🌎 Inside Cloverleaf Infrastructure’s power play #206

Our Q&A with Brian Janous on AI, data center demand, and the need for speed

Global CH4 reduction takes shape as new funds flood into climate; plus we’re hiring!

Happy Monday! Much ado this week around global methane reduction commitments - which are a big deal because methane is 84x more potent than CO2 and contributes to ~25% of global warming.

Our heads are on a swivel with COP, coincidently coinciding with a marked uptick in capital commitments to climate in the form of larger fundings, e.g. Sam Altman’s personal $375m commitment into Helion Energy, Bezos’ earth fund seeding $500m into Ikea and Rockefeller foundations as well as 6 (!) new fund announcements this week from the likes of Shell, Blackrock and World Fund’s $404m debut fund.

In the news, Biden’s spending bill including much of last week’s $555b climate funding passes Congress ushering in new wave of expected EV and infrastructural investments.

We also breakdown the highlights of COP specific actions, namely coal and oil & gas reductions, steel tariffs and $130T (!!) in capital commitments from 150 banks to transitioning the economy to climate.

What a week!

We’re looking for a paid, part time operator to join Climate Tech VC! As the market picks up pace, we’re bringing a teammate onboard who will work closely with us to level up the CTVC platform. A good fit will be technically inclined, financially curious, and obsessed with unf*cking our planet.

You’ll get front row exposure to leading founders and investors, meaningful impact influencing the narrative of climate tech, and the best launchpad for “breaking into” climate and venture. You’re epically curious and a little spicy, while being reliable and prolific. Must love emojis 🙃

If this sounds like it’s got your name written all over it, tell us more through this AirTable form. Recommendations? Email us folks that we need to meet.

November has been the month of major methane action. On Nov. 2nd, the EPA announced new proposed rules to cut methane pollution from the oil and gas industry. That same day, 100 countries representing 70% of the global economy launched the Global Methane Pledge, committing to cut methane emissions by 30% from 2020 levels by 2030. CH4 also remains a critical component of the Build Back Better Act, which includes a methane fee levied against oil and gas companies that exceed industry methane intensity thresholds.

EPA methane rules – strengthen methane pollution standards in the oil and gas industry, crucially extending mitigation and monitoring requirements to existing wells

Rules would require well sites with >3 tons CH4/ yr to routinely monitor methane leaks

Global Methane Pledge – mobilizes both developed and developing countries to slash methane emissions by 30% by the end of the decade

