🌎 Get ready with me: Government grants edition 💅💵

A founder’s guide to winning non-dilutive funding with Elemental Excelerator

The climate tech methane spotlight on Crusoe Energy flares up

Last fall, climate scientists dubbed COP26 the “methane moment,” as 100 countries representing 70% of the global economy committed to reducing methane emissions by 30% from 2020 levels by 2030. And with states like Colorado and New Mexico cracking down on oil and gas methane emissions as recently as last month, the methane moment lives on.

If we want to reach our climate goals, we have to address methane. Methane is 84x more potent than CO2 in the first 20 years after its release and accounts for more than 25% of current warming. While agriculture is the largest source of anthropogenic methane emissions, the energy sector is a close second, accounting for 129 Mt as of November 2021.

A significant chunk of these emissions comes from flaring in the oil and gas sector. When an oil company drills a well, natural gas is often produced as a by-product. If the company can’t transport that gas to market, the excess gas is combusted - or flared - releasing CO2. Uncombusted gas enters the atmosphere as methane. Because flares never have perfect combustion efficiency, flaring drives methane emissions. By some estimates, flaring could account for roughly 2% of global GHG emissions.

With oil and gas regulation intensifying, fossil fuel producers have directed more time, money, and attention to flaring abatement, focusing largely on methane monitoring.

The climate tech community has responded to this demand with a suite of methane tracking solutions ranging in emphasis on local monitoring vs macro analysis. Call them the detectives on the trail of fugitive emissions.

🛰️ Zooming out to space, companies like GHGSAT are using satellites to observe methane emissions from far overhead, providing investors and operators with visualizations of methane activity across basins.

🐤 Meanwhile, on the ground, companies like Project Canary are deploying sensors at well sites to obtain asset-specific data.

Innovators: Project Canary, MethaneSAT, GHGSat, Bluefield, Kairos Aerospace, Picarro, SeekOps, Andium, Kuva Systems, Kayrros

