🌎 Fervo and General Fusion open the exit window #280

A tale of two public debuts

With long duration energy procurement surging, new rankings reveal who's pulling ahead

Happy Monday!

Sightline Climate's new long duration energy storage (LDES) leaderboards are out, and they're showing that lithium-ion is still the tech to beat. With policy driving nearly 10GW of LDES capacity procurement globally this spring, we're diving in below, or join our webinar Friday to learn more about how energy decision-makers use them.

In deals, $1.2bn for renewable energy project development & assets operation across two deals, $752m for autonomous trucking, and $370m for solar component manufacturing.

In other news, tailwinds for offshore wind, new Trump admin energy moves, and grids weather winter storms.

Thanks for reading!

Not a subscriber yet?

📩 Submit deals and announcements for the newsletter at [email protected].

💼 Find or share roles on our job board here.

CTVC is powered by Sightline Climate, the tactical market intelligence platform for energy and investment decision-makers.

This spring, a global rush of long duration energy storage tenders will charge up the sector. Up to 9.3GW of capacity is set for procurement in the next five months, more than the sector has contracted in its entire history.

With billion-dollar decisions on the line, finding the right technology partner is critical. Last week, Sightline Climate released its new Long Duration Energy Storage Leaderboard, offering granular, vendor-level benchmarks built on proprietary and verifiable data. Sightline’s proprietary AI engine and expert analyst team ensure Leaderboards are updated regularly, to reveal new deployments, capital flows, and performance shifts that move the market. The rankings show who is pulling ahead, who is stalling, and critically, why.

We dig into what the leaderboards reveal below. Clients can explore the full rankings and supporting data on the platform here. Join our webinar on Friday to learn more about how you can leverage Leaderboards for your procurement decisions.

Rising electricity demand, widening price volatility, and more frequent extreme weather are pushing long duration energy storage into the spotlight. Utilities are increasingly using LDES to firm renewables, defer transmission upgrades, and improve grid resilience, while regulators look for solutions that protect ratepayers from volatility and outages.

So far, most of the 2.6GW of capacity that’s been awarded has gone to lithium-ion technologies. But emerging LDES technologies’ unique performance benefits or long lifetimes give them a chance to compete. It’s a complex choice for utilities, weighing up cost, performance, and execution experience.