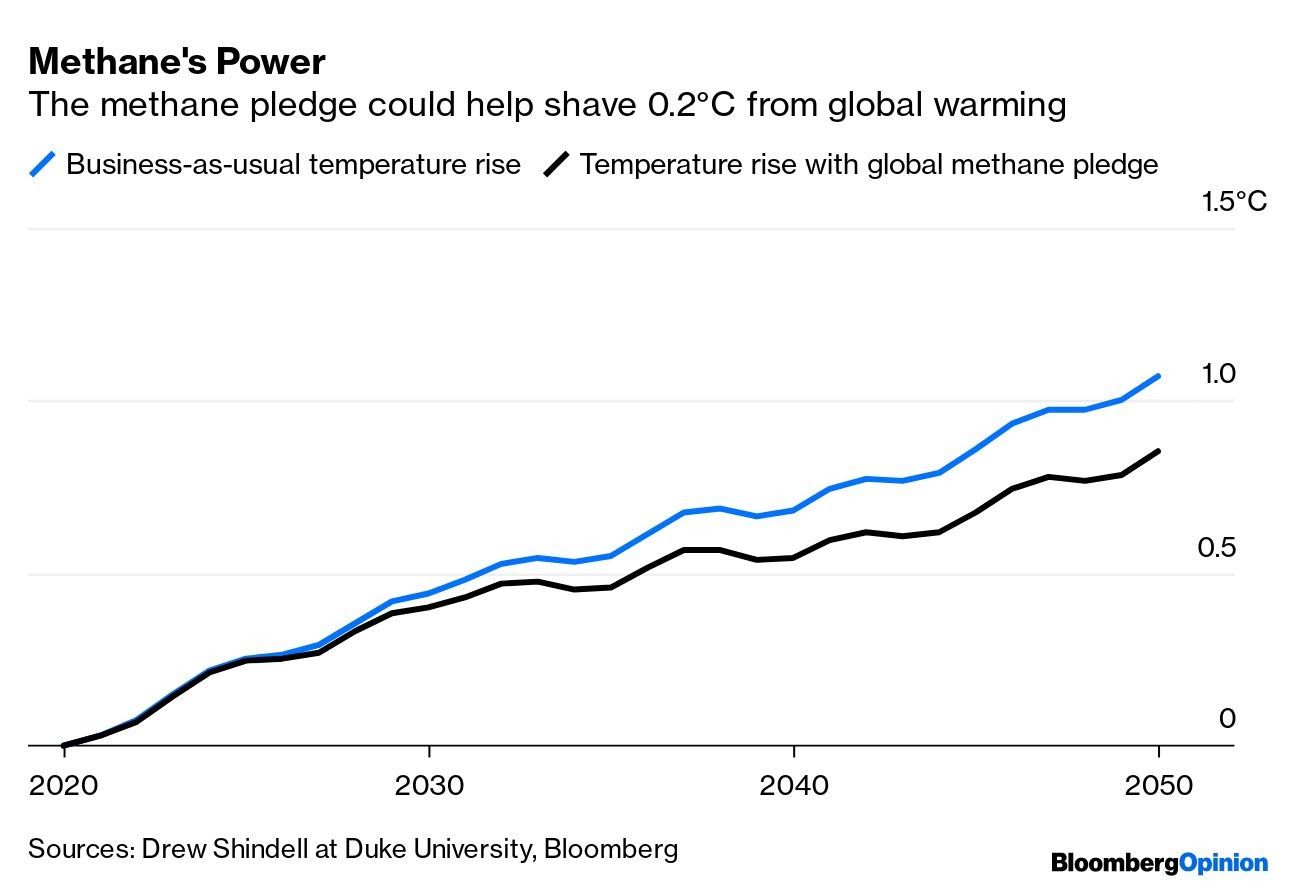

If executed, the pledge could reduce warming by at least 0.2°C by 2050

Methane fee – holds oil and gas companies accountable for exceeding industry methane intensity thresholds

Fee would cost noncompliant companies $900/ CH4 ton beginning in 2023, with penalties increasing to $1500/ CH4 ton for 2025 and beyond

Why methane matters

Known for decades as “the other greenhouse gas,” methane’s finally in the spotlight. Methane is 84x more potent than CO2 in the first two decades after its release, accounting for >25% of current warming. Researchers estimate that robust, expedient methane mitigation in the O&G and agriculture sectors could slow rates of warming by 30%.

Significant methane mitigation technology is already available. The oil and gas industry could cut methane emissions by roughly 75% using existing technology. 2/3rds of this reduction could come at no net cost.

But the oil and gas industry is only part of the problem. Livestock production accounts for ~40% of methane emissions in the US, while landfills account for ~20%. New policies and technologies are also needed to address these sources of methane. Additionally, enhanced methane detection tools can help companies across sectors monitor methane more accurately and continuously.

EPA rules and climate tech

What does existing methane monitoring look like? Currently, much of the oil and gas industry relies on “emissions factors” to calculate methane emissions. Rarely do companies measure methane emissions directly from wells. Studies from the Environmental Defense Fund have shown that traditional methane reporting using emissions factors underestimates methane emissions by 60%.

What do the new EPA rules entail? The EPA plans to mandate “a comprehensive monitoring program to require companies to find and fix leaks.” These rules will compel companies to embrace direct methane measurement. Under the new regulation, roughly 300,000 well sites would adopt routine monitoring.

