🌎 Taxing times for CCUS #254

OBBB blows tailwinds through CCUS, but takeoff stalls

After decades without much movement, SMRs could bring new nuclear capacity online in North America and Europe by 2030

Happy Monday! And happy Succession season premiere to all who celebrate.

Advanced nuclear headlines piled up this week, from partnerships and PPAs for small modular reactor tech to the DOE's report on commercialization. After decades without much movement, SMRs could bring new nuclear capacity online in North America and Europe by 2030.

Elsewhere in the news, the IPCC published its final word on the last five years of climate research, and that word was "dire." President Biden laid out the US climate plan for oceans and NYC lawmakers addressed lithium-ion battery fires.

In deals this week, electric scooters and EV charging in India attract ~$350M. Zero-emissions cargo ships land $139M. A German ESG software provider raises $109M and a French solar power producer raises $103M.

ICYMI, we're hiring! Like data? We want your number. CTVC is looking for a London-based data engineer to help us level up our data operation. If you’re passionate about decarbonization and database design, drop us a line.

Thanks for reading!

Not a subscriber yet?

📩 Submit deals, announcements, events & opportunities, or general curiosities for the newsletter here.

💼 Find or share roles on our job board here.

A cadre of Canadian, Polish, and US companies are committing $400M to advance nuclear small modular reactors (SMRs). Ontario Power Generation, Synthose Green Energy, GE Hitachi, and Tennessee Valley Authority are teaming up to shape the base design of GE Hitachi’s small modular reactor BWRX-300.

☢️ What are SMRs? SMRs are a category of advanced nuclear fission reactors that have a power generation capacity between 50 MW and 500 MW per unit, meaning even the largest SMR is about half the size of existing reactors. The idea is that at a smaller scale SMRs can create financing, siting, manufacturing, and safety benefits compared to traditional reactors.

The details: Ontario Power Generation, Synthose Green Energy, GE Hitachi, and Tennessee Valley Authority announced a partnership to shape the base design of GE Hitachi’s BWRX-300, which received initial approvals from Canada’s nuclear regulators earlier this month to construct North America’s first grid-scale SMR—expected to be completed by the end of 2028.

Meanwhile, Tennessee and Poland are hot on Canada’s heels, with TVA and Synthose Green Energy both taking steps to move GE Hitachi’s SMR through the regulatory hoops.

While SMRs’ nuclear superpower is standardization, they still need some individual site customization. Working together to get the base design nailed down and approved by regulators will set up GEH’s SMR for the tailoring required for these different deployments.

Countries in Asia and the Middle East have been building new nuclear projects. It’s the US and Western Europe that are behind—and hoping SMRs will help them add the nuclear power generation needed to meet net zero goals in the coming decades.

Canada has been forward-thinking about nuclear energy, creating a multi-phase plan that includes both refurbishing existing reactors and investing in SMRs. Ontario alone expects to need an additional 46GW of power to meet electricity demand by 2050 and plans on nuclear power providing ~40% of that new capacity.

Energy security concerns, exacerbated by Russia’s war on Ukraine, have increased the urgency of deploying new nuclear power in Poland and factor into US nuclear strategy as well.

The outlook for bringing SMRs down the cost curve depends on the type of fuel and cooling tech, but when it comes to getting to Nth-of-a-kind projects, “N isn’t very big,” Rachel Slaybaugh, nuclear expert and partner at DCVC, told us. The initial challenge for advanced nuclear companies is to secure enough contracts to finance construction of manufacturing facilities.

Regardless of size, nuclear reactors are capital- and time-intensive, especially compared to renewables and storage opportunities. While large reactors around the world have safely produced clean electricity for more than 60 years, incidents at Three Mile Island (1979), Chernobyl (1986), and Fukushima (2011) have permanently tarnished nuclear’s reputation.

The last two years have brought a “sea change” for nuclear’s role in reaching net zero goals, Slaybaugh said. “The climate community is finally realizing that nuclear is a pretty big tool in the toolbox.”

Shifting public sentiment is tougher. Some people just don’t like the idea of nuclear power and statistics don’t make much of a difference. “But you know what we like less? Climate change. So it is preferable over building new coal power plants,” she said. Younger generations do seem more open to nuclear and polls show that public support is growing in many countries.

🛵 Ola Electric, a Bengaluru, India-based electric scooter company, raised $300M in Series C funding.

⚡Amogy, a Brooklyn, NY-based provider of ammonia-based fuel, raised $139M in Series B funding from Temasek Holdings, DCVC, AP Ventures, SK Innovation, Saudi Aramco Energy Ventures, Zeon Ventures, and MOL PLUS.

