🌎 Introducing Powerstack from Sightline Climate

A new weekly briefing on the moves and motives shaping power markets

Happy Monday!

We’ve got a roundup of the biggest takeaways from London Climate Action Week. TLDR? There’s a major opportunity for Europe with all the US policy whiplash — if it can capture it.

In deals, $100m for livestock management, $71m for solar and energy storage development, and $30m for methane emission management.

In other news, inside the new US megabill’s clean energy rollbacks, Germany’s hydrogen pullback, and the US’ Three Mile Island restart.

And we’ve got a special one for you tomorrow: the launch of our H1’25 report, so be on the lookout!

Thanks for reading!

Not a subscriber yet?

📩 Submit deals and announcements for the newsletter to [email protected].

💼 Find or share roles on our job board here.

Last week, London showed up for Climate Action Week in full force: the heatwave broke just in time for a breezy, blue-skied week packed with panels, pledges, and pints.

LCAW really found its stride this time. Last year, the Breakthrough Energy Summit overlapped and dominated the conversation. This year, people came for LCAW. It felt like a more manageable alternative, avoiding the UNGA gridlock, the NYCW overload, the Davos pomp, the COP protocol. With growing questions about whether to show up at either of those mega-events this year, LCAW offered a welcome middle ground — pop-ups and panels without all the FOMO. And it felt like a gate for those all around the world — we saw familiar and fresh faces from Japan, Dubai, Australia, Canada, the US, and beyond.

The energy was high, and the timing felt right. Amid US policy whiplash, many were asking: Is Europe the next climate tech hotspot? And this week tried to answer that. With boots on cobblestoned ground, here's what we took away.

Europe is pivoting. After decades of relying on “sticks” — heavy regulation, complex policy, and steep penalties — it seems that it's been tripping on them, and is now going the "carrot" route.

Earlier this year, the EU introduced its omnibus investment-led re-industrialization strategy, the Clean Industrial Deal. This week, the UK has launched its own version, the Modern Industrial Strategy, focusing on cutting energy costs, accelerating grid connections, and backing high-growth sectors (the “IS-8”) including climate, AI, and life sciences. Tools include innovation funding, equity stakes in startups, and streamlined regulation.

But sentiment on the ground was clear: the UK has catching up to do. The cost of power is a major barrier — UK electricity prices are the most expensive in Europe, anywhere from three to five times higher than elsewhere, a dealbreaker for clean fuels and electrified manufacturing. Meanwhile, grid connection delays mirror US issues, and permitting bottlenecks are still a challenge.

That said, London is trying to rebrand as a scaleup hub. The new National Wealth Fund is aiming to crowd in £70bn ($96.4bn) of private capital. The LSE launched a private markets platform for secondary share sales. Imperial College and the Undaunted Innovation Hub had a big presence. Founders want predictable policy, local buyers, and accessible funding — and London’s making a play to offer all three.

Still, in the UK, we heard about a persistent Series A gap. While seed is strong and series B can be stitched together, the middle is sparse — earlier and harder than in the US or EU. And the question looms: Even if you raise the capital, can you build here, with the electricity costs and red tape? But hope is high that policy innovation can clear the way.

The phrase “missing middle” gets thrown around a lot, but this week gave it sharper definition. As our 2025 Investor Pulse Check found, there’s particular concern around the $45m–$100m range — too big for VC, too small for project finance.

Founders and investors agreed at LCAW. It’s not just a capital gap, but a lack of enabling infrastructure — things like permitting, offtake agreements, and grid access.

One promising solution: growth credit. This sits between venture and project finance, offering flexible, topco-level debt for hardtech startups. It’s non-dilutive, faster than infrastructure debt, and starting to bridge the “middle within the middle.”

But everyone’s still asking the exit question. Without a finish line, the middle remains a muddle.

Security was a throughline across the week, and not just energy, but national, economic, and climate security. Conversations spanned tariffs, defense, and supply chain resilience, reflecting a shift from globalization to regionalization. That’s fueling new investment theses around efficiency, circularity, and hardening systems against disruption.

Meanwhile, adaptation finally had its moment. Climate impacts are no longer a future scenario — they’re here. Investors are hunting for resilience tech with clear ROI and urgent demand. Startups in flood mitigation, wildfire modeling, water storage, and more were featured center stage. End users range from firefighters to insurers to the military.

We also heard more open talk about climate intervention. Scientific geoengineering, like ARIA’s work on responsible intervention, is edging into serious discussion.

While the US focuses on managing AI power demand, Europe’s question is more fundamental: can it attract data centers in the first place?