What does this mean for climate tech? The EPA’s focus on enhanced methane detection presents a major opportunity for startups providing high-quality, continuous methane monitoring. Project Canary, for example, offers solar-powered devices installed near well sites, capable of detecting 99% of onshore upstream leaks within 12 meters. As the EPA pushes companies to improve the frequency and accuracy of methane tracking, demand for technologies like Project Canary’s is likely to grow.

Other methane innovators: MethaneSat, Bluefield, GHGSat, Andium (See more innovators in Bloomberg Green)

Reducing methane emissions from the oil and gas sector is among the fastest, most cost-effective strategies to combat climate change. With tailwinds from the EPA, Global Methane Pledge, and Build Back Better Act, there's a lot of room for new innovators to come in to help mop up our methane emissions mess.

Special thanks to Gabe Malek for monitoring methane action!

⚡ Helion Energy, an Everett, WA-based startup focused on commercial fusion, raised $2.2b in Series E funding from Mithril Capital, Capricorn Investment Group, Sam Altman ($375m personally!), and Dustin Moskovitz.

⚡ Sunfire, a Germany-based industrial electrolyzer producer, raised $125m in Series D funding from Lightrock, Planet First Partners, Carbon Direct Capital Management, HydrogenOne Capital, and others.

⚡ Infinium, a Sacramento, CA-based electrofuels producer, raised $69m in funding from Amazon’s Climate Pledge Fund, NextEra Energy Resources, AP Ventures, 8090 Partners, Mitsubishi Heavy Industries, and Pavilion Capital.

🌱 Future Farm, a Brazil-based alternative protein producer, raised $58m in Series C funding from BTG, XP, Rage Capital, Monashees, Go4It Capital, Turim MFO, and Enfini Ventures.

🌊 Sofar Ocean Technologies, a San Francisco, CA-based startup focused on ocean data collection, raised $39m in a Series B funding from Union Square Ventures and the Foundry Group.

💨 Loam Bio, an Australia-based carbon removal startup, raised $30m in Series A from Time Ventures, Main Sequence, Horizons Ventures, CEFC, Acre Venture Partners, Grok Ventures, Lowercarbon Capital, and Thistledown Capital.

🥛 TurtleTree, a Singapore-based biotech startup using cell-based technology in milk production, raised $30m in Series A funding from VERSO Capital.

⚡ REsurety, a Boston, MA-based energy analytics company, raised $16m in Series B funding from Launch Capital, Clean Energy Ventures, and Hannon Armstrong.

🌱 Evrnu, a Seattle, WA-based sustainable textiles startup, raised $15m in Series B funding from FullCycle Climate Partners, Hansae, Bestseller, and PDS Venture.

⚡ Yotta Energy, an Austin, TX-based energy storage startup, raised $13m in Series A funding from WIND Ventures, Doral Energy-Tech Ventures, Riverstone Ventures, EDP Ventures, and SWAN Impact Network.

💨 Daphne Technology, a Switzerland-based developer of a sustainable, technically advanced and cost efficient air emissions control system, raised $11m in funding from Shell Ventures, Trafigura, AET, and Saudi Aramco Energy Ventures.

💨 Plan A, a Germany-based carbon accounting and ESG management platform, raised $10m in Series A funding from HV Capital and Keen Venture Partners.

🔋 Eco Stor, a Norway-based repurposing EV batteries to give them a ‘second life,’ raised $8.5m in Series A funding from Agder Energi Ventures, Klaveness Marine Holdings, and individual investors.

☀️ Quativa, a Los Angeles, CA-based residential solar sales platform and marketplace, raised $7m in Series A funding from Blueprint Equity.

🚗 Opibus, a Kenya-based startup converting diesel and gasoline vehicles into electric ones, raised $5m in Seed funding from At One Ventures, Factor[e] Ventures, and Ambo Ventures.

