🌎 Lithium-ion is the benchmark in new LDES leaderboards #281

With long duration energy procurement surging, new rankings reveal who's pulling ahead

Elemental's D-SAFE and Chestnut Carbon's credit facility give roadmap for bankability

Happy Monday!

From milestone-tied notes to asset-backed nature deals, recent deals show climate finance is getting creative.

In deals, $804m for battery storage, $705m for sustainable data center services, and $400m for green hydrogen electrolyzers.

In other news, OpenAI’s massive new contract and need for power, China’s new emissions plans, and India’s new coal + carbon capture initiative.

Thanks for reading!

Not a subscriber yet?

📩 Submit deals and announcements for the newsletter at [email protected].

💼 Find or share roles on our job board here.

What do a milestone-based development note and a $210m credit facility for nature-based carbon have in common? They’re both signals that the capital stack is getting more creative — and more pragmatic — to get deals to bankability.

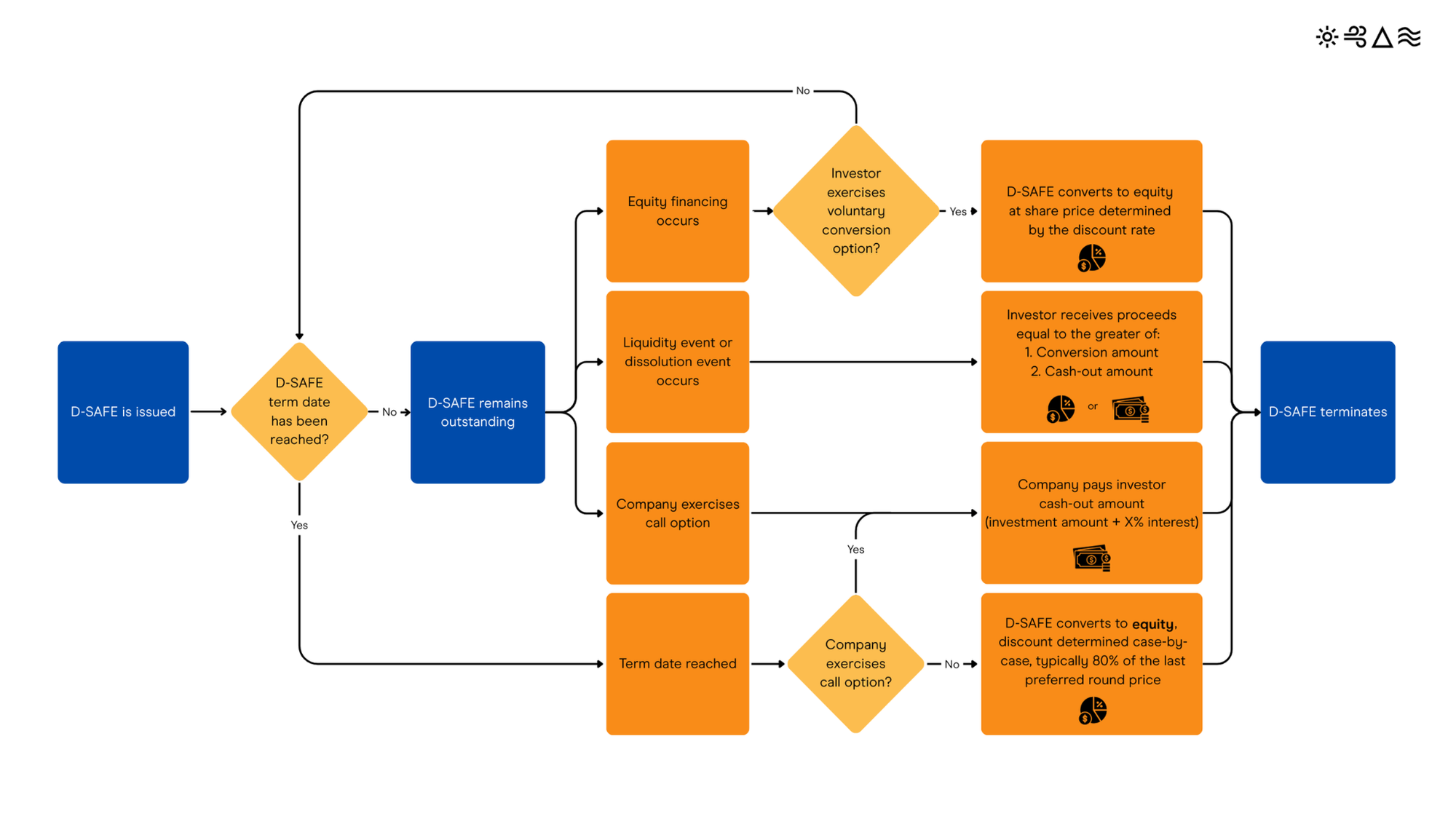

This week, we’re spotlighting two recent financing structures helping projects cross their respective valleys. First, Elemental Impact’s D-SAFE: a flexible, milestone-tied instrument that’s already catalyzed an estimated over $70m in follow-on capital and helped unlock a $50m Series B for organic fertilizer startup Nitricity last week. Second, Chestnut Carbon’s landmark credit facility: a first-of-its-kind $210m deal led by J.P. Morgan and others, structured like traditional project finance, but for a nature-based carbon project. Different ends of the stack, same goal: making novel projects underwritable.

Elemental has been iterating on the D-SAFE — a “Development-SAFE,” modeled after Y Combinator’s original instrument — since launching it a year ago. Paired with a Development Support Agreement (DSA), the structure offers flexible, milestone-based pre-construction capital for FOAK and early commercial projects. So far, Elemental says it has deployed $7m across nine companies, helping unlock more than $70m in follow-on funding.

For Nitricity, a $2m D-SAFE was tied to concrete milestones like site acquisition, engineering design, and permitting for its first commercial facility, a plant that will turn almond shells and renewable power into low-carbon, OMRI-approved nitrogen fertilizer. The project represents a 100x scale-up from Nitricity’s pilot and is already sold out through 2028 under binding offtakes with local organic growers. That early capital helped de-risk the build, fill “last-in” gaps in a $10m stack, and signal institutional readiness — paving the way for a $50m Series B announced last week.

“We know from our climate investing work that there's this well-known void of development capital,” Avra Van der Zee, COO of Elemental, told us. “Yet it's exactly this strong development work that we see leading to successful project outcomes.”

Rather than convert the D-SAFE to equity, Nitricity and Elemental opted for repayment, allowing Elemental to recycle capital into new deals. Nitricity, in turn, redirected the foregone equity into its employee stock option pool to retain key talent.