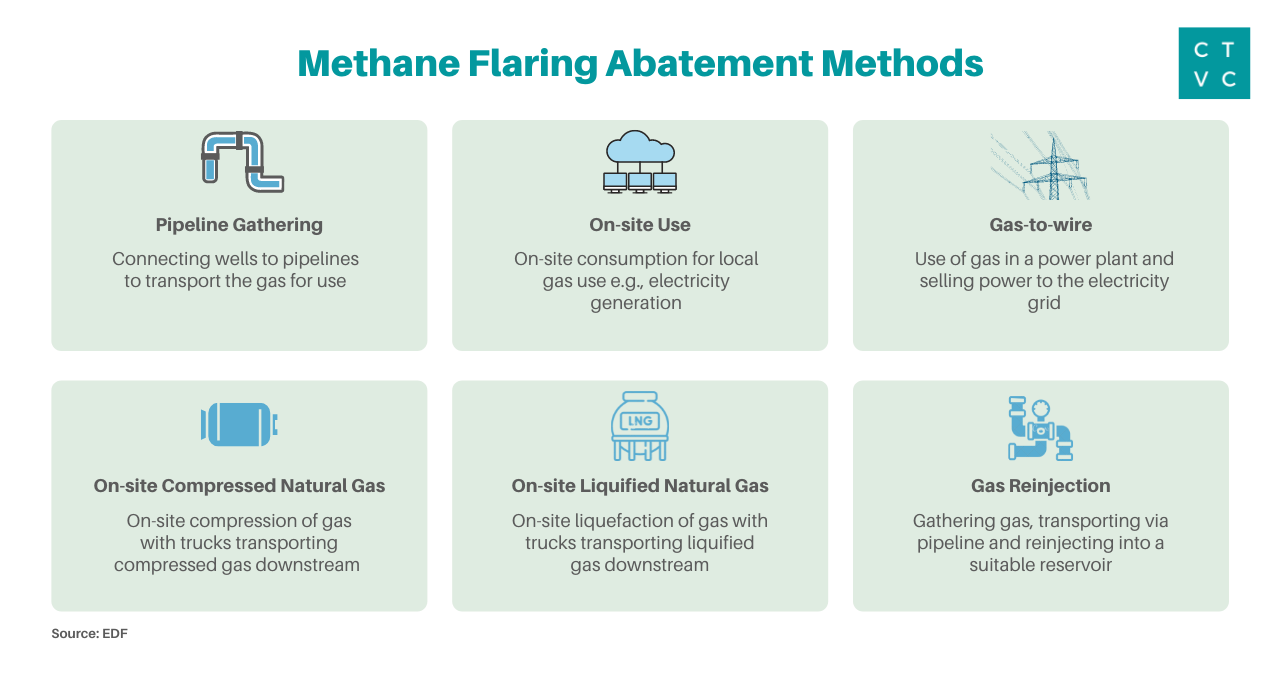

Methane monitoring, however, only solves part of the problem. Ultimately, companies need flaring reduction technology to cut methane emissions from their operations. Thus far, these solutions have taken the form of traditional infrastructure rather than new climate tech.

Pipeline gathering - Connecting wells to pipelines to transport the gas for use

On-site use - On-site consumption for local gas use e.g., electricity generation

Gas-to-wire - Use of gas in a power plant and selling power to the electricity grid

CNG - On-site compression of gas with trucks transporting compressed gas downstream

LNG - On-site liquefaction of gas with trucks transporting liquified gas downstream

Gas injection - Gathering gas, transporting via pipeline and reinjecting into a suitable reservoir

If a company builds appropriate gas lines to all new wells, it can virtually eliminate flaring. With existing technology, the oil and gas industry could cut methane by 75%, with 2/3rds of this reduction coming at no net cost.

However, even though flaring reduction could benefit companies financially in the long term, many are not willing to devote the time and resources to build necessary infrastructure today. There are also critical constraints to each solution including optimal volume range, distance to downstream infrastructure, scalability, and situation requirements (e.g., suitable reservoirs to inject gas).

This presents an opportunity for new solutions and innovation. If a company could help streamline the flaring reduction process, oil and gas methane could decline dramatically.

Special thanks to Gabriel Malek for offering his flare on methane’s moment.

Crusoe Energy, a Denver-based early-stage computing company, claims to have the solution to this flaring reduction conundrum: Bitcoin mining. By using excess gas from oil production to power crypto mining, Crusoe cuts flaring - and thus methane emissions - while serving demand for cloud computing.

This approach sidesteps some of the challenges associated with traditional flaring reduction infrastructure. Compared to pipeline buildout, compressed natural gas, or liquefaction, Crusoe’s mobile, modular data centers require less time and money. As a result, Crusoe sees itself as the bridge between computation and the energy transition. Late last month, Crusoe raised $350m in Series C funding from leading climate tech investors at G2 Venture Partners, Lowercarbon Capital, and others.

But is a company that mines Bitcoin using natural gas really climate tech? We tossed the question over to Twitter: “is Crusoe Energy #climatetech or not?”

Alright, over to the Twitter team: is Crusoe Energy #climatetech or not? 🤷♀️

— Sophie Purdom (@SophiePurdom) April 23, 2022

🪙🔥 @CrusoeEnergy a Denver, CO-based startup uses excess natural gas, which is typically flared and extremely harmful for the planet, to power data centers and cryptocurrency mining operations

The community was torn, so we Zoomed in with the gracious Crusoe CEO, Chase Lochmiller, and VP of Public Engagement & ESG, Holly Gordon, to unpack this climate tech identity crisis.

What’s the quick overview of Crusoe?