Data centers offer economic upside, but they’re massive loads, as we heard everywhere from Big Tech events to Octopus Energy’s Energy Tech Summit to Top Tier Impact’s investor convenings. For instance, facilities are now scaling to 300MW or more — like a small city on one site.

Energy cost is the real bottleneck here. If prices stay high, developers will go elsewhere. South Korea is already offering 50% electricity discounts to attract hyperscalers. Europe will need infrastructure, permitting, and pricing to compete. But AI demand could be the tailwind needed for long-overdue grid upgrades and new clean power.

🐄 Halter, an Auckland, New Zealand-based cattle herd management platform, raised $100m in Series D funding from BOND, Bessemer Venture Partners, Blackbird Capital, DCVC, Icehouse Ventures, and other investors.

⚡ Insight M, a Sunnyvale, CA-based methane management platform, raised $30m in Growth funding from Morgan Stanley Investment Management, Climate Investment, DCVC, and Energy Innovation Capital.

🏠 Enter, a Berlin, Germany-based home energy assessment platform, raised $23m in Series B funding from Coatue, Foundamental, Partech, SE Ventures, Target Global, and noa.

♻️ Novoloop, a Menlo Park, CA-based plastic upcycling technology developer, raised $21m in Series B funding from Taranis.

⚡ Elemental Advanced Materials, a Houston, TX-based carbon nanomaterials and hydrogen producer, raised $20m in Growth funding from Taranis.

🏠 Aedifion, a Köln, Germany-based building energy optimization software developer, raised $20m in Series B funding from Eurazeo, World Fund, BitStone Capital, Drees & Sommer, Hopp Family Office, and other investors.

👕 Colorifix, a Norwich, England-based biological textile dyeing tech developer, raised $18m in Series B funding from Inter Ikea, Goldwin Play Earth Fund, H&M Group Ventures, Ljungstrom Family Office, Regeneration.vc, and other investors.

🌾 Doktar Technologies, an Istanbul, Turkey-based precision agtech provider, raised $9m in Growth funding from European Circular Bioeconomy Fund (ECBF), PYMWYMIC, and Diffusion Capital Partners.

⚡ Ignis H2 Energy, a Houston, TX-based AI-based geothermal explorer and developer, raised $14m in Series A funding from alfa8, GEOLOG, Nabors, and Twynam.

🌱 Climatiq, a Berlin, Germany-based carbon footprint tracking platform, raised $12m in Series A funding from Alstin Capital, Cherry Ventures, and Singular.

🔋 Echandia, a Stockholm, Sweden-based maritime energy storage developer, raised $11m in Series A funding from S2G Investments.

🐄 Antler Bio, a Rathcoole, Ireland-based livestock gene expression platform, raised $4m in Seed funding from The First Thirty, Endgame Capital, and Generation-RE.

🌾 BlueRedGold, a Mariefred, Sweden-based hydroponic saffron farm developer, raised $3m in Seed funding from PINC, PolarVentures, and The Food Tech Lab.

⚡ pHydrogen, a Tokyo, Japan-based green hydrogen developer, raised $2m in Seed funding from Incubate Fund.

⚡ Recurrent Energy, an Austin, TX-based solar and energy storage developer, raised $71m in Debt funding from Santander.

📦 Cellugy, a Gladsaxe, Denmark-based biomaterial developer, raised $9m in Grant funding from European Union.

🛵 Evera Cabs, a New Delhi, India-based EV cab service provider, raised $4m in Debt funding from Mufin Green Finance.

🏭 Rise Robotics, a Somerville, MA-based heavy machine electrification manufacturer, raised $3m in Crowdfunding funding from Fortistar, Techstars, and The Engine.

🥩 Libre Foods, a Barcelona, Spain-based fungal fiber meat alternative manufacturer, raised an undisclosed amount in Asset Sale funding from planetary.

Octopus Energy Generation, a London, UK-based investment firm, closed $60m as part of a $250m initiative over the next three years, aiming to mobilize private investment in clean energy solutions across Africa.

Can’t get enough deals? See full listings and deal analytics on Sightline Climate.

The updated US GOP tax megabill introduces sweeping rollbacks to clean energy policy, targeting the Inflation Reduction Act’s core provisions. The bill:

Germany’s new government plans to cut funding for industrial green hydrogen projects by two-thirds, reducing the €3.7bn previously earmarked to just €1.2bn by 2030, in one of the few hydrogen-favorable economies. This funding had supported over €1bn in “climate protection contracts” for decarbonizing heavy industry, so the cuts mark a sharp reversal in hydrogen support under the new administration.