Chestnut Carbon, meanwhile, closed a $210m non-recourse credit facility backed by J.P. Morgan, Bank of America, BMO, CoBank, and EastWest Bank last month — marking one of the first applications of traditional project finance to a voluntary carbon project in the US. The deal is underpinned by a 25-year, 7m-ton carbon removal offtake with Microsoft and covers a 60,000-acre afforestation portfolio across nine Southeastern states. To get lenders comfortable with the asset class, Chestnut layered in key de-risking elements: land ownership for 100-year permanence, a diversified and biodiverse planting strategy, and independent technical and insurance advisors (ERM, Marsh, CFC) to validate the project.

“When we built the offtake with Microsoft, we weren’t just chasing a contract, we were designing it to be bankable,” Greg Adams, CFO of Chestnut Carbon, told us. “We had project finance in mind from the start … Trees have been around for 350 million years, and yet this is still considered a nascent asset class. We wanted to prove that carbon removal can be treated like infrastructure."

We’ve said it before and we’ll say it again: Climate tech can’t scale without a capital stack that matches its complexity. These two structures — one for early-stage projects, the other a traditional facility applied in a new sector — are proof points for new financial models unlocking real deployment. The D-SAFE shows that milestone-based, founder-aligned capital can help companies graduate from idea to infrastructure. Chestnut’s facility shows that even emerging asset classes like nature-based carbon can meet the underwriting bar, if structured right.

For Elemental, the D-SAFE is a response to the persistent "scale gap" — where early-stage companies need capital to develop projects, but can’t yet access infrastructure-scale funding. Traditional VCs don’t want to fund permitting and engineering work; banks won’t underwrite it. The D-SAFE helps fill that gap with fast, flexible, milestone-tied capital, and the accompanying Development Support Agreement (DSA) gives founders not just money, but a roadmap and support network. Elemental released practitioner notes as well to encourage wider use across the climate ecosystem, which show how the mechanism can be customized to match specific project needs and risk profiles.

Chestnut Carbon’s $210m deal is also a signal that carbon removal can be underwritten as infrastructure, even amid turbulence in the voluntary carbon market. While headlines over the past year have focused on market credibility, price volatility, and stalled corporate demand, this deal shows that high-integrity, nature-based projects can still quietly attract capital. And the cost of capital matters – commercial project finance is significantly cheaper than equity or grant capital. Chestnut’s land ownership is protected by property rights, a (bio)diversified parcel design to reduce natural disaster risk, and a 25-year offtake with Microsoft, which helped give banks what they needed to get to ‘yes.’ But it also took significant effort to translate a new asset class into bank-speak, including bringing in established players like ERM as an independent technical advisor and Marsh/CFC to establish a credible insurance framework.