🌱 IntegrityNext, a Munich, Germany-based supply chain sustainability and ESG platform, raised $109M from EQT Growth.

☀️ Girasole Energies, a Boulogne-billancourt, France-based independent producer of photovoltaic electricity, raised $103M from Mirova.

⚡ CHARGE+ZONE, a Vadodara, India-based fleet electrification and retail EV charging company, raised $54M in Series A funding from BlueOrchard Finance.

⚡ Bioenergy DevCo, a Columbia, MD-based organic waste recycling company, raised $30M from HASI.

🚢 Candela, a Lidingö, Sweden-based maker of electric hydrofoil boats, raised $20M in Series A funding from EQT Ventures and Ocean Zero.

🚗 Revolv, a San Francisco, CA-based provider of full-service EV adoption for commercial fleets, raised $15M in Series A funding from Greenbacker Capital Management.

🏠 HT Materials Science, a Dublin, Ireland-based developer of smarter heat transfer fluids for HVAC, raised $15M in Series A funding from Saudi Aramco Energy Ventures, Barclays Sustainable and Impact Banking, CDP Venture Capital, and Progress Tech Transfer Fund.

🏠 Lun, a Copenhagen, Denmark-based heat pump installation software provider, raised $11M in Seed funding from Foundamental, Lowercarbon Capital, MCJ Collective, Norrsken VC, and Partech.

⚡ Chargetrip, an Amsterdam, Netherlands-based EV navigation software provider, raised $11M in Series A funding from Riverstone LLC, HSBC Asset Management, Blue Bear Capital, Vindeggen, and Axel Springer Porsche.

⚡ Piclo, a London, United Kingdom-based marketplace for energy flexibility services, raised $10M in Series B funding from Future Energy Ventures, Green Angel Syndicate, Clean Growth Fund, Toshiba Energy Systems & Solutions, Sustainable Future Ventures, and Japan Energy Fund.

🌾 Windfall Bio, a Menlo Park, CA-based startup developing a methane-to-organic fertilizer solution, raised $9M in Seed funding from Mayfield Fund and Untitled.

⚡ ampere.cloud, a Berlin, Germany-based platform for renewable energy plant management, raised $5M in Series A funding from Point Nine, Helloworld.vc, Vireo Ventures, HGDF Familienholding GmbH & Co. KG, and Berlin Angel Fund.

🧪 EV Biotech, a Groningen, The Netherlands-based company developing bio-based chemical feedstock, raised $5M in Seed funding from Future Food Fund, Blue Horizon Corporation, Voyagers Climate Tech Fund, NV NOM, Carduso Capital, RUG Ventures, and Triade Investment.

🌾 HeavyFinance, a Vilnius, Lithuania-based investment marketplace sustainable agriculture, raised $3M in Seed funding from Practica Capital and Black Pearls VC.

🍎 OneThird, an Enschede, The Netherlands-based food waste prevention technology company, raised $3M in Seed funding from Halma Ventures, OostNL, Pymwymic, and SHIFT Invest.

🥩 PoLoPo, a Ness Ziona, Israel-based company developing a plant bio-factory for high-scale proteins, raised $2M in Pre-Seed funding from CPT Capital, FoodLabs, HackCapital, Milk & Honey Ventures, Plug and Play, and Siddhi Capital.

🌱 Coolset, an Amsterdam, The Netherlands-based automated decarbonization platform for SMEs, raised $2M in Seed funding from Global Cleantech Capital, Shamrock Investors, and The Sharing Group.

💨 carbonABLE, a Grenoble, France-based web3-powered carbon removal tracking platform, raised $1M in Seed funding from Ethereal Ventures and La Poste Ventures.

Acetica, a company that makes acetic acid production technology for carbon utilization, was acquired by KBR for an undisclosed amount.

InBalance, a Boston-based provider of software for renewables and storage optimization, was acquired by Stem for an undisclosed amount.