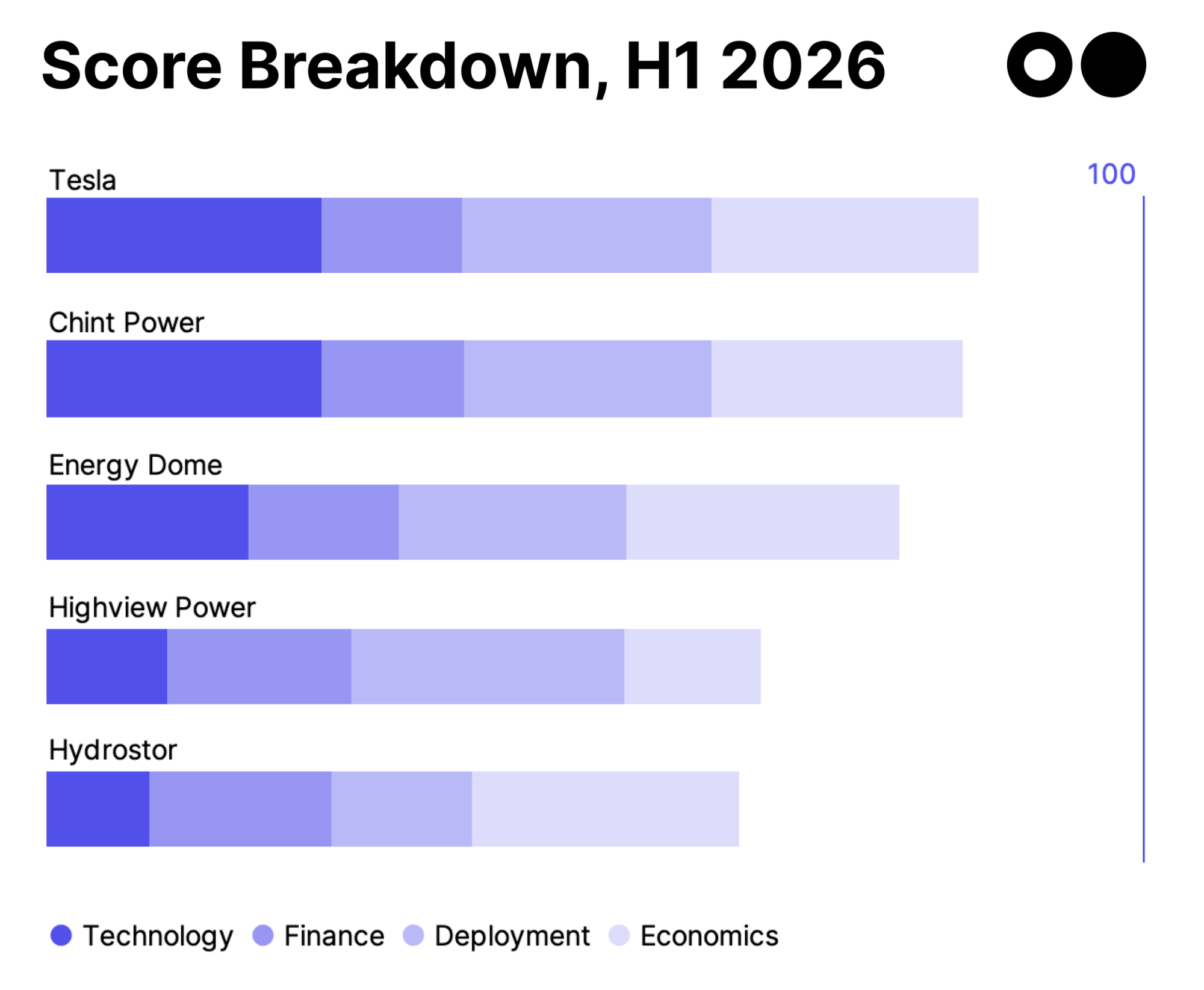

That is where the Leaderboard comes in. Built on Sightline Climate’s Readiness Framework and fully integrated into the Sightline platform, every ranking is traceable to the underlying data and analysis. This allows users to validate assumptions, stress-test decisions, and track how competitive positions evolve. Each company is evaluated across key dimensions based on how utilities, banks, and investors assess readiness: technology performance, financial profile, deployment track record, and economics and cost.

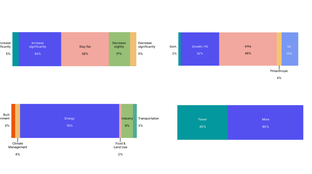

Below is Sightline’s inaugural Leaderboard, with the top 5 vendors, with their subscores across these dimensions normalized and ranked. Clients can see the breakdown of 20+ leading vendors here with the underlying cost, performance, deployment, and financing data. Read more about the methodology here.

This inaugural LDES Leaderboard shows that lithium-ion remains the benchmark for long-duration applications today. Long-duration lithium-ion vendors Tesla and Chint Power lead based on proven deployment at scale, strong round-trip efficiency, and competitive normalized economics at longer durations. Those advantages show up clearly in the underlying deployment, cost, and performance data that inform the rankings.

Among non-lithium alternatives, the next three are mechanical storage vendors, the most competitive today, in large part because they avoid the capital intensity and long lead times associated with building new supply chains. Several electrochemical and thermal storage providers show promise, but their ability to climb the leaderboard will depend on securing near-term awards in the UK, Australia, and Canada.

Active tenders for up to nearly 10GW of LDES capacity are landing in a small number of policy-backed markets, according to Sightline Climate research. New South Wales is expected to award 1GW imminently. Ontario is preparing a 600MW procurement expected in June 2026. And the UK is lining up the largest volume of all, with 2.7–7.7GW set to be contracted under its cap-and-floor scheme, with an initial decision list due in spring 2026. Notably, the UK will consider strategic factors alongside bid price, increasing the odds for non-incumbent technologies.

Emerging LDES technologies could step up here, if they can compete on execution. Vendors selected in today’s tenders early will move down cost curves faster, extend their deployment lead, and set performance benchmarks that shape future procurements. Balance sheets, delivery track records, and real-world performance are key, and understanding who’s positioned to win enables defensible procurement, partnership, and investment decisions.

Sightline will continue to track all of these metrics, releasing an updated leaderboard every six months. Learn more about how we built these leaderboards and what they show live in our webinar on Friday, February 6, at 11 am ET, also featuring insights from one of the leaderboard companies, Energy Dome.

🚗 Waabi, a Toronto, Canada-based generative AI platform for autonomous trucking, raised $752m in Series C funding from G2 Venture Partners, Khosla Ventures, BDC Capital, BMO Global Asset Management, BlackRock, and other investors.

🌋 Zanskar, a Salt Lake City, UT-based geothermal exploration and development platform, raised $115m in Series C funding from Spring Lane Capital, Obvious Ventures, Union Square Ventures, Lowercarbon Capital, Orion Industrial Ventures, and other investors.

