🌏 The bits and bytes of grid tech

(Bonus edition) Part III: The software “middleware” layer for grid operators / utilities

The digital transformation of energy data with Equal Ventures’ Rick Zullo & Simran Suri

The world feels anything but resilient right now - heck, it hasn’t over the past few years. Extreme weather, a hasty pandemic recovery, and now the energy crunch sparked by Russian O&G dependence have only headlined sustainability’s tie up with resiliency.

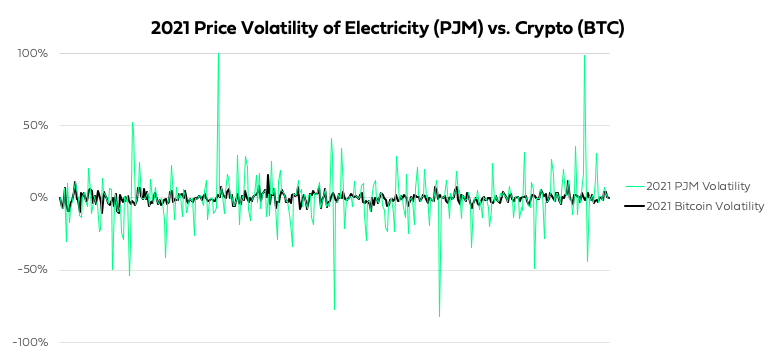

As the cost of oil hits levels we haven’t seen since 2008, it’s evident that we’re a long way yet from a panacea of energy independence and stability. While the ‘energy market’ conjures up images of stodgy constancy, in reality it’s rife with volatility and prices swings dwarfing that of even crypto.

In a game of pin-the-legend-on-the-chart, odds are likely that most folks would flip the series. Another unexpected energy market fact? As of 2020, the US had more blackouts than any other developed country. Each of these wild swings in energy price creates winners and losers. The cost of not knowing real-time energy data has never been higher. Those armed with systems capable of acting on the volatility will reap the arbitrage rewards. And yet, the market remains largely devoid of solutions to navigate these swings in real-time.

For starters, the grid’s power mix is changing. Renewables now make up 87% of new US utility-scale generation capacity in 2021. The power supply from intermittent renewables operates differently from baseload power sources (e.g. nuclear, coal, and hydro), making it much harder to match supply and demand as both sides fluctuate. This mismatch results in displacements that cause electricity price spikes. Solutions like batteries, demand response, and natural gas peaker plants help modulate these spikes. But as the volume of renewables on the grid increases, so will the cost to smooth these spikes - particularly if the Russia invasion of Ukraine persists since both countries are major producers of natural gas for peaker plants and metals necessary for battery storage.

To date, the plan to solve for grid resiliency includes:

➕ building redundant energy supply

📊 expanding demand response programs

🔋 expanding storage capabilities

🔌 curtailing energy demand via energy efficiency programs

It’s estimated that the price tag for achieving a resilient US grid by 2035 comes at a cost of up to $2.5T invested into renewables and demand response. That’s a hefty sum. But investment in hardware alone can’t buy us resiliency. Universal real-time data is the key driver that unlocks a resilient and sustainable grid.