Constellation Energy plans to restart the Three Mile Island nuclear plant a year ahead of schedule in 2027, thanks to faster-than-expected grid interconnection with PJM. The revived plant, which shut down in 2019, will supply carbon-free power to Microsoft and help meet surging demand from AI, factories, and electrified homes. The early restart marks a rare acceleration in nuclear project timelines and signals renewed momentum for US nuclear energy, backed by both state and federal support.

The UK launched a new Modern Industrial Strategy last week, a ten-year plan aimed at boosting business investment and growing eight key high-growth sectors, like advanced manufacturing, clean energy, digital technologies, and life sciences. The strategy focuses on making it easier and cheaper for businesses to invest, cutting electricity costs for energy-intensive industries, and increasing R&D spending to drive innovation, especially in AI and advanced manufacturing. It’s a response to the EU’s Clean Industrial Plan and the US’ IRA, aiming to decarbonize and reindustrialize amid lagging growth.

The UK government reversed its position and rejected the $34bn Morocco-UK Power Project, citing a preference for homegrown energy solutions. The project aimed to deliver Saharan solar and wind energy to British homes via the world’s longest subsea power cable, despite over $137m already invested in development by firms including TAQA, TotalEnergies, and Octopus Energy. It reveals a growing political and strategic preference for domestic energy sovereignty over international clean energy collaboration.

Google has signed a 200MW power purchase agreement with Commonwealth Fusion Systems (CFS) for its first ARC fusion plant in Virginia. It's the world’s largest commercial fusion energy offtake, and the second after Microsoft and Helion's. The agreement also includes a new equity investment and future offtake options, signaling Google’s approach to fusion as a clean firm baseload for AI-driven power demand growth, although CFS is aiming to bring ARC online in the early 2030s.

Check out Kim in Open Circuit’s newest Pod for a dive into our 2025 Investor Market Sentiment Survey — and a sneak peek at our H1’25 report.

UK ETS cuts 11.5% from its carbon bill.

EU offers airlines a sustainable runway — with subsidies for liters of SAF to boost demand.

Geothermal deep dive from Hannah Ritchie.

This Chinese smartphone maker is revving up its EV manufacturing and makes one every 76 seconds.

Cipher, you will be massively missed.

Cool interactive visuals in the race to first from emerging techs.

Olive oil is the new gold?

💡 EarthScale: Apply now to join a 12-month UK-wide programme supporting IP-rich climate tech startups and spinouts advancing to commercialisation. Tailored for ventures at TRL 5–6 with £500K+ in seed funding, this initiative offers expert scaling support, access to top UK facilities, and deep engagement with policy and industry leaders.

📅 2025 Amazon Sustainability Accelerator Demo Day: Hear startups pitching on Thursday, July 3, 2025, at the Barbican Centre in London across skincare, food, pet care, and more, with guest speakers and refreshments.

📅 Seattle Hour of Action: Join us on Wednesday, July 9, 2025, at the 9Zero Climate Innovation Hub, Seattle. Dive into a hands-on hour tackling timely climate policy with actionable steps, no prep required.

📅 PNW Climate Week 2025: Join us from July 16–25, 2025, across Seattle, Portland, Vancouver, and more, for an opportunity to engage with leading climate tech experts and discuss latest innovations in the PNW.

Marketing Internship @ClimateCamp

Head of Plant Design @Heirloom

Senior FP&A Analyst @Afresh

Transmission Planning Engineer @Nira Energy

Senior Accounting Manager @Environmental Defense Fund

SAF & Sustainability Program Manager @Alaska Airlines

Graduate Strategy, Operations, and Finance Intern (Summer 2025) @De-Ice

Business Development Representative (BDR) @Spare-it

Senior Office Coordinator @Sublime Systems

Controller @Heirloom

Chief of Staff @Glacier

Manager, Operations and Compliance @Coalition for Green Capital

IoT Systems Engineer @GlacierGrid

Technical Writer @Redwood Materials

Senior Account Executive @Ecovadis

Primary Engineer (CDAE) @Hitachi Ventures

📩 Feel free to send us deals, announcements, or anything else at [email protected]. Have a great week ahead!

A new weekly briefing on the moves and motives shaping power markets

England strikes lithium and comes up with geothermal gold

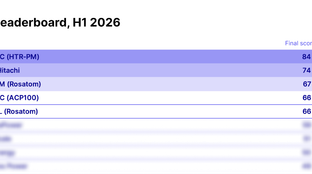

Small reactors, big power rankings