🌏 Spinning CO2 into clothes

Scaling “symbiotic manufacturing” with Rubi Laboratories

A new crop of startups are hot to the scene of this new market opportunity, building off-the-shelf SaaS platforms to automate and standardize the carbon accounting process.

Change happens gradually and then all at once. For years, a quiet revolution has been brewing in ESG corporate disclosure advocacy. With voluntary standards like CDP and metrics guidelines like SASB, leading corporates have opted in to environmental performance transparency. With 42% of companies above a $10bn market cap already disclosing some climate-relevant information, this shift has been happening slowly – and, now, seemingly all at once.

Earlier in November, the UK started the countdown to require all companies to disclose the climate change impacts of their business by 2025. The ruling leans on recommendations from the TCFD (Task Force on Climate-Related Financial Disclosures), an initiative of the Financial Stability Board to promote climate risk assessment. Already, 1,500 organizations have signed on, most in 2020.

Accounting isn’t known as a hotbed of innovation and corporates’ adaptive approaches to climate accounting range from sophisticated (high margin) corporates, like Amazon, which have developed in-house software solutions, to SMBs which have hacked together a hybrid solution of consultants and Excel sheets. In response, a new crop of startups are hot to the scene of this new market opportunity, building off-the-shelf SaaS platforms to automate and standardize the carbon accounting process.

Where to play? The startups are carving up the addressable pie (with some biting off more than others) but all must start with measurement.

Measure: Corporates must filter through internal data silos and synthesize climate-relevant metrics such the GHG emissions of different units and/or geographies of their business.

Scope 5 is a sustainability measurement tool to gather data and build an emissions inventory.

Report: While TCFD has evolved as the most widely-used disclosure, other ESG reporting frameworks such as CDP, GRI, SASB, and the SDG are also prevalent, creating some inconsistency in standards and frequency of reporting.

Persefoni’s platform allows sustainability operators and investors to measure, analyze, and report carbon footprint data across report types.

Manage: You can only manage what you measure. Post-reporting, companies are increasingly going a step further to actively mitigate their emissions, e.g., like Microsoft’s internal carbon price.

Watershed, whose team previously worked on Stripe’s climate initiatives, is a carbon management platform. CEO, Taylor Francis, describes Watershed’s “mission is to help businesses dramatically cut their carbon emissions. Watershed’s software makes it easy for businesses to measure their footprint, take high-impact steps to reduce it, and report on progress to employees and investors — all in one place. We’re working with companies in software, hardware, food, logistics. Their most powerful climate lever is to drive carbon reductions through their supply chain.”

Offset: As corporate net zero commitments have proliferated, carbon offsets have become a necessary (and preferred) method of nullifying emissions that can’t be directly mitigated.

Plan A offers a vertically integrated software solution to measure, monitor, reduce, and offset emissions.

Who to serve? Beyond determining what size and complexity of customer to go after, not all corporate carbon footprints are created equal – therefore carbon accounting SaaS startups must consider their customers depending on two differing emissions profile characteristics: 1) corporates’ carbon intensities and 2) emissions types.

⚖️ Light vs Heavy: Carbon risk materiality varies by emissions amount. Put simply, heavy emitting businesses are most at risk from climate (and regulation), and need the most help. Carbon accounting startups are developing and pricing their software solutions accordingly.

#️⃣ Scope 1, 2, 3: Even within intensity bands, emissions profiles vary depending on where the GHG is produced. For heavy scope 1 emitters, think of O&G majors and industrial cos with direct emissions from production. For heavy scope 3 indirect emitters, think of huge value chains like Apple’s. Most software cos’ (relatively small) emissions footprint leans scope 2, from purchasing electricity and HVAC.

Interested in more content like this? Subscribe to our weekly newsletter on Climate Tech below!

Scaling “symbiotic manufacturing” with Rubi Laboratories

How to build trust and collaboration in CDR with Isometric, starting with the science

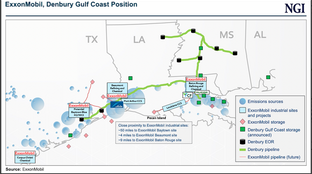

Exxon’s acquisition of Denbury fuels CO2 transport ambitions