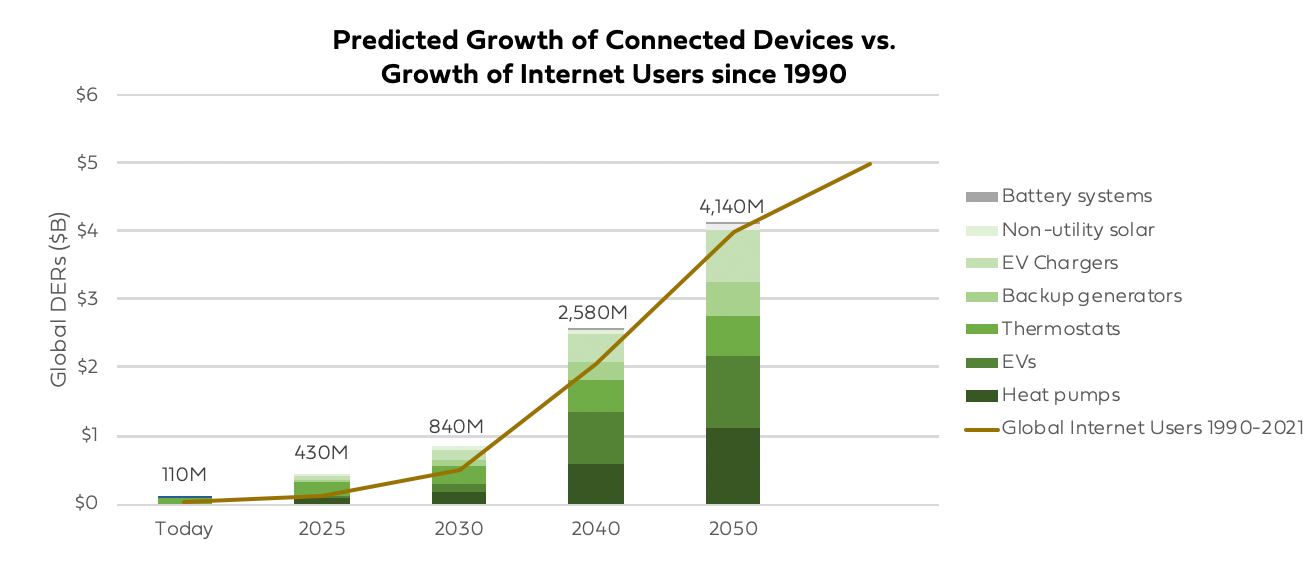

Despite the enormous size of the market opportunity and the extreme degree of price volatility, most energy market decisions remain offline. Customers consume energy downstream with little to no awareness of real-time pricing signals or grid needs. Even at the utility level, many grid operators manage system-level demand smoothing by manually interfacing with peak suppliers and bulk load demand sources. As the number of DERs explodes - mirroring the historic growth of global internet users - it will become impossible for this to be operated manually.

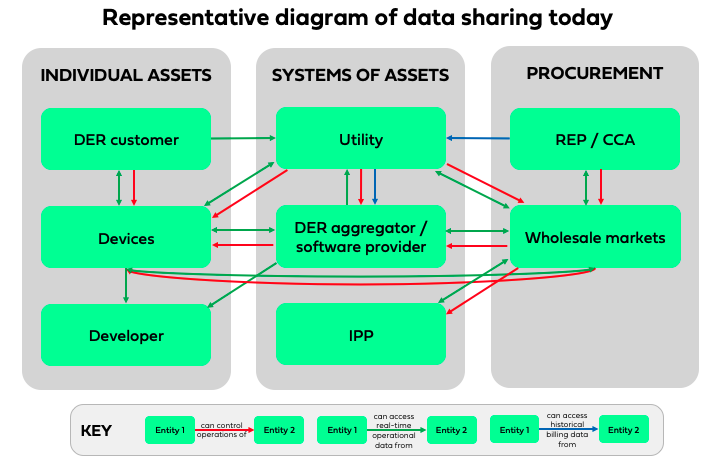

Energy data is now held by a number of different interconnected stakeholders, influenced by:

🎛️ the growing prevalence of behind-the-meter DERs

💻 new software systems for interoperability and energy management (like DER aggregators)