Special thanks to Elemental Impact’s Avra Van der Zee and Chestnut Carbon’s Greg Adams for their time and insights for this piece.

🧪 Nitricity, a Fremont, CA-based electrified climate-smart fertilizer producer, raised $50m in Series B funding from World Fund, Change Forces Capital, Cultivate Next, Energy Infrastructure Partners (EIP), Fine Structure Ventures, and other investors.

👕 AMSilk, a Neuried, Germany-based bio-based silk maker, raised $35m in Growth funding from Athos Group, MIG Capital, and Novo Holdings.

🌾 NeoFarm, a Saint-Nom-la-Bretêche, France-based automated vegetable farming solutions developer, raised $35m in Series B funding from ADEME Investissement, Eurazeo, Bpifrance, Cléry, and Karl Leitzgen family office.

🏭 Sapphire Technologies, a Cerritos, CA-based natural gas and hydrogen turboexpanders company, raised $18m in Series C funding from Cooper and Company, Energy Capital Ventures, Equinor Ventures, and Mitsubishi Heavy Industries.

⚡ Kyoto Fusioneering, a Tokyo, Japan-based nuclear fusion equipment manufacturer, raised $10m in Series C funding from JERA, Kyocera, and Sumitomo Mitsui Trust Bank.

⚡ XENDEE, a San Diego, CA-based microgrid decision support system, raised an undisclosed amount in Series B funding from Eaton Corporation.

💨 CuspAI, a Cambridge, England-based GenAI-driven search platform for new materials systems, raised $99m in Series A funding from New Enterprise Associates, Temasek Holdings, Basis Set Ventures, FJ Labs, Giant Ventures, and other investors.

🏠 DataCrunch, a Helsinki, Finland-based cloud service infrastructure developer, raised $65m in Series A funding from Skaala, Tesi, Varma, byFounders, and J12 Ventures.

⚡ Proxima Fusion, a Munich, Germany-based stellarator-based fusion energy developer, raised $18m in Series A funding from Brevan Howard, CDP Venture Capital, and European Innovation Council.

🚗 Maeving, a Coventry, England-based electric motorcycle manufacturer, raised $11m in Series A funding from Elbow Beach Capital, Future Planet Capital, and Venrex.

⚡ Nuclearn, a Phoenix, AZ-based automation for nuclear energy platform, raised $10m in Series A funding from Blue Bear Capital, AZ-VC, Nucleation Capital, and SJF Ventures.

🔋 LeydenJar, a Leiden, Netherlands-based silicon anode producer, raised $15.2m in Series B funding from Extantia and Invest-NL.

🔋 Fidra Energy, an Edinburgh, Scotland-based battery storage developer and operator, raised $804m in PF Debt funding.

🏠 EcoDataCenter, a Falun, Sweden-based sustainable data center service developer, raised $705m in Debt funding from Deutsche Bank.

⚡ Electric Hydrogen, a Natick, MA-based green hydrogen electrolyzer developer, raised $400m in PF Equity funding from Generate Capital.

⚡ Grenergy, a Madrid, Spain-based renewable energy producer, raised $270m in PF Debt funding from Sumitomo Mitsui Banking Corporation, BBVA, BNP Paribas, and KfW.

🧪 CleanCore Solutions, an Omaha, NE-based aqueous ozone cleaning system developer, raised $175m in Post-IPO Equity funding from FalconX, GSR Ventures, MOZAYYX, and Pantera Capital.

⚡ Kyoto Fusioneering, a Tokyo, Japan-based nuclear fusion equipment maker, raised $36m in Debt funding from Bank of Kyoto, Japan Bank for International Cooperation (JBIC), Japan Finance Corporation, MUFG Bank, and Sumitomo Mitsui Banking Corporation.

👕 AMSilk, a Neuried, Germany-based bio-based silk developer, raised $26m in Convertible Note funding.

🏠 DataCrunch, a Helsinki, Finland-based cloud service infrastructure developer, raised an undisclosed amount in Debt funding from Armada, Nordea Bank, Danske Bank, Local Tapiola, and Norion Bank.

🧱 CarbonBuilt, a Los Angeles, CA-based low-carbon concrete producer, raised an undisclosed amount in PE Expansion funding from Connecticut Innovations.

☀️ Origami Solar, a Bend, OR-based steel solar frame developer, was acquired by Nextracker for $53m.

⚡ Deep Fission, a Berkeley, CA-based modular nuclear microreactor manufacturer, announced a SPAC merger.

📦 Bo (Bopaq), a Montréal, Canada-based reusable packaging maker, was acquired by Tricentris for an undisclosed amount.

