🌎 H1 2025 Climate Tech Investment: Capital stacking up for energy security & resilience

Get Sightline’s signature H1’25 investment trends report inside

The methane monitoring, reporting, and verification tech on our radar, with AccelR8’s Emma Kulow

The US is drilling into methane emissions, with new EPA regulations stemming from the IRA taking effect next week. On May 7th, new rules for oil and gas companies will:

This spate of regulations, announced in December, has spurred investment in the methane monitoring, reporting, and verification (MRV) space, as we explored earlier this year. The improvement and commercialization of MRV technologies present a Catch-22: They’re leading to new accountability and actions from methane emitters, but also revealing that far more methane is being released into the atmosphere than previously known. For example, one recent study found major U.S. oil fields emit three times as much methane as official estimates, while another showed that German coal mines emit 184 times more methane than what’s been reported.

Here, we’ll dive even deeper into the challenges that methane presents, and monitor the solutions on the ground (and in the air).

All methane gas, no brakes

Despite being more potent than carbon dioxide, methane receives far less attention and even less funding — <1% of total climate finance flows, while accounting for nearly a third of global warming. The oft-cited stat is that one ton of methane has ~28 times the warming effect of CO2 over 100 years, but it’s 84 times more in the first 20 years. Plus, high concentrations of the odorless, invisible gas are poisonous, so overexposure affects workers and communities. But this invisible cloud has a visible silver lining: Reducing methane emissions will have a greater immediate (and long-term) impact on climate change over the next 20 years than comparable CO2, and help prevent exacerbating climate feedback loops.

Anthropogenic methane emissions primarily come from agriculture and energy (with waste a smaller but still significant source). Agricultural emissions, primarily driven by livestock, require complex biological and logistical mitigation solutions. Energy is more straightforward: Most emissions stem from three actions — leaking, flaring, and venting — that account for ~25% of all methane released by human-caused activities.

Oil and gas operators have typically reported methane emissions on monthly, quarterly, or even annual bases, but largely used rough calculations and estimations. Now, new MRV technologies allow for continuous, real-time monitoring, detecting both "super-emitter events" and smaller, cumulative leaks. This can unlock more than just emissions benefits: By identifying and fixing leaks, operators can capture valuable methane, and increase revenue — around $1bn in methane literally goes up in smoke annually. With recent support like the DOE and EPA’s $1bn investment in MRV technology, regulatory and technological tailwinds are blowing through the market.

Changing the game

Before these regulations, the ones buying this information were mostly watchdogs — regulators, journalists, other interested parties. With new regulations in place, the customer universe will expand to the emitters themselves — the operators of these assets now on the hook to curb methane emissions.

Asset managers are another important potential buyer, as they own equity in these companies who could be adversely impacted by running afoul of the regulations (e.g. stocks could take a hit if a company is found liable for exceeding methane thresholds and must pay a meaningful penalty).