👩🏾🔬 hardware innovation with new energy devices

🔃 the shift towards deregulated energy markets

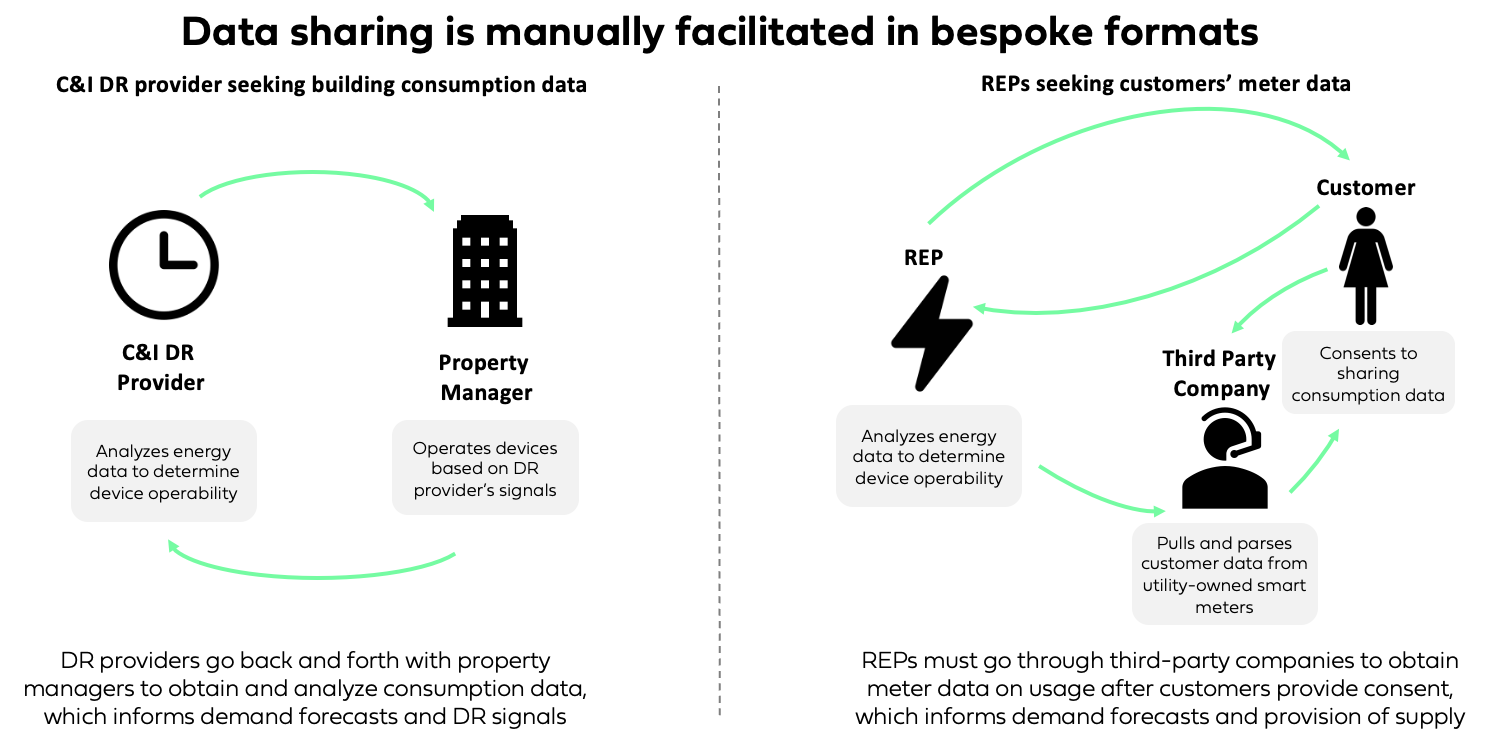

Existing data-sharing infrastructure, however, was built for linear flows of energy – not a distributed, connected grid. These insufficiencies mean that data is shared manually, in bespoke formats, through a number of different channels. Where there is connectivity, it’s often late, low fidelity and expensive. Given the prohibitive cost and limited bandwidth, it only makes sense to build these connections for the largest most strategic sources of supply/ demand, eroding equality in energy markets.

Data connectivity issues result in communication delays and bottlenecks for energy stakeholders.