🍎 Neutral Foods, a Portland, OR-based, carbon neutral food startup, raised $4m in funding from Breakthrough Energy Ventures and Mark Cuban Companies.

🌱 Osmoses, a Cambridge, MA-based maker of membrane technology for gas separations, raised $3m in pre-Seed funding from The Engine, Fine Structure Ventures, FMR LLC, Orbia Ventures, Little Green Bamboo, and angel investors.

👷 Greenwork, a San Francisco, CA-based startup placing workers in energy jobs, raised $2.4m in funding from Climate Capital, Defy Partners, Global Founders Capital, GV, Kleiner Perkins Scout Fund, Tango.vc, UpHonest Capital, Wing Venture Capital, Y Combinator, and a number of angel investors.

💧 Waterplan, a Wilmington, DE-based startup offering a climate water resilience platform for for companies, raised $2.6m in Seed funding from Giant Ventures and individual investors.

🌱 Sway, a Berkeley, CA-based maker of seaweed-based packaging, raised $2.5m in funding from Valor Siren Ventures, Conservation International Ventures, Alante Capital, and BAM Ventures.

Shell announced the creation of a $1.4b sustainable energy fund.

Blackrock launched a $673m fund focused on supporting climate infrastructure in emerging markets.

VC firm World Fund raised $404m for its debut fund dedicated to decarbonization.

Firstime announced the launch of its $100m climate tech fund.

Fifty Years raised $90m for its Fund III focused on investments including deep tech.

ReGen Ventures announced the first close of its climate fund at $50m - read our feature with the team!

Generac is acquiring Toronto-based smart thermostat startup Ecobee for up to $770m.

Xpansiv announced the acquisition of SRECTrade, a leading aggregator of solar Renewable Energy Certificates (RECs).

US climate-policy wonks can finally stop biting their nails (for now) as Biden’s infrastructure bill finally passed through US Congress last Friday—unlocking $550b devoted to infrastructure investments around the country. Other than paying for roads, railways, and repairs, the bill allocates $300b to grid upgrades, EVs and charging infrastructure, climate resilience, and environmental remediation.

It’s been a doozy keeping up with COP26 news. Here are a few highlights:

🌱 More than 100 world leaders pledge to end deforestation by 2030, covering 85% of the world’s forests. Notably, Brazil signed on to protect the Amazon Rainforest, but Indonesia refused to protect their vast palm tree groves, calling the pledge “unfair”.

💨 Leaders also committed to curb methane emissions by 30% by 2030, spurring low-hanging fruit solutions that could reduce warming by 0.5°C with existing technology.

🐼 US and China have been trading politic jabs at each other over messaging climate targets—US scolding China for the state’s deafening silence, China scoffing at Congress’ inability to agree on climate policy. Also this link.

🌱 With India joining the net-zero club, 8 of the 10 largest emitters have now adopted some version of a net-zero target, leaving only Iran and Mexico without one. Global net-zero pledges now cover 88% of emissions.

🦒 In a crucial test case of richer nations supporting developing countries, an alliance of EU countries and the US agreed to spend $8.5b to decarbonize South Africa’s electric system and reduce their reliance on coal.

👷 Speaking of coal, will the world finally phase out coal investments? This group of 40 countries say they’ll halt investments in new coal plants… In 20 years.

🛢️ In oil and gas, 25 countries agreed to stop investments in 2022, but only limiting the voluntary pledge to public funding, not limiting private investments.

👷 In addition to lifting steel tariffs, the EU and the US immediately announced a carbon-based sectoral arrangement for trading steel. The two will negotiate the arrangement over the next 2 years and focus on how they would track emissions and trade lower carbon steel (like this one from SSAB).

🏦 A group of 450 banks led by the former head of Bank of England, Mark Carney, committed $130T of private capital to transitioning the economy.

Jeff Bezos’s Earth Fund sends $500m in seed capital into IKEA and Rockefeller’s $10b foundations to ignite renewable energy investments for poorer countries. In addition to Bezos’ donations to the joint foundation, multinational banks and development agencies poured more than $8b to support investments in developing countries.