⚡ Standard Nuclear, an Oak Ridge, TN-based advanced nuclear fuel developer, raised $98m in Series A funding from Decisive Point, Andreessen Horowitz, Chevron Technology Ventures, and StepStone Group.

🔋 Redwood Materials, a Carson City, NV-based lithium-ion battery recycling platform, raised $75m in Growth funding from Capricorn Partners, Goldman Sachs, and Google.

🚗 Applied EV, a Melbourne, Australia-based vehicle control systems software for autonomous vehicles, raised $40m in Series B funding from National Reconstruction Fund Corporation.

🚗 XFuel, a Dublin, Ireland-based low-carbon marine fuels producer with biomass feedstocks, raised $20m in Series A funding from SOSV, Union Square Ventures, Audacy Ventures, Future Planet Capital, AENU, and other investors.

🏭 GlassPoint, a New York, NY-based industrial solar thermal systems developer, raised $20m in Series A funding from New Investment Solutions and MIG Capital.

🌊 Gigablue, a New York, NY-based ocean-based carbon removal provider, raised $20m in Series A funding from Planet Ocean Capital.

⚡ metergrid, a Stuttgart, Germany-based tenant electricity and energy management platform, raised $12m in Series A funding from SET Ventures, LBBW Venture Capital, Hager, and Mätch VC.

🏭 Co-reactive, a Düsseldorf, Germany-based CO2 mineralization technology developer for cement, raised $8m in Seed funding from High-Tech Gründerfonds (HTGF), NRW BANK, AFI Ventures, HBG Ventures, and Evercurious VC.

⚡ AZX, a San Jose, CA-based AI software provider for grid operations and critical infrastructure, raised $6m in Pre-seed funding from Powerhouse Ventures, KOMPAS, Founders' Co-op, Sustainable Future Ventures, and Stepchange VC.

🧪 Relement, a Breda, Netherlands-based manufacturer of bio-based chemical ingredients, raised $6m in Seed funding from KIKK Capital, The Yield Lab, TNO Ventures, Relement Management, and Brabant Development.

🌦️ Rainbow Weather, a Warsaw, Poland-based high-precision climate and weather forecasting platform, raised $6m in Seed funding from Yuri Gurski.

🚗 Vimag Labs, a Bengaluru, India-based rare earths-free electric motors developer, raised $5m in Seed funding from Accel, Chakra Growth Capital, and Thinkuvate.

⚡ CVector, a Boston, MA-based industrial energy data analytics platform, raised $5m in Seed funding from Powerhouse Ventures, Fusion Fund, Hitachi Ventures, Schematic Ventures, and Myriad Venture Partners.

♻️ Refurbi, a Bogota, Colombia-based refurbished mobile device marketplace, raised $4m in Seed funding from Latin Leap, PSM Impact Ventures, Epic Angels, the Inter-American Development Bank, and Itaú.

🏠Billdr, a Montreal, Canada-based AI-powered operating system for construction, raised $3m in Seed funding from White Star Capital, One Way Ventures, Desjardins Capital, asterX, and FormenteraCapital.

🏠 Lucend, an Amsterdam, Netherlands-based data center optimization platform, raised $3m in Seed funding from Remarkable Ventures, 4impact Capital, Avesta Fund, ME Innovation Fund, New Climate Ventures, and other investors.

🏭 Twogee Biotech, a Munich, Germany-based enzyme for biomass conversion technology designer, raised $3m in Seed funding from Bayern Kapital, High-Tech Gründerfonds (HTGF), Heinz Entsorgung, and AgriFoodTech Venture Alliance.

♻️ ScrapUncle, a New Delhi, India-based online scrap recycling marketplace, raised $2m in Seed funding from Venture Catalysts, Orios Venture Partners, Acumen, and We Founder Circle.

🌾 Proba, a Rotterdam, Netherlands-based supply chain decarbonization platform for agri-food supply chains, raised $2m in Seed funding from The Yield Lab, Future Food Fund, and Value Factory Ventures.

⚡ TetraxAI, a Madrid, Spain-based AI platform for renewable energy project management, raised $2m in Pre-seed funding from The Footprint Firm, Carbon13, CDTI, and Norrsken Evolve.

⚡ EarthSync, a Bengaluru, India-based AI-powered renewable energy optimization software, raised $1m in Pre-seed funding from Theia Ventures and Eximius Ventures.

🏠 Nautilus Data Technologies, a Pleasanton, CA-based data center modular cooling infrastructure developer, raised an undisclosed amount in Series B funding from Pangaea Ventures.

⚡ Low Carbon, a London, England-based renewable energy developer and asset manager, raised $684m in Debt funding from AIB, CIBC, DNB, HSBC, Intesa Sanpaolo,, and other investors.