Monitoring the solution set

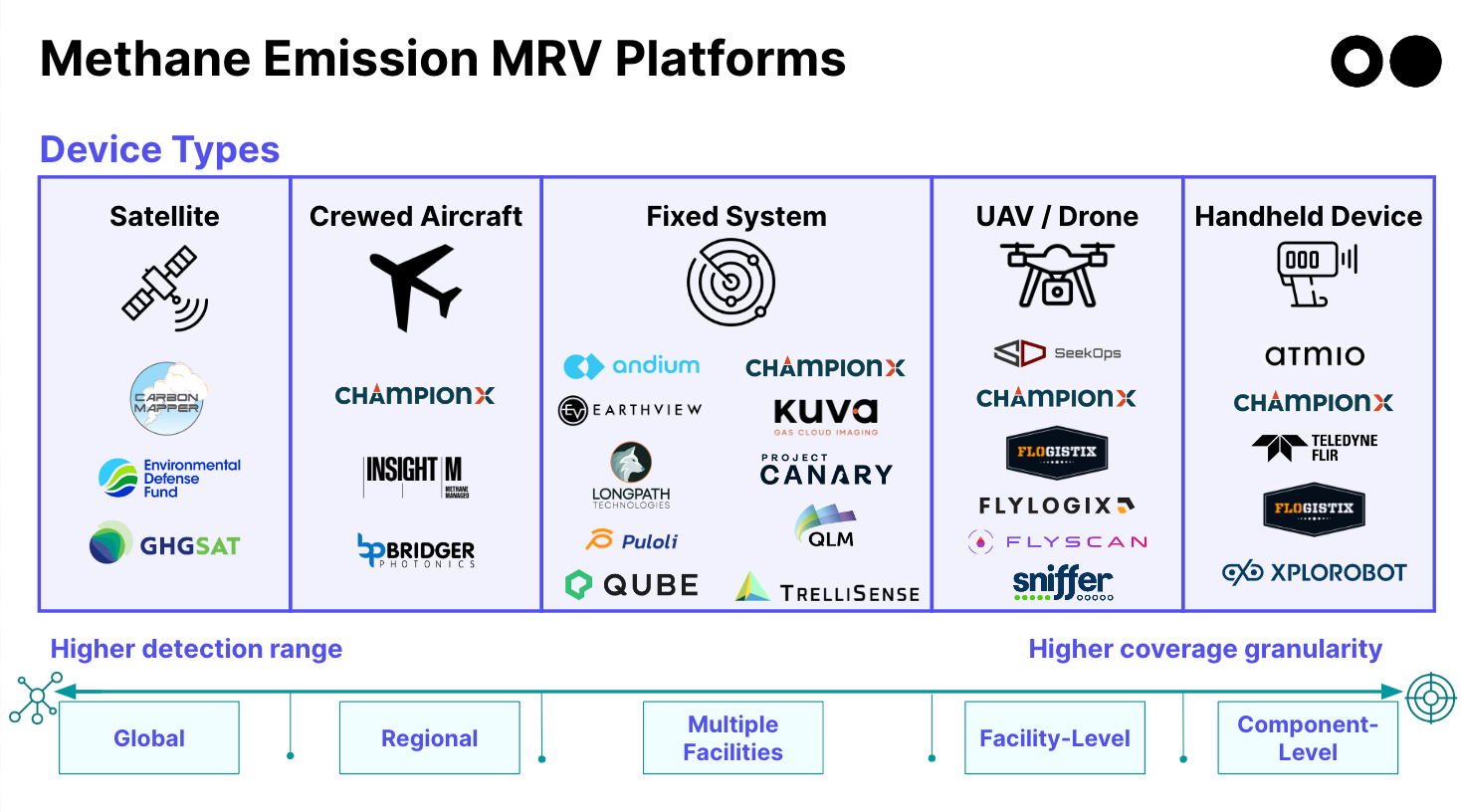

Solutions from incumbents and startups alike have entered the market to meet the needs of the different stakeholders in the methane value chain, from O&G majors to small players to governments. Factors to consider when choosing from the methane solutions menu:

Types of solutions include:

Handheld: Handheld devices are mature technology used for detecting methane at a range of 0.5 to 150 meters. These portable, battery-operated units are becoming increasingly sophisticated, often coupled with advanced software.

Fixed: Like home carbon monoxide alarms, fixed methane detectors can be installed on or near key oil and gas assets to continuously monitor emissions.

UAV/drone: Emerging in the oil and gas sector, uncrewed aerial vehicles (UAVs), aka drones, are increasingly used for tasks like pipeline inspections and accessing difficult offshore assets. Capable of low-altitude flight and navigating around obstacles, drones enable detailed surveys of hard-to-reach infrastructure.

Crewed aircraft: Crewed aircraft equipped with sensors such as laser or infrared spectroscopy can quickly survey large, remote areas for methane concentrations using direct air sampling or remote sensing with location-tracking.

Satellite: Orbiting satellites use spectral imaging technologies like hyperspectral imaging to detect methane over far-reaching area. They measure methane by analyzing reflected sunlight or Earth's infrared light, though weather can impact accuracy. Different satellites vary in granularity and precision, but the tech is improving rapidly.

Beyond monitoring

Data analytics. New startups are emerging to analyze and interpret the vast data from various sources, creating actionable insights. Companies like Kayrros, Sensorup, Beyond AI, Orbio, and Highwood Emissions Management use AI and machine learning for data aggregation, analysis, predictive optimization, and reporting, including for EPA compliance.

Abatement. Meanwhile, other hard-tech companies have cropped up to help companies abate these emissions. Innovators include BioSqueeze, which developed a biomineralization solution to seal well leaks. Crusoe Energy Systems captures flared methane (EPA regulations on flaring are on the horizon) to power modular data center infrastructure. Qnergy uses captured methane to power commercial generators. Frost Methane converts methane from emission sources such as coal mines into carbon offsets.

What’s next?

The new US regulations complement the patchwork of international rules and voluntary commitments in the oil and gas sector:

Key takeaways

Thanks to Emma Kulow from AccelR8, Lauren Singer from Overview Capital, Jon Goldstein from EDF, and Oliver Booth from Sightline Climate for their super contributions to this newsletter.

Get Sightline’s signature H1’25 investment trends report inside

Survey results: what’s working, what’s stalled, and what’s missing

A sneak preview from Sightline’s exclusive client-only webinar