💡 Utility-owned metering infrastructure is commonly used to access interval data; however, this data can’t be shared in real-time. Utilities are rarely incentivized or required to share their data in a standardized format at reasonable prices. To-date, this lack of standardization has prevented other energy stakeholders from building out unified, horizontal APIs that include utilities.

🛠 Hardware-enabled submetering solutions allow access to data from utility-owned metering infrastructure without having to go through utilities themselves. These hardware solutions are installed on top of utility-owned meters and can provide real-time data at custom intervals. However, they often have steep logistical costs, given the need to manufacture and deploy the hardware across multiple meters.

📈 Third-party companies or consultancies offer a reliable means of accessing data, but it’s not typically shared in a standardized format or language. Instead, each company or consultancy uses their own method of translation and language. As such, contracts with these entities can be custom, costly and may not guarantee real-time access to data.

In an era where software eats everything, the grid of tomorrow should look like the internet. The digital truth lies in unified data connectivity that provides universal visibility, communication, and actionability.

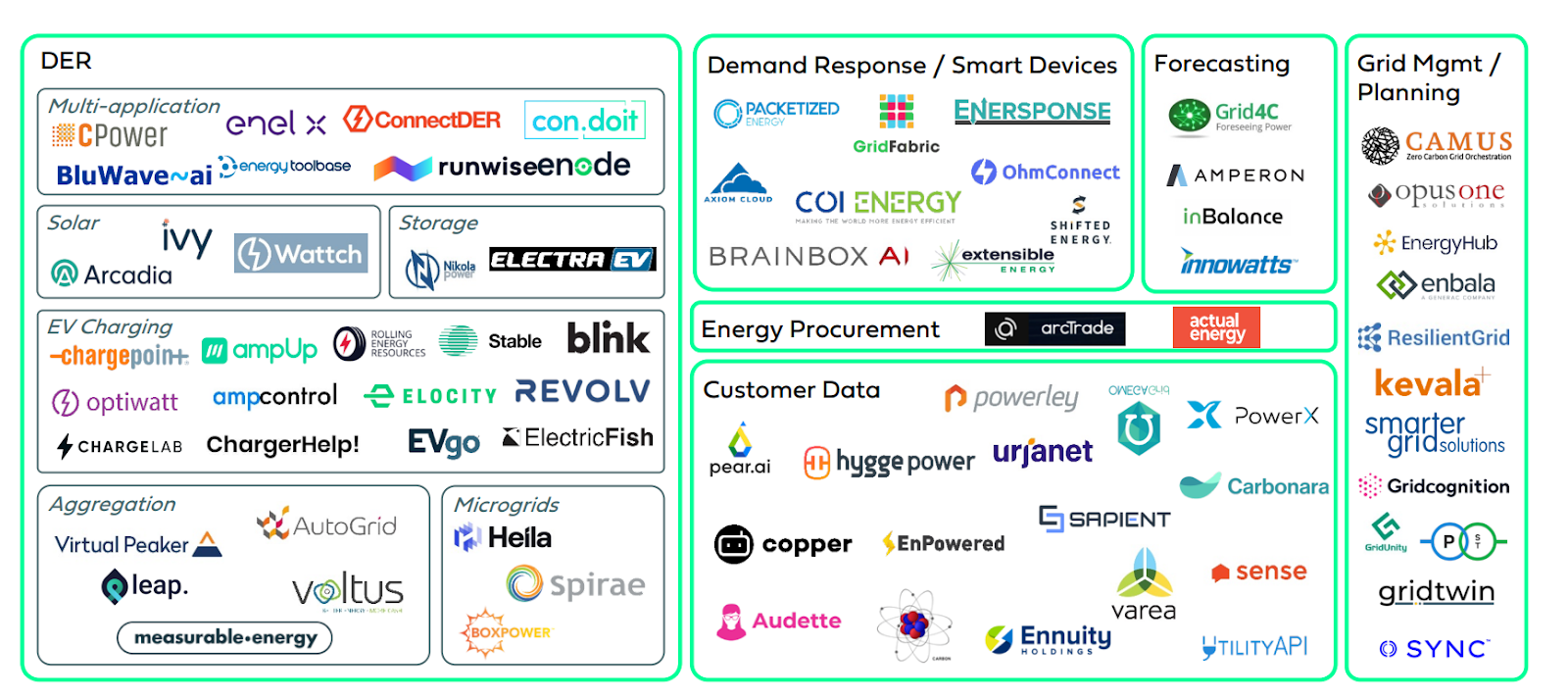

As the market for new energy solutions grows, so has the proliferation of companies with verticalized data connectivity offerings. These companies sync data between nodes within specific verticals, like solar, EV charging, or home energy devices, for use cases like demand response or scheduled usage.