Crusoe builds large scale climate aligned computing infrastructure to solve the biggest and most energy intensive computing problems. I started Crusoe Energy in 2018 with a high school friend of mine, Cully Cavness. We brought very different experiences to the table. I spent my career working on large computing problems in quant finance and technology and Cully spent his career in the energy industry, where he was exposed to gas flaring in the oilfield. We came up with the idea that we could solve this flaring problem by simultaneously solving two of the computing industry’s biggest challenges, the energy costs and climate impact. Crusoe builds mobile modular data centers that can be deployed to sites that are flaring. Instead of the gas being flared, we’re able to utilize it on site to power the data centers. This creates a climate win by mitigating unwanted methane emissions, while also creating low cost computing infrastructure.

What’s the size of the methane flaring problem?

The problem is when oil companies drill wells, they produce gas as a byproduct of oil production. Oftentimes, the value of the gas is almost nothing compared to the oil, so if they don't have access to a pipeline, the most economical thing to do is to light it on fire, or flare it on-site. All those flares around the world add up to ~14 billion cubic feet per day, enough to power Sub-Saharan Africa.

How does Crusoe’s business model address that?

Crusoe’s business model eliminates flaring in an economically efficient manner. We pay a de minimis price for the stranded gas and we monetize it with computation - building, operating, and managing data centers. It turns out transporting data is much easier than transporting molecules of gas.

Our first application is digital currency mining. We started there for a couple of reasons:

So putting it succinctly, we unlock value in stranded energy with computation.

What is Crusoe’s impact on the oil and gas industry and on extending the life of existing or future oil and gas operations?

Modern quality of life is enabled by access to energy, which today is primarily driven by fossil fuels. Until we get to full-scale clean energy, the best path forward is minimizing the impact of fossil fuel production while we transition to carbon-free power sources. That's where we see Crusoe fitting into the picture - being a mechanism for reducing emissions from fossil fuel production during this energy transition period.

You mentioned that Crusoe is solving a climate issue during a period of transition. As fossil fuel consumption declines, how do you think about Crusoe’s long term business?

Our core mission is to align the future of computing with the future of climate. We want to build large-scale computing infrastructure that can be a mechanism to reduce emissions from existing sources of emissions and accelerate development for more carbon free power. If the world stopped using oil entirely today, we would fit in very well with behind-the-meter renewable energy producers, where we can operate as a net buyer of off-peak power production and curtail our computing workloads to free up those clean electrons to support the grid during peak demand.

In our year end forecast, 20% of our energy footprint will be from behind the meter carbon-free resources, and 80% will be from off-grid stranded methane recapture systems and digital flare mitigation.

What do you think underlies pushback from the climate community?

We’re working at the confluence of multiple controversial topics - gas and Bitcoin. A lot of people don't fundamentally understand that there’s a huge emissions difference between burning the gas in a flare compared with a natural gas generator. Flares typically only combust about 90% of the methane, so the biggest problem with flaring isn't the gas that gets burned, it's the 10% that doesn't get burned. Global flaring emits 265 million tonnes of CO2 and 8 million tons of methane per year. Over a 20 year period, methane traps 84x more heat in the atmosphere than an equivalent amount of CO2, so those 8 million tonnes of methane emissions from flaring are responsible for the equivalent warming impact of 672 million tonnes of CO2. So in total, global flaring emits almost a gigaton of CO2e emissions with ~70% originating from unburned methane.

Digital flare mitigation seeks to solve this exact problem. Our digital flare mitigation systems reduce those methane emissions from flaring by 98%. We only operate at oil sites where the only alternative to methane management is flaring. Likewise, we wouldn’t do projects where gas is a major product, not a byproduct. We only operate where there’s a clear counterfactual - without Crusoe, methane would be flared. And we’ve turned down projects where there’s potential for a net increase in emissions. We pay a very de minimis amount for the gas, so having a Crusoe data center wouldn’t enable any sort of drilling decisions.

How does Crusoe chalk up from a Life Cycle Assessment (LCA) perspective compared to the emission impact of other flaring alternatives?

