The missing link to net zero

Closing the loop on decarbonized & resilient supply chains with Energy Impact Partners' Nina Litman

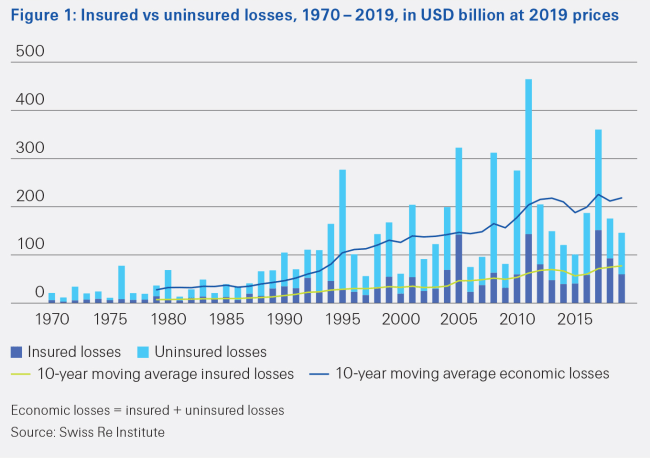

Climate change poses an increasing risk to insurers and their customers. The costs of climate change-driven weather-related disasters have been rising. In 2017, losses totaled more than $306 billion in the U.S.

Climate change poses an increasing risk to insurers and their customers. The costs of climate change-driven weather-related disasters have been rising. In 2017, losses totaled more than $306 billion in the U.S. The 2018 California wildfires alone resulted in $24 billion in losses. Flooding risk in Florida could devalue exposed homes by $30 to $80 billion, or 15% to 35%, by 2050.

Insurers and reinsurers are reacting differently to these growing climate change risks. Most insurers are not factoring rising climate change risks into their premiums. Instead, they have assumed that the risks are static and will follow historical patterns. By contrast, reinsurers, which bear most of the risk of catastrophic losses that these events produce, have prioritized understanding and adapting to climate change. While insurance companies typically do not employ full-time climate scientists, many reinsurers do. This in-house expertise helps them quantify and respond to climate risk.

As climate-change-related losses mount for insurers, their profitability and even their viability could be at risk. They will be forced to respond by halting coverage of vulnerable areas or by raising premiums. These rate increases could be substantial and render insurance unaffordable for ordinary citizens. Government agencies have begun regulating rate increases and offering state-based insurance programs for flooding and select other disasters.

Some reinsurers are a step ahead, offering reduced premiums to customers (i.e., traditional insurers) that take steps to mitigate climate change effects or that discourage building at high-risk locations.

The risks of climate change to insurers extend beyond property damage caused by flooding or wind. These risks can include bodily injury or lawsuits for failure to disclose or account for climate-related risks or for not adopting a low-carbon strategy, among others.

Climate risk is comprised of three risk categories:

Many US state insurance regulators expect all three types of risks to increase over the medium- to long-term. Thus, it is critical for insurers to be able to measure these risks accurately.

Predicting the timing and impact of natural disasters is difficult, to say the least. Using historical data and trends to measure climate risk requires rigorous analysis (just ask the IPCC). Translating this data into financial terms and prices poses an even greater challenge. (Try estimating the price of corn in 2100.) Moreover, even if a model worked today, it would change as climate conditions evolved.

To help with these measurements, the government provides certain risk estimates, but there is evidence they may be flawed. A recent study found that the government significantly underestimates flood risk across the country. Government’s flood maps show homeowners where and how to build to reduce flooding risk and whether to buy flood insurance. Inaccurate government information may have led insurers and homeowners to make decisions that were far riskier than they understood.

Insurers, reinsurers, and consumers need to be able to identify, quantify, and monitor climate-related risks. Climate technology can help perform these functions.

Some tech companies help insurers understand climate risk. Jupiter Intelligence, established in 2017, seeks to quantify the risk and potential economic impact of more than $100 trillion in global infrastructure and provide insights for resiliency and disaster planning. Cities and businesses pay for Jupiter’s predictive and analytics technologies to prepare for the climatological challenges they’re going to face.

New technology is necessary to collect climate data (as discussed in a previous newsletter), convert that data into actionable climate risk insights (e.g., likelihood of flooding), and price that risk. The number of companies offering a bundle of these services is even more limited. In fact, in its Climate Risk and Response report, McKinsey cited risk management technologies that can quantify and price risk as one of the few opportunity areas that will emerge from a changing climate.

To assess and potentially hedge climate risk factors, companies are likely willing to pay for any data that helps inform these decisions. For example, the credit rating service Moody’s bought a majority stake in Four Twenty Seven last year to enhance its climate risk assessment capabilities.

As traditional insurers face greater risk from planetary warming, they will need to enhance their climate risk assessment capabilities. The market potential for such services is substantial since insurers are also some of the largest investors.

Closing the loop on decarbonized & resilient supply chains with Energy Impact Partners' Nina Litman

The new business of seeing climate from space

How supply chain traceability leads us to Net Zero