and transparency only does so much for risk. To combat those then it is about bringing transparency so you’re able to apply to appropriate hedges against those risks. If you want to buy an insurance product to get rid of C&I counterparty risk, you can go to Energetic Insurance, or New Energy Risk to minimize technology risk. But, how do you know which project needs which product, and what it will do for the project? That’s where Banyan comes in, to make it clear. Banyan is helping be part of a broader ecosystem as climate tech, fintech, and insurtech have a lot of great intersections.

How does Banyan go to market?

We’re starting with specialty banks who are on the frontline making investments that touch the customer. With our Series A funding, we’ve now been exploring partnerships with larger banks which we previously didn’t have the capacity to target given their long sale cycles. We also work with funds, including credit lenders and equity investors. Both owner-operators and banks use our platform to understand financial and technical performance and risk.

Congratulations on your $8.2m Series A led by VoLo Earth Ventures, announced earlier this week! Who’s involved, and - most excitingly - what’s next for Banyan?

VoLo is a fantastic lead investor. We’re grateful to also benefit from the project finance experience of Nomadic Venture Partners and climate and fintech understanding of Ulu Ventures and Industrious Ventures as well as support from a great group of angel investors that have been with us since the start.

We’re chasing a larger market now. We’re starting to partner with larger institutions - the faster that we get these big funds on our software, the faster we can all decarbonize. We’re also expanding geographically first through Japan, with touch points across Asia. It’s going to be a big year for Banyan!

Does the efficient flowing of sustainable capital get your juices flowing? On the heels of their Series A, Banyan is rapidly expanding their Product and Engineering teams, and hiring across the board. If you’re an overworked Analyst - or GP, for that matter - on yet another massive solar financing deal, shoot Banyan a message about how you can get some sleep, and spend more dollars on next-generation climate technology deployments. (Very much CTVC’s pitch, for the record 😉)

A founder’s guide to winning non-dilutive funding with Elemental Excelerator

Venturing into nature with Diego Saez-Gil at Pachama

The climate tech methane spotlight on Crusoe Energy flares up