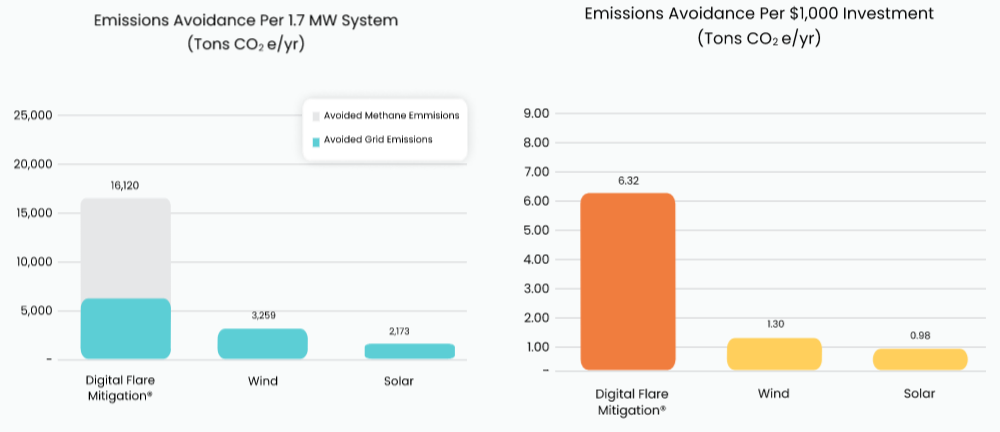

If you believe there's a fixed demand for computing workloads, then you can displace downstream grid-connected emissions by bringing the compute upstream to a Crusoe stranded off grid resource. From that perspective the LCA is far better: we both reduce the methane emissions, as well as avoid emissions from traditional downstream consumption.

We actually did an analysis around the avoided grid emissions and found that spending $1 on a DFM project results in 5-7 times the reduction in overall emissions compared to spending $1 on a solar or wind project.

Want to permanently stamp out emissions from flaring fires? Crusoe is growing quickly and is particularly interested to meet folks with carbon capture and storage interest and experience. Today, Crusoe addresses the 70% of flaring’s emissions from methane - in the future, they’re interested in using CCS to capture the pesky rest from those CO2 emissions and “take the footprint of flaring to zero.” Likewise, Crusoe is actively soliciting new customers that are interested in low cost and low impact computing resources.

Triage to tackle climate change. Because methane is >80x more potent than CO2 in the first 20 years after its release, finding solutions to eliminate natural gas flaring - a key source of methane - is essential to buy us time to implement decarbonization innovation. Flaring reduction may seem less sexy than other climate tech solutions, especially when other forms of traditional infrastructure can help combat the problem, but it can play a key role in putting the energy industry on a path to net zero. Climate tech that supports similar triage efforts can align with the shorter time horizons of venture investors.

Counterfactuals matter. Crusoe counts as climate tech only if the gas it uses would otherwise have been flared. Bitcoin mining that creates demand for new fossil fuel buildout or extends the life of existing oil and gas production cannot be considered a climate solution.

Strange energy transition bedfellows. Reaching our long term climate goals will require carbon-intensive incumbents in high-emitting industries like oil and gas to embrace decarbonization and climate tech innovation. Though it may seem strange to see oil and gas flaring in the same sentence as “climate tech,” direct collaboration between startups like Crusoe and multinational energy companies like ExxonMobil is key to driving real emissions reduction. Expect more cooperation between climate innovators and oil majors on everything from CCUS to electric vehicles in years to come.

Clean(er) coin. The climate benefits of flare mining surpass other forms of cryptocurrency mining. Crusoe’s climate tech secret sauce lies in its use of excess natural gas. By relying on gas that would otherwise have been flared or vented, Crusoe scores two climate wins: methane reduction and the avoided emissions from mining that might otherwise have relied on dirtier energy from the grid. Bitcoin mining that uses excess renewables only captures the avoided emissions piece.

A founder’s guide to winning non-dilutive funding with Elemental Excelerator

Infrastructure investing for impact with Banyan Infrastructure's Amanda Li

Venturing into nature with Diego Saez-Gil at Pachama