⚡ Greenko Group, a Hyderabad, India-based renewable energy platform, raised $524m in Debt funding from National Bank for Financing Infrastructure and Development (NaBFID).

☀️ Inox Clean Energy, a Worli, India-based solar module and cell manufacturer, raised $370m in Debt funding from National Bank for Financing Infrastructure and Development (NaBFID).

🔋 Jupiter Power, an Austin, TX-based energy storage independent power producer, raised $275m in Debt funding from Barclays, HSBC, ING Capital, Société Générale, and Sumitomo Mitsui Banking Corporation.

🔋 terralayr, a Zurich, Switzerland-based front-of-meter battery energy storage system developer, raised $72m in Project Finance Debt funding from Commerzbank and ABN AMRO.

🔋 AlphaHPA, a Gladstone, Australia-based ultra-high purity aluminium materials for battery manufacturing producer, raised $53m in Project Finance Equity funding from National Reconstruction Fund Corporation (NRFC).

⛏️ Lion Copper and Gold Corp, a Vancouver, Canada-based copper and gold mining project developer, raised $31m in Project Finance Equity funding from Nuton.

⚡ Econergy, a London, United Kingdom-based independent renewable power producer, raised $29m in Project Finance Debt funding from Santander.

🥛 Modern Milkman, a Manchester, United Kingdom-based return-and-reuse grocery delivery platform, raised $14m in Debt funding from Salica Investments.

🌱 SPIN360, a Milan, Italy-based sustainability strategy consultancy, was acquired by Bureau Veritas for an undisclosed amount.

🌡 KNOW-WILDFIRE, a Rockville, MD-based wildfire detection and protection systems provider, was acquired by N5 Sensors for an undisclosed amount.

⚡ AustroCel Hallein, a Hallein, Austria-based bio-based cellulose and specialty materials producer, was acquired by Oji Holdings for an undisclosed amount.

💰 Mubadala Capital, an Abu Dhabi, UAE-based alternative asset manager, closed $550m for its debut Co-Investment Fund from global institutional investors, focusing on private equity co-investments across North America and Europe.

💰 Obvious Ventures, a San Francisco, CA-based early-stage venture capital firm, closed $360m for Fund V from undisclosed investors, focusing on startups advancing planetary health, human health, and economic health.

This is a sample of deals available for Sightline clients. Can’t get enough deals?

The 800MW Vineyard Wind offshore wind farm in Rhode Island won a court case against the Trump administration to continue construction, after a stop-work order was issued in late December. The 62-turbine wind farm’s win in court keeps a nearly complete project moving forward and is the latest in several legal setbacks for the administration’s offshore wind pause.

In other wind news, 10 European countries, including the UK, France, and Germany, agreed to build an offshore wind power grid in the North Sea. It will develop 100GW of offshore wind power — enough for 143m homes — and link the turbines to multiple countries’ electricity infrastructure, as the continent moves to cut its reliance on Russian pipeline gas and US LNG.

In more Trump admin news, the DOE canceled a $1.8bn loan commitment meant to help Arizona Public Service, the state’s largest utility, build clean energy and transmission. It also quietly rewrote major DOE nuclear safety rules, cutting hundreds of pages of requirements on reactor safety, environmental protection, and accident oversight. Additionally, a federal court found that the DOT must release $5bn of public funding for EV charging infrastructure.

US grids largely survived last week’s heavy storms, with ERCOT’s diversified mix of new batteries and winterized plants withstanding the extremes. Meanwhile, during the storms, the Trump admin directed grid operators to use backup power from data centers’ on-site generators during Winter Storm Fern, potentially unlocking ~35GW of unused capacity. While this option wasn’t used, most data centers have never supplied power to the grid, and it could stress-test load flexibility.

In automaker news, Tesla announced it was scrapping production of its Model S and Model X, and reported its first-ever annual drop in revenue. Meanwhile, GM is pivoting away from fuel cells, ending its fuel-cell partnership with Honda, signaling a broader industry pullback from hydrogen vehicles (although Honda will continue independently).

China will invest RMB 4T ($560bn) in fixed-asset infrastructure during the 15th Five-Year Plan for 2026–2030, sharply increasing spending on the power grid. It’s up 40% from the 14th FYP, reflecting mounting pressure on transmission and distribution networks from its rapid buildout of wind, solar, and renewables. Now, grid expansion and flexibility, not generation capacity, are paramount for China’s energy strategy.

Dr. Copper surged to an all-time high, with March futures climbing over 8% to about $6.45 a pound, marking a rare sixth straight monthly gain. Rising electricity demand and geopolitical risks are tightening supply, highlighting copper’s central role in the energy transition even as prices continue to rise.