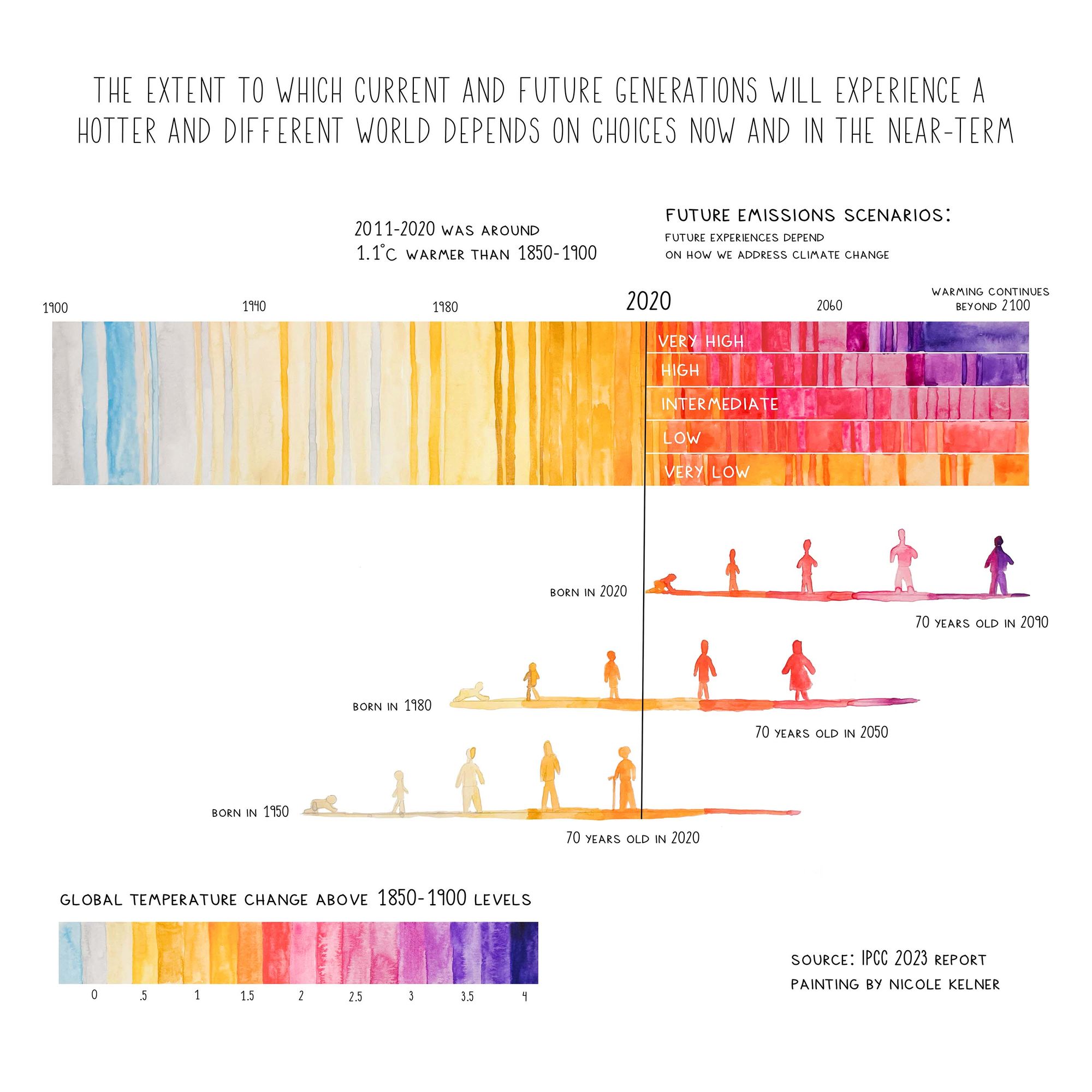

The IPCC published its latest report summarizing five years of research on global warming, GHG emissions, and climate impacts. It emphasized that the keys to accelerating the energy transition are political will and money. A public account of how it was written reveals Saudi Arabia, China, and India tried to minimize references to fossil fuels as the main cause of global warming. From the VC side, here are some opportunities for climate tech to support the IPCC’s recommendations.

The Biden administration released its Ocean Climate Action Plan, the first-ever government-wide strategy to maximize ocean protection to combat climate change. The initiatives tie together goals such as designating 40% federal investment benefits relating to climate change to disadvantaged communities, producing 30 GW of energy from offshore wind, and conserving at least 30% of US lands and waters by 2030.

President Biden also issued his first veto, rejecting legislation that aimed to prevent retirement portfolio managers from weighing ESG issues in their investment decisions. Top Democrats warned ‘MAGA ideology’ and anti-ESG bills pose major risks to US industry and business.

The Green Climate Fund, a $12B international climate finance facility, committed a record $253.7M to Africa’s Infrastructure Climate Resilient Fund. Through ICRF, AFC Capital Partners will finance greenfield and brownfield infrastructure and co-invest in climate-resilient transport and logistics, renewable energy systems, and telecommunication and digital infrastructure.