Global carbon emissions in 2021 are on course to rebound to near pre-pandemic levels following an unprecedented drop in 2020, according to the Global Carbon Project, an international research consortium.

But! Based on data from the Global Carbon Project, global CO2 emissions have been flat rather than increasing for a decade, the difference coming from major reassessment of land-use emissions. Yet, IPCC says differently. Even if emissions are flat, global warming still increases.

The DOE launched the Carbon Negative Shot, the first federal government effort on carbon dioxide removal, 3rd target within the DOE Earthshot initiative. This energy earthshot aims to fund projects to achieve durable & scalable CDR, across the full suite of approaches, for a cost of $100/net tCO2e.

Shayle is back from the Interchange to gab climate action with Canary Media’s new podcast Catalyst!

Cheat sheet! Energy professor extraordinaire Jesse Jenkins breaks down the need to know facts from each climate bill in this Google Sheet.

Tracking November’s climate trackers:

Carbon180’s carbon removal policy tracker: find, sort, and digest the latest on CDR legislation, whether it’s R&D, tax incentives, environmental justice.

NYT’s country charts: follow the 10 biggest polluting countries as they miss their (several) emissions targets.

Sierra Club’s Build Back Better Tracker: dig into this spreadsheet on BBB climate funding commitments.

IEA’s Sustainable Recovery Tracker: In 2020, the IEA and IMF estimated that $1T every year until 2023, we might be on track for Paris-compliance. Find out just how off track we are.

Climate Voice’s GoTimeForClimate Corporate Rhetoric Tracker: Find out which influential companies are obstructing Build Back Better and which ones are leading it (spoiler: none are).

Inspired? Make your own with the Financial Times!

Property, my property. The Hamptons are spending $1M this year to cart new sand onto their eroding beaches.

SPAN launches a partnership with Sunrun and a new EV charger.

Toyota launches its 280-mile range EV to drop in mid-2022. The best part? The solar roof.

Fortune’s Impact 20 list includes climate tech startups like Apeel, Northvolt, Redwood Materials, and Pachama.

Gates… Fink… Bezos... Everyone hop aboard the climate train! Now Microsoft President Brad Smith waxes poetic on climate: “the race to build climate tech is similar in scale to putting a man on the moon.”

Ithaca votes to commit to 100% building electrification, with the help of BlocPower.

Rolls Royce flew a Boeing 747 on 100% Sustainable Aviation Fuels – reducing the carbon emissions of the flight by 80%.

ProPublica released a detailed interactive map showing cancer-causing industrial air pollution in the US.

Rich Americans are carbon filthy.

🗓️ Cleantech x Japan 2021: For climate tech startups looking to expand into the Japanese market, join on Nov 10th for a virtual networking event with the largest Japanese energy organizations.

🗓️ Schneider Electric’s North American Innovation Summit: Join on Nov 10th for a discussion between the leadership of Schneider Electric, Hewlett-Packard, Corporate Knights, and more about home and supply chain electrification.

Chief of Staff @Climate Tech VC!

Chief of Staff @Noon Energy

Business Development Fellow @Noon Energy

Account Director @Antenna Group

Product Marketing Lead @Myst AI

Energy Markets Associate @CleanCapital

Customer Success Manager @ClimateView

Fellowship Associate @Climatebase

Content Production Intern @Therma

Senior Process Engineer @CarbonBuilt

Founding Software Engineer @Bluebird Climate

Lead Mechanical Engineer @Yard Stick PBC

Feel free to 📩 send us new ideas, recent fundings, events & opportunities, or general curiosities. Have a great week ahead!

Our Q&A with Brian Janous on AI, data center demand, and the need for speed

England's new election ushers in a new test of clean energy and climate tech

H1'24 funding totaled $11.3 billion, down 20% from H1 2023.