New oil lawsuit in Michigan - but not about emissions, about affordability and antitrust.

NextEra’s new mantra: more megawatts, more nuclear.

Germany’s second thoughts suggest nuclear is back on the table

From Japan to Sichuan, a high-profile panda commute.

Kyle Chan’s op-ed on China reversing global tech flows.

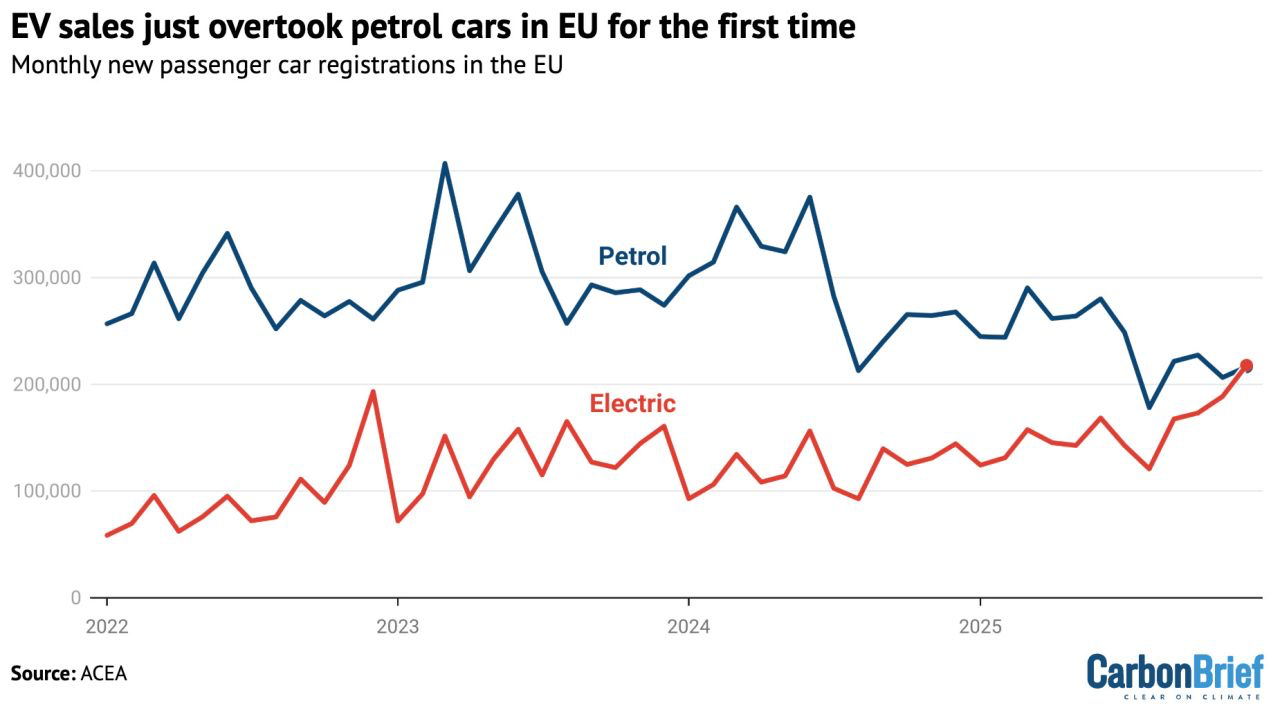

A clean snapshot showing the rise of clean cars.

The US leaves the Paris agreement, global ambition stays true.

Tiny robots are diving deep to measure the ocean’s hidden climate power.

Getting wild: One man’s journey to rewild the Arctic.

📅 H1 2025 LDES Leaderboards: Join Sightline Climate for a rundown of who's leading in LDES, the numbers behind the rankings, and how things could change in the next few months. Featuring insights from Energy Dome.

📅 DTech: Sightline co-founder and CPO Mark Taylor is heading to San Diego on February 2-5 to explore resiliency, reliability, sustainability, or grid modernization. Get in touch if you’ll be there as well.

📅 Climate Tech Outlook, What Scales in 2026: Join Carbon Equity’s webinar on February 10th to learn from an expert panel about the latest updates and expert insights on what's next for climate tech investors in 2026. The Panel will explore where demand is clearest, where policy and industrial tailwinds matter most, and which segments are positioned to scale.

📩 Feel free to send us deals, announcements, or anything else at [email protected]. Have a great week ahead!

A tale of two public debuts

US courts roll back Trump-era actions on offshore wind and DOE grant cancellations

We asked, you answered, and experts weighed in on 2026