Existing players are verticalized, which limits TAM. The current cohort of many energy data connectivity startups rarely cross verticals, instead focusing on building out additional SaaS/services products in their specific sub-segments to increase their existing customer base’s ACVs. This reaction is only natural given the industry’s long sales cycles and need to show sufficient revenue to access additional capital. While this approach makes sense for short-term revenue goals, it may limit a solution’s ability to scale into other applications and stakeholders. Ultimately, limiting total potential by pigeonholing to a bespoke niche.

Verticalization requires customization. Today’s startups resemble the system integrators, charging high prices with large service arrangements to achieve revenue targets. This approach prioritizes traditional linear growth, rather than leaning on the power of networks. Trading near-term revenue for ubiquity and trading linear growth for exponential network growth has unlocked massive opportunity in other industries - now it’s the energy industry’s time.

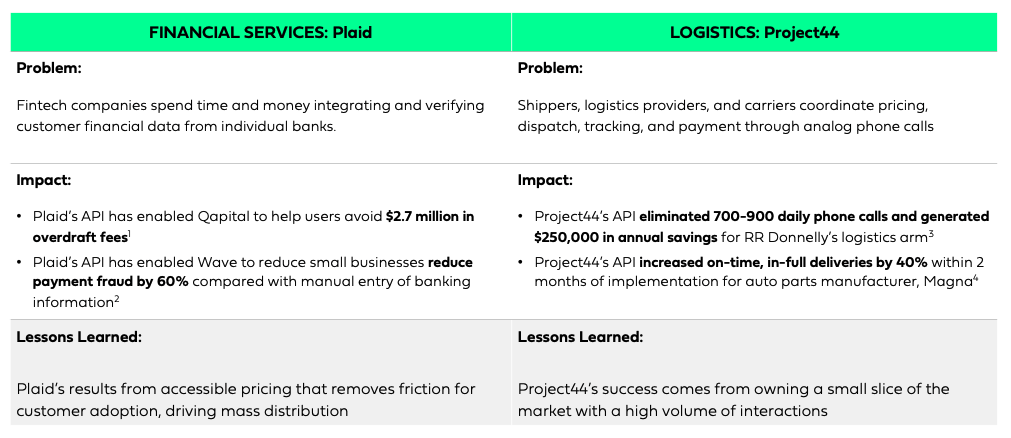

Energy is a uniquely complex industry, but it’s not alone. Financial services and logistics have long struggled with similar data network challenges, from which success stories Plaid and Project44 emerged to tackle data connectivity and interoperability in their respective markets. (Disclosure: Rick Zullo is an investor in Project44)

While verticalized solutions create value, ubiquity ultimately unlocks true transformation. Plaid and Project44 innovated on their pricing and distribution to build network businesses, not just SaaS businesses.