Ford revealed that it expects its EV division to lose $3B this year. Even with the success of new models like the F-150 Lightning and Mustang Mach-E, it’s still gas-powered cars, trucks, and SUVs that are paying the bills for automakers as they pile money into EVs.

Another one? South Korean battery manufacturer LG Energy Solutions will invest $5.5B on a battery factory in Arizona.

Nio, a Chinese EV startup, registered to lobby in the US, indicating the company plans to enter the American market. The nine-year-old company started its expansion into the EU in 2021 and says it plans to sell vehicles in the US beginning in 2025.

Legislating lithium battery fires: NYC policymakers signed five bills into law requiring e-bike batteries to meet recognized safety standards and prohibiting local shops from tampering with or selling repaired batteries, which are more likely to catch fire. Local repair shops will have to send damaged batteries back to the original manufacturer, rather than repairing them on-site.

After a season of extreme weather that’s left more than two dozen people dead in California, the state faces billions of dollars in losses caused by events including bomb cyclones, atmospheric rivers, tornadoes, mudslides and flooding.

German utility EnBW committed $2.6B to build one of Europe's largest offshore wind farms. Meanwhile, BP, TotalEnergies, and UK renewables firms were among the 13 companies awarded leases to develop offshore wind in Scotland to supply power to North Sea oil and gas platforms in order to lower the sector's emissions.

DOE put the Valley of Death on notice last week with its new Pathways to Commercial Liftoff reports. After months of discussion with the private sector, DOE shared its learnings on bringing clean hydrogen, advanced nuclear, and long duration energy storage to large-scale adoption. Get the details from the OTT’s Vanessa Chan in our full breakdown.

Hypercharged: $50.8 billion has been invested in EV infrastructure since the IRA passed and US EV manufacturing capacity is expected to take off by mid-decade.

What’s the cost to quit coal? For India, it's $900 billion to transition 5 million coal workers into clean energy jobs.

Blame the boats. Offshore wind isn’t killing whales.

Burial, cremation or… compost? Young Americans lobby to be composted upon death, which is currently illegal in the vast majority of states.

The permafrost “glue” that holds the Alps together is melting and the California Coast is disappearing. So are the number of days extreme athletes can surf and climb.

Flesh-eating bacteria is swimming towards the East Coast. Meanwhile, a 5,000-mile-wide seaweed blob is headed towards Florida.

30 million green jobs will hit the EU market by 2030. Workers will need to be reskilled at much faster rates to accommodate.

“Should The Government Pay for Your Bad Climate Decisions?” The Daily covers the government’s antithetical incentives for Americans to live in risky ways, including fire- and flood-prone zones.

The Montana State Constitution guarantees “the right to a clean and healthful environment…for present and future generations.” So Montana Youth are suing, calling fossil fuel investments unconstitutional.

Go down the carbon sequestration rabbit hole, or should we say Class VI well.

🗓️ Canary Live Boston: Join Canary Media and Post Script Media’s live event on Apr 6th, where they’ll engage in decarbonization discussions and conduct a live recording of the Carbon Copy podcast.

🗓️ 2023 MIT Energy Conference: Join MIT Apr 11th and 12th for two days of interactive panel sessions, networking, and their climate tech startup showcase. Register now for VIP tickets, and use promocode CTVC10 on General Admission and virtual tickets!

💡 EarthX’s E-Capital Summit: Request to join EarthX’s annual summit taking place from Apr 19th-22nd to network with investors, businesses, and policy leaders, and possibly even pitch your early-stage climate technology.

💡 Google Carbon Removal Research: Apply by Apr 28th to Google’s Carbon Removal Research Awards program, which is aiming to fund research that accelerates carbon removal approaches.

🙋 Data Engineer @CTVC

Program Manager @The Clean Fight

Analyst, Investments @Aspen

Associate @Valo Ventures

Software Engineer @QuitCarbon

Product Designer (UI/UX) @QuitCarbon

Managing Director, Activate Houston @Activate

Head of Impact Partnerships @ClimateAI

Climate Strategy and Development @Patch

Managing Director of Sustainability Investments @gener8tor

Climate Solutions @Cloverly

Feel free to 📩 send us new ideas, recent fundings, events & opportunities, or general curiosities. Have a great week ahead!

OBBB blows tailwinds through CCUS, but takeoff stalls

One Big Beautiful Bill ushers in new (and old) energy agenda

Climate, capital, and carrots in London's new playbook