⚡ Ambient Fuels, a New York City, NY-based green hydrogen project developer, was acquired by Electric Hydrogen for an undisclosed amount.

Vireo Ventures, a Berlin, Germany‑based early‑stage venture capital firm, raised $59m for Electrification Fund I, which will focus on investments in European early‑stage companies accelerating electrification across grids, storage, mobility, industry, and real estate.

This is a sample of deals available for Sightline clients. Can’t get enough deals?

OpenAI has signed a record-breaking $300bn cloud contract with Oracle, needing 4.5GW of power capacity for AI data centers over the next five years, equivalent to about four nuclear reactors. This unprecedented scale shows the growing AI infrastructure demands on generation and the grid, but also the potential for investment in next-gen power sources.

China will introduce absolute carbon emissions caps in select industries starting in 2027, transitioning its national ETS from intensity-based benchmarks to hard limits. This marks a critical evolution from its pilot markets and signals a tightening policy stance ahead of the planned full rollout by 2030. While carbon prices remain low, the move sets the stage for future price signals that could meaningfully shift industrial decarbonization and energy transition planning in the world's top emitter.

India will launch a national carbon capture initiative offering up to 100% funding for select projects, as it seeks to decarbonize while expanding coal power through 2035. The government is betting on CCUS to reconcile rising energy demand with climate targets, despite questions over the effectiveness of coal + CCUS strategies. This move treats geological storage as a strategic asset — similar to the EU’s approach for energy security.

A new Nature paper finds that Earth’s safe geological carbon storage capacity is about 1,460 GtCO2, ten times less than previous estimates, limiting the long-term potential of CCS. The study’s risk-based assessment reframes CCS as a finite, intergenerational resource that could be exhausted by 2200 if current climate scenarios play out. This makes early-mover advantage critical and could spark competition over storage sites.

The EU’s top court upheld the inclusion of nuclear and gas in its green taxonomy, rejecting Austria’s challenge and preserving access to green finance, despite environmental concerns. The ruling reinforces nuclear’s role in low-carbon baseload power and grants gas a transitional status under strict limits, possibly a boost for CCS. Both now stand to attract greater investment in Europe’s evolving energy mix.

In nuclear news, the European Commission committed $11.5bn to fission and fusion R&D, joining the US DOE in a public funding push, while Morgan Stanley revised its 2050 global nuclear capacity forecast up 53% to 586 GW. The launch of the Industrial Advanced Nuclear Consortium, backed by Exxon and Rio Tinto, and Kazatomprom’s plan to triple uranium exploration, including overseas, signal strong public and private sector momentum.

Google gets charged up on LDES, helping SRP store sun for the night shift.

Plans to dim the sun in Antarctica get left out in the cold by UK ministers.

DOE pulls the plug on contrarian climate crew after report sparks scientific storm.

A new power play to keep Tennessee’s grid cool with liquid nitrogen heat.

Generate’s overview of August: EV sales surge, PPA prices bump, solar investment holds the line, and Fed rates.

Mast digs deep in Montana — burying wildfire waste underground.

Heatmap asks: Chris Wright or Chris Wrong?

💡 SET Award 2026: Apply by October 31st to join the 10th anniversary edition of this global climate-tech competition. Winners receive €10,000 prize money, a free trip to Berlin to pitch at the SET Tech Festival.

📅 VERGE 2025: Join us on October 28–30 in San Jose, CA (map link), for the premier event for professionals decarbonizing their organizations and supply chains. As part of Trellis Impact 25, attendees will also gain access to GreenFin and Bloom. Register by June 13 to save $500 and use partner code TI25SL for 10% off.

💡 Exelon’s 2026 Climate Change Investment Initiative (2c2i): Apply by September 29 for funding to support projects advancing environmental justice, climate resilience, and clean energy innovation in underserved communities.

💡 2025 Buildings Tech Lab: Apply by October 24, 2025 to join this public-private initiative by the NYC Department of Buildings and Partnership Fund for New York City. The program seeks early- and growth-stage tech companies with solutions for workforce optimization and workflow modernization in construction and development regulation.

Growth Marketer @WorkHero

Founding Software Engineer @Barnwell Bio

Business Development Lead @Barnwell Bio

Head of Distribution @Floodbase

GTM Strategy Director @Floodbase

Head of Operations @Tokamak Energy

Enterprise Account Executive @Supercritical

Policy Manager @Carbon Business Council

📩 Feel free to send us deals, announcements, or anything else at [email protected]. Have a great week ahead!

With long duration energy procurement surging, new rankings reveal who's pulling ahead

A tale of two public debuts

US courts roll back Trump-era actions on offshore wind and DOE grant cancellations