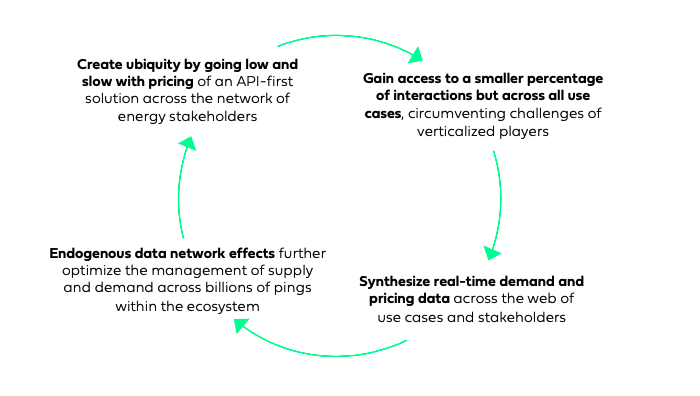

To achieve the network effect, players need to remove friction from adoption wherever possible.

Plaid made pricing accessible with per-API-call pricing to remove friction, enabling mass adoption by consumer fintechs and legacy financial institutions. Affordability drives ubiquity. By drastically cutting prices, a horizontal player can anchor its approach around network growth, rather than artificial, short-term revenue milestones. This can unlock higher adoption, while making it difficult for legacy players to compete. In network plays, the trophy goes to whoever owns the network - even if the monetization per call might be low.

Project44 provides system-to-system connections, focusing on horizontal distribution and network growth, rather than developing ancillary product features. Acting as the network distributor simplifies the path to market and removes fear of revenue cannibalization (e.g., who gets to claim the demand response revenue?). Reducing these competitive pressures is critical to aligning around a single unified solution - eliminating the need for bespoke integrations and daisy-chained infrastructure built by system integrators, while enabling higher functioning, scalable IT infrastructure.

Pricing and distribution drives load growth from as many distributed sources as possible - creating a flywheel for interoperability and efficiency. Managing supply and demand during extreme weather events becomes more accurate and efficient, in turn increasing returns to the platform. Value accrues to whoever achieves network depth and breadth. For as much as possible, no electron can be left behind.

Energy needs real-time visibility and a single source of truth. As we move to a grid dominated by renewables, the energy ecosystem becomes more intermittent but interconnected - where decision-making relies on real-time data visibility and interoperability. How much better could demand response events perform if the grid could call on all available DERs, weather forecasts, etc? We’ve seen data standardization written into the transformation of healthcare data and portability of consumer financial data. But energy markets still lack this centralized data exchange connecting all stakeholders.

Existing energy players continue to stay in their lane. Energy cos have tended to verticalize in their respective nodes (e.g., solar, EV charging, home energy devices) - driving higher ACVs at the opportunity cost of horizontal scale. However, the market is seeing early signs of verticalized players transitioning into a platform approach and moving across verticals with Arcadia’s ARC API, SunRun’s shift to include EVs, and Stem’s updated Athena software solution. TBD how these solutions evolve into achieving true horizontal ubiquity, but it’s a start.

Building a platform, not a product, drives long-term value. Energy today is more holistic than ever before. Today’s grid presents a tremendous opportunity for new API infrastructure solutions to emerge, using low, volume-based pricing across devices, stakeholders and their data. But patience is key - and enabling the network to scale may eschew short-term monetization in favor of long-term stickiness.

Achieving data network density and ubiquity is a unicorn-sized opportunity. Unlocking universal data hidden across siloed devices and stakeholders is a herculean task. This may be one of the hardest digital businesses to build in the energy space, but also one of the biggest for whoever pulls it off.

Special thanks to Rick Zullo, Simran Suri, and the team at Equal Ventures. Liked the insights and graphics from this piece? Read Equal Ventures’ full open sourced research deep dive deck for more ideas on how to build the next Plaid for energy. If you’re an entrepreneur building digital solutions for energy data, reach out – the team would love to hear from you!

(Bonus edition) Part III: The software “middleware” layer for grid operators / utilities

Part II: How grid tech is the rails of the energy transition

The Goldilocks effect in geothermal HVAC systems